Australia Plasterboard Market Size, Share, Trends and Forecast by Form, Type, End-Use Sector, and Region, 2026-2034

Australia Plasterboard Market Overview:

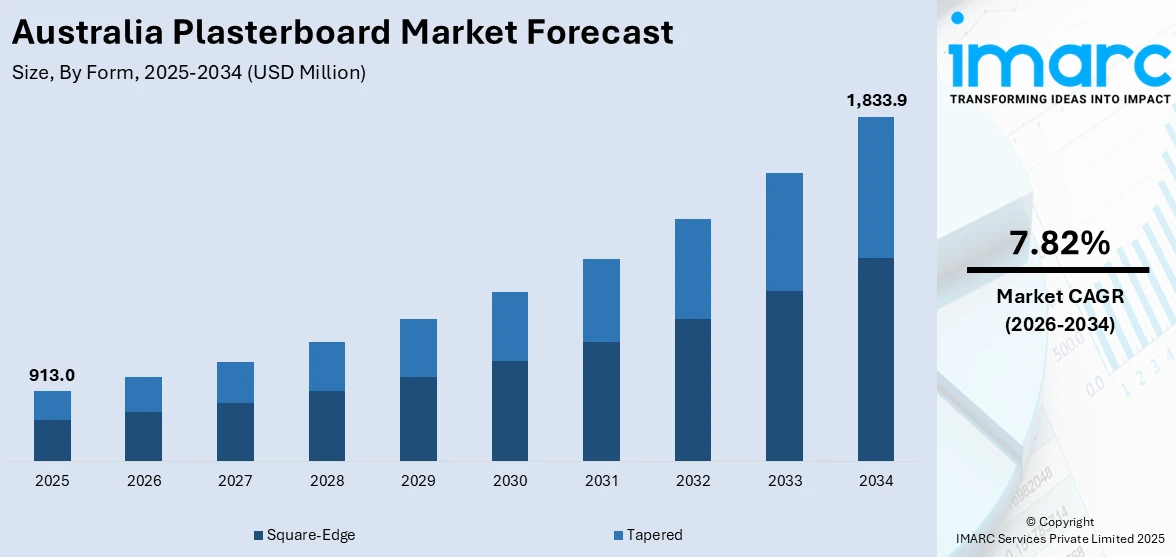

The Australia plasterboard market size reached USD 913.0 Million in 2025. Looking forward, the market is expected to reach USD 1,833.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.82% during 2026-2034. The market is driven by strong building activity, and increased focus on sustainability. Innovations in technology have also created superior plasterboard products with increased fire resistance, sound insulation, and thermal insulation capabilities. Growing concern for sustainable construction has created an increased demand for environment-friendly plasterboard products, including recycled material ones or ones that help enhance indoor air quality, which further contribute to the development and competitiveness of the Australia plasterboard market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 913.0 Million |

| Market Forecast in 2034 | USD 1,833.9 Million |

| Market Growth Rate 2026-2034 | 7.82% |

Key Trends of Australia Plasterboard Market:

Focus on Green Building Materials

More attention is being paid to eco-friendly building materials in Australia, of which plasterboard products are part. The companies are producing more plasterboards made with recycled contents and low embodied carbon to respond to the need for climate-friendly construction materials. This is in line with the overall drive toward green building techniques and applying green construction materials in line with the attempts to reduce greenhouse emissions and save resources. The use of such eco-friendly plasterboard products is set to continue as environmental consciousness grows among consumers and industry players, which further contributes to the Australia plasterboard market growth.

To get more information on this market Request Sample

Technological Developments in Plasterboard Products

Technological developments are contributing much to the development of the Australian plasterboard industry. Companies are producing plasterboard products with improved qualities, including better fire protection, soundproofing, and moisture regulation. These developments meet the growing need for construction materials that promote efficient and healthy living and working conditions. Furthermore, the incorporation of intelligent technologies within plasterboard products, including sensors to measure temperature and humidity, is becoming a trend that increases the functionality and performance of building products, further contributing to the growing Australia plasterboard market demand.

Impact of Regulatory Standards on Plasterboard Market

Regulatory requirements are having a huge impact on the market for plasterboard in Australia. Safety standards and building codes, especially fire-resistance and energy-efficiency standards, are powering demand for high-tech plasterboards. Manufacturers are reacting by creating plasterboards that either match or better these high standards, thus meeting requirements and improving building safety and performance. These regulatory standards are dictating product development along with market dynamics, as firms that comply with these standards are in a better position to thrive in the competitive Australian building industry.

Growth Drivers of Australia Plasterboard Market:

Residential Housing Sector Expansion

Australia's residential housing market is performing robustly, and demand for building materials like gypsum boards is increasing. Government stimulation in the form of the HomeBuilder program has stimulated residential building, leading to higher consumption of gypsum boards in interior use. As of September 2024, dwelling commencements increased by 4.6% to 43,247, seasonally adjusted. The Australian Bureau of Statistics also recorded a rise in private sector house building approvals, which indicates a strong pipeline of residential projects where the use of gypsum boards as a fundamental wall and ceiling material is critical. Urbanization processes and urban population increase in cities such as Melbourne and Sydney are further driving housing needs, with developers seeking affordable and efficient construction techniques. Gypsum boards are especially popular due to simplicity of installation and flexibility. The remodeling market is also expanding, as homeowners employ gypsum boards to improve interior design and functionality, further entrenching their position within the Australian building sector.

Growing Commercial Infrastructure Development

According to the Australia plasterboard market analysis, the booming commercial construction industry in the region is a major growth driver for the plasterboard industry. Growth in office buildings, retail, healthcare facilities, and schools demands products that provide flexibility, toughness, and adherence to strict building codes. Major Australian cities like Brisbane, Perth, and Melbourne are experiencing rising investment in commercial property driven by growth in economies and urban renewal activities. These advancements require plasterboard products with improved fire rating and acoustic performance to satisfy both occupant comfort and safety requirements. Apart from this, the focus on sustainable and green buildings has promoted environmentally responsible plasterboard solutions. The commercial market's focus on streamlined construction schedules also benefits from plasterboard utilization because of its fast installation feature, which assists projects in staying within schedule and budget.

Impact of Natural Disasters on Building Codes and Material Demand

The vulnerability of Australia to natural disasters like bushfires, cyclones, and floods has resulted in stricter building codes and increased demand for fire-resistant and moisture-resistant construction materials such as plasterboard. The disasters have made builders and homeowners become more conscious of the need for fire-resistant and moisture-resistant materials to improve building safety and durability. In areas where these types of natural hazards are more likely to occur, plasterboard products with specialized characteristics, such as fire retardant and water-resistant attributes, are being specified in greater numbers to meet emerging codes and insurance standards. Moreover, rebuilding following disaster activity generates stable demand growth. This emphasis on resiliency and durability in building materials is part of a larger trend in the Australian building industry, where safety and longevity are also considered in tandem with aesthetic and functional concerns.

Opportunities of Australia Plasterboard Market:

Demand for Lightweight and Moisture-Resistant Plasterboards

Australia's varied climate, from humid coastal areas to dry inland regions, poses special challenges for building materials. In the coastal cities of Brisbane and Sydney, high humidity can cause moisture-related problems for buildings. This has driven demand for moisture-resistant plasterboards that are capable of such conditions. Manufacturers are meeting the challenge by creating specialized plasterboards that can resist moisture absorption and increase the longevity and durability of structures in these conditions. There is also a growing demand for lightweight plasterboards throughout Australia. These products decrease the overall weight of buildings, making them ideal for specific structural conditions in certain areas, while also making handling and installation simpler. With the construction sector remaining committed to efficiency and sustainability, development and take-up of lightweight, moisture-resistant plasterboards hold great opportunities for expansion in the Australian market.

Growth in Retrofit and Renovation Projects

The Australian housing sector is undergoing change toward retrofit and renovation projects, prompted by aspects like housing affordability as well as the need to upgrade existing buildings. This pattern is especially observed in established cities where the expense of new building is great. Homeowners and developers alike are now finding it more convenient to refurbish old structures to conform to modern criteria of comfort, energy efficiency, and beauty. Plasterboard products feature prominently in such endeavors with flexible solutions for wall and ceiling linings, insulation, and fire resistance. The need for specialized plasterboard products that address the requirements of renovation works, including acoustic performance and thermal insulation, is increasing. This movement toward renovation and retrofit works offers a huge opportunity for plasterboard manufacturers to innovate and deliver customized solutions that address the changing needs of the Australian construction industry.

Growing Demand from the Hospitality and Tourism Industry

Australia's growing hospitality and tourism sectors offer a new market opportunity for plasterboard. Tourist hotspots like the Gold Coast, Sydney, and Western Australia are experiencing high levels of investment in resorts, hotels, and recreational facilities. These projects demand interior building products that achieve durability, fire resistance, and appearance. Plasterboard's adaptability has made it a popular option for designing comfortable, safe, and fashionable interiors that live up to the hospitality industry's high expectations. Further, the pandemic recovery has fueled renovations and new constructions in this industry, which has added to the demand. This expansion prompts manufacturers to design plasterboard products exclusively for hospitality use, targeting soundproofing, resistance to moisture, and decoration. With Australia remaining a favorite among tourists, the market for plasterboard can leverage consistent infrastructure development and additions fueled by tourism and hospitality sectors.

Challenges of Australia Plasterboard Market:

Volatility of Raw Material Supply and Prices

The Australian market for plasterboard is hugely confronted with threats from volatility in supply and prices of major raw materials such as gypsum and paper. Australia depends partially on imports for gypsum, and chaos in international supply chains, fueled by recent geopolitical tensions and shipping delays, has added uncertainty in material supply. Moreover, instability in the raw material price affects production expenses directly, which can put pressure on manufacturers and influence pricing strategies. The use of imported material also subjects the market to currency fluctuations, adding to cost management complexity. Australian producers are required to maintain competitive pricing while ensuring consistent quality and supply, which can be a constraint on their operational flexibility. Such raw material constraints can delay production schedules, delay project schedules, and raise overall costs, which represents a significant obstacle in a highly competitive construction materials industry.

Stringent Building Codes and Compliance Requirements

Australia has strict building codes and safety standards, such as fire resistance, acoustic performance, and energy efficiency rating, which plasterboard products have to meet. While these standards guarantee quality construction and safety for occupants, they also raise product development complexity and cost for manufacturers. Complying with them demands ongoing innovation, rigorous testing, and certification, which is costly. Various states and territories have other localized requirements, producing a fragmented regulatory landscape. Operating in this environment requires specialized knowledge and can detract from time-to-market for new plasterboard products. Small producers are especially likely to struggle to fulfill these changing regulations at significant cost. As such, compliance pressures can restrain market entry, lower product choice, and increase prices for builders and end-users, ultimately impacting the growth path of the Australian plasterboard market.

Competition from Alternative Building Materials

The Australian market for plasterboard is increasingly competing with alternative building materials like fiber cement boards, timber panels, and green composites. These alternatives tend to be preferred for their improved durability, water resistance, or green credentials. Where the environmental conditions are extreme, such as coastal or flood-risk areas, the use of materials resistant to dampness, salt, or termite attack than standard plasterboard might be preferred. Furthermore, technology progress has brought with it modular and prefabricated options that occasionally obviate the need for plasterboard in finishes. Demand from consumers for environmentally friendly building products also pushes the adoption of new materials that can have reduced environmental profiles or better energy efficiency. Consequently, plasterboard producers need to innovate and update their products regularly in order to maintain market share, involving high expenditure on research and development. The existence of such alternatives is a continuous threat to plasterboard's preeminence in Australian building.

Australia Plasterboard Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on form, type, and end-use sector.

Form Insights:

- Square-Edge

- Tapered

The report has provided a detailed breakup and analysis of the market based on the form. This includes square-edge and tapered.

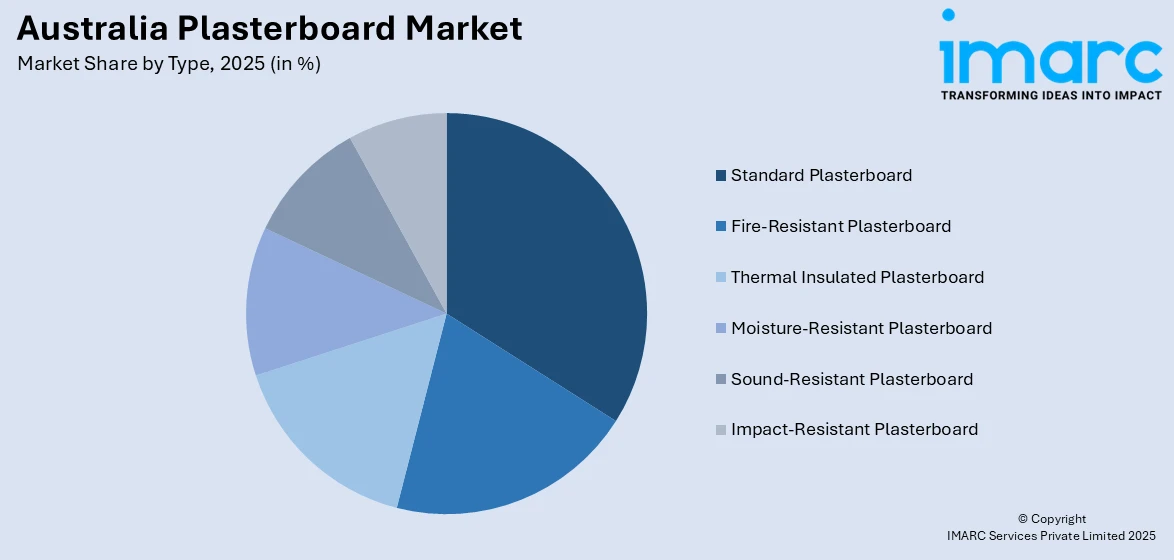

Type Insights:

Access the comprehensive market breakdown Request Sample

- Standard Plasterboard

- Fire-Resistant Plasterboard

- Thermal Insulated Plasterboard

- Moisture-Resistant Plasterboard

- Sound-Resistant Plasterboard

- Impact-Resistant Plasterboard

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes standard plasterboard, fire-resistant plasterboard, thermal insulated plasterboard, moisture resistant plasterboard, sound-resistant plasterboard, and impact resistant plasterboard.

End-Use Sector Insights:

- Residential

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes residential and non-residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plasterboard Market News:

- In March 2024, Etex finalized the purchase of BGC’s plasterboard and fiber cement divisions to enhance its sustainable portfolio in Australia and New Zealand.

- In October 2023, Etex, based in Belgium, signed a deal with BGC to purchase the gypsum and fibre cement divisions of the building materials firm. The gypsum industry comprises manufacturing units for wallboard, plasters, compounds, and cornices, including the gypsum wallboard facility located in Perth, Western Australia. BGC runs nine warehouses throughout Australia and New Zealand.

Australia Plasterboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Square-Edge, Tapered |

| Types Covered | Standard Plasterboard, Fire-Resistant Plasterboard, Thermal Insulated Plasterboard, Moisture-Resistant Plasterboard, Sound-Resistant Plasterboard, Impact-Resistant Plasterboard |

| End-Use Sectors Covered | Residential, Non-Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plasterboard market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plasterboard market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plasterboard industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia plasterboard market was valued at USD 913.0 Million in 2025.

The Australia plasterboard market is projected to exhibit a CAGR of 7.82% during 2026-2034.

The Australia plasterboard market is expected to reach a value of USD 1,833.9 Million by 2034.

The major trends of the Australia plasterboard market include eco-friendly, lightweight, and moisture-resistant products to meet sustainability goals and diverse climate challenges. There is also growing adoption of fire-resistant and soundproofing plasterboards, alongside innovations supporting smart building technologies. Renovation projects and demand for quick, efficient installations are also shaping market dynamics.

The Australia plasterboard market is driven by a booming residential housing sector, increased commercial infrastructure development, and the need for resilient building materials due to natural disasters. Urbanization, government housing programs, and stricter building regulations further escalate demand for versatile, fire-resistant, and moisture-resistant plasterboard products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)