Australia Payments Market Size, Share, Trends and Forecast by Mode of Payment, End Use Industry, and Region, 2026-2034

Australia Payments Market Overview:

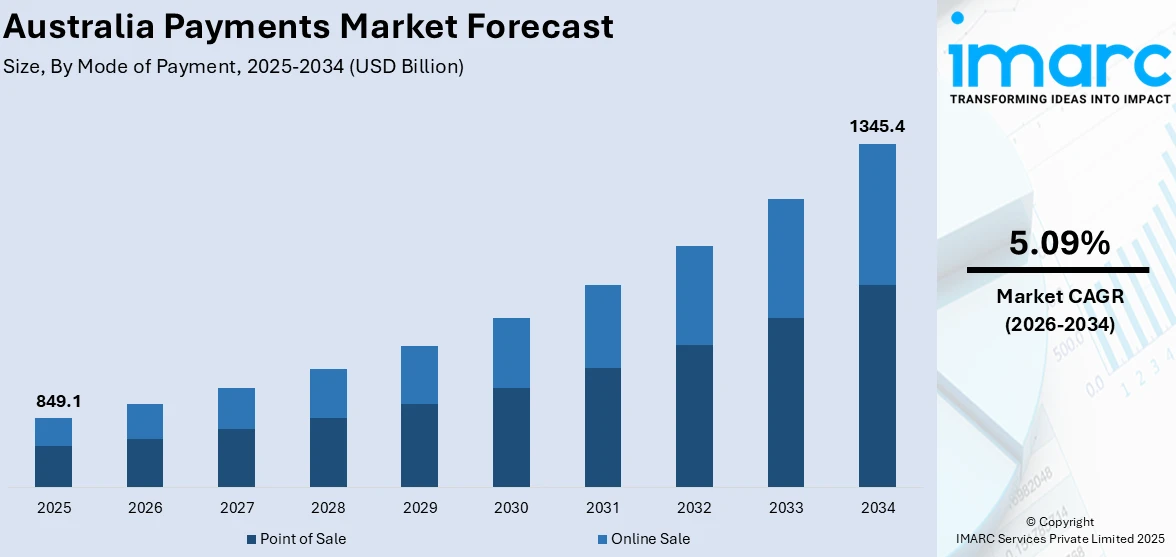

The Australia payments market size reached USD 849.1 Billion in 2025. Looking forward, the market is expected to reach USD 1,345.4 Billion by 2034, exhibiting a growth rate (CAGR) of 5.09% during 2026-2034. The market is influenced by elements such as widespread digital uptake, a rise in mobile payment usage, the emergence of buy-now-pay-later options, innovations in secure transaction technology, the growing prominence of contactless payment methods, robust regulatory backing, and an increasing consumer desire for quick, efficient, and seamless payment solutions across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 849.1 Billion |

| Market Forecast in 2034 | USD 1,345.4 Billion |

| Market Growth Rate 2026-2034 | 5.09% |

Key Trends of Australia Payments Market:

Increasing Adoption of Digital Payments

The usage of digital payments in Australia has been growing exponentially, for example, in October 2024, Australians made over 500 million mobile wallet transactions amounting to over USD 20 Billion. This is a clear indication of the preference of consumers towards the ease, speed, and security that digital payment solutions offer. The Australian Banking Association reported that during June 2023, 98.9% of consumer interactions were being conducted through digital channels like mobile banking apps and online websites. This change is not just among consumers, but businesses are also quickly adjusting to this trend. According to industry reports, in August 2023, 46% of Australian businesses have four or more payment instruments, and 45% want to enhance what they currently have. In addition, the growing usage of artificial intelligence (AI) and machine learning on online payments has improved security and fraud reduction measures, and this has placed more confidence among businesses and consumers to use such methods. Biometric identification methods, for example, fingerprints and face-scanning, have become common methods of mobile payment today, keeping fraud to a minimum. Besides this, the establishment of real-time payments through the New Payments Platform (NPP) has introduced instant money transfers between banks, further streamlining digital transactions.

To get more information on this market Request Sample

Substantial Reduction in Cash Usage

Australia is also experiencing a strong reduction in cash use, with cash payments only accounting for 13% of consumer transactions in 2022, reducing significantly from 69% in 2007. This phenomenon is noticed in numerous sectors, particularly in transport and food retail, where cash payments have declined significantly as contactless card payments and digital payments have increased. The drop in cash usage has led to a notable decrease in ATM withdrawals. According to the Reserve Bank of Australia, ATM withdrawals reached around 29.3 million in April 2023, representing a decrease of 8.9% compared to April 2022. The total of ATMs also declined, as bank ATMs dropped from nearly 14,000 in 2017 to approximately 5,700 by mid-2023. Banks are reevaluating the feasibility of cash services because of the slump in demand. The Commonwealth Bank of Australia invested USD 410 Million in cash services over the last financial year and only earned USD 60 Million from such services, representing a net outlay of USD 350 Million. The financial cost has pushed banks to close down physical outlets and ATMs, and also affects consumer trends towards digital payments. As Australia moves to a completely digital payment landscape, advances in cybersecurity, infrastructure resilience, and financial inclusion will ensure a seamless transition. Greater fraud protection, real-time payment capabilities, and greater accessibility will enhance consumer confidence, driving additional take-up and positioning Australia as a global leader in digital payments.

Growth Factors of Australian Payments Market:

Expansion of E-Commerce and Omni-Channel Retail

The rapid growth of Australia’s e-commerce sector is playing a crucial role in driving digital payment adoption. As consumers increasingly make purchases on e-commerce websites and demand experiences with fewer jams at the checkout process, companies have had to rise to the challenge and provide uninterrupted, yet safe and speedy options of payment. The emergence of multi-channel shopping, which entails physical shops, online, and mobile devices, requires continuity of payment platforms at every point of contact. Consumers are likely to demand consistency and stability across the board, whether they shop in a store, through mobile apps, or on e-commerce sites. This trend is compelling payment service providers to innovate and invest in infrastructure that ensures interoperability and ease of use, which is expected to fuel the Australia payments market share. As e-commerce continues to expand, the need for integrated payment ecosystems becomes increasingly important to enhance customer satisfaction and brand loyalty.

Advancements in Payment Technology

The emerging payment tech is changing the Australian payments bonanza, not only in advancing the level of security, but also for convenience. Biometric authentication methods like facial recognition and fingerprint scanning offer a secure way to access payment systems without relying on traditional passwords. These technologies enhance security by verifying users through unique physical characteristics. The use of tokens as a replacement for sensitive information diminishes the possibility of fraud associated with tokenization. Furthermore, natural artificial intelligence is being utilized to flag suspicious action in real time, boosting fraud prevention with no effect on the user experience. Not only are these advancements increasing consumer confidence, but businesses are also utilizing them to make the transaction process quicker and more user-friendly. With the continuity of digital security issues, the inclusion of new technologies at the front end of payments is likely to gain more substance, quickening the industry-wide adoption. According to the Australia payments market analysis, these innovations are making digital payments safer, smarter, and more user-friendly for Australian consumers.

Rise of Fintech and Challenger Banks

The rise of fintech startups and challenger banks is transforming Australia’s financial services sector, especially in payments. These agile, tech-driven firms are disrupting traditional banking by offering streamlined, user-friendly digital payment solutions that resonate with modern consumers. Their mobile-first approach, simplified onboarding, and transparent fee structures particularly appeal to younger generations and underserved customers, such as gig workers or those with limited credit history. By providing personalized financial services and faster access to funds, fintechs are reshaping customer expectations and setting new industry standards. In response, traditional banks are accelerating their digital transformation efforts to remain competitive. The continued emergence of these non-traditional players is fostering innovation, improving accessibility, and expanding the reach of digital payments across Australia.

Opportunities of Australia Payments Market:

Growth in Cross-Border Transactions

As Australia deepens its trade ties with Asia-Pacific nations and expands its global economic reach, the demand for efficient and affordable cross-border payment solutions is rising. Businesses and consumers are increasingly seeking seamless international payment options that offer transparency, real-time processing, and support for multiple currencies. This trend presents a significant opportunity for payment service providers to develop and offer specialized solutions that cater to cross-border needs, such as instant international transfers, competitive exchange rates, and low transaction fees. By embracing digital infrastructure and partnerships with global payment networks, Australian providers can meet the growing demand and position themselves as leaders in international transactions, particularly for small businesses and global e-commerce operators, which is driving the Australia payments market growth.

Demand for Value-Added Payment Services

In today’s digital-first environment, Australian consumers and merchants expect more than basic payment functionality. There is increasing demand for value-added services integrated into payment platforms, such as loyalty programs, personalized rewards, purchase insights, and spending analytics. These features enhance the customer experience and help businesses build stronger relationships with their clientele. For merchants, such services provide valuable data that can be used to tailor marketing efforts and improve operational efficiency. For consumers, the ability to track spending and earn incentives creates a more engaging and rewarding payment journey. Providers that bundle these services into their platforms are not only improving user retention but also differentiating themselves in a highly competitive market.

Expansion in Underserved Segments

A considerable growth opportunity exists in targeting underserved segments of the Australian population, such as rural communities, small-scale businesses, and elderly consumers who may still rely on cash or traditional banking. These groups often face barriers like limited internet access, lack of digital literacy, or exclusion from mainstream financial services. Payment providers can address these gaps by offering user-friendly platforms, offline payment solutions, and inclusive digital onboarding experiences. Simplified mobile apps, biometric login features, and localized customer support can make digital payments more accessible. By focusing on inclusivity and functionality, companies can unlock new markets, promote financial inclusion, and expand digital payment usage across a broader demographic spectrum in Australia.

Government Support of Australia Payments Market:

Open Banking and Consumer Data Right (CDR)

Australia’s adoption of Open Banking under the Consumer Data Right (CDR) is transforming the financial ecosystem by putting data ownership in the hands of consumers. Through CDR, individuals can securely share their financial data with accredited third-party providers, unlocking access to more personalized and competitive payment solutions. This framework fosters innovation by allowing fintechs and other non-traditional players to offer tailored services that were previously monopolized by established institutions. It enhances transparency, empowers informed financial decisions, and improves overall market efficiency. As more consumers become aware of their data rights, Open Banking is expected to drive deeper integration of digital payments across various sectors while promoting consumer-centric solutions in Australia’s financial landscape.

Support for Real-Time Infrastructure

The Australian government, in collaboration with the Reserve Bank of Australia (RBA), has significantly supported the rollout and enhancement of real-time payment infrastructure through the New Payments Platform (NPP). This initiative allows for immediate, 24/7 transfers between participating banks, drastically improving the speed and convenience of transactions for both consumers and businesses, which is further boosting the Australia payments market demand. The NPP also supports additional services like PayID, simplifying payments by linking them to phone numbers or email addresses instead of account numbers. Real-time infrastructure contributes to greater transparency, reduces settlement delays, and supports economic productivity. As digital payments become increasingly central to daily life, the government’s commitment to robust, real-time systems is a key enabler of seamless financial transactions nationwide.

Regulatory Encouragement for Competition

Australia’s financial regulators have taken proactive steps to foster greater competition within the payments sector. Through a series of reforms, including easing licensing requirements and streamlining compliance processes, the government has created a more inclusive environment for fintech startups and digital payment providers. These measures are designed to lower market entry barriers, encourage innovation, and expand consumer choice. Increased competition has pushed traditional financial institutions to enhance their offerings, improve customer service, and adopt newer technologies. Moreover, this dynamic environment has fueled collaboration between banks and fintechs, leading to more efficient, agile, and user-centric payment solutions. By supporting a competitive marketplace, the government ensures continued progress in delivering cutting-edge financial services across Australia.

Australia Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on mode of payment and end use industry.

Mode of Payment Insights:

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of payment. This includes point of sale (card payments, digital wallet, cash, and others) and online sale (card payments, digital wallet, and others).

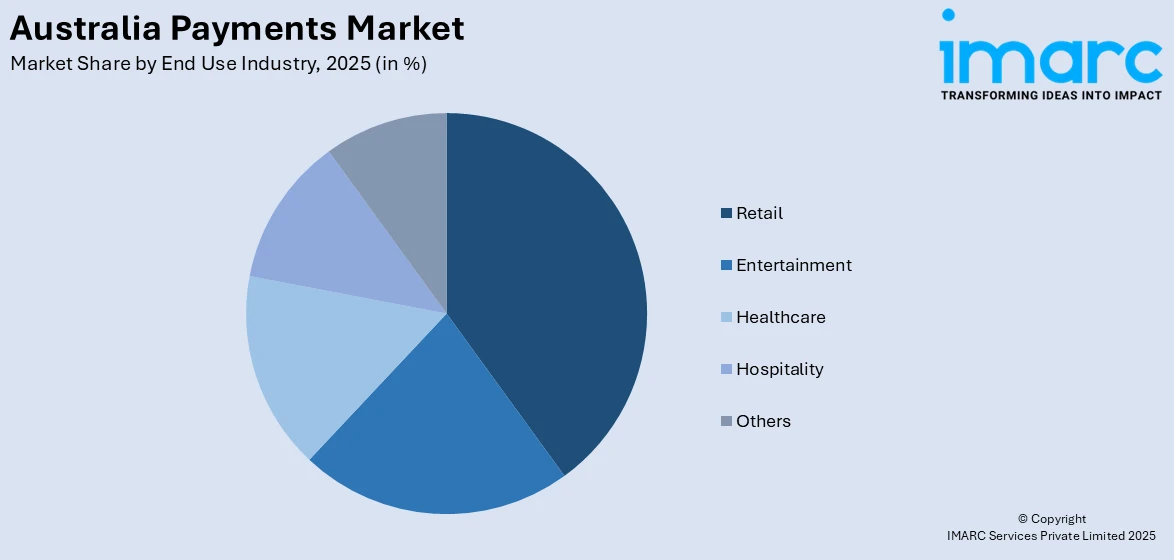

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes retail, entertainment, healthcare, hospitality, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Payments Market News:

- February 2025: The Commonwealth Bank of Australia (CBA) has joined forces with the New South Wales (NSW) Government to upgrade banking services, increasing accessibility for individuals, businesses, and communities. This partnership promotes the use of digital banking and payment options, enhancing Australia's digital payments sector.

- December 2024: Australia and New Zealand Banking Group (ANZ) increased its ANZ Express Payments service to enable inbound cross-border payments of up to AUD500, handled in nearly real-time, every day of the week. This action improves Australia’s payments sector by increasing the efficiency and rapidity of global transactions.

- August 2024: BNY and Commonwealth Bank of Australia (CBA) initiated a partnership for cross-border payments, allowing both businesses and individuals to obtain international payments in 60 seconds, irrespective of their banking institution. This partnership improves the pace and effectiveness of international transactions, aiding the increasing innovation in Australia’s payment sector.

Australia Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Payments Covered |

|

| End Use Industries Covered | Retail, Entertainment, Healthcare, Hospitality, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The payments market in Australia was valued at USD 849.1 Billion in 2025.

The Australia payments market is projected to exhibit a CAGR of 5.09% during 2026-2034.

The Australia payments market is projected to reach a value of USD 1,345.4 Billion by 2034.

Expansion in the Australian payments sector is driven by widespread smartphone penetration, robust e-commerce, and supportive regulations such as Open Banking. AI and machine learning improve fraud prevention, while advanced POS infrastructure and digital platforms boost adoption. Government and central bank efforts further enhance payment efficiency and security.

Australians are embracing digital transformation in payments through the rise of mobile wallets, contactless cards, and real-time systems like the New Payments Platform, which represents the primary market trend. “Buy Now, Pay Later” services and growing cryptocurrency interest reshaping transaction habits, along with reduced cash usage underlines a sustained tilt toward fast, tech-enabled payments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)