Australia Organic Pasta Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Australia Organic Pasta Market Summary:

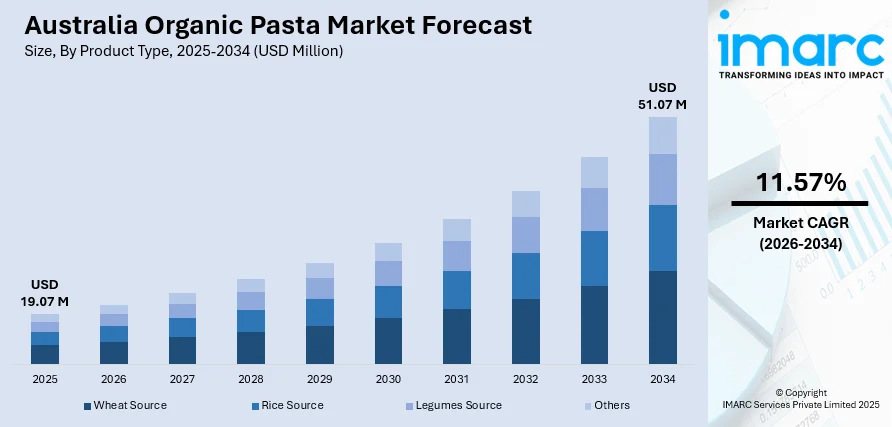

The Australia organic pasta market size was valued at USD 19.07 Million in 2025 and is projected to reach USD 51.07 Million by 2034, growing at a compound annual growth rate of 11.57% from 2026-2034.

The Australia organic pasta market is experiencing robust expansion on account of increasing health consciousness among people and increasing preferences for natural, chemical-free food products. The demand for organic pasta is strengthening as Australians prioritize clean-label ingredients and sustainable food choices. Growing awareness about the nutritional benefits of organic wheat and alternative grain pastas, coupled with expanding retail availability through major supermarket chains and e-commerce platforms, continues to support market penetration. Advancements in organic farming practices, increasing household adoption, and rising interest in plant-based diets are reshaping consumption patterns, positioning organic pasta as an essential component of healthy dietary preferences across the nation's Australia organic pasta market share.

Key Takeaways and Insights:

-

By Product Type: Wheat source dominates the market with a share of 87.8% in 2025, owing to its widespread availability, familiar taste profile, and alignment with traditional pasta preferences. The strong consumer trust in organic wheat products and their nutritional benefits fuels continued market leadership.

-

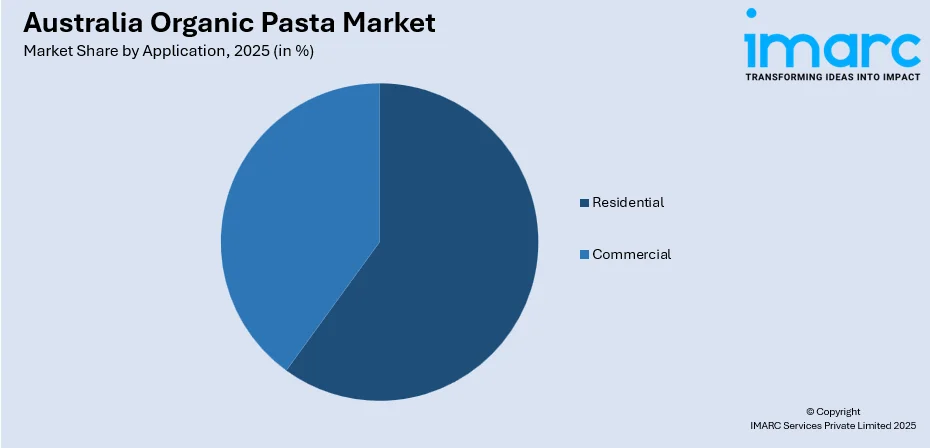

By Application: Residential leads the market with a share of 76.7% in 2025. This dominance is driven by increasing home cooking trends, growing health awareness among households, and the rising preference for organic ingredients in daily meal preparation across Australian families.

-

By Distribution Channel: Offline stores represent the largest segment with a market share of 69.8% in 2025, reflecting consumer preference for in-store purchasing where product inspection, certification verification, and immediate availability support confident purchasing decisions.

-

By Region: Australia Capital Territory & New South Wales comprises the largest region with 34.8% share in 2025, driven by concentrated urban populations, higher disposable incomes, strong retail infrastructure, and elevated health consciousness among consumers in Sydney and surrounding metropolitan areas.

-

Key Players: Key players drive the Australia organic pasta market by expanding product portfolios, improving manufacturing processes, and strengthening nationwide distribution networks. Their investments in marketing, sustainability initiatives, and partnerships with retailers boost awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Australia organic pasta market is advancing as consumers increasingly seek healthier, sustainable food alternatives that align with modern dietary preferences. The organic food sector in Australia has witnessed significant expansion, with the country possessing over 53 Million hectares of certified organic farmland, representing approximately 70% of the world's total organic agricultural land according to the Australian Organic Market Report 2023. This substantial organic farming base provides a strong foundation for organic pasta production, ensuring reliable supply of certified organic wheat and alternative grains. Major supermarket chains have significantly expanded their organic product offerings, improving accessibility for mainstream consumers. The combination of robust certification standards, growing retailer commitment, and shifting consumer values toward chemical-free nutrition continues to strengthen market fundamentals and drive sustained Australia organic pasta market growth.

Australia Organic Pasta Market Trends:

Rising Demand for Clean-Label and Natural Products

Australian consumers are increasingly prioritizing clean-label products that are free from artificial additives, preservatives, and synthetic chemicals. This shift is driving demand for organic pasta made from certified ingredients without genetically modified organisms. The trend reflects broader lifestyle changes where health-conscious shoppers scrutinize ingredient lists and prefer products aligned with natural nutrition principles. Growing consumer expenditure on food categories, particularly organic options, demonstrates stronger uptake among individuals prioritizing digestive health and overall wellbeing across the country.

Expansion of Plant-Based and Alternative Grain Varieties

The organic pasta market is witnessing growing diversification beyond traditional wheat-based products to include rice, legume, and quinoa-based alternatives. These innovations cater to consumers with dietary restrictions, gluten sensitivities, and those seeking higher protein content. Manufacturers are responding to plant-forward dietary preferences by developing organic pasta varieties using chickpeas, lentils, and brown rice. This product diversification is expanding consumer choice and attracting health-conscious buyers seeking nutrient-dense alternatives that maintain the convenience and versatility of traditional pasta preparations.

E-Commerce and Digital Retail Channel Growth

Online grocery platforms are increasingly becoming important distribution channels for organic pasta products, offering consumers convenient access to diverse organic selections. The Australia online grocery market reached USD 14,202.0 Million in 2024 and is projected to grow at a compound annual growth rate of 21.22% during 2025-2033. This digital expansion enables organic pasta brands to reach wider audiences, particularly younger demographics comfortable with online purchasing. Enhanced delivery infrastructure, subscription models, and personalized recommendations are making organic products more accessible to time-conscious consumers across metropolitan and regional areas.

Market Outlook 2026-2034:

The Australia organic pasta market outlook remains optimistic as consumer preferences continue shifting toward healthier, sustainably produced food options. Over the course of the projected period, increasing urbanization, rising disposable incomes, and growing environmental consciousness are anticipated to maintain demand momentum. The market generated a revenue of USD 19.07 Million in 2025 and is projected to reach a revenue of USD 51.07 Million by 2034, growing at a compound annual growth rate of 11.57% from 2026-2034. Continued retail expansion, product innovation in alternative grain pastas, and strengthening e-commerce capabilities will support market penetration across diverse consumer segments seeking natural, chemical-free nutrition options.

Australia Organic Pasta Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Wheat Source |

87.8% |

|

Application |

Residential |

76.7% |

|

Distribution Channel |

Offline Stores |

69.8% |

|

Region |

Australia Capital Territory & New South Wales |

34.8% |

Product Type Insights:

- Wheat Source

- Rice Source

- Legumes Source

- Others

Wheat source dominates with a market share of 87.8% of the total Australia organic pasta market in 2025.

Organic wheat-based pasta maintains its leadership position due to strong consumer familiarity, versatile culinary applications, and alignment with traditional dietary preferences across Australian households. The segment benefits from Australia's robust organic wheat farming sector, which operates under strict certification standards governed by organizations such as Australian Certified Organic and NASAA Certified Organic. These certifications ensure products meet rigorous environmental and health standards, building consumer confidence in wheat-based organic pasta products. Wheat-based organic pasta appeals to families seeking reliable, nutritious meal options that integrate seamlessly into everyday cooking routines.

The wheat source segment continues expanding as manufacturers introduce premium varieties including whole wheat, durum wheat semolina, and ancient grain blends that appeal to health-conscious consumers. In May 2024, Monte's Fine Foods launched a new range of dried pasta featuring shapes crafted from 100% organic durum wheat semolina and water, demonstrating ongoing product innovation within this segment. The combination of nutritional benefits, sustainable farming practices, and widespread retail availability positions organic wheat pasta as the foundation of Australia's organic pasta consumption.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Residential leads with a share of 76.7% of the total Australia organic pasta market in 2025.

The residential segment dominates the Australia organic pasta market as households increasingly prioritize healthier meal preparation using certified organic ingredients. Growing awareness about the health benefits of chemical-free foods, combined with rising home cooking trends accelerated during recent years, continues driving household purchases. Australian families are particularly attentive to ingredient quality when preparing meals for children, making organic pasta an attractive choice for health-conscious parents seeking nutritious options that support childhood development and overall family wellness.

Consumer spending on organic food products has demonstrated consistent growth across Australian households, with shoppers increasingly indicating that sustainable lifestyle choices are important to them. This shift reflects broader cultural changes where environmental responsibility and personal health intersect in everyday purchasing decisions. The residential segment benefits from expanded retail availability through major supermarket chains and specialty health food stores, making organic pasta accessible for everyday meal planning. Enhanced product visibility, dedicated organic aisles, and improved labeling help consumers identify certified options quickly. This widespread distribution, combined with competitive pricing strategies and promotional activities, supports sustained household adoption of organic pasta products throughout the country.

Distribution Channel Insights:

- Offline Stores

- Online Stores

Offline stores exhibit a clear dominance with a 69.8% share of the total Australia organic pasta market in 2025.

Offline retail channels maintain market leadership as consumers prefer physical store shopping for organic food products where they can examine packaging, verify certifications, and access immediate product availability. Major supermarket chains including Woolworths and Coles have significantly expanded their organic product sections, integrating dedicated organic aisles that improve accessibility and normalize organic products within weekly grocery shopping. These leading retailers provide substantial distribution reach for organic pasta brands, leveraging their extensive nationwide store networks to connect products with health-conscious shoppers across metropolitan and regional areas.

Specialty stores and health food retailers continue playing important roles in the offline distribution landscape, offering curated organic product selections that attract discerning consumers seeking premium quality options. According to the Australia Retail Association, retail spending across Australia reached AUD 35.9 Billion in May 2024, with food sales experiencing notable growth. The combination of established retail infrastructure, consumer trust in physical shopping experiences, and effective in-store merchandising strategies supports the continued dominance of offline channels in organic pasta distribution.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the leading segment with a 34.8% share of the total Australia organic pasta market in 2025.

Australia Capital Territory & New South Wales remains the leading region for organic pasta consumption, driven by concentrated urban populations in Sydney and surrounding metropolitan areas where health-conscious consumers demonstrate strong purchasing power. The region benefits from extensive retail infrastructure, including numerous supermarket locations, specialty health food stores, and organic markets that provide convenient access to certified organic products. Higher disposable incomes in metropolitan Sydney enable premium product purchases, supporting the growth of organic food categories including pasta. The state's cosmopolitan population embraces diverse culinary traditions, creating robust demand for quality pasta products that align with health and sustainability values.

Australia Capital Territory & New South Wales maintain a substantial presence of certified organic farms, with organic farm acreage demonstrating consistent growth in recent years. This strong organic farming presence supports local production and distribution of organic food products while reducing transportation requirements. The region's diverse climate enables year-round organic farming operations, ensuring reliable supply chains for organic pasta manufacturers and retailers serving the state's substantial consumer base. Well-established logistics networks connecting producers, processors, and retailers further strengthen regional market infrastructure supporting organic pasta availability.

Market Dynamics:

Growth Drivers:

Why is the Australia Organic Pasta Market Growing?

Increasing Health Consciousness and Clean-Label Preferences

Australian consumers are becoming increasingly conscious about their dietary choices, driving demand for organic food products that align with health and wellness priorities. Rising awareness about the potential negative effects of synthetic pesticides, artificial additives, and genetically modified organisms in conventional food products encourages consumers to seek organic alternatives. The organic pasta segment benefits from this shift as health-conscious shoppers prioritize products made from certified organic ingredients without chemical residues. According to the Australian Institute of Health and Welfare, cardiovascular disease represented nearly 12% of the overall disease burden in 2024, motivating many Australians to adopt healthier dietary patterns. This health-focused consumer behavior supports sustained demand for organic pasta as part of balanced nutrition strategies that emphasize natural, minimally processed foods.

Expanding Retail Distribution and Accessibility

The organic pasta market is benefiting from significant retail expansion as major supermarket chains increase their organic product offerings and improve shelf visibility. Woolworths and Coles, which together dominate the Australian grocery market, have integrated dedicated organic sections into their stores, making organic pasta accessible to mainstream consumers during regular shopping trips. This retail expansion removes previous barriers to organic product access and normalizes organic purchasing behavior across diverse demographic segments. Leading supermarkets have launched price initiatives affecting essential grocery items, demonstrating retailer commitment to improving organic food affordability. Enhanced product assortment, strategic shelf placement, and promotional activities by leading retailers continue strengthening organic pasta market penetration across metropolitan and regional areas throughout Australia.

Strong Organic Certification Standards and Consumer Trust

Australia maintains robust organic certification frameworks that build consumer confidence in organic product authenticity and quality. The country possesses extensive certified organic farmland, representing a significant portion of the world's total organic agricultural land, with numerous certified organic businesses operating across production and processing sectors. Certification bodies including Australian Certified Organic and NASAA Certified Organic ensure products meet stringent environmental and health standards through regular audits and compliance monitoring. Consumer recognition of certification marks has strengthened considerably, with shoppers increasingly identifying trusted organic logos when making purchasing decisions. This certification transparency provides assurance about ingredient sourcing and production practices, enabling consumers to make informed purchasing decisions that support organic pasta market growth.

Market Restraints:

What Challenges the Australia Organic Pasta Market is Facing?

Premium Pricing and Affordability Concerns

Organic pasta products typically command higher prices compared to conventional alternatives due to increased production costs associated with certified organic farming practices. This price premium can deter price-sensitive consumers, particularly during periods of economic uncertainty when households prioritize essential spending. Limited purchasing power among certain demographic segments restricts broader market penetration despite growing health awareness.

Supply Chain and Production Constraints

Organic pasta production faces supply chain challenges including fluctuating availability of certified organic raw materials, particularly during adverse weather conditions affecting organic wheat harvests. The time-intensive certification process for organic farming creates barriers for farmers transitioning from conventional practices, potentially limiting supply growth. These constraints can impact consistent product availability and pricing stability.

Limited Consumer Awareness in Regional Areas

While organic food awareness is strong in metropolitan centers, regional and rural areas demonstrate lower familiarity with organic product benefits and certification standards. Limited distribution infrastructure in these regions reduces product accessibility, while traditional food purchasing habits may resist premium organic alternatives. This geographic disparity in awareness and availability constrains nationwide market expansion potential.

Competitive Landscape:

The Australia organic pasta market features a competitive environment characterized by both established food manufacturers and specialized organic brands competing for market share. Companies are focusing on product differentiation through diverse pasta varieties, premium ingredient sourcing, and sustainable packaging innovations. Strategic partnerships with major retailers and investments in brand awareness campaigns are enabling market players to strengthen their positions. Certification credentials, quality consistency, and supply chain reliability serve as key competitive differentiators. Manufacturers are expanding product portfolios to include alternative grain options, responding to evolving consumer preferences for gluten-free and high-protein pasta varieties. Innovation in organic farming practices and processing technologies continues shaping competitive dynamics across the Australian organic pasta landscape.

Australia Organic Pasta Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wheat Source, Rice Source, Legumes Source, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Offline Stores, Online Stores |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia organic pasta market size was valued at USD 19.07 Million in 2025.

The Australia organic pasta market is expected to grow at a compound annual growth rate of 11.57% from 2026-2034 to reach USD 51.07 Million by 2034.

Wheat source dominates the market with a share of 87.8%, owing to widespread consumer familiarity, traditional dietary preferences, versatile culinary applications, and alignment with Australia's robust certified organic wheat farming sector.

Key factors driving the Australia organic pasta market include rising health consciousness, increasing demand for clean-label products, expanding retail distribution through major supermarkets, growing e-commerce accessibility, strong organic certification standards, and shifting consumer preferences toward sustainable food choices.

Major challenges include premium pricing affecting affordability for price-sensitive consumers, supply chain constraints impacting raw material availability, limited consumer awareness in regional areas, certification costs for producers, and competition from conventional pasta alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)