Australia Paper and Paperboard Packaging Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Australia Paper and Paperboard Packaging Market Overview:

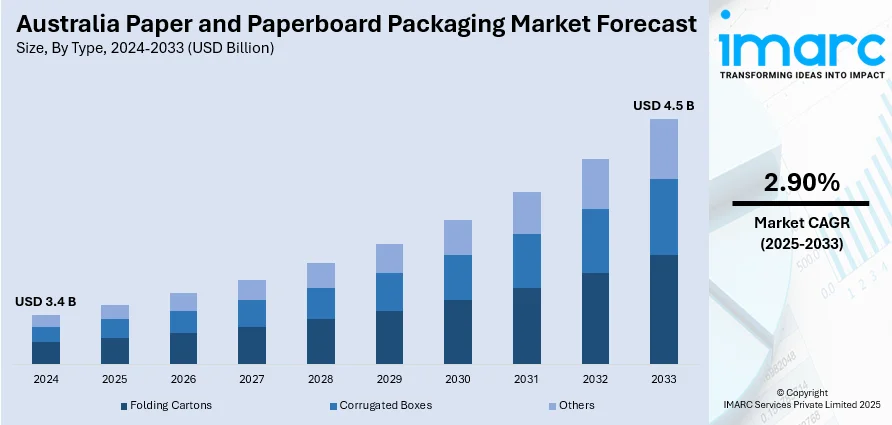

The Australia paper and paperboard packaging market size reached USD 3.4 Billion in 2024. Looking forward, the market is expected to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The market is expanding due to rising e-commerce, government policies reducing plastic usage, and increasing food and beverage consumption. Growing focus on sustainability, recycling initiatives, and premium packaging demand further strengthen the industry’s outlook. Innovation in barrier coatings and printing technologies enhances applications, supporting competitiveness and eco-conscious consumer preferences, ultimately driving the Australia paper and paperboard packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate 2025-2033 | 2.90% |

Key Trends of Australia Paper and Paperboard Packaging Market:

Sustainable Packaging Dictates Consumer Preference

Concern over the environment, as well as regulatory support, is increasingly directing consumer purchasing practices in Australia towards sustainable paper and paperboard packaging. The shift indicates a larger cultural move to minimize single-use plastics and promote renewable, recyclable packaging substitutes. For instance, in November 2024, Mars' MasterFoods will be testing Australia's first paper-recyclable squeeze-on tomato sauce packs, slashing plastic by 58%. The innovation is being done in favor of sustainability to help remove 190 metric tonnes of plastic by 2025. Moreover, paper and paperboard substrate materials, on account of being biodegradable and easy to recycle, are gaining traction within various sectors such as food and beverage (F&B), e-commerce, and personal care. This shift is also driven by growing demand for compostable and FSC-certified packaging, especially in urban areas where environmental awareness is high. As consumers value brands that share sustainable values, companies are now moving to embrace paper-based solutions that are not only functional but also sustainable. Australia paper and paperboard packaging market outlook remains positive as sustainability emerges as the key pillar of packaging innovation, opening up opportunities for growth by producers who invest in green technology and circular economy principles.

To get more information on this market, Request Sample

Personalization and Print-Ready Packaging in Retail

An increasing focus on brand uniqueness and shelf display is driving the need for personalization and print-ready paper and paperboard packaging solutions in Australia. Packaging is becoming an important marketing vehicle for manufacturers and retailers, using advanced printing technology to provide high-quality, visually appealing packaging with bright, color-rich designs that convey brand image and product information clearly. The trend is especially common in the cosmetics, pharmaceutical, and high-end food industries, where the quality of the packaging directly impacts consumer perceptions of product value. Digital printing and low-volume customization are facilitating even the smaller companies to be able to reach bespoke packaging, which, in turn, is increasing the visual presentation industry standards. In addition to and coinciding with e-commerce and DTC business model growth, packaging also acts as a necessary element of unboxing. Australia paper and paperboard packaging market growth is directly related to this trend, which prioritizes functionality and aesthetics equally.

Lightweight and Functional Design Innovation

Design innovation that seeks to minimize material use while ensuring structural integrity is driving the future of paper and paperboard packaging in Australia. Lightweight packaging achieves both sustainability objectives through reduced raw material input and functional advantages in lower shipping costs and more efficient handling. For example, In November 2023, Opal officially opened its $140 million Wodonga corrugated cardboard packaging plant, incorporating leading technology and sustainable approaches, manufacturing 100,000 tonnes of packaging a year. Furthermore, it is especially important in industries such as food delivery, e-commerce, and pharmaceuticals, where volume and speed are dominant business considerations. The innovations of the near past are directed toward multi-functional pack forms, such as easy-open designs, resealability, and moisture barriers—that facilitate usability without detracting from recyclability. These functional enhancements mirror a wider market trend favoring user experience in tandem with environmental objectives. With evolving logistics and consumer expectations, demand for maximized paper-based solutions will continue to grow. Australia paper and paperboard packaging market share is expected to grow further as lightweight, high-performance formats become increasingly popular across industries demanding efficiency and consumer convenience.

Growth Drivers of Australia Paper and Paperboard Packaging Market:

Expanding E-commerce Sector

The rapid growth of online shopping in Australia has created a surge in demand for protective, durable, and cost-effective packaging solutions. As consumers increasingly purchase everything from groceries to electronics online, e-commerce retailers depend heavily on corrugated boxes, folding cartons, and lightweight paperboard materials to ensure safe and reliable delivery. Paper and paperboard packaging is particularly favored for its versatility, recyclability, and ability to withstand transit challenges while maintaining product integrity. Moreover, the sector’s emphasis on sustainable practices has further boosted the adoption of paper-based packaging as an eco-friendly option compared to plastics. With e-commerce continuing to expand, the need for innovative designs that combine protection, branding, and environmental responsibility will significantly drive the market’s long-term growth.

Government Push for Plastic Reduction

Australia’s strong legislative push to eliminate or reduce single-use plastics is one of the most important drivers of the Australia paper and paperboard packaging market growth. Regulatory initiatives at both federal and state levels are encouraging manufacturers and retailers to adopt paper-based alternatives that align with sustainability goals. These policies not only reduce environmental impact but also push businesses to explore recyclable and compostable paperboard packaging options. Retailers, food service providers, and e-commerce companies are increasingly adopting such materials to comply with government standards while appealing to eco-conscious consumers. This shift creates new growth opportunities for paper packaging producers, who benefit from rising demand. The government’s stance on plastic reduction ensures that paperboard packaging remains central to Australia’s sustainable packaging transition.

Rising Food and Beverage Consumption

The food and beverage sector in Australia plays a pivotal role in driving the Australia paper and paperboard packaging market demand. With growing consumer preference for ready-to-eat meals, takeout services, and packaged grocery products, the need for safe, functional, and visually appealing packaging continues to rise. Paper cups, folding cartons, trays, and food-safe coated paperboard are increasingly used by quick-service restaurants, cafés, and supermarkets to package products conveniently and sustainably. Health-conscious consumers also associate paper-based packaging with eco-friendliness and safety, further reinforcing its adoption. Additionally, the trend toward premium packaging in beverages and specialty foods adds to the sector’s reliance on paperboard. As consumption expands, this steady demand ensures long-term growth for manufacturers serving the food and beverage supply chain.

Opportunities of Australia Paper and Paperboard Packaging Market:

Circular Economy and Recycling Initiatives

The growing emphasis on a circular economy in Australia creates significant opportunities for paper and paperboard packaging manufacturers. With national policies and consumer awareness favoring recycling, waste reduction, and resource efficiency, companies can invest in recyclable, compostable, and closed-loop packaging solutions. Adopting circular practices not only reduces environmental impact but also strengthens brand reputation and aligns with corporate sustainability goals. Manufacturers that innovate in this space, by using post-consumer recycled fibers or designing packaging for easy reuse, gain competitive advantages and access to a broader client base. Additionally, circular initiatives encourage collaboration across supply chains, from suppliers to retailers, enabling cost savings, enhanced operational efficiency, and compliance with evolving environmental regulations.

Premium and Luxury Packaging Demand

Demand for premium and luxury packaging in Australia is on the rise, driven by high-end consumer goods, cosmetics, and specialty food sectors. Brands increasingly focus on packaging that conveys sophistication, quality, and exclusivity, presenting opportunities for paperboard manufacturers to develop value-added solutions. Specialty finishes, embossed designs, foil stamping, and customized printing enhance visual appeal and differentiate products in competitive markets. Such packaging not only elevates the consumer experience but also reinforces brand positioning, fostering customer loyalty. For manufacturers, investing in advanced production techniques and design capabilities allows them to cater to this niche segment while commanding higher margins. According to the Australia paper and paperboard packaging market analysis, this trend signals the growing intersection of functionality, aesthetics, and sustainability in paperboard packaging solutions.

Technological Advancements in Paperboard

Technological innovations are transforming the capabilities of paper and paperboard packaging in Australia. Advanced barrier coatings improve moisture, grease, and gas resistance, making paperboard suitable for diverse applications, including food, beverages, and pharmaceuticals. Enhanced printing technologies enable high-resolution graphics, personalized designs, and multi-color finishes, supporting both marketing appeal and brand differentiation. These advancements allow manufacturers to create packaging that meets performance requirements without compromising environmental sustainability. Additionally, integration of smart packaging features, such as QR codes or tamper-evident elements, is increasingly feasible. By leveraging technology, companies can expand the application scope of paperboard, reduce waste through improved durability, and meet evolving consumer demands for functionality, aesthetics, and eco-conscious solutions, strengthening their competitive edge in the market.

Challenges of Australia Paper and Paperboard Packaging Market:

Volatility in Raw Material Prices

The Australian paper and paperboard packaging market faces significant pressure from volatility in raw material prices, particularly pulp and other fiber-based inputs. Since these materials are globally traded commodities, their prices are subject to fluctuations driven by supply chain disruptions, international demand, energy costs, and environmental regulations. Manufacturers often struggle to maintain consistent pricing strategies, as unpredictable raw material costs reduce profit margins and create uncertainty in financial planning. This volatility also impacts smaller players more severely, as they lack the financial flexibility to absorb sudden cost surges. As a result, many producers are compelled to explore cost optimization, long-term supplier partnerships, or alternative raw materials to ensure sustainability and competitiveness in the marketplace.

Competition from Alternative Materials

Although paper and paperboard packaging is widely regarded as eco-friendly, competition from alternative materials is intensifying. Bioplastics, reusable packaging, and other innovative materials are gaining traction among environmentally conscious consumers and industries seeking enhanced durability and performance. These alternatives often claim similar sustainability benefits, making them attractive substitutes in applications like food packaging, retail, and e-commerce. The growing investment in advanced materials by global packaging companies further strengthens their appeal. For paper-based packaging suppliers, this rising competition demands continuous innovation, improved functionality, and the integration of barrier technologies to remain relevant. Without differentiation, the market risks losing segments to alternatives that combine environmental benefits with added strength, reusability, or extended product shelf life.

Infrastructure Gaps in Recycling Systems

Despite Australia’s strong policy framework supporting sustainability and waste reduction, recycling infrastructure for paper and paperboard packaging remains uneven across regions. Many areas lack efficient collection, segregation, and processing facilities, which reduces the overall recovery rate of paper products. This inconsistency creates operational inefficiencies for packaging manufacturers and limits the closed-loop potential of the industry. In addition, insufficient consumer awareness about proper disposal practices further exacerbates the problem, with recyclable paper often ending up in landfills. These infrastructure gaps not only slow progress toward national recycling targets but also undermine the market’s ability to showcase its environmental credentials. Addressing these challenges requires collaborative efforts between governments, manufacturers, and recycling companies to standardize systems and invest in modern processing capabilities.

Australia Paper and Paperboard Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Folding Cartons

- Corrugated Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes folding cartons, corrugated boxes, and others.

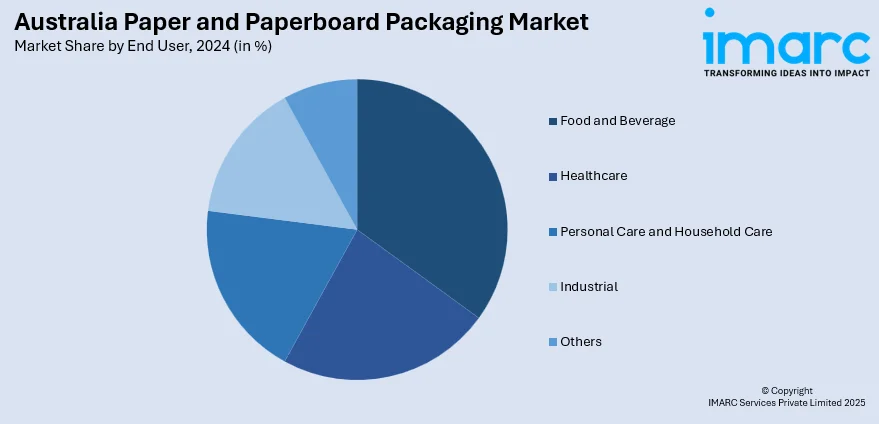

End User Insights:

- Food and Beverage

- Healthcare

- Personal Care and Household Care

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, healthcare, personal care and household care, industrial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Paper and Paperboard Packaging Market News:

- In October 2024, Mountain Blue, a pioneer in blueberry genetics innovation, made a partnership announcement with Opal to test plastic-free cardboard packaging for its Eureka brand, in collaboration with Coles Group. This move reflects their dedication to sustainability and plastic waste minimization in the food packaging industry.

- In March 2024, BioPak recorded strong growth with developments in its home compostable range, such as the introduction of Australia's first PHA-lined cups and new aqueous solutions for sushi trays and sauce cups. The company also added B Corps Huskee and Decent Packaging to the BioPak Group and pledged to Net-Zero GHG emissions by 2050.

Australia Paper and Paperboard Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Folding Cartons, Corrugated Boxes, Others |

| End Users Covered | Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Others. |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia paper and paperboard packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia paper and paperboard packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia paper and paperboard packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper and paperboard packaging market in Australia was valued at USD 3.4 Billion in 2024.

The Australia paper and paperboard packaging market is projected to exhibit a CAGR of 2.90% during 2025-2033.

The Australia paper and paperboard packaging market is projected to reach a value of USD 4.5 Billion by 2033.

The Australia paper and paperboard packaging market is witnessing trends such as the adoption of recyclable and compostable materials, integration of smart packaging technologies, and growth in premium, visually appealing designs. The increasing demand from the e-commerce, food delivery, and retail sectors further drives innovation, aligning with sustainability and consumer convenience priorities.

Growth in Australia’s paper and paperboard packaging market is driven by rising e-commerce activities, government initiatives to curb plastic usage, and increasing demand from the food and beverage sector. Advancements in paperboard technologies and consumer preference for eco-friendly solutions further accelerate market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)