Australia Over-the-Counter Pain Relievers Market Size, Share, Trends and Forecast by Drug Type, Formulation, Distribution Channel, End User, and Region, 2026-2034

Australia Over-the-Counter Pain Relievers Market Summary:

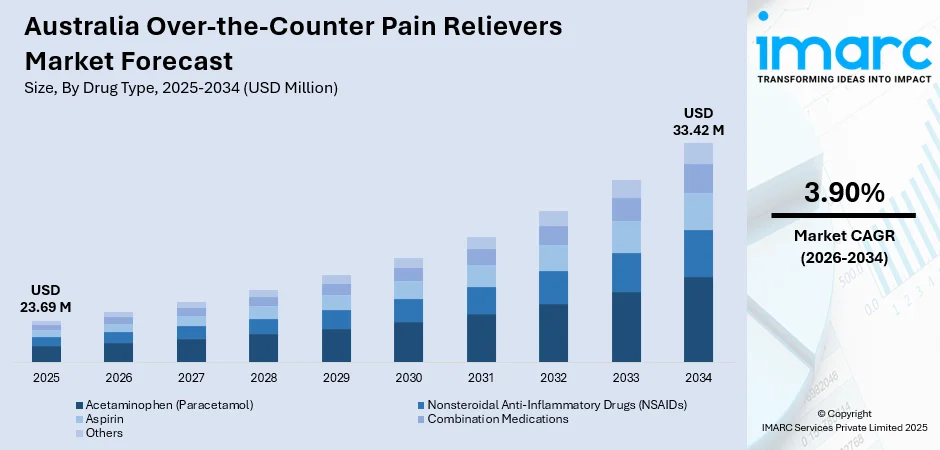

The Australia over-the-counter pain relievers market size was valued at USD 23.69 Million in 2025 and is projected to reach USD 33.42 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

The market experiences steady expansion driven by increasing health consciousness among Australians seeking effective self-medication solutions for everyday ailments such as headaches, muscle pain, and menstrual discomfort. The aging demographic, particularly those aged 45 and above experiencing chronic pain conditions, creates sustained demand for accessible pain management options. Retail channel proliferation across urban and rural areas, combined with the rapid growth of digital pharmacy platforms, enhances product accessibility and purchasing convenience, thereby expanding the Australia over-the-counter pain relievers market share.

Key Takeaways and Insights:

- By Drug Type: Acetaminophen (Paracetamol) dominates the market with a share of 38% in 2025, driven by its established safety profile for fever reduction and mild-to-moderate pain relief.

- By Formulation: Tablets and capsules lead the market with a share of 59% in 2025, owing to their universal consumer familiarity, convenient portability for workplace and travel use, precise dosage control minimizing administration errors, extended shelf stability without refrigeration requirements, and affordability in mass production compared to liquid or topical alternatives.

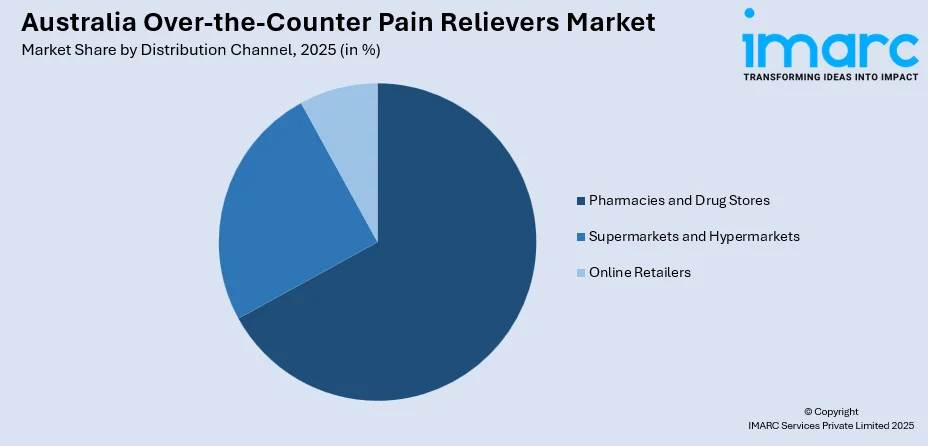

- By Distribution Channel: Pharmacies and drug stores represent the largest segment with a market share of 67% in 2025, benefiting from healthcare-associated trust that reduces purchasing hesitation for pain management products.

- By End User: Adults dominate the market with a share of 64% in 2025, reflecting working-age population demand for rapid pain relief to maintain productivity, higher disposable income enabling regular purchases.

- By Region: Australia Capital Territory and New South Wales lead the market with a share of 29% in 2025, supported by the concentration of Australia's largest urban population centers including Sydney metropolitan area, higher healthcare expenditure capacity, dense pharmacy network coverage, and advanced digital infrastructure facilitating online purchasing channels.

- Key Players: The Australia over-the-counter pain relievers market exhibits moderate competitive intensity, with established pharmaceutical manufacturers and private-label suppliers competing across retail and pharmacy distribution channels through brand recognition, pricing strategies, and product formulation innovations.

To get more information on this market Request Sample

Australia's over-the-counter pain reliever sector demonstrates resilient expansion patterns anchored in demographic shifts toward an aging population where chronic pain affects one in five Australians aged 45 and above, according to the Australian Institute of Health and Welfare. The market benefits from evolving consumer attitudes favoring proactive self-care and preventive health management, reducing reliance on clinical consultations for manageable conditions. Retail infrastructure development, including pharmacy network expansion and digital commerce platforms where a massive number of Australians accessed online shopping sites monthly in 2024 representing major increase from 2020 levels, strengthens product accessibility across metropolitan and regional markets. Online purchasing of medicines is prevalent owing to the convenience and ultra-fast delivery presented by the companies. In February 2025, the Therapeutic Goods Administration implemented revised paracetamol packaging regulations reducing general sale pack sizes from 20 to 16 tablets to address intentional overdose concerns affecting approximately 225 hospitalized patients and 50 fatalities annually, while maintaining consumer access through pharmacy-supervised larger pack availability.

Australia Over-the-Counter Pain Relievers Market Trends:

Digital Pharmacy Expansion and Omnichannel Consumer Engagement

Online pharmaceutical retail platforms experience accelerated adoption as Australian consumers increasingly favor digital purchasing channels for over-the-counter health products. The integration of click-and-collect services, subscription-based automatic refills, and mobile application interfaces enhances purchasing convenience while reducing time constraints associated with physical store visits. Apart from this, pharmacy chains implemented artificial intelligence-powered inventory management and demand forecasting systems enabling faster product reordering, particularly evident in preparation for winter flu season addressing previous supply chain gaps in cold relief medication availability. E-commerce penetration reaches younger demographic segments comfortable with comparative product review analysis and doorstep delivery expectations, while telehealth integration facilitates one-click prescription refill capabilities linking digital consultation services with online pharmaceutical purchases. IMARC Group predicts that the Australia e-commerce market is projected to attain USD 1,568.60 Billion by 2033.

Enhanced Health Literacy and Informed Self-Medication Practices

Consumer knowledge regarding pharmaceutical ingredients, dosage protocols, and potential medication interactions demonstrates measurable improvement through accessible digital health information platforms and pharmacy-led educational initiatives. Australians exhibit heightened attention to active ingredient identification, particularly concerning products containing multiple paracetamol formulations where approximately one-fifth of exposures involve concurrent use of multiple paracetamol-containing preparations. This evolving health consciousness manifests in careful label examination, pharmacist consultation frequency increases for product selection guidance, and responsible medication storage practices. The partnership between the Australian government and healthcare education programs specifically targeting pain management awareness accelerates consumer confidence in appropriate over-the-counter product utilization, supporting market adoption among previously hesitant segments while promoting safer medication practices across demographic groups. In 2025, a trial of a new management strategy aimed at possibly helping thousands of Australian women with endometriosis and chronic pelvic pain was conducted in the country. Eight medical clinics situated in different regions of Australia, such as New South Wales, Victoria, South Australia, and Western Australia, will participate in trials for the new Endometriosis Management Plan (EMP).

Regulatory Evolution and Product Accessibility Optimization

Therapeutic Goods Administration policy adjustments reshape market dynamics through balanced approaches addressing safety concerns while maintaining consumer access to essential pain management products. The 2025 implementation of revised paracetamol packaging requirements reducing supermarket pack sizes from 20 to 16 tablets and pharmacy shelf products from 100 to 50 tablets addresses annual hospitalization rates of 225 patients and 50 fatalities from intentional overdose, with highest incidence among adolescent and young adult populations. State-level variations including Queensland and Western Australia maintaining stricter behind-counter requirements for packs exceeding 16 tablets demonstrate jurisdictional flexibility within national safety frameworks, while blister packaging mandates for all general sale and pharmacy products enhance tamper-evidence and dose tracking capabilities.

Market Outlook 2026-2034:

The Australia over-the-counter pain relievers market trajectory reflects sustained expansion influenced by demographic aging patterns where chronic pain prevalence intensifies among populations 65 years and older. The market generated a revenue of USD 23.69 Million in 2025 and is projected to reach a revenue of USD 33.42 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034. Regulatory framework evolution balancing consumer safety through packaging restrictions with accessibility maintenance for legitimate therapeutic use establishes sustainable growth parameters supporting market stability through the forecast period.

Australia Over-the-Counter Pain Relievers Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Drug Type |

Acetaminophen (Paracetamol) |

38% |

|

Formulation |

Tablets and Capsules |

59% |

|

Distribution Channel |

Pharmacies and Drug Stores |

67% |

|

End User |

Adults |

64% |

|

Region |

Australia Capital Territory and New South Wales |

29% |

Drug Type Insights:

- Acetaminophen (Paracetamol)

- Nonsteroidal Anti-Inflammatory Drugs (NSAIDs)

- Aspirin

- Combination Medications

- Others

Acetaminophen (Paracetamol) dominates with a market share of 38% of the total Australia over-the-counter pain relievers market in 2025.

Acetaminophen maintains market leadership through its established safety profile for fever reduction and mild-to-moderate pain management across diverse patient populations including pediatric, adult, and geriatric segments. Clinical practitioners consistently recommend paracetamol as first-line analgesic therapy due to minimal gastrointestinal side effects compared to nonsteroidal anti-inflammatory alternatives, reduced contraindication concerns for patients with kidney or cardiovascular conditions, and documented efficacy in managing common ailments including headaches, dental pain, menstrual discomfort, and osteoarthritis symptoms.

Cost-effectiveness positions acetaminophen favorably against branded prescription alternatives and combination formulations, particularly appealing to price-sensitive consumers and private-label product manufacturers supplying major retail chains including Chemist Warehouse and Woolworths supermarket health sections. Market dynamics reflect supply chain adaptations following historical stockpiling behavior when government authorities implemented single-unit purchase restrictions addressing paracetamol shortage concerns, subsequently establishing more resilient inventory management protocols. The widespread availability across multiple distribution channels including supermarkets, convenience stores, pharmacies, and online platforms ensures consistent product accessibility for consumers seeking immediate pain relief solutions without prescription requirements, supporting sustained market share retention through the forecast period despite increasing competition from alternative analgesic formulations and combination therapy products targeting specific pain conditions.

Formulation Insights:

- Tablets and Capsules

- Gels and Ointments

- Sprays

- Liquids and Syrups

Tablets and capsules lead with a share of 59% of the total Australia over-the-counter pain relievers market in 2025.

Tablets and capsules command market preference through universal consumer familiarity spanning multiple generations, offering standardized dosage precision that minimizes administration errors common with liquid measurements or topical application inconsistencies. The solid oral formulation provides optimal portability for workplace environments, travel scenarios, and personal carry requirements where spillage risks and temperature sensitivity concerns associated with liquid or topical alternatives present practical limitations. Extended shelf stability without refrigeration requirements positions tablets favorably for both retail inventory management and household storage, reducing product waste and ensuring consistent therapeutic efficacy throughout product lifecycle. Blister packaging implementations mandated under February 2025 Therapeutic Goods Administration regulations enhance tamper-evidence capabilities, dose tracking for adherence monitoring, and child-resistant features addressing accidental ingestion prevention.

Manufacturing economics favor tablet and capsule production through high-volume automated processing capabilities reducing per-unit costs, enabling competitive pricing strategies across both branded and private-label market segments. Consumer preference studies indicate tablets remain the principal choice for occasional self-medication particularly among busy working individuals and families seeking straightforward dosing instructions without complex application protocols required for topical formulations. Market dynamics accommodate formulation diversity where fast-dissolving tablets target rapid onset requirements, extended-release variants serve chronic pain management needs, and effervescent preparations appeal to consumers preferring alternative administration methods.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retailers

Pharmacies and drug stores exhibit a clear dominance with a 67% share of the total Australia over-the-counter pain relievers market in 2025.

Pharmacy channels maintain dominant positioning through healthcare-associated trust relationships that substantially reduce purchasing hesitation for pain management products, particularly among consumers seeking professional validation for self-medication decisions. Pharmacist consultation availability provides real-time product selection guidance addressing concerns regarding drug interactions with existing prescriptions, dosage appropriateness for specific conditions, and contraindication awareness for patients with comorbidities including liver function impairment or cardiovascular conditions. Comprehensive inventory depth spanning prescription medications, over-the-counter products, and health supplements positions pharmacies as one-stop healthcare destinations where consumers consolidate purchasing activities, driving cross-category sales and customer loyalty development. The November 2024 Sigma Healthcare-Chemist Warehouse merger consolidating over 1,000 pharmacy locations strengthens retail network density particularly in urban markets while raising Australian Competition and Consumer Commission scrutiny regarding wholesale competition impacts and independent pharmacy competitiveness preservation.

Strategic pharmacy locations in high-traffic commercial areas including shopping centers, medical precincts, and transportation hubs maximize consumer accessibility during routine errands and healthcare visits. Private-label product development by major pharmacy chains including Chemists Own brand with over 300 generic products captures price-sensitive segments while maintaining margin control through vertical integration eliminating branded manufacturer markup layers. Regulatory framework positioning larger pack sizes behind pharmacy counters under Therapeutic Goods Administration February 2025 paracetamol restrictions reinforces channel importance for consumers requiring chronic pain management quantities, creating natural traffic generation for pharmacist-supervised sales of fifty to one hundred tablet packs unavailable through supermarket or convenience store channels subject to sixteen tablet general sale limitations.

End User Insights:

- Adults

- Pediatric

- Geriatric

Adults lead the market commanding 64% share of the total Australia over-the-counter pain relievers market in 2025.

Adult segment dominance reflects working-age population demand for rapid pain relief solutions enabling productivity maintenance across professional, domestic, and social obligations where acute discomfort including headaches, muscle strain, menstrual pain, and minor injuries could otherwise impair functional capacity. Higher disposable income among employed adults facilitates regular purchasing patterns without significant budgetary constraints, supporting preference for branded products offering perceived quality advantages alongside generic alternatives when price sensitivity governs selection decisions. Self-medication confidence develops through accumulated healthcare experiences and digital information accessibility, reducing dependency on clinical consultations for managing routine ailments deemed appropriate for over-the-counter intervention.

Chronic pain prevalence affecting one in five Australians aged 45 and above establishes sustained demand patterns where daily or regular medication use becomes lifestyle necessity rather than occasional intervention, particularly evident in osteoarthritis management, persistent back pain conditions, and degenerative joint disorders common among middle-aged and approaching-retirement demographics. Marketing strategies targeting adult consumers emphasize rapid onset formulations, extended duration variants, and combination products addressing multiple symptoms simultaneously, aligning product positioning with time-constrained schedules and multitasking lifestyle requirements. Workplace wellness initiatives incorporating first-aid station stocking with analgesic supplies, occupational health clinic integration of acetaminophen for industrial injury pain management, and corporate health insurance benefits covering over-the-counter medication purchases further embed adult segment consumption patterns supporting market leadership sustainability through demographic and employment trends. In 2025, OsteoLife launched its Workplace Wellbeing Workshop Program in Sydney and New South Wales.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the leading geographic segment with 29% market share.

New South Wales hosts Australia's largest urban concentration centered on Sydney metropolitan area encompassing over five million residents, generating substantial consumer base volumes for over-the-counter health products across diverse socioeconomic segments. Dense pharmacy network coverage including major chains and independent operators ensures comprehensive geographic accessibility from central business districts through suburban corridors to outer regional areas, supporting both walk-in purchasing and home delivery service expansion. Higher average household income levels compared to national medians enable discretionary health spending where branded pain reliever preferences coexist with generic alternatives, maintaining robust revenue generation across product price tiers.

Healthcare awareness campaigns and government-supported pain management education initiatives concentrate resources in high-population density areas maximizing outreach effectiveness, consequently elevating health literacy and appropriate self-medication practices. Competitive retail dynamics foster aggressive promotional activities, pricing strategies, and inventory diversity as pharmacy chains and supermarket health sections vie for market share within affluent consumer segments exhibiting lower price elasticity and brand loyalty susceptibility. The regional concentration of pharmaceutical manufacturing, wholesale distribution centers, and corporate headquarters operations enhances supply chain efficiency through reduced logistics costs and shortened delivery timeframes, supporting inventory turnover rates and product freshness maintenance crucial for consumer confidence in medication efficacy and safety throughout product lifecycle from manufacture through point-of-sale.

Market Dynamics:

Growth Drivers:

Why is the Australia Over-the-Counter Pain Relievers Market Growing?

Aging Population and Escalating Chronic Pain Prevalence

Australia experiences sustained demographic aging where the proportion of individuals aged 65 and above continues expanding, creating persistent demand for pain management solutions addressing chronic conditions prevalent among elderly populations. According to the Australian Institute of Health and Welfare, chronic pain affects one in five Australians aged 45 and over, with prevalence intensifying to twenty-two percent among those aged 75-84 years and twenty-four percent for individuals 85 years and older. Conditions including osteoarthritis, back pain, neuropathic disorders, and degenerative joint diseases generate daily medication requirements where over-the-counter analgesics serve as accessible first-line interventions. The 2024 National Pain Survey conducted by Chronic Pain Australia stated that 50% of Australians in the prime earning years live with chronic pain and are unable to work. This demographic trajectory establishes durable market foundations as the aging population segment continues expanding through the forecast period, driving sustained consumption patterns for regular pain relief medication.

Rising Self-Medication Culture and Preventive Healthcare Adoption

Patient behavior shifts toward proactive health management and self-care practices reduce dependency on clinical consultations for manageable ailments, accelerating over-the-counter pain reliever utilization across demographic segments. Time constraints associated with medical appointment scheduling, clinic wait times, and work hour disruptions motivate consumers to address minor pain conditions through readily accessible pharmacy and retail channel products without prescription requirements. Digital health information platforms, pharmacy-led educational initiatives, and social media wellness communities enhance consumer knowledge regarding appropriate medication selection, dosage protocols, and ingredient awareness, building confidence in self-medication decisions. Additionally, more than 7 million individuals in the country live with arthritis or musculoskeletal conditions, such as osteoarthritis, inflammatory arthritis, Sjogren's Disease, gout, back pain, and many others. This is encouraging the Australian government and education programs to focus on pain management awareness campaigns, addressing previous knowledge gaps and safety concerns.

Retail Infrastructure Expansion and Digital Commerce Integration

Pharmacy network proliferation across urban and regional markets enhances product accessibility, while digital commerce platforms introduce convenient purchasing alternatives accommodating contemporary consumer preferences for time-efficient shopping experiences. Pharmacy e-commerce platforms exhibit growing market share through click-and-collect services, subscription-based automatic refills, and doorstep delivery capabilities. Artificial intelligence-powered inventory management systems implemented by major pharmacy chains in early 2024 optimize supply chain efficiency through demand forecasting and automated reordering protocols, evidenced in winter flu season preparation addressing previous cold relief product availability gaps. In 2024, the Australian government received 87 new applications for the opening of new pharmacies in the months post announcement of 60 days prescription.

Market Restraints:

What Challenges the Australia Over-the-Counter Pain Relievers Market is Facing?

Regulatory Packaging Restrictions and Compliance Costs

Therapeutic Goods Administration implementation of revised paracetamol packaging regulations effective 2025 imposes operational adjustments for manufacturers and retailers managing inventory transitions, labeling compliance, and distribution channel modifications. Pack size reductions from 20 to 16 tablets for general sale channels and 100 to 50 tablets for pharmacy shelf products require manufacturing line reconfiguration, packaging material redesign, and inventory turnover acceleration to eliminate non-compliant stock before regulatory deadlines. Blister packaging mandates increase per-unit production costs compared to bottle formats, potentially compressing profit margins particularly for price-sensitive generic and private-label segments. State-level variations including Queensland and Western Australia maintaining stricter behind-counter requirements for packs exceeding 16 tablets create jurisdictional complexity for national distribution strategies requiring customized inventory allocation and retail staff training protocols across geographic markets.

Overdose Concerns and Hepatotoxicity Safety Profile

Paracetamol-related adverse events including hospitalizations for liver injury and fatalities from overdose incidents generate ongoing safety scrutiny despite widespread therapeutic utility. Intentional overdose rates peak among adolescent and young adult populations demonstrating impulsive self-harm behaviors, while accidental dosing errors result from concurrent use of multiple paracetamol-containing products including cold and flu combination formulations where ingredient overlap creates cumulative dose concerns. Public health messaging emphasizes hepatotoxicity risks and maximum daily dose limitations potentially dampens consumption frequency among safety-conscious consumers, particularly those managing chronic pain conditions requiring regular medication use. Media coverage of overdose incidents and regulatory interventions heightens consumer awareness regarding paracetamol dangers, potentially motivating alternative analgesic selection including nonsteroidal anti-inflammatory drugs or topical formulations perceived as lower-risk options.

Market Consolidation and Competitive Landscape Disruption

The November 2024 Australian Competition and Consumer Commission approval of the Sigma Healthcare-Chemist Warehouse merger despite preliminary June 2024 competition concerns introduces market concentration risks affecting independent pharmacy competitiveness, wholesale pricing dynamics, and consumer choice availability. The consolidated entity controlling wholesale distribution to over 4,000 community pharmacies alongside 600 Chemist Warehouse franchise locations creates vertical integration potentially disadvantaging independent operators lacking comparable purchasing power and supply chain efficiency. Australian Competition and Consumer Commission warnings regarding potential wholesale option limitations, retail competition reduction, and service quality impacts reflect regulatory uncertainty surrounding merged operations influence on pharmaceutical product pricing and availability across distribution channels. Independent pharmacies face heightened competitive pressures from major chain operations offering private-label alternatives, volume-based pricing advantages, and comprehensive marketing resources that smaller operators struggle to match, potentially constraining market diversity and limiting consumer access options in underserved regional markets where independent pharmacies provide primary healthcare retail coverage.

Competitive Landscape:

The Australia over-the-counter pain relievers market exhibits moderate competitive intensity characterized by established multinational pharmaceutical manufacturers, domestic generic producers, and private-label suppliers competing across retail and pharmacy distribution channels. Major players maintain market leadership through brand recognition, product portfolio diversity, and distribution network density. Competitive strategies emphasize pricing differentiation where branded products command premium positioning based on consumer trust and perceived quality advantages, while generic and private-label alternatives capture price-sensitive segments through retail chain partnerships and cost-effective manufacturing. Innovation focus areas include extended-release formulations, combination products targeting specific pain conditions, and packaging enhancements addressing consumer convenience and safety requirements under evolving Therapeutic Goods Administration regulatory frameworks.

Recent Developments:

- In June 2025, Viatris' NSAID Celebrex Relief is announced to be the first and only non-prescription treatment of this type in Australia for short-term acute pain alleviation.

Australia Over-the-Counter Pain Relievers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Acetaminophen (Paracetamol), Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Aspirin, Combination Medications, Others |

| Formulations Covered | Tablets and Capsules, Gels and Ointments, Sprays, Liquids and Syrups |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retailers |

| End Users Covered | Adult, Pediatric, Geriatric |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia over-the-counter pain relievers market size was valued at USD 23.69 Million in 2025.

The Australia over-the-counter pain relievers market is expected to grow at a compound annual growth rate of 3.90% from 2026-2034 to reach USD 33.42 Million by 2034.

Acetaminophen (Paracetamol) dominated the drug type segment with 38% market share, driven by its established safety profile, widespread physician recommendations as first-line analgesic therapy, and cost-effectiveness across diverse consumer segments requiring fever reduction and pain management.

Key factors driving the Australia over-the-counter pain relievers market include aging population demographics where chronic pain affects one in five Australians aged 45 and above, rising self-medication culture reducing dependency on clinical consultations, and retail infrastructure expansion including pharmacy network proliferation and digital commerce platforms Australians accessed online shopping sites monthly in 2024 representing a major increment.

Major challenges include Therapeutic Goods Administration regulatory packaging restrictions effective February 2025 reducing pack sizes and imposing compliance costs, paracetamol overdose concerns affecting approximately 225 annual hospitalizations and 50 fatalities generating safety scrutiny, and market consolidation through the November 2024 Sigma Healthcare-Chemist Warehouse merger creating competitive landscape disruption affecting independent pharmacy operations and wholesale pricing dynamics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)