Australia Personal Luxury Goods Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2025-2033

Australia Personal Luxury Goods Market Overview:

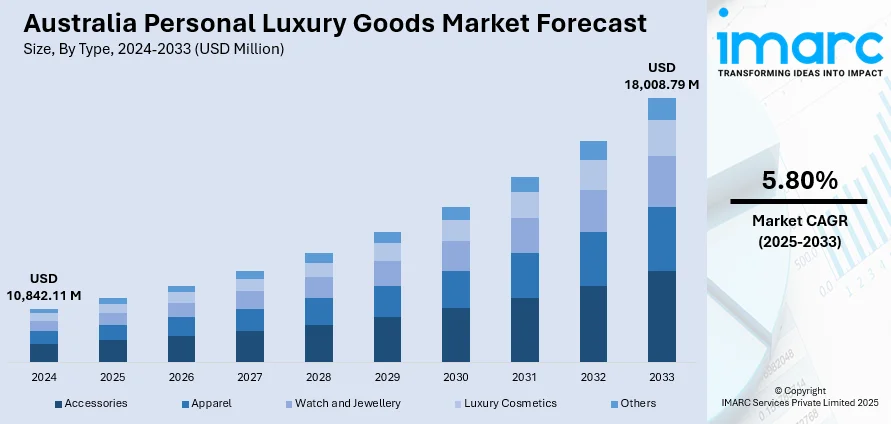

The Australia personal luxury goods market size reached USD 10,842.11 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 18,008.79 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The rising disposable incomes among consumers, a growing base of high-net-worth migrants, resurgent international tourism, digitally-savvy millennials favoring premium products through e-commerce and experiential flagship stores, and luxury brand expansions into emerging urban centers are strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,842.11 Million |

| Market Forecast in 2033 | USD 18,008.79 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Personal Luxury Goods Market Trends:

Digital Transformation and Omnichannel Acceleration

Australia’s personal luxury goods market is undergoing a digital transformation, with brands adopting omnichannel strategies that merge e-commerce, social commerce, and immersive technologies to engage younger, tech-savvy consumers. The number of high-net-worth individuals (HNWIs) reached 22.8 million in Australia in 2024, driving total wealth to a record US$86.8 trillion. In Australia alone, there are now 333,000 HNWIs, reflecting a 7.8% rise from 2023. This affluent consumer base is fueling demand for personalized and tech-enabled luxury experiences. Domestically, Australia’s e-commerce market is booming, valued at USD 536.0 billion in 2024 and expected to grow at a CAGR of 12.70% to reach USD 1,568.60 billion by 2033. In response, luxury brands are investing in digital flagship stores, augmented reality (AR) and virtual reality (VR) virtual try-ons, artificial intelligence (AI)-driven personalization, and direct-to-consumer channels. Social commerce platforms like Instagram and WeChat are also playing a key role, allowing brands to engage Millennials and Gen Z consumers and extend their reach beyond major urban centers with seamless, round-the-clock shopping experiences.

To get more information on this market, Request Sample

Post-Pandemic Tourism Recovery Fueling In-Store Luxury Spend

The resurgence of international travel has become a key driver of luxury goods growth in Australia, with affluent visitors returning to major retail centers and emerging cities. According to Tourism Research Australia, international visitors made 7.6 million trips in the year ending December 2024 and spent AUD 32.9 billion in Australia, a 5% increase from 2019. This influx of high-spending tourists complements the rise in domestic affluence, with the luxury market in Australia generating 7.96 billion in 2024, fueled by strong sales of designer clothing, handbags, watches, and jewellery. In response, luxury brands are expanding their presence with new boutiques, pop-up experiences, exclusive limited-edition drops, and personalized services like styling appointments and multilingual staff, reinforcing international tourism as a vital part of Australia's luxury market.

Australia Personal Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, gender, and distribution channel.

Type Insights:

- Accessories

- Apparel

- Watch and Jewellery

- Luxury Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes accessories, apparel, watch and jewellery, luxury cosmetics, and others.

Gender Insights:

- Female

- Male

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes female and male.

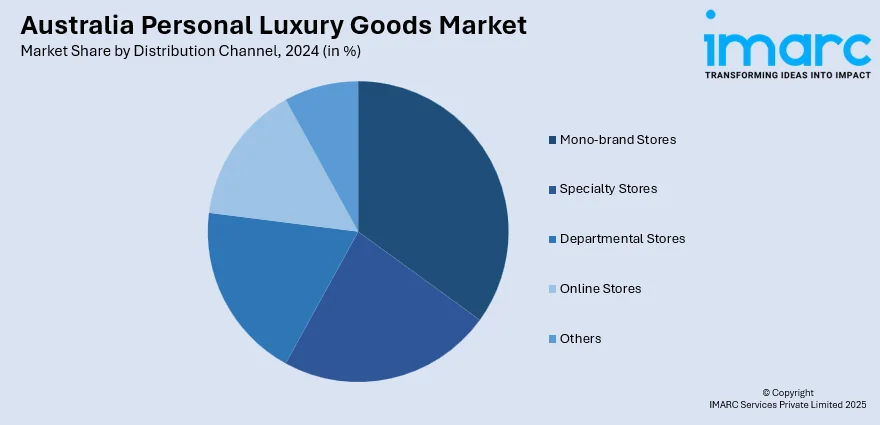

Distribution Channel Insights:

- Mono-brand Stores

- Specialty Stores

- Departmental Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mono-brand stores, specialty stores, departmental stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Personal Luxury Goods Market News:

- May 2025: Australian luxury fashion label CAMILLA unveiled a new boutique at Burnside Village, Adelaide, offering an immersive retail experience. This launch underscores CAMILLA's position in the personal luxury goods market, blending fashion with experiential design.

- March 2025: Balmain launched its luxury fragrance line, Les Éternels de Balmain, in Australia, exclusively at David Jones. Developed with Estée Lauder, the collection features eight gender-neutral eaux de parfum inspired by Balmain’s couture heritage and modern vision. This debut marks Balmain’s expansion into personal luxury goods, blending high fashion with fine fragrance to redefine contemporary luxury.

Australia Personal Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Accessories, Apparel, Watch and Jewellery, Luxury Cosmetics, Others |

| Genders Covered | Female, Male |

| Distribution Channels Covered | Mono-brand Stores, Specialty Stores, Departmental Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia personal luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia personal luxury goods market on the basis of type?

- What is the breakup of the Australia personal luxury goods market on the basis of gender?

- What is the breakup of the Australia personal luxury goods market on the basis of distribution channel?

- What is the breakup of the Australia personal luxury goods market on the basis of region?

- What are the various stages in the value chain of the Australia personal luxury goods market?

- What are the key driving factors and challenges in the Australia personal luxury goods market?

- What is the structure of the Australia personal luxury goods market and who are the key players?

- What is the degree of competition in the Australia personal luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia personal luxury goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia personal luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia personal luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)