Australia Plant Based Protein Market Size, Share, Trends and Forecast by Source, Type, Nature, Application, and Region, 2025-2033

Australia Plant Based Protein Market Size and Share:

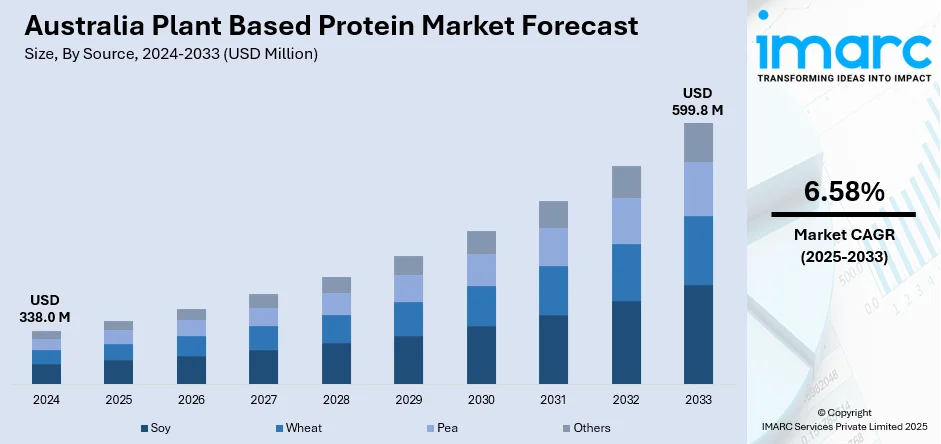

The Australia plant based protein market size reached USD 338.0 Million in 2024. Looking forward, the market is projected to reach USD 599.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.58% during 2025-2033. The market is fueled by the growing health awareness among consumers. Environmental issues, including the need to lower carbon footprints and save water resources, are also encouraging consumers to shift toward plant-based protein sources. The presence of a large range of plant protein sources, and increase in vegan, vegetarian, and flexitarian lifestyles are further increasing the Australia plant based protein market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 338.0 Million |

| Market Forecast in 2033 | USD 599.8 Million |

| Market Growth Rate 2025-2033 | 6.58% |

Key Trends of Australia Plant Based Protein Market:

Innovation and Product Diversification

The plant-based protein industry in Australia is embracing innovation by diversifying product lines to satisfy a huge range of consumers. Brands are launching different sources of plant protein, such as pea, rice, soy, and oats, and attempting to create products that resemble in taste and texture conventional animal-based proteins. Such diversification allows consumers to choose from several other alternatives that meet their chosen dietary standards and considerations. Moreover, hybrid developments involving plant proteins and conventional meats are also growing due to the rise of flexitarians who intend to prohibit their own consumption of meat yet do not want to compromise on taste. BY raising the profile of plant protein, these innovations are also aiding in the acceptance of plant protein by different demography groups.

To get more information on this market, Request Sample

Retail Expansion and Accessibility

The availability of plant-based protein products in Australia is increasing, with major retailers committing greater shelf space to these products. According to the IMARC Group, the Australia plant-based food market size reached USD 330.4 Million in 2024, and is further expected to reach USD 981.3 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. Supermarkets and grocery stores are growing their plant-based categories, making it simpler for customers to locate and buy plant-based protein products. Apart from this, retail expansion comes with rising availability of plant-based options in foodservice venues such as restaurants, cafes and fast-food chains which are incorporating more plant-based menu items to accommodate changing consumer preferences. The expanding visibility of plant-based proteins across both retail and foodservice channels is also driving adoption of plant-based diets by a wider population and influencing the Australia plant based protein market growth.

Sustainability and Ethical Considerations

Sustainability and ethics are major forces behind the Australian plant-based protein market. Consumers today are cognizant of the environmental consequences of animal agriculture, such as greenhouse gas emissions, land use, and water use. Therefore, there is a shift toward the consumption of plant-based diets as a way to minimize ecological footprints. In addition, issues regarding animal well-being and the need to promote cruelty-free food production are shaping buying habits. As a response, businesses are focusing on the sustainable sourcing and ethical manufacturing of their plant-based protein products, positioning their offerings in accordance with the values of environmentally and socially responsible consumers.

Growth Drivers of Australia Plant Based Protein Market:

Rising Health and Wellness Awareness

The increasing focus on health and wellness among Australian consumers is significantly driving Australia plant based protein market demand. There is a growing interest in diets that are high in protein while low in saturated fats and cholesterol which corresponds with the health benefits of plant-based protein. This trend is further supported by the need to combat lifestyle-related illnesses such as obesity, diabetes, and heart disease. Additionally, consumers are attracted to plant-based options due to their high fiber content, essential amino acids, and potential for weight management. As awareness about the health risks associated with excessive animal protein intake grows the transition to plant-based diets is becoming more mainstream thereby enhancing market growth across retail, foodservice, and packaged product sectors.

Increasing Vegan and Flexitarian Population

Australia has experienced a consistent increase in both the vegan and flexitarian populations which substantially boosts the consumption of plant-based protein. The vegan movement has shifted from a niche market to a broader appeal with many consumers choosing a fully plant-based diet for health, ethical, or environmental reasons. Meanwhile, flexitarianism where individuals cut back on but do not entirely remove animal products has gained popularity expanding the potential consumer base for plant-based protein products. This change is driven by heightened public discussions on climate change, animal rights, and sustainable living. As awareness continues to grow food manufacturers and restaurants are increasing their plant-based offerings adapting to changing dietary preferences and diversifying their product lines to cater to both dedicated vegans and health-minded flexitarians.

Technological Advancements in Processing

According to Australia plant based protein market analysis, advancements in processing technology are crucial for enhancing the taste, texture, and nutritional value of plant-based protein products. Innovative extraction methods allow for greater protein yields from sources like peas, soy, chickpeas, and hemp while reducing unwanted flavors. New formulation techniques are also improving the functionality of plant proteins making them applicable for a broader range of uses from meat substitutes to sports nutrition and baked goods. Moreover, developments in preservation technology are extending shelf life without compromising quality. These advancements increase consumer acceptance and enable manufacturers to produce competitive high-quality plant-based products ultimately fostering market growth and brand differentiation.

Opportunities of Australia Plant Based Protein Market:

Sports Nutrition Segment Growth

The sports nutrition segment offers a considerable growth opportunity for the Australia plant-based protein market, as athletes and fitness enthusiasts increasingly turn to plant-based supplements for muscle recovery, endurance, and overall performance. Products like plant-based protein powders, bars, and beverages are gaining popularity due to their superior digestibility, allergen-free properties, and lower ecological impact compared to animal-based alternatives. This trend is driven by growing awareness about the advantages of pea, soy, and hemp protein, which provide essential amino acids without the cholesterol found in animal sources. Endorsements from fitness influencers and sports professionals promoting plant-based diets are also speeding up acceptance. With the rising demand for functional, performance-oriented nutrition, manufacturers have the chance to create specialized formulations aimed at athletic needs, widening their consumer base in the active lifestyle market.

Rising Export Potential

The rising demand for plant-based protein in the Asia-Pacific region presents a considerable export opportunity for Australian producers. Nations like China, Japan, and Singapore are experiencing substantial growth in plant-based consumption, fueled by increased health consciousness, urbanization, and a shift in dietary habits. Australia is well-regarded for its high-quality, clean, and sustainably sourced agricultural products, making it a reliable supplier in these markets. By utilizing its advanced food technology and rigorous quality standards, Australia can meet the needs of premium segments looking for safe and nutritious plant-based protein options. By enhancing export-focused production, establishing strategic trade partnerships, and customizing products to suit regional preferences, Australian producers can reinforce their presence and take advantage of the rising demand for sustainable protein alternatives in the area.

Collaboration with Food Technology Startups

Collaborative efforts between established food companies and innovative food technology startups present a strong opportunity to elevate the Australia plant-based protein market. Startups often introduce advanced processing techniques, unique protein sources, and inventive product ideas, while established companies offer scaling capabilities, market access, and distribution networks. These partnerships can hasten the development of plant-based products that closely mimic the taste, texture, and appearance of animal-derived proteins. Joint ventures also facilitate quicker commercialization of research-driven innovations, from fermentation-based proteins to hybrid plant-cell-based blends. This combined approach accelerates time-to-market and also enhances brand differentiation in a competitive landscape. By harnessing shared expertise, companies can meet evolving consumer demands while positioning Australia as a frontrunner in plant-based protein innovation.

Challenges of Australia Plant Based Protein Market:

High Production Costs

High production expenses continue to be a considerable challenge for the Australia plant-based protein market, arising from sophisticated extraction technologies, specialized processing machinery, and the procurement of premium raw materials. Many plant protein sources, such as pea and hemp, require expensive processing to achieve the desired flavor, texture, and nutritional profiles. Moreover, small-scale domestic production and reliance on imports for specific ingredients can escalate overall costs. These financial burdens often lead to higher retail prices, which may limit accessibility for budget-conscious consumers. To tackle this issue, manufacturers must investigate cost-effective production methods, invest in the local cultivation of protein-rich crops, and capitalize on economies of scale. Effectively lowering costs while maintaining product quality will be essential for broader market penetration and competitive pricing.

Taste and Texture Limitations

Taste and texture represent significant barriers to the widespread acceptance of plant-based protein products in Australia. While innovations have enhanced sensory attributes, some consumers still perceive plant-based alternatives as less appealing compared to traditional animal proteins. Factors such as beany or earthy flavors and a less “meat-like” mouthfeel can deter repeated purchases. Achieving desirable texture and flavor profiles necessitates advanced formulation techniques, blending various plant proteins, and using natural flavor enhancers. Ongoing investment in research and development, along with feedback-driven product adjustments, can help close this sensory gap. By focusing on taste and texture enhancements, manufacturers can attract first-time buyers and foster brand loyalty among consumers seeking satisfying, high-quality plant-based protein products.

Competition from Traditional Protein Sources

The Australia plant-based protein market contends with strong competition from well-established animal protein sectors, including meat, dairy, and seafood, which enjoy significant consumer loyalty, established supply chains, and cultural importance. These traditional protein sources are often regarded as more affordable and readily accessible, creating challenges for the plant-based market. Moreover, aggressive marketing by conventional protein producers can overshadow plant-based alternatives. To compete effectively, plant-based brands must focus on clear value propositions, such as sustainability, health benefits, and innovation. Strategic marketing, competitive pricing, and expanding into mainstream retail and foodservice channels will be crucial in positioning plant-based proteins as viable, appealing alternatives to traditional sources.

Australia Plant Based Protein Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, nature, and application.

Source Insights:

- Soy

- Wheat

- Pea

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes soy, wheat, pea, and others.

Type Insights:

- Concentrates

- Isolates

- Textured

The report has provided a detailed breakup and analysis of the market based on the type. This includes concentrates, isolates, and textured.

Nature Insights:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the market based on the nature. This includes conventional and organic.

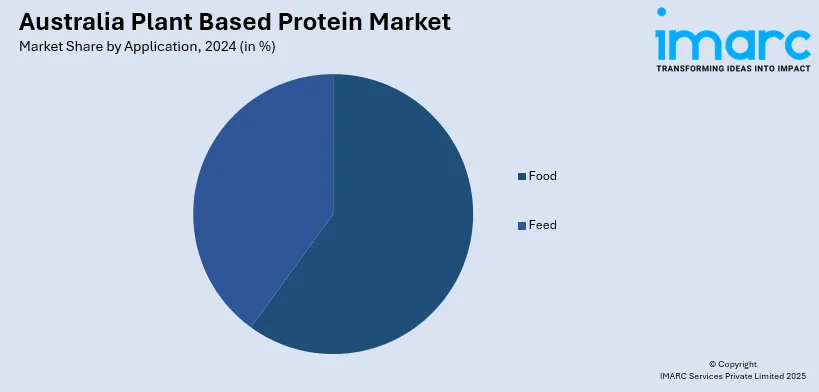

Application Insights:

- Food

- Meat Alternatives

- Dairy Alternatives

- Bakery Products

- Performance Nutrition

- Convenience Foods

- Others

- Feed

The report has provided a detailed breakup and analysis of the market based on the application. This includes food (meat alternatives, dairy alternatives, bakery alternatives, performance nutrition, convenience foods, others) and feed.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plant Based Protein Market News:

- In March 2025, My Co, the investment arm of the Paule Family Office concentrating on FABtech (Food, Agri & Bio) start-ups, purchased plant-based protein production firm, Australian Plant Proteins (APP). APP was the initial company in Australia to create and market a plant protein isolate powder. It leads in cutting-edge plant-based protein innovations and is crucial in establishing Australia’s status – and reputation – internationally in this expanding sector.

Australia Plant Based Protein Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Soy, Wheat, Pea, Others |

| Types Covered | Concentrates, Isolates, Textured |

| Natures Covered | Conventional, Organic |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plant based protein market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plant based protein market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plant based protein industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plant based protein market in Australia was valued at USD 338.0 Million in 2024.

The Australia plant based protein market is projected to exhibit a compound annual growth rate (CAGR) of 6.58% during 2025-2033.

The Australia plant based protein market is expected to reach a value of USD 599.8 Million by 2033.

The Australia plant-based protein market is witnessing trends such as product innovation with improved taste and texture, growing adoption in sports nutrition, expansion of vegan and flexitarian lifestyles. Increased retail and foodservice availability, and rising demand for clean-label, fortified, and sustainably produced protein products are further contribute to market growth.

Market growth is driven by increasing health and wellness awareness, environmental sustainability concerns, technological advancements in processing, and growing demand for allergen-free protein alternatives. Expanding retail presence, supportive government initiatives, and the sports nutrition sector’s interest in plant-based protein further accelerate market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)