Australia PCB Components Market Size, Share, Trends and Forecast by Component Type, PCB Type, End Use Industry, and Region, 2025-2033

Australia PCB Components Market Size and Share:

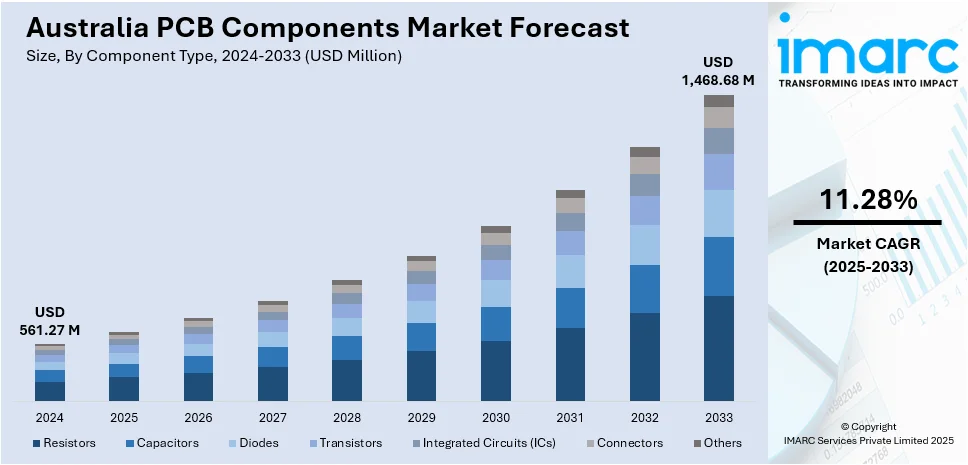

The Australia PCB components market size reached USD 561.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,468.68 Million by 2033, exhibiting a growth rate (CAGR) of 11.28% during 2025-2033. The market is driven by consumer demand for smart electronics and wearables that require advanced PCB designs. Automotive electrification and government-backed clean mobility initiatives are increasing the uptake of high-reliability circuit components. Simultaneously, the growth of industrial automation and renewable energy systems is accelerating PCB usage in power management and control applications, further augmenting the Australia PCB components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 561.27 Million |

| Market Forecast in 2033 | USD 1,468.68 Million |

| Market Growth Rate 2025-2033 | 11.28% |

Australia PCB Components Market Trends:

Rising Demand from Consumer Electronics and Smart Devices

Australia’s growing appetite for smart devices, wearable technology, and advanced home electronics is significantly impacting the domestic PCB components ecosystem. Increased consumer spending on smartphones, laptops, gaming consoles, and connected appliances is elevating the need for compact, high-density printed circuit boards. As devices become slimmer and more functional, demand for multi-layered and miniaturized PCB components, such as surface-mount capacitors, resistors, and IC sockets, continues to grow. Local electronics assembly businesses are also scaling up, supported by government incentives for domestic production and design capabilities. Furthermore, the market is seeing increased importation of mid-range consumer electronics, which in turn drives PCB assembly services and component sourcing activity among Australian distributors. On October 25, 2023, Queensland-based Crystalaid upgraded its PCB manufacturing capabilities by integrating a vacuum vapor phase oven and a flying probe tester, supported by two Moon to Mars Supply Chain Capability Improvement Grants from the Australian Space Agency. These upgrades enable the production of space-grade SMT circuit boards that withstand temperatures from –40°C to +150°C, with solder joint defect rates reduced to below 3%. Emerging tech such as IoT-integrated wearables, medical devices, and smart metering systems is accelerating interest in rigid-flex PCBs and high-frequency substrates that enable fast data transfer. These consumer trends are creating sustained market momentum as innovation cycles shorten and demand for complex electronic architecture rises. The acceleration in product sophistication and digital lifestyle preferences is directly influencing Australia PCB components market growth.

To get more information on this market, Request Sample

Expansion of Industrial Automation and Clean Energy Infrastructure

Australia’s industrial automation and renewable energy sectors are emerging as key contributors to the demand for printed circuit board components. With factories modernizing and deploying robotics, sensors, and PLC systems, control units embedded with customized PCBs are essential. Simultaneously, the installation of solar inverters, battery storage units, and smart grid devices across residential and commercial facilities is driving adoption of power PCBs and surge-protected assemblies. Many renewable energy systems rely on reliable PCB integration to ensure efficient power conversion, monitoring, and control. Furthermore, mining and logistics sectors are leveraging automation tools equipped with embedded electronics, where ruggedized PCB components play a central role. As investments increases in solar farms, wind energy projects, and localized battery storage networks, suppliers of PCB parts, such as connectors, fuses, and transformers, are witnessing higher volume orders. A recent study found that a small-scale waste PCB recycling plant in Australia using black copper smelting could achieve a net benefit of AUD 175 million (USD 117 million) over 20 years with an internal rate of return (IRR) of 76%, based on a processing capacity of 10,000 tons/year. The estimated processing cost was AUD 5.33/kg, while potential revenue ranged from AUD 7.3 to AUD 9.3/kg. Given that Australia generated 554,000 tons of e-waste in 2020 but recycled only about 10% through official schemes, the study highlights a strong economic case for expanding domestic PCB recycling infrastructure to reduce reliance on overseas processing and capture significant resource value. Local manufacturers are also ramping up prototyping and low-volume production services for energy OEMs. This intersection of sustainability goals and automation demand is reinforcing the importance of PCB infrastructure in modern industrial systems.

Australia PCB Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, PCB type, and end use industry.

Component Type Insights:

- Resistors

- Capacitors

- Diodes

- Transistors

- Integrated Circuits (ICs)

- Connectors

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes resistors, capacitors, diodes, transistors, integrated circuits (ICs), connectors, and others.

PCB Type Insights:

- Rigid PCBs

- Flexible PCBs

- Rigid-Flex PCBs

The report has provided a detailed breakup and analysis of the market based on the PCB type. This includes rigid PCBs, flexible PCBs, and rigid-flex PCBs.

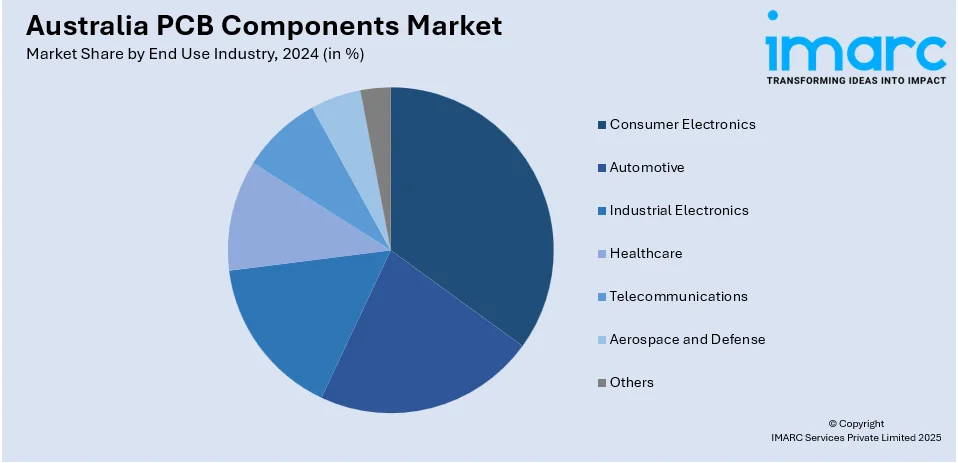

End Use Industry Insights:

- Consumer Electronics

- Automotive

- Industrial Electronics

- Healthcare

- Telecommunications

- Aerospace and Defense

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes consumer electronics, automotive, industrial electronics, healthcare, telecommunications, aerospace and defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia PCB Components Market News:

- On April 8, 2025, it was confirmed that the Electronics Design and Assembly Expo (Electronex) will return to Melbourne from May 7–8, marking Australia's largest electronics exhibition to date. Spanning over 27,000 sqm at the Melbourne Convention and Exhibition Centre and co-located with Australian Manufacturing Week, the event will feature more than 100 local and international exhibitors showcasing advanced PCB components, SMT systems, test solutions, and AI-driven electronics innovations. A 2023 survey showed 98% of attendees found the expo beneficial, reinforcing its role as a key platform for Australia’s electronics and PCB manufacturing market.

Australia PCB Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Resistors, Capacitors, Diodes, Transistors, Integrated Circuits (ICs), Connectors, Others |

| PCB Types Covered | Rigid PCBs, Flexible PCBs, Rigid-Flex PCBs |

| End Use Industries Covered | Consumer Electronics, Automotive, Industrial Electronics, Healthcare, Telecommunications, Aerospace and Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia PCB components market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia PCB components market on the basis of component type?

- What is the breakup of the Australia PCB components market on the basis of PCB type?

- What is the breakup of the Australia PCB components market on the basis of end use industry?

- What is the breakup of the Australia PCB components market on the basis of region?

- What are the various stages in the value chain of the Australia PCB components market?

- What are the key driving factors and challenges in the Australia PCB components market?

- What is the structure of the Australia PCB components market and who are the key players?

- What is the degree of competition in the Australia PCB components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia PCB components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia PCB components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia PCB components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)