Australia Patient Engagement Solutions Market Size, Share, Trends and Forecast by Therapeutic Area, Application, Component, Delivery Type, End User, and Region, 2025-2033

Australia Patient Engagement Solutions Market Overview:

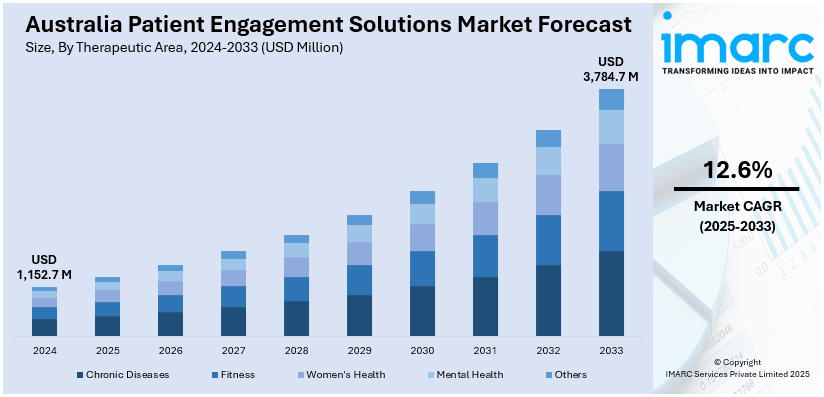

The Australia patient engagement solutions market size reached USD 1,152.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,784.7 Million by 2033, exhibiting a growth rate (CAGR) of 12.6% during 2025-2033. The rising digital healthcare adoption, increased government support for telehealth, growing demand for personalized care, and advancements in AI and data analytics are some of the factors contributing to the Australia patient engagement solutions market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,152.7 Million |

| Market Forecast in 2033 | USD 3,784.7 Million |

| Market Growth Rate 2025-2033 | 12.6% |

Australia Patient Engagement Solutions Market Trends:

Rising Digital Healthcare Adoption

The increasing integration of digital technologies in healthcare is a key driver of the patient engagement solutions market in Australia. Hospitals and clinics are implementing electronic health records (EHR), mobile apps, and online portals to enhance communication between patients and providers. Digital tools improve appointment scheduling, remote consultations, and access to medical records, leading to better patient experiences and engagement. The shift towards a digitally connected healthcare system is further fueled by the growing tech-savviness of patients who prefer mobile-based interactions for managing their health. As digital transformation continues, healthcare providers increasingly rely on engagement solutions to enhance efficiency, which is fueling the Australia patient engagement solutions market share. For instance, in January 2025, MedAdvisor Solutions, a worldwide leader in pharmacy technology and patient engagement, released its latest case study highlighting the success of Australia's Expanded Scope of Practice initiative in over 3,800 pharmacies nationwide. The MedAdvisor for Pharmacy platform, utilized by over 95% of pharmacies in Australia, enables the features needed to assist the broadened practice scope, a government program aimed at tackling healthcare workforce deficits and extended patient wait times, especially in rural regions.

To get more information on this market, Request Sample

Government Support for Telehealth and eHealth Initiatives

The Australian government has been actively promoting telehealth and digital health initiatives through funding and policy support. Programs such as My Health Record and Medicare-backed telehealth consultations have encouraged the adoption of patient engagement solutions. Government incentives for digital healthcare services, especially in rural and remote areas, further creates a positive impact on the Australia patient engagement solutions market outlook. Additionally, regulations supporting data security and interoperability encourage healthcare providers to invest in patient-centered digital solutions. These policies ensure better accessibility to healthcare services while streamlining communication between patients and practitioners, making patient engagement solutions a crucial part of Australia’s evolving healthcare landscape. For instance, in March 2025, Tasmania's Health Department broadened the reach of its virtual care initiative. The Acute Virtual Monitoring Program of the Care@home service will now include more short-term conditions and illnesses, such as urinary tract infections, cellulitis, and gastroenteritis. It will also accept referrals for patients who have been discharged to assist in their transition.

Australia Patient Engagement Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on therapeutic area, application, component, delivery type, and end user.

Therapeutic Area Insights:

- Chronic Diseases

- Obesity

- Diabetes

- Cardiovascular

- Others

- Fitness

- Women's Health

- Mental Health

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes chronic diseases (obesity, diabetes, cardiovascular, others), fitness, women's health, mental health, and others.

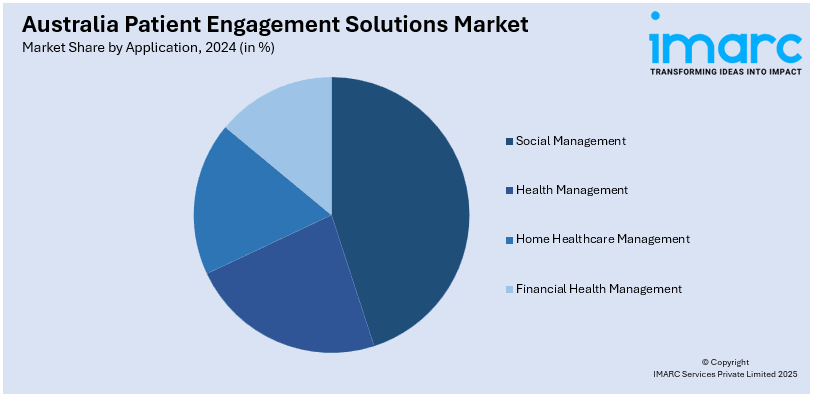

Application Insights:

- Social Management

- Health Management

- Home Healthcare Management

- Financial Health Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes social management, health management, home healthcare management, and financial health management.

Component Insights:

- Software

- Services

- Hardware

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software, services, and hardware.

Delivery Type Insights:

- Web-based/Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the delivery type have also been provided in the report. This includes web-based/cloud-based and on-premises.

End User Insights:

- Payers

- Providers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes payers, providers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Patient Engagement Solutions Market News:

- In March 2025, HIMSS collaborated with Evolve Health Digital, a digital health coaching and consulting company, to provide certification programs in Australia, including the HIMSS Certified Professional in Digital Health Transformation Strategy (CPDHTS), Certified Associate in Healthcare Information and Management Systems (CAHIMS), and Certified Professional in Healthcare Information and Management Systems (CPHIMS).

Australia Patient Engagement Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapeutic Areas Covered |

|

| Applications Covered | Social Management, Health Management, Home Healthcare Management, Financial Health Management |

| Components Covered | Software, Services, Hardware |

| Delivery Types Covered | Web-based/Cloud-based, On-premises |

| End Users Covered | Payers, Providers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia patient engagement solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia patient engagement solutions market on the basis of therapeutic area?

- What is the breakup of the Australia patient engagement solutions market on the basis of application?

- What is the breakup of the Australia patient engagement solutions market on the basis of component?

- What is the breakup of the Australia patient engagement solutions market on the basis of delivery type?

- What is the breakup of the Australia patient engagement solutions market on the basis of end user?

- What is the breakup of the Australia patient engagement solutions market on the basis of region?

- What are the various stages in the value chain of the Australia patient engagement solutions market?

- What are the key driving factors and challenges in the Australia patient engagement solutions market?

- What is the structure of the Australia patient engagement solutions market and who are the key players?

- What is the degree of competition in the Australia patient engagement solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia patient engagement solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia patient engagement solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia patient engagement solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)