Australia Paints and Coatings Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

Australia Paints and Coatings Market Overview:

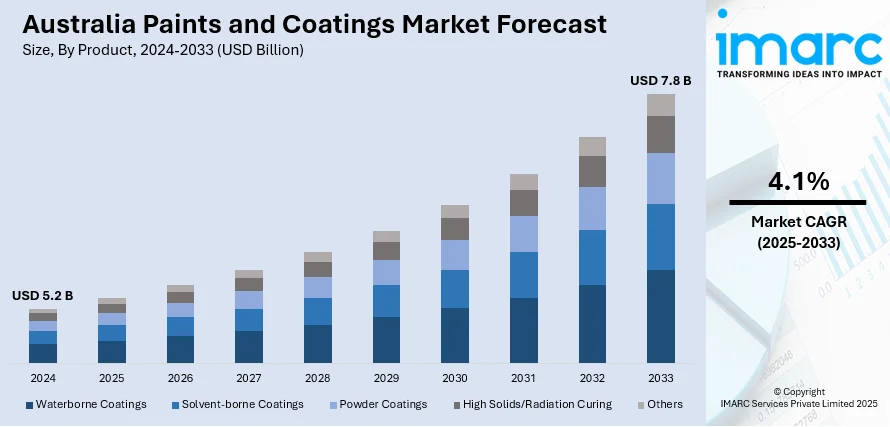

The Australia paints and coatings market size reached USD 5.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The market is experiencing significant growth mainly driven by construction activity, infrastructure upgrades, and rising demand for eco-friendly products. In line with this, innovation in water-based and low-VOC formulations across residential, commercial, and industrial applications are also contributing positively to the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

Australia Paints and Coatings Market Trends:

Rising Demand for Low-VOC and Eco-Friendly Products

The growing emphasis on sustainability is deeply influencing product innovation for Australia's paints and coatings industry. Stringent environmental regulations and growing consumer demand for low-odor, non-toxic products are pushing the shift to low-VOC and eco-friendly formulations. The shift is one of the main drivers of the Australia paints and coatings market share, with manufacturers employing bio-based materials and waterborne technologies to keep pace with evolving standards. For instance, in October 2023, Glasurit announced the launch of AraClass, an innovative range of clearcoats and undercoats in Australia, combining quality, speed, and sustainability. Featuring EcoBalance products that significantly reduce CO2 emissions, AraClass aims to enhance profitability while promoting eco-effectiveness, supporting the automotive repair industry's transition toward environmentally friendly solutions. Green building certifications and energy-efficient construction are also driving the adoption of sustainable coatings in residential, commercial, and industrial markets. Retailers and contractors are responding to this demand by carrying and recommending products that are environmentally aligned. Product labeling and marketing now also frequently highlight eco-compliance as a key selling point. This change in demand among consumers and conformity with regulation will remain a key force behind Australia paints and coatings market growth over the coming years.

To get more information on this market, Request Sample

Rise in Powder Coating Adoption

Powder coatings are witnessing increased adoption in Australia, especially within industrial and architectural applications, due to their superior durability, corrosion resistance, and cost-effectiveness. These coatings are solvent-free, generate minimal waste, and emit near-zero volatile organic compounds (VOCs), making them a preferred option for environmentally conscious projects. Their ability to provide uniform finishes without runs or drips adds to their appeal in automotive, appliance, metal furniture, and infrastructure segments. Local manufacturers and applicators are also investing in advanced powder coating technologies to meet demand from mining, transport, and construction sectors. For instance, in August 2023, Capral Aluminium installed a new CUBE Plus vertical powder coating line at its Huntingwood facility, enhancing automation and efficiency. The company also acquired Allyman Aluminium, expanding its distribution network in NSW. This move aligns with Capral’s commitment to sustainability, as it achieves ASI certification for its operations. Moreover, the ease of recyclability and the potential for automation in application processes are encouraging broader use across high-volume production lines. As regulatory bodies continue to support sustainable industrial practices, the role of powder coatings is expected to expand significantly in the Australia paints and coatings market outlook.

Australia Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, material, and application.

Product Insights:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes waterborne coatings, solvent-borne coatings, powder coatings, high solids/radiation curing, and others.

Material Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

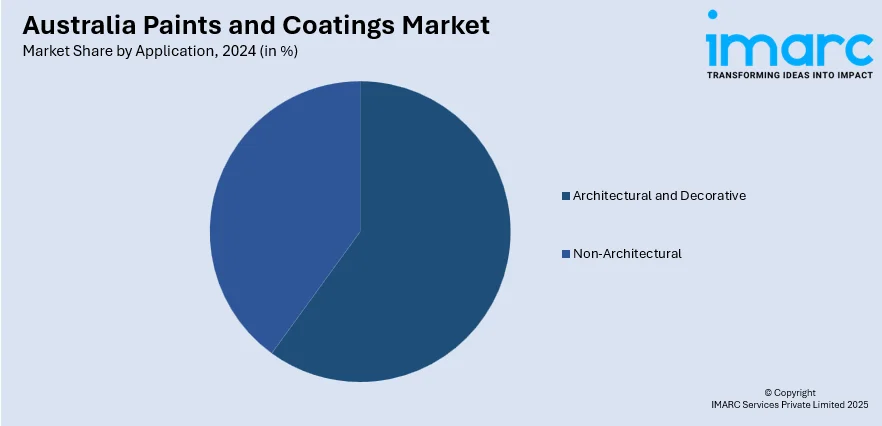

Application Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes architectural and decorative, and non-architectural (automotive and transportation, wood, general industrial, marine, protective, and others).

Regional Insights:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Paints and Coatings Market News:

- In December 2024, Australia’s ACM CRC, LaserBond, and The University of Sydney announced their partnership to develop an automated, high-efficiency laser cladding system for metal matrix composite coatings. This project aims to enhance local manufacturing, reduce reliance on overseas parts, and improve corrosion resistance, addressing key industrial needs across various sectors.

- In May 2024, AkzoNobel's International Yacht Coatings received Australian Made accreditation, highlighting its dedication to local craftsmanship. Products such as Micron AP and Ultra 2 are the first International yacht coatings products that will showcase the Australian Made logo, signifying their high-quality standards and supporting the growth of Australian manufacturing in the boating industry.

- In August 2023, BAE Systems and the Australian government announced a new F-35 coatings facility in Williamtown, enhancing support for the Royal Australian Air Force’s fleet. This expansion, part of a significant growth initiative, will create over 350 jobs by 2025, benefiting local industries and the Asia Pacific F-35 program.

Australia Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Applications Covered |

|

| Regions Covered | Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia paints and coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia paints and coatings market on the basis of product?

- What is the breakup of the Australia paints and coatings market on the basis of material?

- What is the breakup of the Australia paints and coatings market on the basis of application?

- What is the breakup of the Australia paints and coatings market on the basis of region?

- What are the various stages in the value chain of the Australia paints and coatings market?

- What are the key driving factors and challenges in the Australia paints and coatings market?

- What is the structure of the Australia paints and coatings market and who are the key players?

- What is the degree of competition in the Australia paints and coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia paints and coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)