Australia Pigments Market Size, Share, Trends and Forecast by Product Type, Color Index, Application, and Region, 2025-2033

Australia Pigments Market Overview:

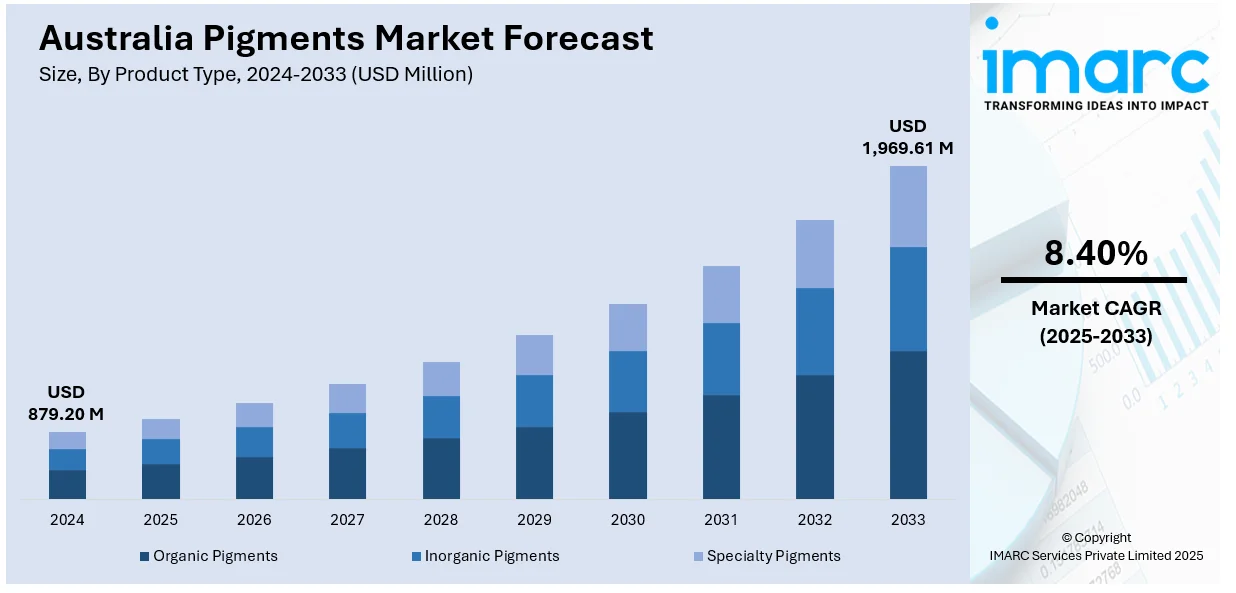

The Australia pigments market size reached USD 879.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,969.61 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The growing demand for pigments in Australia is supported by the expansion of the cosmetics, personal care, and textile sectors. In the cosmetics industry, there is a trend of bold, enduring products made with safe, novel pigments, as well as an increasing focus on clean and environment-friendly formulations. Moreover, the growing textile sector is fueling the demand for premium, long-lasting pigments, especially in fast fashion and high-end markets. Advancements in pigment technologies are further contributing to the expansion of the Australia pigments market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 879.20 Million |

| Market Forecast in 2033 | USD 1,969.61 Million |

| Market Growth Rate 2025-2033 | 8.40% |

Australia Pigments Market Trends:

Increasing Demand From Cosmetics and Personal Care Industry

The rising demand for pigments in the cosmetics and personal care industry, particularly as individuals seek products that deliver vibrant colors, texture, and long-lasting performance, is offering a favorable market outlook. With increased awareness about the safety of cosmetic ingredients, there is a noticeable shift toward natural and synthetic pigments that not only provide visually appealing results but also ensure skin safety. The ongoing advancement in product formulas, particularly in cosmetics, such as foundations, lipsticks, and eye shadows, requires specialized pigments that can produce particular effects. Besides this, the growing focus on cleaner beauty and the increasing number of local and international cosmetic brands entering the market are catalyzing the demand for pigments that meet these standards. Additionally, regulations surrounding cosmetic products are encouraging companies to innovate with pigments that comply with new safety guidelines, further contributing to the market growth. As individuals increasingly prioritize high-quality, safe beauty products, the demand for pigments in the cosmetics sector continues to grow, driven by both the need for innovation and regulatory compliance in product formulations. In 2024, O&M launched its ORIGINAL.pigment range, including 12 vibrant, intermixable direct dyes designed for vivid, long-lasting hair color. The products were vegan, cruelty-free, and infused with Australian botanical extracts, offering gentle, clean beauty solutions.

To get more information on this market, Request Sample

Growth of Textile Industry

The robust textile sector in Australia is driving the need for pigments, especially in the manufacturing of colored textiles and clothing. The Australian textile and apparel sector attained USD 27.52 billion in 2023, and is forecasted to expand at a CAGR of 5.10% to hit USD 44.18 billion by 2032, according to the IMARC Group. With the evolution of the fashion industry, there is a rise in the need for bright, durable color in fabrics. Moreover, the growing emphasis on sustainability and eco-friendly fashion is encouraging textile producers to shift towards water-based and non-toxic pigments to meet user demands for safer, environmentally responsible products. The rise of both fast fashion and luxury fashion sectors in Australia is leading to an increasing demand for sophisticated pigments in textile dyeing and finishing methods. The fast fashion industry's focus on swift production rates and diversity, along with the luxury fashion sector's attention to exceptional quality, are catalyzing the demand for pigments that provide both brightness and longevity. Additionally, progress in pigment technologies, including the creation of dyes that offer better color retention and fading resistance, is bolstering their significance in the textile sector. These advancements are allowing textile producers to satisfy both aesthetic and practical requirements, further supporting the Australia pigments market growth.

Australia Pigments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, color index, and application.

Product Type Insights:

- Organic Pigments

- Azo Pigments

- Phthalocyanine Pigment

- Quinacridone Pigment

- Other Organic Pigments

- Inorganic Pigments

- Titanium Dioxide Pigments

- Iron Oxide Pigments

- Cadmium Pigments

- Carbon Black Pigments

- Chromium Oxide Pigments

- Complex Inorganic Pigments

- Others

- Specialty Pigments

- Classic Organic Pigments

- Metallic Pigments

- High-Performance Pigments

- Light Interference Pigments

- Fluorescent Pigment

- Luminescent Pigments

- Thermo-Chromic Pigments

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic pigments (azo pigments, phthalocyanine pigment, quinacridone pigment, and other organic pigments), inorganic pigments (titanium dioxide pigments, iron oxide pigments, cadmium pigments, carbon black pigments, chromium oxide pigments, complex inorganic pigments, and others), and specialty pigments (classic organic pigments, metallic pigments, high-performance pigments, light interference pigments, fluorescent pigment, luminescent pigments, and thermo-chromic pigments)

Color Index Insights:

- Red

- Orange

- Yellow

- Blue

- Green

- Brown

- Others

A detailed breakup and analysis of the market based on the color index have also been provided in the report. This includes red, orange, yellow, blue, green, brown, and others.

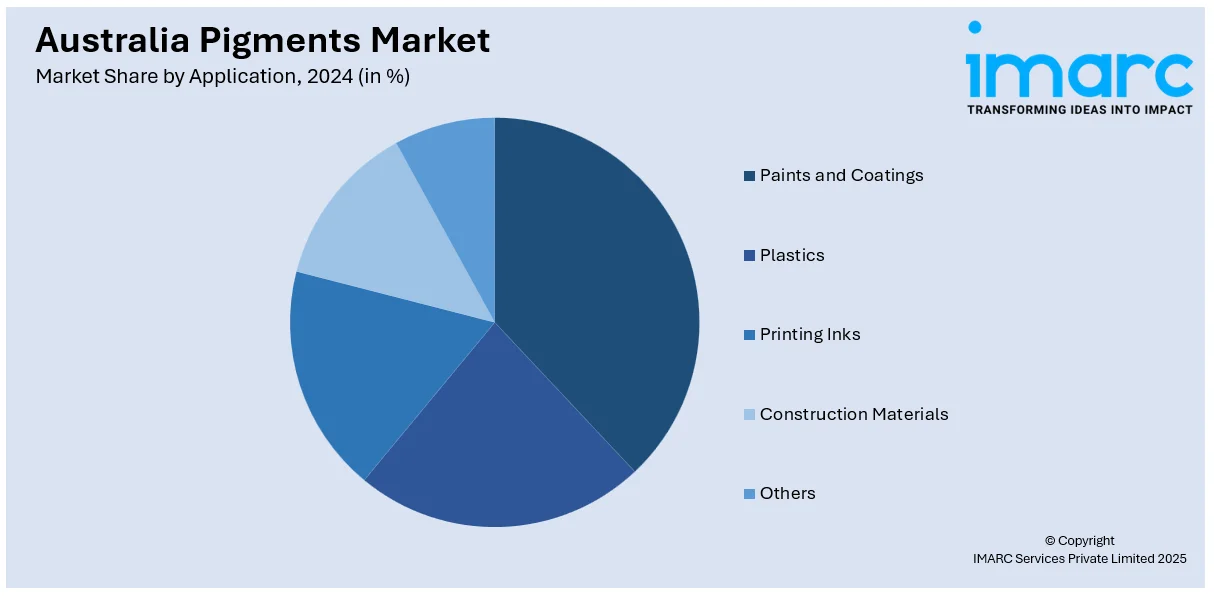

Application Insights:

- Paints and Coatings

- Plastics

- Printing Inks

- Construction Materials

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes paints and coatings, plastics, printing inks, construction materials, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pigments Market News:

- In October 2024, Canon Australia launched the image PROGRAF PRO-1100, a new A2 printer for professional photographers and enthusiasts. It featured a 12-ink pigment system for better color depth and durability, offering prints that can last up to 200 years.

- In January 2024, Deakin University in Australia announced a breakthrough method to recycle textile waste into pigments for coloring polymers. The process, supported by Sustainability Victoria, used low water and energy to grind colored textile waste into reusable pigment powders.

Australia Pigments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Color Indexes Covered | Red, Orange, Yellow, Blue, Green, Brown, Others |

| Applications Covered | Paints and Coatings, Plastics, Printing Inks, Construction Materials, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pigments market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pigments market on the basis of product type?

- What is the breakup of the Australia pigments market on the basis of color index?

- What is the breakup of the Australia pigments market on the basis of application?

- What is the breakup of the Australia pigments market on the basis of region?

- What are the various stages in the value chain of the Australia pigments market?

- What are the key driving factors and challenges in the Australia pigments market?

- What is the structure of the Australia pigments market and who are the key players?

- What is the degree of competition in the Australia pigments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pigments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pigments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pigments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)