Australia Organic Snack Foods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Flavor, and Region, 2025-2033

Australia Organic Snack Foods Market Size and Share:

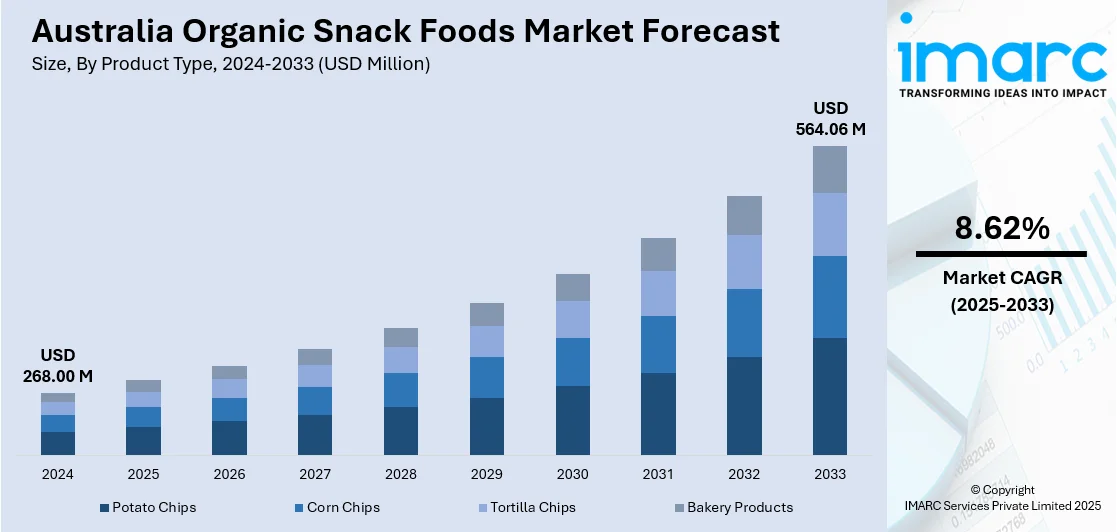

The Australia organic snack foods market size reached USD 268.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 564.06 Million by 2033, exhibiting a growth rate (CAGR) of 8.62% during 2025-2033. The market is fueled by growing consumer interest in clean-label, plant-based foods and functional nutrition that aligns with health and wellness objectives. Digital retailing and special store channels are broadening access, while product innovation emphasizes transparency, sustainability, and specific benefits such as immunity and digestion. As consumers embrace healthier, more informed lifestyles, organic snack foods that align with ethical and nutritional values are on the rise, growing Australia organic snack foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 268.00 Million |

| Market Forecast in 2033 | USD 564.06 Million |

| Market Growth Rate 2025-2033 | 8.62% |

Australia Organic Snack Foods Market Trends:

Increased Demand for Clean Label and Plant-Based Ingredients

Organic snack foods in Australia are experiencing growing demand as consumers prefer clean-label and plant-based ingredients. Consumers are reading product labels more carefully, looking for transparency in origin, and shunning artificial additives and genetically modified ingredients. Organic snack products made from legumes, nuts, seeds, and fruits have seen an upsurge as health-conscious Australians seek balanced nutrition. As more people embrace vegetarianism and flexitarian diets, plant-based compositions now find themselves at the forefront of product innovation in this category. In addition, organic snacks provide allergen-friendly options, facilitating inclusivity across consumption habits. Retailers are increasing shelf space for certified organic items to accommodate this trend. For instance, in November 2024, Welly opened up Australia's market for organic snack foods when it introduced its 100% organic fruit bites in more than 350 Woolworths stores across the country, with Berry Bliss, Mango Tango, and Apple Pie flavors. Moreover, Australia organic snack food market growth is increasingly driven by the rising demand for minimally processed, ethically sourced ingredients that align with sustainability and personal wellness goals. Clean-label, plant-focused innovations are emerging as key forces shaping the country’s evolving snack landscape.

To get more information on this market, Request Sample

Increased Demand with E-Commerce and Specialty Retail

Online retail platforms are playing a very significant role in defining consumer access to organic snack foods in Australia. E-commerce adoption, driven by convenience and expansive product variety, has facilitated brands to access health-conscious consumers outside urban locations. Subscription services and online grocery websites are presenting managed collections of organic snack foods, frequently accompanied by lifestyle content and ingredient education. Independent organic retailers and specialty health food stores are also seeing more traffic, fueled by rising awareness of ingredient integrity and sourcing ethics. This dual-model distribution system—blending digital access with specialty in-store experience—is building deeper brand-consumer interaction. As consumers grow to appreciate increased transparency and traceability, these media present a perfect vehicle for rich product stories. This multi-channel development mirrors Australia organic snack foods market directions, which show that distribution models blending convenience, individualization, and product authenticity will continue dominating the industry's direction in the short term.

Emphasis on Functional Nutrition and Specific Health Benefits

Organic snack foods are not only being adopted in Australia due to their purity but also for their ability to promote particular health benefits. Functional nutrition is driving product development, with ingredients chosen for their ability to boost immunity, improve digestion, energy levels, or brain function. Superfoods like chia, turmeric, maca, and matcha are becoming more commonly featured in bars, bites, and crisps in order to meet wellness objectives. With consumers favoring management of long-term health, snack foods that are part of overall dietary systems are growing in popularity. Low-sugar, high-protein, and high-fiber organic snacks that appeal to active lifestyles are also observing a clear shift. These taste in accordance with the growing focus Australians have on preventative health and natural food. Emphasizing Australia organic snack foods market trends, the demand for functional organic snacks illustrates how consumer demand is shifting away from mere sustenance to personalized nutritional experience, ultimately leading to a more evolved and health-oriented organic snacking culture.

Australia Organic Snack Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and flavor.

Product Type Insights:

- Potato Chips

- Corn Chips

- Tortilla Chips

- Bakery Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes potato chips, corn chips, tortilla chips, and bakery products.

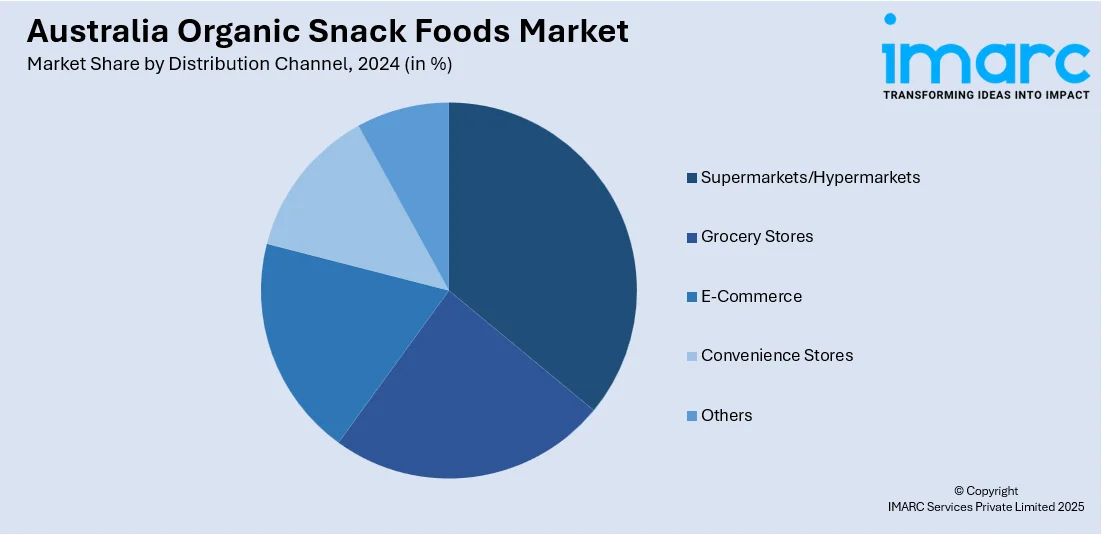

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Grocery Stores

- E-Commerce

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, grocery stores, e-commerce, convenience stores, and others.

Flavor Insights:

- Chocolate

- Vanilla

- Strawberry

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes chocolate, vanilla, strawberry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Organic Snack Foods Market News:

- In November 2024, FULFIL Vitamin & Protein Bars were introduced in Australia, providing a delicious, healthy snack choice with 9 vitamins and minimal sugar. Sold only at Woolworths, varieties such as Chocolate Peanut Butter and Salted Caramel are designed to meet active consumers' need for smarter snacking.

Australia Organic Snack Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Potato Chips, Corn Chips, Tortilla Chips, Bakery Products |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Grocery Stores, E-Commerce, Convenience Stores, Others |

| Flavors Covered | Chocolate, Vanilla, Strawberry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia organic snack foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia organic snack foods market on the basis of product type?

- What is the breakup of the Australia organic snack foods market on the basis of distribution channel?

- What is the breakup of the Australia organic snack foods market on the basis of flavor?

- What is the breakup of the Australia organic snack foods market on the basis of region?

- What are the various stages in the value chain of the Australia organic snack foods market?

- What are the key driving factors and challenges in the Australia organic snack foods?

- What is the structure of the Australia organic snack foods market and who are the key players?

- What is the degree of competition in the Australia organic snack foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia organic snack foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia organic snack foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic snack foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)