Australia Personal Finance Software Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Australia Personal Finance Software Market Overview:

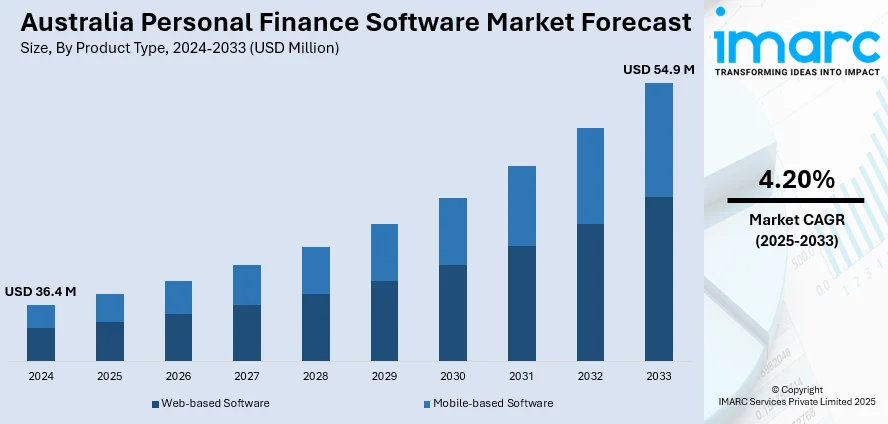

The Australia personal finance software market size reached USD 36.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 54.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. Australia’s market is growing steadily, driven by rising fintech adoption, demand for real-time payment solutions, and increased focus on financial transparency among SMEs and startups. User-friendly interfaces, automation features, and integration with banking platforms continue to support wider adoption across business and consumer segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.4 Million |

| Market Forecast in 2033 | USD 54.9 Million |

| Market Growth Rate 2025-2033 | 4.20% |

Australia Personal Finance Software Market Trends:

Fintech Expansion Demands High-Performance Chips

Australia’s rapidly evolving fintech sector is placing new demands on backend infrastructure, especially in secure data handling and real-time financial analytics. As digital platforms gain traction among startups, SMEs, and larger enterprises, the pressure to deliver seamless, high-speed financial services is reshaping data center requirements. High-performance, scalable chips are becoming central to managing large volumes of transactions, cross-border transfers, and compliance functions efficiently. In November 2024, Airwallex launched its ‘Airwallex for Startups’ program in New Zealand, offering fintech tools that include money management solutions, foreign exchange services, and cashback incentives. While launched abroad, this move signals how regional fintech ecosystems are expanding their footprint to support business growth through digital tools. For Australia, similar developments reflect a broader shift toward integrated financial platforms that demand robust data processing power. As local fintech firms offer more automated services, backend environments powered by energy-efficient, high-capacity chips will be key to managing service loads. From reconciliation and billing to risk analytics and KYC workflows, advanced chip integration will be vital for ensuring operational speed, data security, and customer experience in Australia’s growing digital finance landscape.

To get more information on this market, Request Sample

Real-Time Payments Drive Demand for Advanced Hardware Solutions

Australia’s payment landscape is rapidly evolving, with widespread adoption of instant payments and digital wallets. This shift is increasing the need for robust backend systems capable of handling real-time transaction processing, fraud detection, and biometric validation. Financial platforms require specialized hardware that ensures low-latency performance, encryption capabilities, and the ability to process multiple tasks simultaneously to manage secure transactions at scale. In April 2024, Volt introduced a PayTo-based one-click payment solution in Australia, enabling fast and secure digital transactions while reducing fraud risks. This move underscores how Australian fintech providers are prioritizing user trust, speed, and security in their payment innovations. These solutions rely on high-performance infrastructure that supports encrypted data, biometric inputs, and seamless API integrations with banking systems. As e-wallets and instant payment systems continue to grow, data center operators in Australia must adopt advanced processing systems tailored to the needs of fintech. This includes scalable encryption, multi-factor authentication, and real-time analytics capabilities. The trend highlights the increasing demand for infrastructure designed to meet the complex requirements of a connected financial ecosystem, ensuring both security and efficiency in handling transactions.

Australia Personal Finance Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Web-based Software

- Mobile-based Software

The report has provided a detailed breakup and analysis of the market based on the product type. This includes web-based software and mobile-based software.

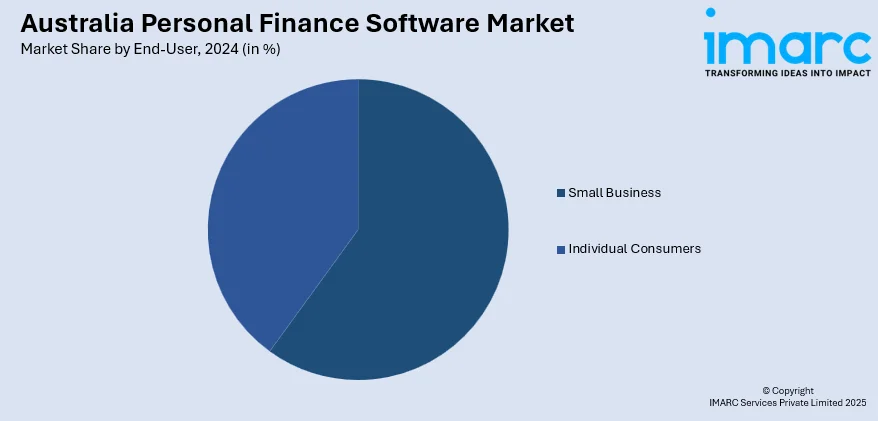

End-User Insights:

- Small Business

- Individual Consumers

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes small business and individual consumers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Personal Finance Software Market News:

- March 2025: Fiserv launched Clover in Australia, offering an all-in-one point-of-sale platform for SMEs. The system integrates payment processing, inventory, accounting, and staff management, advancing the personal finance software market by enabling streamlined financial tracking, real-time insights, and improved operational control for small businesses.

- February 2025: AMP launched a digital bank for small businesses in Australia using Starling Bank’s Engine SaaS platform. The bank introduced tools for cashflow management, spending controls, and numberless debit cards, driving growth in personal finance software focused on security, automation, and business financial planning.

Australia Personal Finance Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Web-Based Software, Mobile-Based Software |

| End-Users Covered | Small Business, Individual Consumers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia personal finance software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia personal finance software market on the basis of product type?

- What is the breakup of the Australia personal finance software market on the basis of end-user?

- What are the various stages in the value chain of the Australia personal finance software market?

- What are the key driving factors and challenges in the Australia personal finance software market?

- What is the structure of the Australia personal finance software market and who are the key players?

- What is the degree of competition in the Australia personal finance software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia personal finance software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia personal finance software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia personal finance software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)