Australia Personal Hygiene Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Australia Personal Hygiene Market Overview:

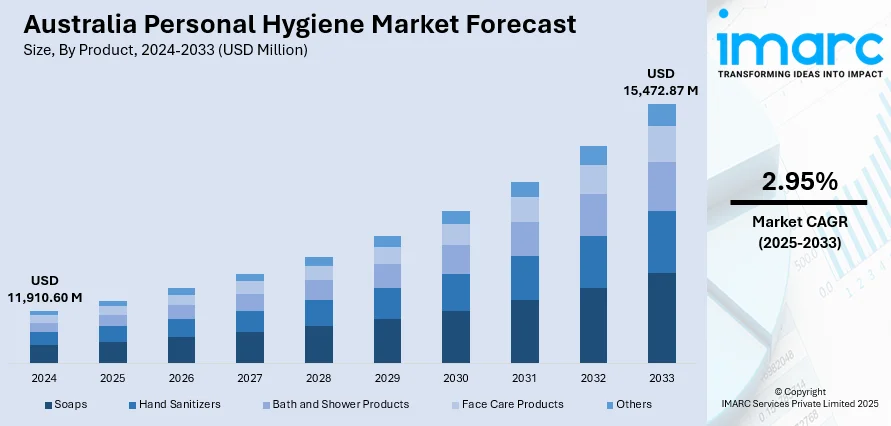

The Australia personal hygiene market size reached USD 11,910.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 15,472.87 Million by 2033, exhibiting a growth rate (CAGR) of 2.95% during 2025-2033. The market is driven by rising consumer demand for natural and organic hygiene products, fueled by health-conscious purchasing behaviors and stricter regulatory standards on synthetic ingredients. E-commerce growth and preference for convenience are accelerating subscription-based and direct-to-consumer models, supported by personalized marketing and contactless shopping trends. These factors, combined with increasing digital adoption and sustainability focus, will further augment the Australia personal hygiene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,910.60 Million |

| Market Forecast in 2033 | USD 15,472.87 Million |

| Market Growth Rate 2025-2033 | 2.95% |

Australia Personal Hygiene Market Trends:

Growing Demand for Natural and Organic Personal Hygiene Products

The market is undergoing a notable transition towards natural and organic products, propelled by a growing consumer consciousness regarding health and environmental issues. Consumers are becoming more cautious about synthetic ingredients, parabens, and sulfates, opting instead for products with plant-based, cruelty-free, and sustainably sourced components. Brands that emphasize transparency in sourcing and eco-friendly packaging are gaining traction, particularly among younger demographics such as Millennials and Gen Z. Additionally, the rise of clean beauty movements and stricter regulations on chemical ingredients have further accelerated this trend. Companies are responding by reformulating products to include natural alternatives, including tea tree oil, aloe vera, and coconut oil. Retailers are also expanding their organic hygiene offerings, with supermarkets and pharmacies dedicating more shelf space to these products. This trend is expected to grow as consumers continue to prioritize wellness and sustainability in their purchasing decisions.

To get more information of this market, Request Sample

Increasing Adoption of Direct-to-Consumer Models and Subscription-Based

The rise in direct-to-consumer (DTC) sales and subscription-based models, offering convenience and personalized experiences, is also supporting the Australia personal hygiene market growth. With the rise of e-commerce, consumers are increasingly subscribing to recurring deliveries of essentials including soaps, shampoos, and skincare products, reducing the need for in-store purchases. Australia's eCommerce market reached AUD 63.6 Billion (approximately USD 40.98 Billion), showing a 68% increase in internet retail share since pre-pandemic levels. This has increased demand for various sectors, including personal hygiene items. The fashion, electronics, and beauty and personal care categories led the way, with AUS 5.11 Billion (approximately USD 3.36 Billion) being spent solely on personal care, representing a 7.6% year-over-year increase. With 41% of Australians preferring digital wallets and 31% choosing debit or credit cards for making purchases online, eCommerce is constantly revolutionizing the retail landscape, particularly for eco-friendly hygiene brands. Brands are leveraging data analytics to tailor product recommendations, enhancing customer retention. Additionally, DTC brands are bypassing traditional retail channels, using social media and influencer marketing to engage directly with consumers. This approach allows for competitive pricing, exclusive product launches, and stronger brand loyalty. The COVID-19 pandemic further accelerated this shift as consumers sought contactless shopping options. As digital adoption grows, more companies are expected to adopt subscription and DTC strategies to meet changing consumer expectations for convenience and customization in personal hygiene purchases.

Australia Personal Hygiene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Soaps

- Hand Sanitizers

- Bath and Shower Products

- Face Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes soaps, hand sanitizers, bath and shower products, face care products, and others.

Gender Insights:

- Unisex

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes unisex, male, and female.

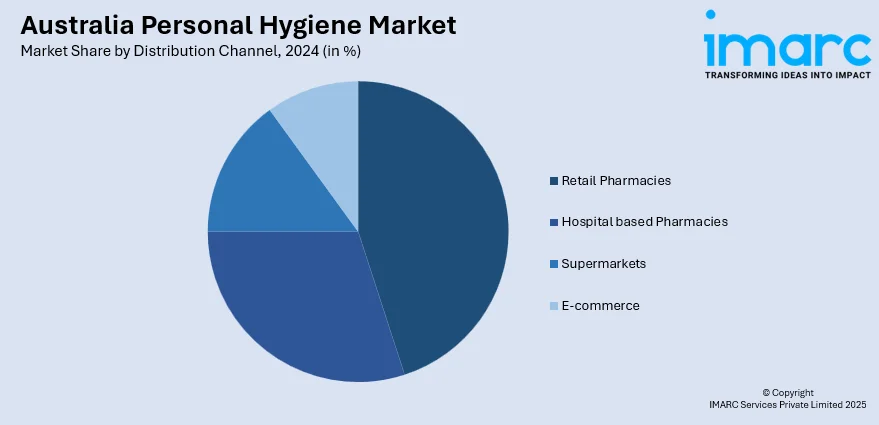

Distribution Channel Insights:

- Retail Pharmacies

- Hospital based Pharmacies

- Supermarkets

- E-commerce

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies, hospital based pharmacies, supermarkets, and e-commerce.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Personal Hygiene Market News:

- March 28, 2025: US skin care company Hydrinity announced its expansion into the Australian market through a partnership with Device Consulting, aiming to distribute its high-end products via plastic surgeons, dermatologists, and cosmetic general practitioners. With rising consumer awareness of personal hygiene and skincare, the Australian market is expected to nearly double in size over the next 5 to 7 years, driven by health-oriented consumers who prioritize skin health. This strategic initiative enables Hydrinity to place itself as a leading skincare solution for Australian medical professionals committed to high-end aesthetic treatments.

Australia Personal Hygiene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Soaps, Hand Sanitizers, Bath and Shower Products, Face Care Products, Others |

| Genders Covered | Unisex, Male, Female |

| Distribution Channels Covered | Retail Pharmacies, Hospital based Pharmacies, Supermarkets, E-commerce |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia personal hygiene market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia personal hygiene market on the basis of product?

- What is the breakup of the Australia personal hygiene market on the basis of gender?

- What is the breakup of the Australia personal hygiene market on the basis of distribution channel?

- What is the breakup of the Australia personal hygiene market on the basis of region?

- What are the various stages in the value chain of the Australia personal hygiene market?

- What are the key driving factors and challenges in the Australia personal hygiene market?

- What is the structure of the Australia personal hygiene market and who are the key players?

- What is the degree of competition in the Australia personal hygiene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia personal hygiene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia personal hygiene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia personal hygiene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)