Australia Palletized Cargo Market Size, Share, Trends and Forecast by Pallet Type, Cargo Type, Mode of Transportation, End Use Industry, and Region, 2025-2033

Australia Palletized Cargo Market Overview:

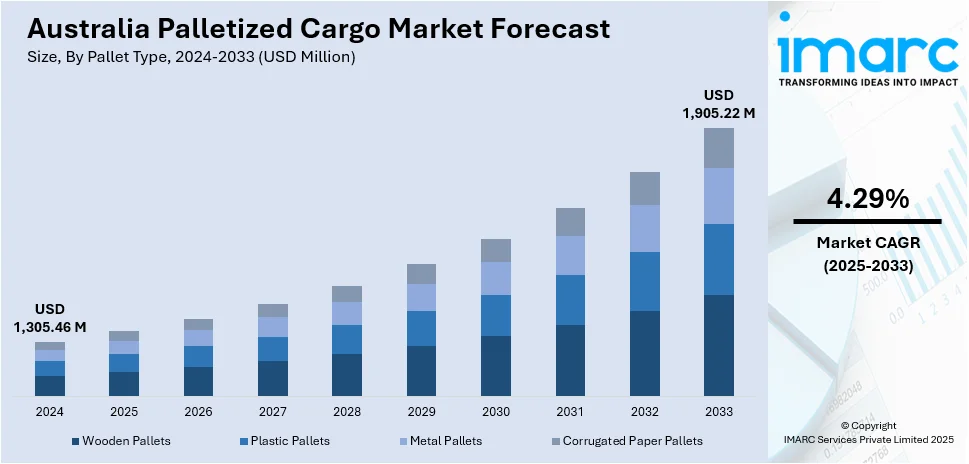

The Australia palletized cargo market size reached USD 1,305.46 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,905.22 Million by 2033, exhibiting a growth rate (CAGR) of 4.29% during 2025-2033. Rising e-commerce, demand for efficient cold chain logistics, and export growth in agriculture and pharmaceuticals are some of the factors contributing to Australia palletized cargo market share. Government infrastructure spending and automation adoption in warehouses are also key contributors, along with regional trade partnerships increasing freight volumes across ports.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,305.46 Million |

| Market Forecast in 2033 | USD 1,905.22 Million |

| Market Growth Rate 2025-2033 | 4.29% |

Australia Palletized Cargo Market Trends:

Growth of Advanced and Sustainable Warehousing for Palletized Cargo

Australia is moving toward larger, more sophisticated warehousing designed to support complex logistics demands. New facilities are being developed with high-clearance pallet storage, expansive mezzanine levels, and infrastructure capable of handling bulky freight like full truck cabs. These warehouses are not only increasing capacity but also improving distribution speed and flexibility across domestic and regional networks. Environmental considerations are being integrated from the ground up, with energy-efficient lighting, EV charging stations, and green building certifications becoming standard. This approach supports both operational performance and sustainability goals. As freight volumes rise and supply chains require greater agility, these high-capacity sites are becoming central to the efficient handling and movement of palletized cargo across Australia and beyond. These factors are intensifying the Australia palletized cargo market growth. For example, in April 2024, Daimler Truck partnered with DB Schenker to run its new 19,000 sq m warehouse in Melbourne, designed to support parts distribution across Australia and New Zealand. Stocking over 40,000 SKUs, the facility includes high-clearance pallet storage, EV charging stations, and a 4,000 sq m mezzanine. With sustainable features and efficient loading infrastructure, the warehouse strengthens Australia’s palletized cargo and logistics capabilities in the commercial vehicle sector.

To get more information on this market, Request Sample

Automation Accelerating Palletized Cargo Handling

Australia is advancing its palletized cargo logistics with automated dimensioning systems that streamline operations and reduce manual tasks. These systems allow for real-time capture of weight and measurements, improving processing speed and overall efficiency. As e-commerce continues to grow, the need for faster, more accurate handling has become essential. Automation supports this by enhancing fulfilment accuracy, improving delivery timelines, and reducing the risk of bottlenecks in busy logistics hubs. With improved data capture and minimal human intervention, facilities are now better equipped to handle large volumes of palletized freight. This shift is helping logistics providers increase reliability and performance while laying the groundwork for more responsive and scalable supply chain operations across Australia. For instance, in July 2024, FedEx introduced its Dynamic Drive-through Pallet (DTP) Dimensioning System in Australia, debuting at its new Adelaide facility. The technology more than doubles handling speed, to 400 shipments per hour, enhancing pallet processing efficiency. Australia is the first market outside the US to adopt DTP, supporting rising e-commerce demand and boosting delivery speeds. The system integrates automated weight and dimension capture, strengthening Australia’s palletized cargo logistics and regional fulfilment operations.

Australia Palletized Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on pallet type, cargo type, mode of transportation, and end use industry.

Pallet Type Insights:

- Wooden Pallets

- Plastic Pallets

- Metal Pallets

- Corrugated Paper Pallets

The report has provided a detailed breakup and analysis of the market based on the pallet type. This includes wooden pallets, plastic pallets, metal pallets, and corrugated paper pallets.

Cargo Type Insights:

- Dry Cargo

- Perishable Cargo

- Hazardous Cargo

- Heavy Equipment and Machinery

A detailed breakup and analysis of the market based on the cargo type have also been provided in the report. This includes dry cargo, perishable cargo, hazardous cargo, and heavy equipment and machinery.

Mode of Transportation Insights:

- Road Transport

- Rail Transport

- Air Transport

- Sea Transport

The report has provided a detailed breakup and analysis of the market based on the mode of transportation. This includes road transport, rail transport, air transport, and sea transport.

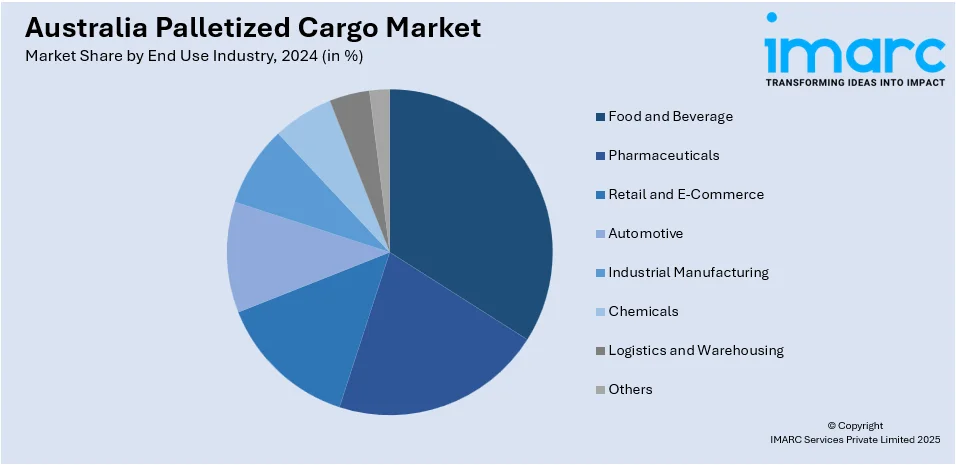

End Use Industry Insights:

- Food and Beverage

- Pharmaceuticals

- Retail and E-Commerce

- Automotive

- Industrial Manufacturing

- Chemicals

- Logistics and Warehousing

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food and beverage, pharmaceuticals, retail and e-commerce, automotive, industrial manufacturing, chemicals, logistics and warehousing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Palletized Cargo Market News:

- In May 2025, fulfilmentcrowd launched a 20,000 sq ft fulfilment center in Kemps Creek, Sydney, strengthening Australia's palletized cargo capabilities. Equipped for high-volume carton and pallet storage, the site supports local and regional distribution. Positioned near Sydney Ports and Mascot Airport, it boosts logistics efficiency. This expansion supports growing retail demand, free trade benefits, and supply chain diversification, establishing Australia as a strategic hub for Asia Pacific commerce and omnichannel fulfilment.

Australia Palletized Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pallet Types Covered | Wooden Pallets, Plastic Pallets, Metal Pallets, Corrugated Paper Pallets |

| Cargo Types Covered | Dry Cargo, Perishable Cargo, Hazardous Cargo, Heavy Equipment and Machinery |

| Modes of Transportation Covered | Road Transport, Rail Transport, Air Transport, Sea Transport |

| End Use Industries Covered | Food and Beverages, Pharmaceuticals, Retail and E-Commerce, Automotive, Industrial Manufacturing, Chemicals, Logistics and Warehousing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia palletized cargo market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia palletized cargo market on the basis of pallet type?

- What is the breakup of the Australia palletized cargo market on the basis of cargo type?

- What is the breakup of the Australia palletized cargo market on the basis of modes of transportation?

- What is the breakup of the Australia palletized cargo market on the basis of end use industry?

- What is the breakup of the Australia palletized cargo market on the basis of region?

- What are the various stages in the value chain of the Australia palletized cargo market?

- What are the key driving factors and challenges in the Australia palletized cargo market?

- What is the structure of the Australia palletized cargo market and who are the key players?

- What is the degree of competition in the Australia palletized cargo market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia palletized cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia palletized cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia palletized cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)