Australia Plastic Packaging Market Size, Share, Trends and Forecast by Material, Product, End Use Industry, and Region, 2025-2033

Australia Plastic Packaging Market Size and Share:

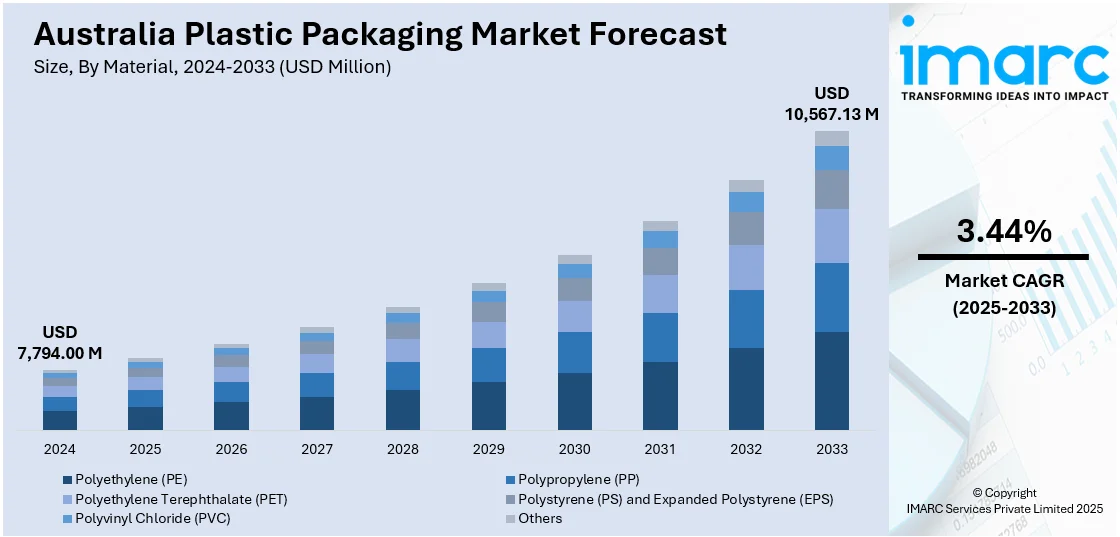

The Australia plastic packaging market size reached USD 7,794.00 Million in 2024. Looking forward, the market is projected to reach USD 10,567.13 Million by 2033, exhibiting a growth rate (CAGR) of 3.44% during 2025-2033. The market is driven by strong demand from sectors like food and beverage, healthcare, and personal care, and innovations in lightweight, durable, and sustainable plastic materials. Government efforts to reduce plastic waste by implementing strict policies are also influencing packaging choices, thus shaping the Australia plastic packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,794.00 Million |

| Market Forecast in 2033 | USD 10,567.13 Million |

| Market Growth Rate 2025-2033 | 3.44% |

Key Trends of Australia Plastic Packaging Market:

Innovation in Bioplastics and Sustainable Packaging Solutions

Growing environmental concerns and consumer preferences are pushing innovation in biodegradable, recyclable, and reusable plastic packaging materials. Australian manufacturers are investing in R&D to develop advanced solutions like compostable films, plant-based plastics, and circular packaging systems. The aim is to reduce environmental impact without compromising the functionality, safety, and visual appeal of packaging. These sustainable innovations are increasingly being adopted by businesses looking to align with environmental, social, and governance (ESG) goals and maintain compliance with tightening government regulations. As a result, sustainability-driven innovations are not only reshaping the packaging supply chain but also opening new market opportunities and fostering consumer trust in brands. For instance, in February 2025, Amcor and Tip Top Bakeries, an Australian bread company, partnered to introduce bread bags that use a verified mass balance method and contain 30% recycled plastic. Several popular items, such as Tip Top The One Gluten Free, Tip Top The One, and Tip Top 9 Grain, use the redesigned packaging, which began to show up in stores in September 2024. These revised bags are available to consumers in Australia's largest supermarkets.

To get more information of this market, Request Sample

Stringent Government Regulations and Waste Reduction Targets

The Australia plastic packaging market growth is also driven by the Australian federal and state governments implementing strict policies to reduce plastic waste and encourage recycling. Initiatives like the 2025 National Packaging Targets intends to ensure that all packaging is reusable, recyclable, or compostable. Extended producer responsibility schemes are also being enforced, requiring companies to manage the environmental impact of their packaging materials. These regulations are pressuring businesses to invest in sustainable alternatives and improve packaging recyclability. As companies adapt to avoid penalties and maintain compliance, demand is rising for innovative, regulation-compliant plastic packaging solutions. Thus, legislative pressure is not only driving the transformation of packaging practices but also fueling market growth through innovation. For instance, in September 2024, Detpak, a packaging solutions firm located in South Australia, introduced the widest selection of more than 20 commercially biodegradable and recyclable PBS-lined cartons, trays, and lunchboxes in Australia. This falls in line with new laws that will reduce the use of single-use plastics. Polybutylene succinate, or PBS, is a polymer that is derived from both fossil fuels and renewable plant sources.

Shift Toward Sustainable Packaging

The transition to sustainable packaging is becoming a significant factor affecting Australia plastic packaging market demand. As environmental issues increase and regulations on waste management become stricter, producers are resorting to using recyclable, reusable, and biodegradable plastics in order to decrease their environmental footprint. Consumers are becoming more conscious of what they buy, favoring products with green packaging. This is creating innovation in the field of developing materials such as bio-based plastics and compostable films, which provide strength without harming the environment. Retailers and brands are adopting sustainability programs by incorporating greener packaging options to meet corporate social responsibility goals. With the growing demand for sustainable options, firms that invest in environmentally friendly packaging are gaining a competitive advantage and improving their brand reputation in the marketplace.

Growth Drivers of Australia Plastic Packaging Market:

Expanding Food and Beverage Industry

The expansion of the food and beverage sector is a primary catalyst for the Australia plastic packaging market, as manufacturers seek solutions that provide convenience, safety, and longer shelf life. Plastic packaging boasts remarkable barrier properties that safeguard products from contamination, moisture, and spoilage while preserving freshness. With growing consumer interest in ready-to-eat meals, packaged snacks, and beverages, the industry is increasingly dependent on innovative plastic formats such as bottles, pouches, trays, and films. Furthermore, lightweight and economical plastic materials enable manufacturers to enhance logistics and cut transportation costs. The sector’s emphasis on branding and product differentiation also drives the adoption of visually appealing and functional plastic packaging designs, thereby enhancing its utilization throughout the food and beverage supply chain.

Growth in E-Commerce

According to Australia plastic packaging market analysis, the swift growth of e-commerce is significantly boosting the need for durable, lightweight, and protective packaging solutions. Online shopping requires packaging that will withstand handling, shipping, and numerous storage environments without compromising product safety and appearance. Given their strength, flexibility, and economical cost, plastic materials are best equipped to meet these demands. Retailers and carriers are using high-performance plastics to protect products from electronics to cosmetics to foods. Moreover, growth in subscription boxes and direct-to-consumer businesses is fueling demand for creative, branded plastic packaging that improves the consumer experience. With continued growth in online buying, the demand for dependable, sustainable, and secure plastic packaging will continue as a key driver of the market.

Versatility and Customization Enhancing Market Appeal

The adaptability and customization potential of plastic packaging are significant factors driving its use across various industries in Australia. Plastic can be easily shaped into different forms, sizes, and designs to meet specific product requirements and branding needs. This versatility allows manufacturers to create packaging that boosts shelf appeal, improves functionality, and aligns with consumer preferences. Customization also caters to specialized applications, such as resealable packs, portion-controlled containers, and ergonomic designs that enhance user convenience. Industries ranging from food and beverages to healthcare and personal care reap the advantages of these flexible packaging solutions. The ability to deliver both practical performance and visual appeal positions plastic as a favored option for businesses aiming to stand out in competitive markets.

Opportunities of Australia Plastic Packaging Market:

Smart Packaging Integration Enhancing Consumer Engagement

Smart packaging is emerging as a promising opportunity in the Australia plastic packaging market, offering value beyond product protection. By incorporating features like QR codes, NFC technology, and tracking systems, brands can provide consumers with product information, authenticity verification, and interactive experiences. These technologies also enable real-time supply chain monitoring, improving inventory management and reducing losses. For example, consumers can scan a package to learn about product origins, usage tips, or promotional offers, enhancing brand connection. In sectors such as food, beverages, and pharmaceuticals, smart packaging improves safety, transparency, and compliance. As digital engagement becomes a competitive advantage, integrating intelligent features into plastic packaging is likely to drive market innovation and brand differentiation.

Customization and Branding Potential

Customization in plastic packaging presents a strong opportunity for businesses to stand out in a competitive marketplace. The ability to design packaging in various shapes, colors, and finishes allows brands to align with their identity and target audience preferences. Eye-catching designs, embossing, and high-quality printing enhance shelf appeal, while functional features like resealable closures or ergonomic shapes improve user convenience. For premium products, custom packaging can convey quality and exclusivity, influencing purchasing decisions. In industries such as food, cosmetics, and personal care, visually distinctive packaging helps build brand recognition and loyalty. As competition intensifies, businesses leveraging customization and branding in plastic packaging can strengthen their market presence and create lasting consumer impressions.

Export Opportunities Expanding Market Reach

Export potential offers a valuable growth avenue for the Australia plastic packaging market, particularly in the Asia-Pacific region. Countries with growing consumer markets, such as China, Japan, and Southeast Asian nations, demand high-quality, durable, and innovative packaging solutions. Australia’s strong reputation for quality standards and advanced manufacturing capabilities positions it well to meet these needs. Exporting plastic packaging for food, beverages, pharmaceuticals, and personal care products can open new revenue streams for local producers. Customising designs and materials to meet regional preferences and regulatory requirements further enhances competitiveness. By establishing strategic partnerships and leveraging trade agreements, Australian manufacturers can strengthen their international presence and benefit from rising global demand for premium packaging.

Challenges of Australia Plastic Packaging Market:

Environmental Concerns

Environmental concerns present a significant challenge for the Australia plastic packaging market, as public and regulatory pressure to reduce plastic waste intensifies. Single-use plastics are increasingly criticized for contributing to pollution and landfill buildup, prompting demand for sustainable alternatives. Manufacturers face the challenge of balancing performance, cost, and eco-friendliness while transitioning toward recyclable, biodegradable, or compostable materials. Additionally, growing consumer preference for minimal or zero-waste packaging forces companies to rethink traditional designs and production methods. Failure to address environmental issues can damage brand reputation and result in lost market share. To remain competitive, the industry must invest in green innovation, closed-loop recycling systems, and education initiatives promoting responsible packaging use.

Regulatory Compliance Increasing Operational Pressures

Stricter packaging waste and recycling laws are creating operational challenges for the Australia plastic packaging industry. Government initiatives aimed at reducing single-use plastics, improving recycling rates, and enforcing extended producer responsibility require companies to adapt quickly. Compliance often demands significant investment in research, new materials, and updated production processes, increasing costs. Moreover, navigating varied state-level regulations can complicate supply chain planning and product distribution. Non-compliance risks financial penalties, market restrictions, and reputational harm. While these regulations push the industry toward sustainable practices, they also require businesses to balance innovation with profitability. Companies that proactively align with evolving regulatory frameworks can mitigate risks and position themselves as leaders in responsible packaging.

Competition from Alternative Materials

The growing popularity of alternative materials such as paper, glass, and metal is creating competition for the Australia plastic packaging market. These materials are often perceived as more eco-friendly, appealing to environmentally conscious consumers. Government incentives promoting sustainability and eco-friendly practices further increase competitive pressure on plastic packaging. While plastic remains cost-effective and versatile, alternatives are gaining ground in sectors like food, beverages, and cosmetics, where brand image and sustainability are strong selling points. This trend pressures plastic packaging manufacturers to innovate, incorporating recycled content or developing bio-based plastics to retain market relevance. Failure to address these competitive pressures could lead to reduced market share over time.

Australia Plastic Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, product, and end use industry.

Material Insights:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS) and Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS) and expanded polystyrene (EPS), polyvinyl chloride (PVC), and others.

Product Insights:

- Bottles and Jars

- Trays and Containers

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes bottles and jars, trays and containers, and others.

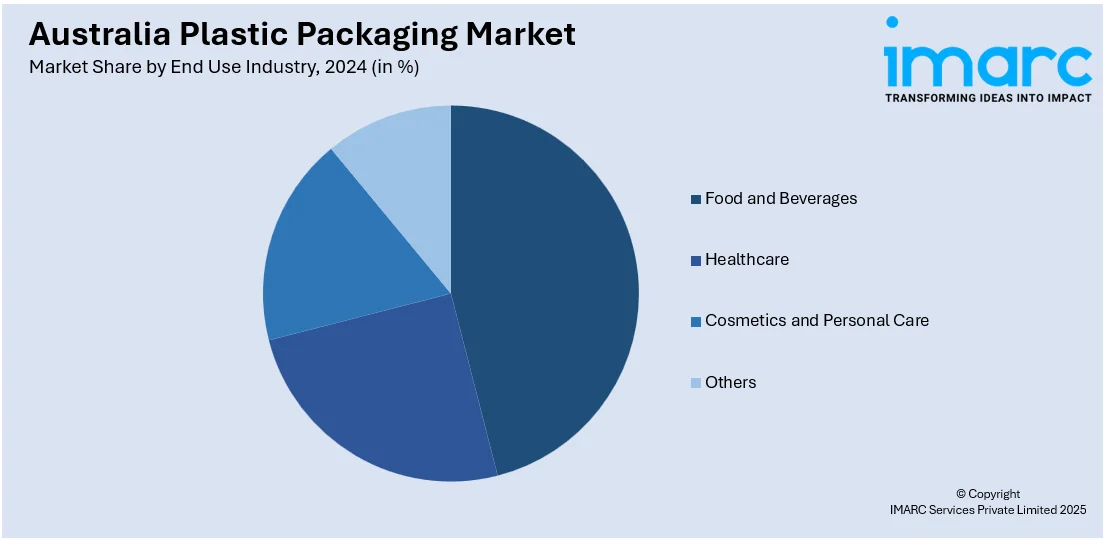

End Use Industry Insights:

- Food and Beverages

- Healthcare

- Cosmetics and Personal Care

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food and beverages, healthcare, cosmetics and personal care, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plastic Packaging Market News:

- In September 2024, the Australian Government initiated a public consultation as it attempts to overhaul plastic packaging restrictions in the country. The consultation opened on September 27, 2024, and stakeholders had until October 28, 2024, to provide input. By requiring a minimum amount of recycled material, the proposed law seeks to lessen the usage of hazardous chemicals in packaging.

- In November 2024, Better Packaging and Australia Post teamed up to launch POLLAST!C satchels, a new range of recycled plastic mailers that can be purchased online and in Post Offices across the country. Through the repurposing of OBP into robust, useful packaging, the partnership seeks to address plastic waste.

Australia Plastic Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS) and Expanded Polystyrene (EPS), Polyvinyl Chloride (PVC), Others |

| Products Covered | Bottles And Jars, Trays and Containers, Others |

| End Use Industries Covered | Food and Beverages, Healthcare, Cosmetics and Personal Care, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plastic packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plastic packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plastic packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic packaging market in Australia was valued at USD 7,794.00 Million in 2024.

The Australia plastic packaging market is projected to exhibit a compound annual growth rate (CAGR) of 3.44% during 2025-2033.

The Australia plastic packaging market is expected to reach a value of USD 10,567.13 Million by 2033.

The Australia plastic packaging market is witnessing trends such as increased adoption of sustainable and recyclable materials, rising demand for flexible and lightweight packaging. Integration of smart packaging technologies, growth in e-commerce-driven packaging needs, and greater focus on customization and branding for enhanced consumer appeal are also contributing to market growth.

Market growth is driven by the expanding food and beverage sector, rapid e-commerce growth, cost-effectiveness and versatility of plastic, and advancements in packaging technology. Rising demand for durable, safe, and long shelf-life solutions, urbanization, changing consumer lifestyles, and increasing need for convenient packaging formats further strengthen market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)