Australia Plant-Based Food Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel and Region, 2025-2033

Australia Plant-Based Food Market Overview:

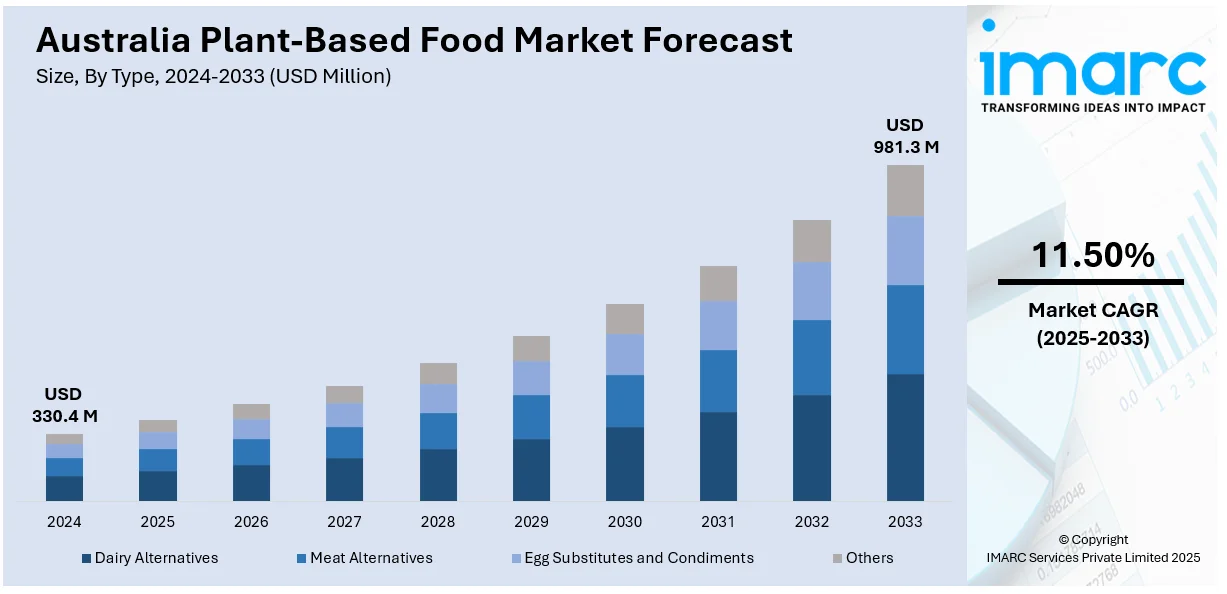

The Australia plant-based food market size reached USD 330.4 Million in 2024. Looking forward, the market is expected to reach USD 981.3 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is expanding robustly, backed by growing consumer uptake, shifting eating habits, and increasing availability of plant foods throughout the nation via mainstream stores and online channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 330.4 Million |

| Market Forecast in 2033 | USD 981.3 Million |

| Market Growth Rate 2025-2033 | 11.50% |

Key Trends of Australia Plant-Based Food Market:

Expansion of Clean-Label and Nutrient-Enriched Alternatives

Australian consumers are increasingly concerned with transparency and nutritional content in plant-based food options. This has driven a clear trend towards clean-label products—those produced from few, familiar ingredients and devoid of artificial ingredients. For instance, in April 2024, Else Nutrition officially entered the market with the launch of its soy-free, plant-based infant and toddler formula in Australia, providing clean-label options produced from almond, buckwheat, and tapioca. Moreover, manufacturers are therefore increasing the nutritional content of plant-based options by including ingredients high in protein, fiber, and key micronutrients. This is particularly evident in meat and dairy substitutes, in which legumes, grains, and fortified blends are taking the place of synthetic fillers. Consumers consider such formulas to be more reliable and conducive to long-term health objectives. This trend is also encouraged by consumer interest in whole food-based diets, especially among flexitarian and health-conscious segments. Australia plant-based food market outlook shows a robust growth path, as companies sharpen their products to respond to changing expectations regarding clean formulation and functional nutrition, strengthening consumer loyalty through products that meet both health and ethical standards, which further contribute to the Australia plant-based food market demand.

To get more information on this market, Request Sample

Diversification Across Meal Categories and Formats

Plant food in Australia is no longer restricted to meat alternatives or soy milk; it is growing across meal categories such as snacks, desserts, ready meals, sauces, and even bread. For example, in September 2023, NEXT Foods rolled out a new range of plant-based pasta sauces in 550 Coles supermarkets nationwide, with locally produced pouches containing plant-based meat and chef-recipe variants such as Carbonara and Bolognese. Furthermore, consumers are looking for plant-based options that fit easily into their everyday eating routines, ranging from breakfast cereals enriched with plant protein to egg-free condiments and dairy-free frozen desserts. This diversification indicates a move from niche consumption to mass adoption, with plant-based ingredients cropping up in both classic and gourmet recipes. It also illustrates the growing versatility of alternative proteins and oils, which enable flavor and texture innovation that resonates with broader consumers. Australia plant-based food market share is increasingly making headway in general grocery expenditure, especially as supermarkets and food service companies expand their plant-based offerings. Having these products available in daily categories simplifies plant-based consumption and makes it more accessible to households regardless of dietary preference.

Strong Growth in Regional and Online Retail Channels

According to the Australia plant-based food market analysis, demand for plant-based food in the region is growing in the major cities and also throughout other regions, underpinned by enhanced distribution channels and online retail platforms. Consumers in lower-density states are intensely looking to online channels to access a greater variety of plant-based foods that might not be available in local supermarkets. These involve specialty condiments, allergen-friendly dairy substitutes, and meal packages aligned with vegan or allergen-specific diets. Virtual retailers have larger product variety and complete ingredient disclosures, appealing to knowledgeable shoppers interested in targeting distinct health or moral criteria. In parallel, leading chain stores are increasing plant-based shelf space among regional units. Australia plant-based food market growth is thus being fueled by the twin forces of e-commerce and regional retail expansion, marking a national normalization of plant-based consumption that goes beyond metropolitan trends and extends to varied consumer bases across the nation.

Growth Factors of Australia Plant-Based Food Market:

Changing Consumer Values and Lifestyle Choices

In Australia, the increase in popularity of plant‑based foods is rooted heavily in changing consumer values and lifestyle attitudes. With growing concerns about environmental sustainability and animal well‑being among Australians, especially in urban centers such as Sydney, Melbourne, and Brisbane, people are making informed choices to consume foods that align with their ethical values. This is influenced by international campaigns along with national and local initiatives and learning about the environmental advantages of consuming less meat. Wellness culture, which encompasses yoga, meditation, and holistic health, has particularly gained traction in the coastal towns and health-focused suburbs of Australia, fostering the demand for plant‑based options. Additionally, the prevalence of social media communities and influencers within Australia promoting plant‑based living has amplified this shift. These local voices speak to uniquely Australian experiences like beach lifestyle, growing concerns about bushfire-related environmental damage, and reef conservation, making plant‑based choices feel personally meaningful and resonant. As a result, the Australian consumer is not simply adopting global trends but translating them with a regional perspective centered on local sustainability, ethical consciousness, and individual wellbeing.

Culinary Innovation and Local Ingredient Integration

Australia's fast-growing plant-based food industry has been fueled, in large part, by culinary creativity deeply ingrained in the nation's distinct variety of ingredients and food culture. Chefs, food startups, and food manufacturers throughout Australia are experimenting with indigenous botanical ingredients such as wattle seed, macadamia, lemon myrtle, and quandong to create plant-based products with an indelibly Australian flavor. This blend of native taste and innovative plant‑based technology has piqued the interest and appetite of consumers. In addition, Australia's multicultural fabric, which is a mix of European, Asian, Pacific, and Indigenous cuisines, remains a source of inspiration for innovative plant‑based products such as laksa made vegan, plant‑based banh mi with native spices, and inventive variations of Greek‑style dips with bush tomatoes. Local food trucks, cafés, and artisanal producers are now hubs for these creative offerings, working to mainstream and legitimize plant‑based options in mainstream food culture in Melbourne laneways, Sydney inner-city suburbs, and country towns as well. This grassroots movement of regionally based food innovation fortifies consumer confidence in plant‑based products, rendering them both up‑to‑date and clearly local.

Retail Dynamics and Policy‑Driven Accessibility

An important growth driver for Australia's plant‑based food industry rests in the way regulatory environments and retailers are influencing accessibility and prevalence. National supermarket stores, quality grocery retailers, and health food specialty stores are gradually growing plant‑based ranges, enhancing product visibility and consumer coverage in both metropolitan and rural communities such as those in Queensland and Western Australia where food access concerns are more acute. At the same time, state and government policies, such as sustainability commitments, waste reduction initiatives, and backing for alternative protein innovation, are setting fertile ground for producers and farmers. Programs aligned with climate targets and local development frequently roll out grants or pilot schemes to producers that use plant-based or cell-based material, which stimulates investment and local production. In addition, schools and local innovation hotspots are actively engaging with food tech startups to test plant-based protein sources from pulses, seaweed, or indigenous grains as part of larger regional agricultural diversification and resiliency efforts. This overlap of retail drive and policy push, augmented by Australia's investment in sustainable development and regional fairness, nourishes consumer convenience of access and industry energy, driving the plant‑based food sector forward nationwide.

Opportunities of Australia Plant-Based Food Market:

Discovering Indigenous Ingredients and Specific Biodiversity

Australia's unparalleled biodiversity presents a deep potential for the plant‑based food industry through the incorporation of Indigenous ingredients that are both nutritionally valuable and story‑rich. Indigenous botanicals including wattle seed, quandong, Davidson plum, macadamia, and lemon myrtle have huge unused potential to take plant‑based foods to new heights with unique Australian character and flavor profiles. There is increasingly strong consumer demand, domestically and globally, for foods celebrating genuine regional terroir and indigenous cultural heritage. Through partnership with Aboriginal people, companies can source these ingredients ethically while respecting traditional knowledge systems. This interaction serves a twofold purpose: producers can tap into distinctive, resilient crops well-suited to Australia's landscapes, while consumers can find richly Australian culinary narratives embedded in their food. These indigenous ingredients can be infused into a broad range of products, from dairy‑free sweets and nut‑based foods to meaty foodstuffs, offering a premium, regionally based plant‑based innovation platform that differentiates Australia in the global marketplace.

Regional Specialty and Tourism-Linked Branding

Australia's plant‑based food sector would gain significantly by tapping into its strong tourism sector and regional branding glamour. Distinct regions like Western Australia's Margaret River, Tasmania's cool‑climate backcountry, and subtropical north Queensland are already renowned for local fruits, gourmet trails, and food tourism. Integrating plant-based foods into these local identities, like a Tasmanian vegan truffle pesto or wattle seed-seasoned sausage roll from outback bakeries, provides a strong story for tourists willing to engage with local food culture through an ethical conduit. Specialty food tours, farmers' markets, and coastal food festivals can expose these plant-based innovations in the flesh to consumers, enticing curiosity and desire that can flow through into wider retail and online channels of distribution. This strategy not only increases the market impact of Australian plant‑based products but also strengthens consumer confidence by presenting them as place-based, artisanal foods, and not mass-market substitutes. It's a chance to build a premium segment that combines tourism, regional identity, ethical consumption, and culinary narratives.

Agricultural Diversification and Export Pathways

Australia's large agricultural infrastructure and well‑established export networks offer fertile soil to increase opportunities for plant‑based foods. Numerous regional farming regions that were historically geared toward grain, pulse, and oilseed production are now increasingly welcoming diversification into crops tailored for plant‑based ingredients like chickpeas, lentils, lupins, and specialty grains well-suited to Australia's diverse climates. This transition not only benefits local economies and sustainable agriculture but also provides a stable supply chain for manufacturers working on plant‑based alternatives. In addition, Australia's image as a high‑quality agricultural exporter presents opportunities for plant‑based products to access Asia, the Middle East, and beyond—with an ever‑increasing international demand for clean-label and ethically sourced foods. By leveraging trade agreements and established cold-chain supply chains, Australian businesses are able to shift regional plant‑based product from farm gate to world gourmet shelves. This alignment of agricultural diversification, supply security, and export opportunity represents a strategic imperative for growing Australia's plant‑based industry while enhancing the nation's global reputation as the producer of premium, sustainable food innovations.

Challenges of Australia Plant-Based Food Market:

Climate Variability and Agricultural Supply Instabilities

One of the greatest threats facing Australia's plant-based food industry has its roots in the country's extreme climate volatility and intense weather disturbances. Recurrent droughts, variable rainfall patterns, and regular bushfires put pressure on the supply chain for essential plant-based crops like legumes, pulses, native grains, and specialty crops. Most of these materials are grown in important agricultural areas such as New South Wales' Riverina, Victoria's Mallee, or Western Australia's Wheatbelt, areas that are also suffering from heat stress and water shortages. This vulnerable climatic context can result in variable yields, lower crop quality, and increased costs of production, ultimately making it more difficult for plant‑based producers to find certain, high-quality raw materials. For new producers or small-scale operations, these environmental stresses can undermine their capacity to scale when there is existing consumer demand. Additionally, after disasters such as extended droughts or fire damage, infrastructure must be rebuilt, and agricultural land resilience must be re-established, which are more complicated undertakings in areas historically concentrated on traditional agriculture, as opposed to diversified plant‑based-focused systems.

Perceptions and Cultural Food Norms

In Australia, very strong food traditions and cultural practices pose significant challenges in marketing plant‑based foods to larger groups. Many Australians have a deep identification with meat-based meals, built around beef, lamb, and seafood staples that are integral to national and rural identities, especially among farming communities or outback parts of Queensland and Western Australia. These cultural connections and daily routines make it difficult for plant-based alternatives to gain a foothold in households where meat is perceived as key both for daily nutrition and social gatherings such as backyard barbecues or community celebrations. There is typically the feeling that plant-based foods are less rich in flavor or satisfying than conventional animal foods, particularly when presented without culinary context. For manufacturers, the challenge of changing such attitudes involves investment in carefully developed flavor profiles, cooking displays, and country-specific promotion, which are initiatives that take time, imagination, and capital. In the absence of consistent exposure and localized narratives that place plant‑based alternatives as just as rich, warming, and compatible with Australian food culture, adoption could continue to be restricted to niche markets.

Regulatory Clarity and Market Differentiation

A less evident but still real challenge facing Australia's plant-based foods industry is one of regulatory uncertainty and upcoming controversy around product names and claims. Producers have to figure out changing rules about how to label plant-based food products, whether something can be labeled "sausage," "cheese," or "milk" when made from plant ingredients. This uncertainty presents risk for companies, particularly those dealing in product-specific items such as those suited to local taste in regions like Tasmania or coastal New South Wales, where branding within regions depends greatly on simple messaging. Without harmonized standards or label clarity, plant‑based manufacturers could experience resistance from regulatory bodies or disorientation among consumers, who might find name inconsistencies as misleading. Meanwhile, this regulatory churn can slow innovation and hold back investment, whereby firms might not bring new products to market if the rules might change again, especially in discerning markets such as Victoria's hospitality industry or environmentally focused retailers throughout Melbourne. In addition, distinguishing between one plant-based food and another, particularly in the face of increased competition, hinges on clear labeling, traceability of ingredients, and authentic claims to origin or ethical sourcing, all of which require strong internal systems and sometimes encounter uneven regulatory enforcement. Such nuance can be real roadblocks to securing consumer trust and building momentum in a rapidly growing but still developing environment.

Australia Plant-Based Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, source, and distribution channel.

Type Insights:

- Dairy Alternatives

- Meat Alternatives

- Egg Substitutes and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy alternatives, meat alternatives, egg substitutes and condiments, and others.

Source Insights:

- Soy

- Almond

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes soy, almond, wheat, and others.

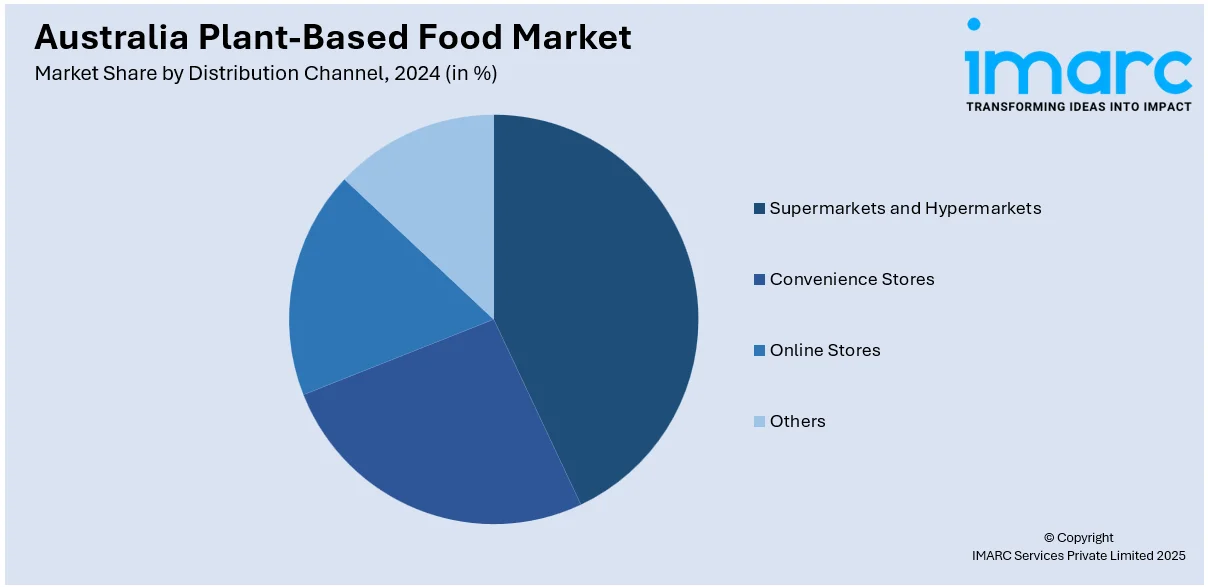

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. this includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plant-Based Food Market News:

- In November 2024, Harvest B opened Australia's first plant-based meat ingredient production plant in Penrith, NSW, delivering locally made protein substitutes to feed food producers clean-label, shelf-stable products to advance domestic manufacturing and help lessen reliance on imported plant-based proteins.

- In September 2024, Australian brand vEEF launched a carbon-neutral plant-based meat range, such as beef mince and a range of sausages, now stocked at Woolworths. Equally priced with animal meat, the range has less plastic packaging and aims to meet increasing demand for sustainable, affordable, and healthy food choices among Australian homes.

Australia Plant-Based Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Alternatives, Meat Alternatives, Egg Substitutes and Condiments, Others |

| Sources Covered | Soy, Almond, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plant-based food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plant-based food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plant-based food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia plant-based food market was valued at USD 330.4 Million in 2024.

The Australia plant-based food market is projected to exhibit a CAGR of 11.50% during 2025-2033.

The Australia plant-based food market is expected to reach a value of USD 981.3 Million by 2033.

Growing demand for clean-label products, greater usage of indigenous ingredients like macadamia and wattle seed, and the growth of plant-based dairy and meat substitutes are some of the major trends of the Australia plant-based food sector. Major supermarkets now offer dedicated plant-based sections, while restaurants and cafés innovate menus to cater to health-conscious and flexitarian consumers, further increasing market share.

The growing consumer consciousness of sustainability, ethical eating, and health is driving the plant-based food business in Australia. Retail expansion and influencer advocacy further normalize plant-based choices, supporting mainstream adoption across diverse Australian regions and demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)