Australia Paper Napkins Market Size, Share, Trends and Forecast by Product Type, Material Type, Application, Distribution Channel, and Region, 2025-2033

Australia Paper Napkins Market Overview:

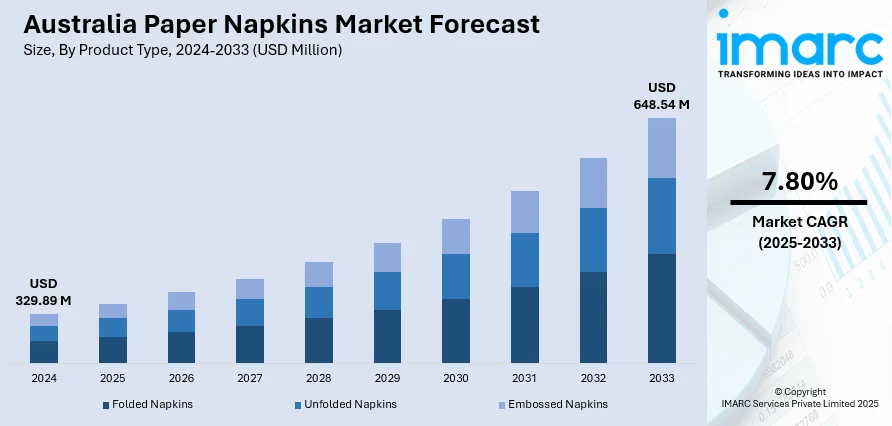

The Australia paper napkins market size reached USD 329.89 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 648.54 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is driven by heightened hygiene awareness, increased dining-out culture, and rising demand for sustainable, biodegradable products. Growth in institutional consumption, especially from healthcare and education sectors, further boosts volume. Strong retail distribution and private label penetration continue to shape Australia paper napkins market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 329.89 Million |

| Market Forecast in 2033 | USD 648.54 Million |

| Market Growth Rate 2025-2033 | 7.80% |

Australia Paper Napkins Market Trends:

Tourism Revival and Outdoor Event Catering

Australia’s tourism and events sector has rebounded significantly, resulting in heightened demand for paper napkins in outdoor catering, festivals, and hospitality services. For instance, as per industry reports, in 2024, Australia’s tourism sector is expected to reach a record $265.5BN, accounting for 10% of the national economy, while supporting 1.42 million jobs, a rise of nearly 10% from 2023. Domestic visitor spending is projected to climb to $148BN, while international visitor spending, which jumped 195% to $31.6BN in 2023, is forecast to reach $35BN in 2024 and $52.5BN by 2034. Looking ahead to 2034, the sector could surpass $345BN in value and back 2 million jobs, representing 12% of total employment. Disposable napkins are essential for hygiene and ease of service at temporary or large-scale events where washing infrastructure is limited. With rising inbound tourism and domestic travel, cafes, food trucks, and pop-up venues have expanded, all requiring high-volume napkin supply. This segment’s growth is complemented by trends in experiential dining and mobile food services, which emphasize convenience without compromising hygiene. Manufacturers are introducing water-resistant and durable napkin varieties tailored for outdoor use. This trend contributes materially to Australia paper napkins market growth by broadening seasonal and event-based consumption cycles and introducing new avenues for product innovation and marketing.

To get more information on this market, Request Sample

E-commerce and Subscription-Based Hygiene Product Distribution

The digital transformation of retail in Australia has facilitated new sales channels for paper napkins through e-commerce and subscription-based models. Consumers now prefer direct-to-doorstep delivery of hygiene essentials, including tissue and napkin products. Subscription services offer convenience and ensure stock consistency for households and small businesses. In addition, online platforms provide wider product comparisons, eco-label visibility, and customer reviews, enabling more informed and value-driven purchasing decisions. For instance, as per industry reports, Australia's toilet, towel, and tissue paper market is projected to reach 767,000 tons and $1.6 Billion by 2035, growing at a CAGR of 1.5% in volume and 2.5% in value from 2024 . In 2024, consumption was 651,000 tons, a 5.6% increase from 2023, with a market value of $1.2 billion, up 9.5% year-over-year . The toilet paper segment leads with 330,000 tons consumed, followed by paper hand towels at 209,000 tons . The market is driven by demand for premium, eco-friendly products and a shift towards online retail. Retailers and brands are also offering bundled napkin packages alongside related goods like tissues and cleaning products, enhancing cart value. These developments in digital retail and auto-replenishment models are rapidly reshaping traditional distribution methods, contributing significantly to Australia paper napkins market growth and introducing flexible, consumer-centric purchasing behavior.

Australia Paper Napkins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/region level for 2025-2033. Our report has categorized the market based on product type, material type, application, and distribution channel.

Product Type Insights:

- Folded Napkins

- Unfolded Napkins

- Embossed Napkins

The report has provided a detailed breakup and analysis of the market based on the product type. This includes folded, unfolded, and embossed napkins.

Material Type Insights:

- Recycled Paper

- Virgin Paper

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes recycled paper and virgin paper.

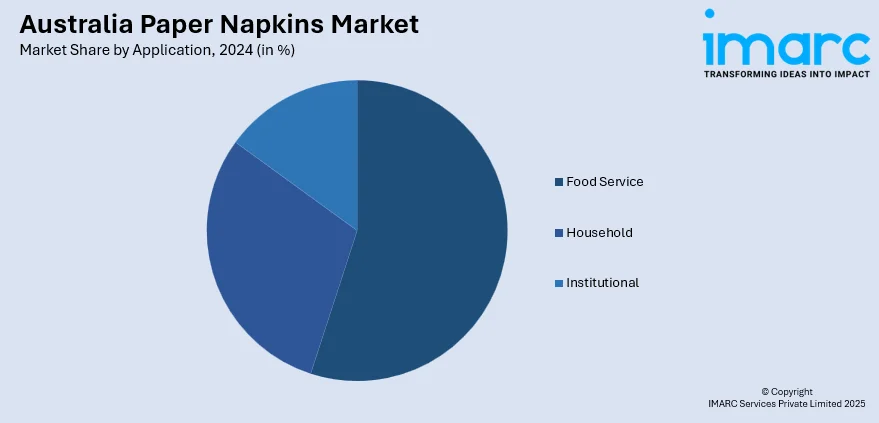

Application Insights:

- Food Service

- Household

- Institutional

The report has provided a detailed breakup and analysis of the market based on the application. This includes food service, household, and institutional.

Distribution Channel Insights:

- Online

- Offline

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline (supermarkets and hypermarkets, convenience stores, and specialty stores)

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Paper Napkins Market News:

- In March 2025, Essity unveiled the world’s first tissue machine powered entirely by geothermal steam at its Kawerau Paper Mill in New Zealand, investing $20 Million to reduce carbon emissions by 25%. The upgrade, involving global and local experts, cuts the mill’s total carbon footprint by 66%. Producing brands like Tork, Sorbent, and Purex, the mill contributes $40 Million annually to the local economy.

- In January 2024, Austria’s Andritz launched a new 3.65m-wide PrimeLineCOMPACT tissue production line at Yuen Foong Yu’s Chingshui mill in Taiwan. Operating at up to 1,650 m/min, it produces toilet paper, napkins, and facial tissues with high quality and energy efficiency. Key innovations include PrimeFlow 2-layer headbox, PrimePress XT Evo shoe press, and PrimeDry Steel Yankee. The system processes up to 112 admt/d of pulp and enhances Yuen Foong Yu’s sustainable, low-emission production.

Australia Paper Napkins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Folded Napkins, Unfolded Napkins, Embossed Napkins |

| Material Types Covered | Recycled Paper, Virgin Paper |

| Applications Covered | Food Service, Household, Institutional |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia paper napkins market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia paper napkins market on the basis of product type?

- What is the breakup of the Australia paper napkins market on the basis of material type?

- What is the breakup of the Australia paper napkins market on the basis of application?

- What is the breakup of the Australia paper napkins market on the basis of distribution channel?

- What is the breakup of the Australia paper napkins market on the basis of region?

- What are the various stages in the value chain of the Australia paper napkins market?

- What are the key driving factors and challenges in the Australia paper napkins market?

- What is the structure of the Australia paper napkins market and who are the key players?

- What is the degree of competition in the Australia paper napkins market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia paper napkins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia paper napkins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia paper napkins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)