Australia Pediatric Healthcare Market Size, Share, Trends and Forecast by Type, Treatment, and Region, 2026-2034

Australia Pediatric Healthcare Market Summary:

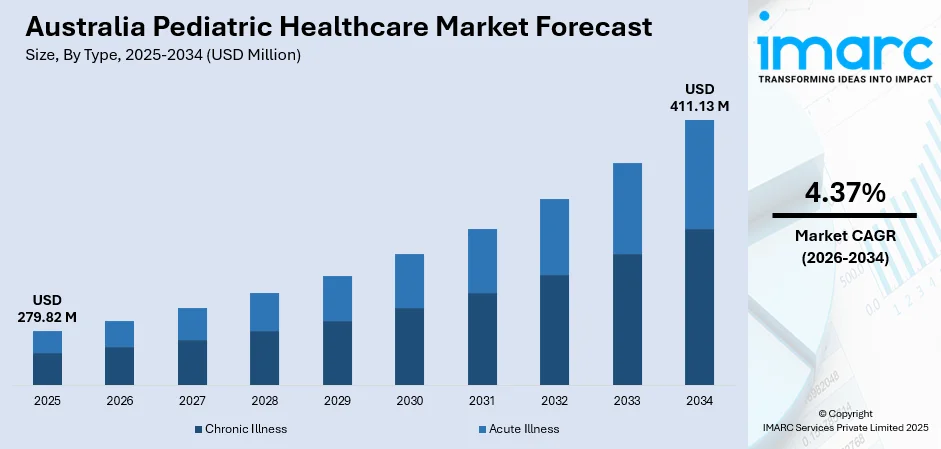

The Australia pediatric healthcare market size was valued at USD 279.82 Million in 2025 and is projected to reach USD 411.13 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

The Australian pediatric healthcare market is experiencing substantial growth driven by rising prevalence of childhood respiratory illnesses, expanding government immunization programs, and increased public health investments in children's hospital infrastructure. The introduction of innovative preventive therapies, including RSV vaccines and monoclonal antibodies, combined with digital health integration and telehealth adoption, is reshaping service delivery models and improving accessibility across metropolitan and regional areas, contributing to the expanding Australia pediatric healthcare market share.

Key Takeaways and Insights:

- By Type: Acute Illness dominates the market with a share of 65% in 2025, driven by the high incidence of respiratory infections, gastroenteritis, and seasonal illnesses requiring immediate medical intervention among pediatric populations.

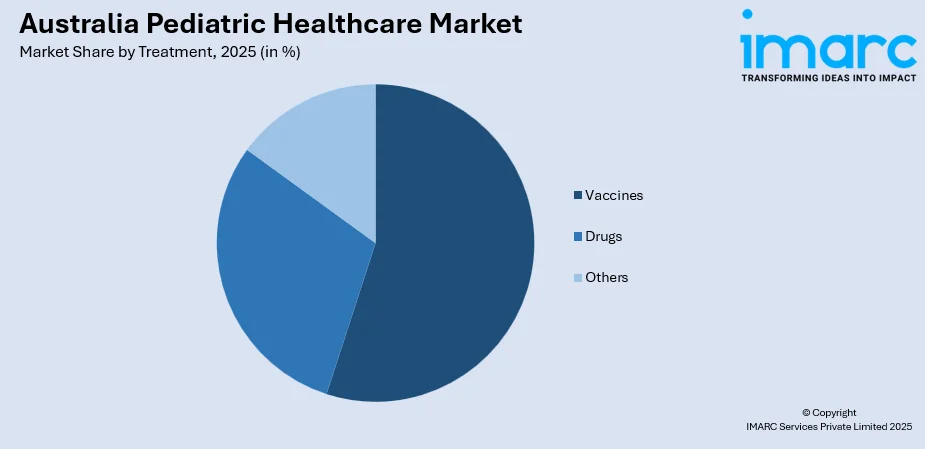

- By Treatment: Vaccines lead the market with a share of 50% in 2025, supported by comprehensive National Immunization Program coverage and recent additions of RSV preventive therapies for infant protection.

- Key Players: The Australia pediatric healthcare market features a competitive landscape comprising major pharmaceutical corporations, specialized children's hospital networks, digital health providers, and immunization service companies competing across therapeutic segments and regional markets.

To get more information on this market Request Sample

The Australian pediatric healthcare sector represents a critical component of the nation's broader healthcare infrastructure. The market encompasses comprehensive services ranging from preventive immunization programs to acute care interventions and chronic disease management. Australia's National Immunization Program provides funded vaccines against diseases, with childhood coverage rates about 90% at key age milestones. The NSW Government's 2025-26 Budget investment of $40.1 million toward establishing the 'Kookaburra Centre' at The Children's Hospital at Westmead exemplifies the ongoing commitment to specialized pediatric care infrastructure, bringing total investment in the Westmead Stage 2 Redevelopment to $659.1 million. This facility will become Australia's first complex care center specifically designed for children with multiple chronic and complex health conditions, demonstrating the evolving sophistication of pediatric healthcare delivery

Australia Pediatric Healthcare Market Trends:

Expansion of RSV Prevention Programs for Infant Protection

The Australian pediatric healthcare landscape has undergone significant transformation with the introduction of respiratory syncytial virus prevention programs targeting infants. RSV represents a leading cause of hospitalization among children under six months of age, driving substantial healthcare system burden. Western Australia, Queensland, and New South Wales launched state-managed nirsevimab programs during the 2024 RSV season, with subsequent national expansion. In November 2024, the Australian Government announced that the maternal RSV vaccine Abrysvo would be available from February 2025 to all pregnant women under the National Immunization Program, complemented by targeted nirsevimab administration for high-risk infants.

Digital Health Integration and Telehealth Adoption in Pediatric Care

Digital health technologies are increasingly embedded in Australian pediatric healthcare delivery, facilitating improved access to specialized services particularly for families in rural and remote regions. Telehealth platforms enable video consultations between metropolitan pediatric specialists and regional healthcare providers, reducing geographical barriers to quality care. The Queensland Telepaediatric Service has delivered over 23,054 telehealth consultations across 37 pediatric clinical specialties since its establishment, demonstrating the viability of virtual care models. The National Digital Health Strategy 2023-2028 supports continued expansion of these capabilities, with AI-powered diagnostic tools now being deployed routinely at major hospitals including those developed by Sydney-based Harrison.ai.

Growing Focus on Preventive Care and Chronic Disease Management

Australian pediatric healthcare is experiencing a strategic shift toward preventive interventions and comprehensive chronic disease management programs. Asthma remains the leading cause of disease burden among children aged 5-14 years, while mental health conditions including anxiety disorders represent growing concerns requiring integrated care approaches. According to the AIHW, an estimated 45% of children aged 0-14 had one or more chronic conditions in 2022, with hay fever, allergic rhinitis, and asthma ranking among the most prevalent. The Australian Government's 2024-25 Budget allocated $888.1 Million over eight years to strengthen mental health and suicide prevention systems, including specific provisions for child and adolescent services.

Market Outlook 2026-2034:

The Australia pediatric healthcare market demonstrates robust growth potential throughout the forecast period, underpinned by sustained government investment in children's hospital infrastructure, expanding immunization coverage, and evolving care delivery models. The convergence of preventive healthcare initiatives, digital transformation in service delivery, and increasing focus on specialized pediatric facilities is reshaping the competitive landscape. Rising awareness among parents regarding childhood health management, coupled with enhanced accessibility through telehealth platforms and integrated care pathways, continues to strengthen demand across metropolitan and regional markets, positioning Australia as a leader in pediatric healthcare excellence. The market generated a revenue of USD 279.82 Million in 2025 and is projected to reach a revenue of USD 411.13 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

Australia Pediatric Healthcare Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Acute Illness | 65% |

| Treatment | Vaccines | 50% |

Type Insights:

- Chronic Illness

- Acute Illness

The acute illness segment dominates with a market share of 65% of the total Australia pediatric healthcare market in 2025.

Acute illnesses encompass the spectrum of sudden-onset conditions requiring immediate medical attention, including respiratory infections, gastroenteritis, injuries, and seasonal infectious diseases that disproportionately affect pediatric populations. Respiratory tract infections represent a significant component of acute pediatric presentations, with bronchiolitis being the most common respiratory infection in children under 12 months and the leading cause of hospitalization among infants under six months.

The segment's dominance reflects the inherent nature of pediatric health patterns, where developing immune systems render children more susceptible to infectious agents and environmental pathogens. The Western Australian nirsevimab immunization program achieved 71% infant coverage prior to and during the 2024 RSV season, which was associated with 57% fewer hospital admissions for RSV – the leading cause of infant hospitalization in Australia – demonstrating the significant impact of preventive interventions on acute illness burden.

Treatment Insights:

Access the Comprehensive Market Breakdown Request Sample

- Vaccines

- Drugs

- Others

The vaccines segment leads with a share of 50% of the total Australia pediatric healthcare market in 2025.

Vaccines represent the cornerstone of preventive pediatric healthcare in Australia, delivered through the comprehensive National Immunization Program that provides funded protection against 18 diseases for eligible children. The National Immunization Strategy 2025-2030 establishes a vision for healthier Australia through immunization, supported by six priority areas addressing current and future vaccination needs.

The vaccine segment has experienced significant expansion with the introduction of RSV preventive therapies in 2024-2025. The National RSV Mother & Infant Protection Program commenced on February 3, 2025, providing pregnant women across Australia free access to the maternal RSV vaccine Abrysvo under the NIP. State and territory programs additionally offer nirsevimab (Beyfortus) free of charge to eligible infants, creating a comprehensive two-pronged approach to RSV prevention. The NCIRS Annual Immunization Coverage Report 2024 noted concerning ongoing declines in childhood vaccination coverage since the COVID-19 pandemic, with vaccines due at older ages more likely to be delayed, highlighting the importance of catch-up vaccination initiatives.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the largest share of the pediatric healthcare market, anchored by major pediatric hospital facilities and comprehensive children's healthcare networks. The region benefits from substantial government investment in specialized pediatric infrastructure, advanced medical research capabilities, and well-established immunization service delivery systems serving both metropolitan and regional communities.

Queensland maintains a robust pediatric healthcare infrastructure centered on dedicated children's hospital facilities and expanding preventive care programs. The state demonstrates strong commitment to pediatric health through significant budget allocations and the implementation of comprehensive immunization initiatives targeting infants and pregnant women, positioning the region as a leader in childhood disease prevention strategies.

Western Australia demonstrated leadership in pediatric preventive healthcare by pioneering state-wide government-funded infant immunization programs. The region's proactive approach to childhood disease prevention has resulted in substantial improvements in infant health outcomes, with successful program implementation serving as a model for other Australian jurisdictions seeking to enhance pediatric healthcare delivery.

Victoria and Tasmania, along with the Northern Territory and Southern Australia regions, continue developing pediatric healthcare capacity through strategic investments in telehealth infrastructure and digital health solutions. These regions focus on addressing workforce distribution challenges affecting regional and remote communities, leveraging technology-enabled care models to improve accessibility to specialized pediatric services across geographically dispersed populations.

Market Dynamics:

Growth Drivers:

Why is the Australia Pediatric Healthcare Market Growing?

Expansion of Government-Funded Immunization Programs and Preventive Therapies

The Australian government's sustained commitment to expanding immunization coverage represents a fundamental growth driver for the pediatric healthcare market. The National Immunization Program continuously evolves to address emerging health threats while maintaining comprehensive protection against established vaccine-preventable diseases. Recent program enhancements include the introduction of RSV preventive therapies, marking a significant advancement in infant protection strategies. State and territory governments complement federal initiatives by implementing targeted immunization campaigns addressing regional health priorities and supporting catch-up vaccination programs for children who have fallen behind on scheduled doses.

Substantial Investment in Pediatric Hospital Infrastructure and Specialized Care Facilities

Significant government and private investment in children's hospital infrastructure is driving market expansion and enabling enhanced service delivery capabilities across metropolitan and regional healthcare networks. The new 12-storey Sydney Children's Hospital building at Randwick is due for completion in late 2025, providing state-of-the-art pediatric facilities equipped with advanced medical technologies. The Gold Dinner 2025 raised a record $84.3 Million for Sydney Children's Hospitals Foundation, surpassing previous years' fundraising achievements and demonstrating strong philanthropic support for pediatric healthcare advancement.

Digital Health Integration and Telehealth Expansion Improving Healthcare Accessibility

The accelerated adoption of digital health technologies and telehealth services is expanding pediatric healthcare accessibility, particularly for families in regional and remote Australia. The 2024-25 Federal Budget allocated $47.5 Million over four years to expand Healthdirect Australia's virtual health services, enabling consumers to access appropriate care remotely. AI-powered diagnostic tools developed by companies including Sydney-based Harrison.ai are now deployed routinely at major hospitals for radiology and pathology interpretation, helping clear backlogs and support overworked clinicians.

Market Restraints:

What Challenges the Australia Pediatric Healthcare Market is Facing?

Healthcare Workforce Shortages and Maldistribution Across Geographic Regions

Critical workforce shortages, particularly in rural and remote areas, constrain pediatric healthcare service delivery and accessibility. Research indicates that small rural towns suffer the greatest shortfalls in healthcare workforce per capita, with three times fewer doctors and twice as few nurses and allied health workers compared to metropolitan areas. The Skills Priority List 2023 reported that more than four in five health professional occupations were in shortage, affecting pediatric specialists, general practitioners, and allied health professionals serving children.

Declining Childhood Vaccination Coverage Rates Since the COVID-19 Pandemic

Concerning declines in childhood vaccination coverage since the COVID-19 pandemic threaten preventive health outcomes. One in three children received their first MMR vaccine dose late, while one in five received their second DTP-containing vaccine dose late, risking exposure to preventable diseases.

Geographic Disparities in Access to Specialized Pediatric Services

Significant geographic disparities exist in access to specialized pediatric healthcare services, with rural and remote families facing longer travel distances and waiting times for specialist consultations. Rural pediatric outpatient waiting times extending up to six years have been reported in some regions, with certain areas lacking any dedicated pediatric services, creating substantial barriers to timely diagnosis and intervention for children with developmental and health concerns.

Competitive Landscape:

The Australia pediatric healthcare market features a competitive landscape comprising public hospital networks, private healthcare operators, pharmaceutical companies, and digital health providers. Pharmaceutical competitors participate through immunization product supply, while digital health innovators contribute telehealth platforms and AI diagnostic tools. Market dynamics increasingly reflect the integration of preventive and curative approaches, with competition centered on innovation in care delivery models, geographic reach expansion, and service quality differentiation.

Recent Developments:

- June 2025: The NSW Government announced a $40.1 million investment in the 2025-26 Budget to establish the Kookaburra Centre at The Children's Hospital at Westmead, creating Australia's first complex care center for children with chronic and complex health conditions.

- February 2025: The National RSV Mother & Infant Protection Program commenced, providing pregnant women across Australia free access to Abrysvo vaccine under the National Immunization Program, representing the first major addition to infant preventive therapies.

Australia Pediatric Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chronic Illness, Acute Illness |

| Treatments Covered | Vaccines, Drugs, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia pediatric healthcare market size was valued at USD 279.82 Million in 2025.

The Australia pediatric healthcare market is expected to grow at a compound annual growth rate of 4.37% from 2026-2034 to reach USD 411.13 Million by 2034.

The acute illness segment dominated the Australia pediatric healthcare market with a 65% share in 2025, driven by high incidence of respiratory infections, gastroenteritis, and seasonal illnesses requiring immediate medical intervention among children.

Key factors driving the Australia pediatric healthcare market include expansion of government-funded immunization programs including RSV preventive therapies, substantial investment in children's hospital infrastructure, and digital health integration enabling improved accessibility through telehealth services.

Major challenges include healthcare workforce shortages particularly in rural and remote areas with three times fewer doctors per capita than metropolitan regions, declining childhood vaccination coverage rates since the COVID-19 pandemic, and geographic disparities in access to specialized pediatric services

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)