Australia Over the Top Market Size, Share, Trends and Forecast by Component, Platform Type, Deployment Type, Content Type, Revenue Model, Service Type, Vertical, and Region, 2025-2033

Australia Over the Top Market Overview:

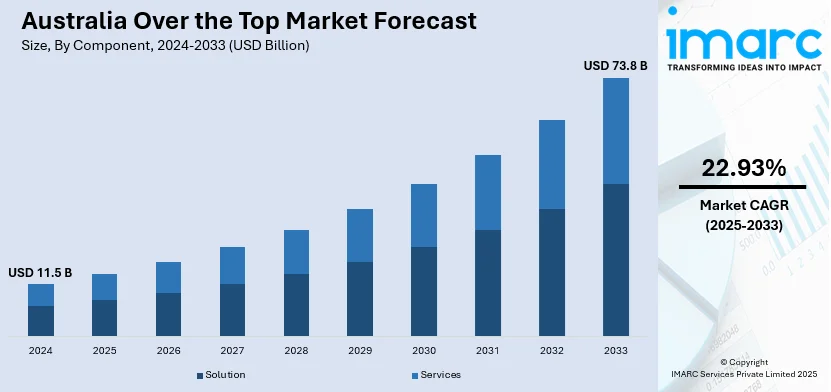

The Australia over the top market size reached USD 11.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 73.8 Billion by 2033, exhibiting a growth rate (CAGR) of 22.93% during 2025-2033. The market is primarily driven by rising internet penetration, a growing inclination toward on-demand entertainment, and the widespread adoption of smart devices, further supported by the increasing demand for localized content, flexible pricing models that boost user engagement, and enhanced network infrastructure enabling high-quality streaming across both urban and regional areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 73.8 Billion |

| Market Growth Rate 2025-2033 | 22.93% |

Australia Over the Top Market Trends:

Rising Demand for Localized and Original Content

A prominent trend in Australia’s OTT market is the surge in demand for locally produced and culturally resonant content. Viewers increasingly seek stories that reflect Australian society, values, and diverse identities. In response, platforms like Stan, Binge, and Netflix have expanded investments in original Australian series, films, and documentaries. Regulatory pressure, such as potential local content quotas for international platforms, also pushes global players to commission homegrown content. This trend enhances user engagement while supporting the domestic media production ecosystem. The emphasis on localization helps platforms distinguish themselves in a crowded streaming landscape, fostering brand loyalty and catering to regional tastes that globalized content may overlook.

To get more information on this market, Request Sample

Growing Integration of Freemium and Hybrid Monetization Models

OTT platforms in Australia are increasingly turning to freemium and hybrid monetization strategies to attract and retain subscribers amid rising subscription fatigue and economic pressures. As viewers become more selective with paid services, ad-supported video on demand (AVOD) models and freemium access tiers are gaining momentum. These models provide basic content for free while placing premium offerings behind a paywall, allowing platforms to serve both cost-conscious users and those seeking premium experiences. Services like SBS On Demand and 7plus are capitalizing on ad revenues, with Broadcaster Video on Demand (BVOD) platforms such as 7plus, 9Now, and 10 Play collectively witnessing a 12.7% rise in advertising revenue, totaling $441 million. This growing preference for AVOD underscores how diversified monetization is helping platforms scale audiences and stay agile in a saturated, churn-sensitive market.

Mobile-First Viewing and Short-Form Content Consumption

With mobile internet usage surging across Australia, there is a strong shift toward mobile-first OTT consumption, particularly among younger demographics. Consumers increasingly watch content on smartphones and tablets, prompting OTT providers to optimize user experiences across mobile devices. This shift also supports the rising popularity of short-form content available on platforms like YouTube, TikTok, and Instagram Reels. Fast-paced lifestyles and reduced attention spans drive the demand for bite-sized, easily digestible videos. OTT platforms are now exploring new monetization models through mobile advertising, in-app purchases, and partnerships with telecom operators. The trend redefines traditional viewing behavior, favoring on-the-go, personalized consumption over scheduled, long-form programming.

Australia Over the Top Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, platform type, deployment type, content type, revenue model, service type, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Platform Type Insights:

- Smartphones

- Smart TV's

- Laptops Desktops and Tablets

- Gaming Consoles

- Set-Top Boxes

- Others

A detailed breakup and analysis of the market based on the platform type have also been provided in the report. This includes smartphones, smart tv's, laptops desktops and tablets, gaming consoles, set-top boxes, and others.

Deployment Type Insights:

- Cloud

- On-Premise

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud and on-premise.

Content Type Insights:

- Voice Over IP

- Text and Images

- Video

- Others

A detailed breakup and analysis of the market based on the content type have also been provided in the report. This includes voice over IP, text and images, video, and others.

Revenue Model Insights:

- Subscription

- Procurement

- Rental

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes subscription, procurement, rental, and others.

Service Type Insights:

- Consulting

- Installation and Maintenance

- Training and Support

- Managed Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes consulting, installation and maintenance, training and support, and managed services.

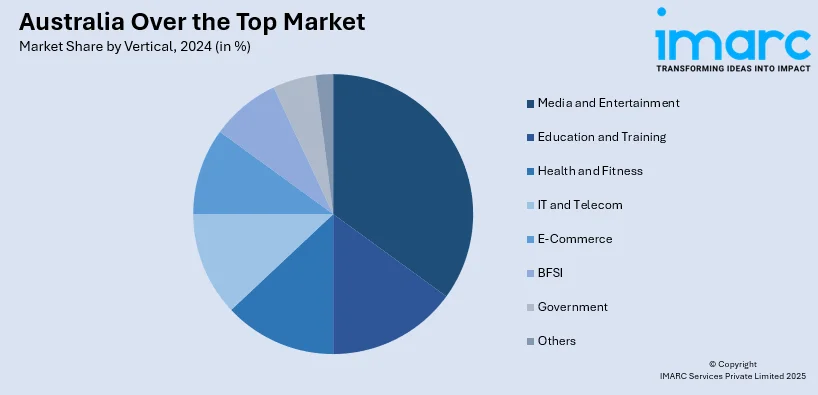

Vertical Insights

- Media and Entertainment

- Education and Training

- Health and Fitness

- IT and Telecom

- E-Commerce

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes media and entertainment, education and training, health and fitness, it and telecom, e-commerce, BFSI, government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Over the Top Market News:

- In March 2025, Warner Bros. Discovery launched its Max streaming platform in Australia, marking a key step in its global expansion strategy. CEO JB Perrette emphasized the goal of building a large-scale international streaming giant by blending global content with strong local storytelling. Following its U.S. debut in May 2023, Max continues its international rollout, with Turkey set to launch next. Perrette believes scale and global reach will define future streaming industry leaders.

- In August 2024, ABC NEWS is set to unveil a refreshed website, enhanced features, and a new on-air look on August 19, 2024. The revamp includes the return of the iconic ABC TV News Theme, remixed for modern audiences. The updated design offers a seamless, personalized experience across digital, TV, and radio platforms. ABC Director of News Justin Stevens emphasizes the importance of delivering a unified and engaging experience to millions of Australians each week.

Australia Over the Top Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Platform Types Covered | Smartphones, Smart TV's, Laptops Desktops and Tablets, Gaming Consoles, Set-Top Boxes, Others |

| Deployment Types Covered | Cloud, On-Premise |

| Content Types Covered | Voice Over IP, Text and Images, Video, Others |

| Revenue models Covered | Subscription, Procurement, Rental, Others |

| Service Types Covered | Consulting, Installation and Maintenance, Training and Support, Managed Services |

| Verticals Covered | Media and Entertainment, Education and Training, Health and Fitness, IT and Telecom, E-Commerce, BFSI, Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia over the top market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia over the top market on the basis of component?

- What is the breakup of the Australia over the top market on the basis of platform type?

- What is the breakup of the Australia over the top market on the basis of deployment type?

- What is the breakup of the Australia over the top market on the basis of content type?

- What is the breakup of the Australia over the top market on the basis of revenue model?

- What is the breakup of the Australia over the top market on the basis of service type?

- What is the breakup of the Australia over the top market on the basis of vertical?

- What is the breakup of the Australia over the top market on the basis of region?

- What are the various stages in the value chain of the Australia over the top market?

- What are the key driving factors and challenges in the Australia over the top market?

- What is the structure of the Australia over the top market and who are the key players?

- What is the degree of competition in the Australia over the top market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia over the top market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia over the top market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia over the top industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)