Australia Personal Grooming Products Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, Form, and Region, 2025-2033

Australia Personal Grooming Products Market Overview:

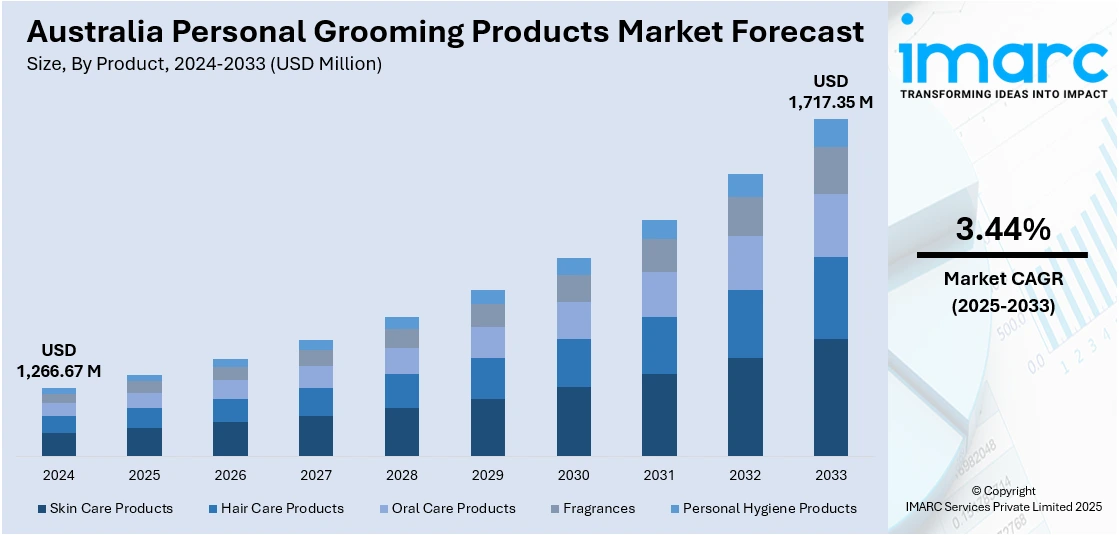

The Australia personal grooming products market size reached USD 1,266.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,717.35 Million by 2033, exhibiting a growth rate (CAGR) of 3.44% during 2025-2033. The market is witnessing steady growth driven by rising consumer awareness about self-care, evolving beauty standards, and increasing demand for natural and sustainable products. Expanding e-commerce platforms and premium product innovations further support market expansion. Male grooming and multifunctional solutions are also gaining popularity, contributing to the overall Australia personal grooming products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,266.67 Million |

| Market Forecast in 2033 | USD 1,717.35 Million |

| Market Growth Rate 2025-2033 | 3.44% |

Australia Personal Grooming Products Market Trends:

Rising Consumer Awareness and Self‑Care Culture

Australia is witnessing a cultural shift where personal grooming is increasingly tied to overall self-care and wellness. Consumers, especially Gen Z and Millennials, are more informed and conscious about their appearance, hygiene, and skin health. Social media, beauty influencers, and changing societal standards have pushed grooming beyond basic hygiene into a daily wellness ritual. Both men and women are adopting multi-step routines, incorporating skincare, hair care, and fragrances. This growing interest is encouraging innovation, with brands launching personalized, targeted, and premium grooming solutions. Education via online platforms and tutorials is further driving engagement. Consumers are not only seeking effective products but also experiences that reflect their values, including wellness, individuality, and confidence, making grooming an essential component of modern Australian lifestyles.

To get more information on this market, Request Sample

Preference for Natural, Organic, and Sustainable Products

The significant rise in demand for natural, organic, and eco-friendly grooming products in Australia is driving the Australia personal grooming products market growth. Consumers are increasingly reading ingredient labels and choosing products free from parabens, sulfates, and synthetic fragrances. The market is seeing a surge in plant-based formulations using native Australian botanicals like tea tree oil and eucalyptus. Sustainability also plays a critical role, with buyers favoring cruelty-free, vegan-certified, and recyclable products. This eco-conscious behavior influences purchasing decisions, particularly among younger demographics. Brands with strong sustainability credentials and transparent sourcing are experiencing higher loyalty and preference. Additionally, ethical packaging, carbon-neutral operations, and refillable containers are becoming differentiators. This shift toward clean and green grooming is reshaping product development, pushing manufacturers to innovate while maintaining environmental responsibility.

Growth of E‑commerce and Digital Retail Channels

The expansion of e-commerce and digital platforms is a major growth driver in Australia’s personal grooming market. Consumers value the convenience, accessibility, and product variety offered by online stores. E-commerce enables brands to reach beyond physical retail limitations, offering services like virtual consultations, skin analysis tools, and subscription-based deliveries. Social commerce, influencer marketing, and user-generated content are fueling digital engagement. Online shoppers also benefit from detailed product information, reviews, and competitive pricing. Mobile shopping apps and targeted ads further personalize the customer experience. Particularly in urban and regional areas, digital accessibility is reshaping purchasing behavior. As technology evolves, grooming brands are leveraging digital innovations to boost visibility, customer loyalty, and sales, making online retail central to market expansion strategies.

Australia Personal Grooming Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, distribution channel, and form.

Product Insights:

- Skin Care Products

- Hair Care Products

- Oral Care Products

- Fragrances

- Personal Hygiene Products

The report has provided a detailed breakup and analysis of the market based on the product. This includes skin care products, hair care products, oral care products, fragrances, and personal hygiene products.

Gender Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes men, women, and unisex.

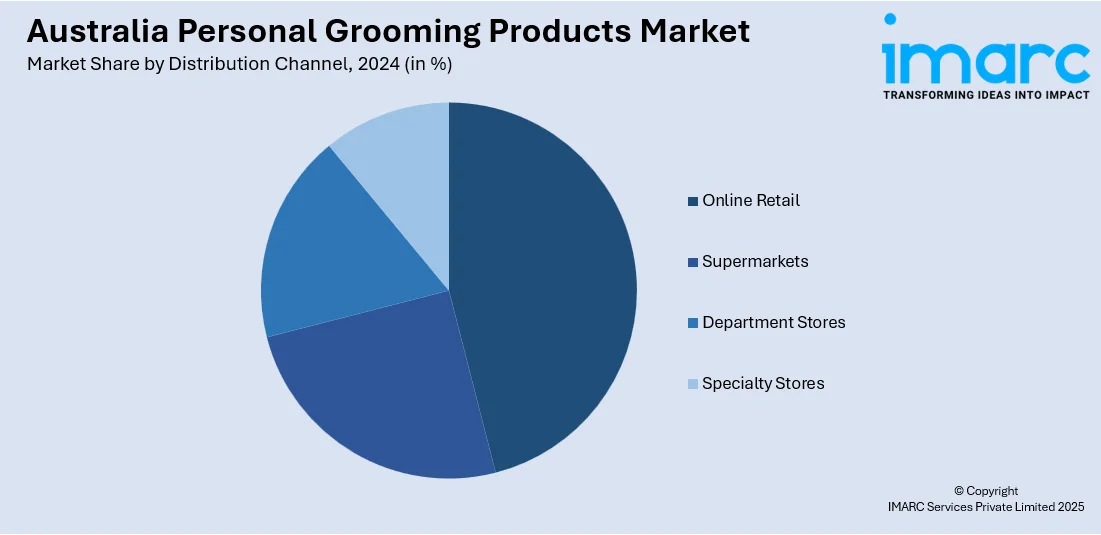

Distribution Channel Insights:

- Online Retail

- Supermarkets

- Department Stores

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail, supermarkets, department stores, and specialty stores.

Form Insights:

- Liquid

- Cream

- Gel

- Spray

- Wipes

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid, cream, gel, spray, and wipes.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include the Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Personal Grooming Products Market News:

- In July 2024, Dove Men+Care creates and manufactures grooming and personal care items tailored specifically for men. The company, which previously sponsored Australian Rugby from 2014 to 2019, is back at the Wallabies to dispel the myths that men have about taking care of themselves.

- In February 2023, Wuli Grooming, the vegan haircare brand made in Australia with all-natural ingredients, debuted at the Australian retailer Myer, marking a significant milestone for the rising beauty brand. Rooted in the conviction that products made for curly and wavy hair can suit any hair type, the brand's gender-neutral line is now available for purchase at myer.com.au. Myer’s more than 18 million online customers each month can now effortlessly find and buy Wuli Grooming’s curl creams, sea salt sprays, and matte and shine balms.

Australia Personal Grooming Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Skin Care Products, Hair Care Products, Oral Care Products, Fragrances, Personal Hygiene Products |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Online Retail, Supermarkets, Department Stores, Specialty Stores |

| Forms Covered | Liquid, Cream, Gel, Spray, Wipes |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia personal grooming products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia personal grooming products market on the basis of product?

- What is the breakup of the Australia personal grooming products market on the basis of gender?

- What is the breakup of the Australia personal grooming products market on the basis of distribution channel?

- What is the breakup of the Australia personal grooming products market on the basis of form?

- What is the breakup of the Australia personal grooming products market on the basis of region?

- What are the various stages in the value chain of the Australia personal grooming products market?

- What are the key driving factors and challenges in the Australia personal grooming products market?

- What is the structure of the Australia personal grooming products market and who are the key players?

- What is the degree of competition in the Australia personal grooming products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia personal grooming products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia personal grooming products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia personal grooming products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)