Australia Packaged Beverages Market Size, Share, Trends and Forecast by Type, Packaging Type, Distribution Channel, and Region, 2025-2033

Australia Packaged Beverages Market Size Overview:

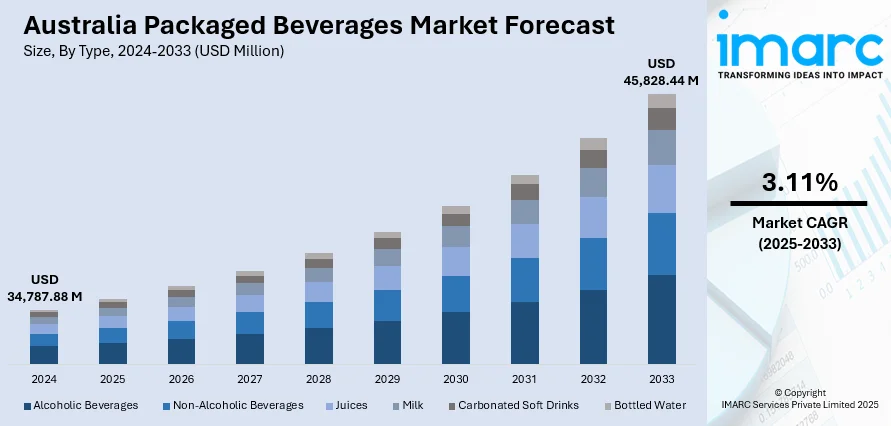

The Australia packaged beverages market size reached USD 34,787.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 45,828.44 Million by 2033, exhibiting a growth rate (CAGR) of 3.11% during 2025-2033. At present, consumers are shifting their interest towards health and wellness. This trend, along with the expansion of digital retail platforms, is positively influencing the market. Moreover, the increasing awareness about the ecological implications of plastic waste is expanding the Australia packaged beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34,787.88 Million |

| Market Forecast in 2033 | USD 45,828.44 Million |

| Market Growth Rate 2025-2033 | 3.11% |

Australia Packaged Beverages Market Trends:

Increased Consumer Demand for Health-Conscious Choices

The Australian market for packaged beverages is witnessing major growth as consumers are shifting their interest towards health and wellness. Consumers are increasingly becoming health-conscious and are consciously looking for beverages with less sugar, natural ingredients, and functional attributes like immunity support and hydration. In response, companies are introducing and formulating healthier options like plant-based beverages, functional waters, and low-calorie drinks to meet this trend. Brands are also promoting product labels with clear information about nutritional content so that consumers have complete knowledge about their drink options. This emerging trend of consuming healthier products is driving the demand for new-age clean-label drinks, which is motivating manufacturers to build larger portfolios of products and invest in product development aligning with these themes. In 2024, Australian kombucha brand Kommunity Brew announced their venture into manufacturing hydration and probiotic drinks.

To get more information on this market, Request Sample

Expansion of E-commerce and Online Retail Channels

The expansion of online retail platforms is making a major impact on Australia's packaged beverages industry. Consumers are making more use of the convenience of buying from home, causing online sales of beverages to skyrocket. Retailers and makers are responding by building a strong online presence and tailoring their products to suit e-commerce platforms. Firms are leveraging digital marketing tactics, subscription services, and delivery models to boost customer experience and sales. Additionally, the rise of e-platforms is making it easier for companies to introduce specialist and premium drink offerings that might not be easily found in mainstream retail stores. This change is not just making consumers able to buy a greater range of products but is also driving innovation in packaging, for example, making products available in more sustainable materials and smaller sizes for one-off consumption. Online shopping is continuing to be pivotal in extending market reach.

Sustainability and Environmental Considerations

Sustainability is emerging as a major factor propelling the Australia packaged beverages market growth. Increasing awareness about the ecological implications of plastic waste is encouraging brands to turn to sustainable packaging solutions. Producers are also opting for recyclable materials, biodegradable materials, and renewable materials-based packaging. Along with packaging, a new trend is emerging through the promotion of beverage formulations emphasizing sustainability, e.g., beverages incorporating responsibly sourced ingredients or utilizing energy-efficient processes. Consumers are embracing brands that prove a dedication to lowering their carbon footprint, catalyzing the demand for green beverages. Firms are responding to these issues by making investments in sustainability programs, including the use of refillable or reusable containers and developing recycling encouragement programs. For instance, in 2025, The Australian packaging firm Visy will produce an eco-friendly beverage can featuring an average of 83% recycled material at its facility in Yatala, Queensland. Collaborating with brewer Stone & Wood, brand owner Lion, aluminum coil supplier Novelis, and mining firm Rio Tinto, the companies have jointly developed a pilot project named Re-In-Can-Ation to create a more sustainable beverage can.

Australia Packaged Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, packaging type, and distribution channel.

Type Insights:

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Juices

- Milk

- Carbonated Soft Drinks

- Bottled Water

The report has provided a detailed breakup and analysis of the market based on the type. This includes alcoholic beverages, non-alcoholic beverages, juices, milk, carbonated soft drinks, and bottled water.

Packaging Type Insights:

- Cartons

- Cans

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes cartons, cans, bottles, and others.

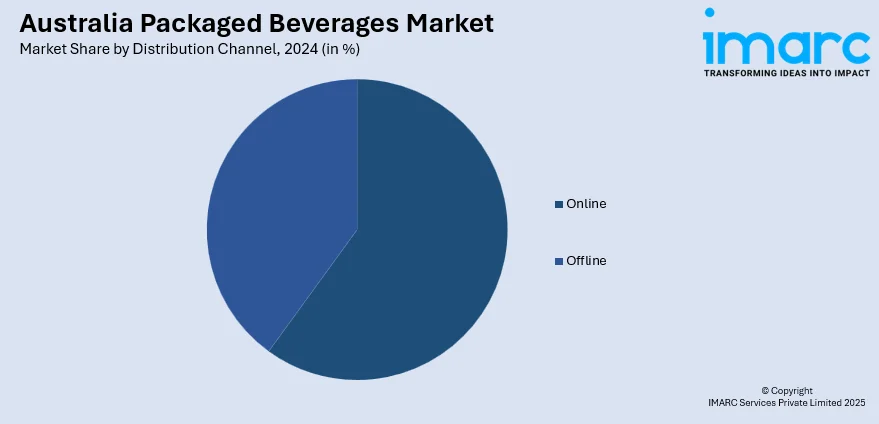

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Packaged Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic Beverages, Non-Alcoholic Beverages, Juices, Milk, Carbonated Soft Drinks, Bottled Water |

| Packaging Types Covered | Cartons, Cans, Bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia packaged beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia packaged beverages market on the basis of type?

- What is the breakup of the Australia packaged beverages market on the basis of packaging type?

- What is the breakup of the Australia packaged beverages market on the basis of distribution channel?

- What is the breakup of the Australia packaged beverages market on the basis of region?

- What are the various stages in the value chain of the Australia packaged beverages market?

- What are the key driving factors and challenges in the Australia packaged beverages market?

- What is the structure of the Australia packaged beverages market and who are the key players?

- What is the degree of competition in the Australia packaged beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia packaged beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia packaged beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia packaged beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)