Australia Plastic Recycling Market Size, Share, Trends and Forecast by Type, Source, End User, and Region, 2025-2033

Australia Plastic Recycling Market Overview:

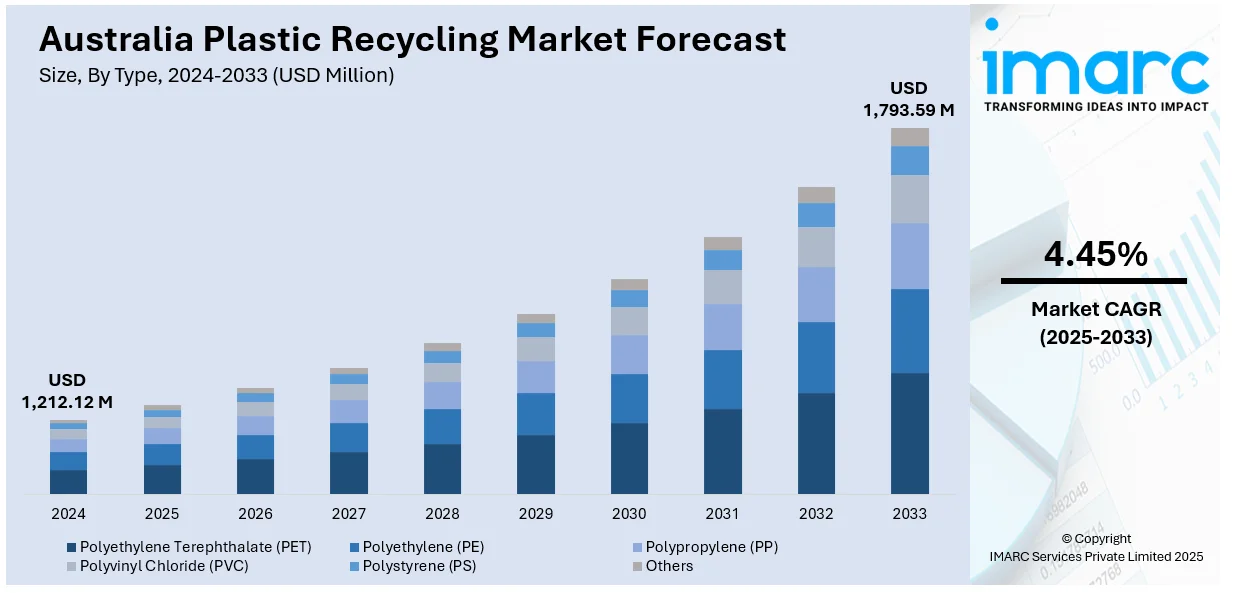

The Australia plastic recycling market size reached USD 1,212.12 Million in 2024. Looking forward, the market is expected to reach USD 1,793.59 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. The market is advancing due to strict government regulations, innovative recycling technologies, and growing environmental awareness. Public and private sector collaboration is enhancing recycling infrastructure. Increasing consumer preference for sustainable products and corporate sustainability goals are further accelerating market growth. These combined drivers significantly influence the dynamics of the Australia plastic recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,212.12 Million |

| Market Forecast in 2033 | USD 1,793.59 Million |

| Market Growth Rate 2025-2033 | 4.45% |

Key Trends of Australia Plastic Recycling Market:

Government Regulations and National Policy Frameworks

Australia's plastic recycling market is significantly influenced by comprehensive government regulations and national policies aimed at promoting sustainable waste management. The National Plastics Plan outlines strategies to increase plastic recycling, reduce unnecessary plastics, and mitigate environmental impacts. The government will prohibit problematic plastics while establishing packaging standards and building recycling equipment. Through the Recycling Modernisation Fund (RMF), the government backs initiatives that enable domestic processing of increased amounts of plastic waste. The prohibition on exporting unsorted mixed plastics forces global businesses to construct domestic recycling systems. These regulatory measures collectively drive the growth and advancement of Australia's plastic recycling industry.

To get more information on this market, Request Sample

Corporate Sustainability Initiatives and Consumer Demand

Corporate sustainability commitments and increasing consumer demand for environmentally friendly products are driving the Australia plastic recycling market growth. Businesses are adopting circular economy principles, integrating recycled materials into their products, and supporting recycling programs. For example, major retailers like Woolworths, Coles, and Aldi have initiated soft plastics recycling programs in response to consumer expectations and environmental concerns. Startups like RecycleSmart offer innovative recycling solutions, catering to environmentally conscious consumers. This synergy between corporate initiatives and consumer behavior fosters a market environment conducive to the growth of plastic recycling in Australia.

Infrastructure Development and Industry Collaboration

The development of recycling infrastructure and collaboration among industry stakeholders are pivotal in advancing the Australia plastic recycling market demand. Government funding through programs like the Recycling Modernization Fund supports the establishment of new recycling facilities and the upgrade of existing ones. Collaborative efforts between government, industry, and communities facilitate the creation of efficient recycling systems. For instance, the Soft Plastics Taskforce, comprising major supermarkets and recycling organizations, works toward implementing nationwide soft plastics recycling solutions. Such infrastructure development and industry collaboration enhance the capacity and effectiveness of plastic recycling operations across the country. For instance, in March 2025, bagMUSTER, Australia's first industry-led collection and recycling program for soft plastic agricultural input bags, was formally introduced in Ballarat. This event marked a major advancement in the country's agricultural sustainability. Key industry leaders, government officials, and members of the media gathered at the event to commemorate the launch of the program and its potential to revolutionize the management of agricultural plastic waste.

Growth Drivers of Australia Plastic Recycling Market:

Shifting Global Trade Policies and Domestic Supply Chain Stress

One of the biggest drivers of growth in Australia's plastic recycling industry is the changing global trade dynamics, especially bans on exports of plastic wastes. Over the past few years, major importers such as China, Malaysia, and Indonesia banned or imposed restrictions on the entry of low-grade plastic waste, leaving Australia to reconsider its waste export strategy. Consequently, pressure to recycle and process plastic locally has grown, prompting investment in local recycling capacity. This has prompted the development of regional recycling centers and incentivized manufacturers to source recycled products at home. Supply chain interruptions during international events have also increased Australian companies' appreciation for the dangers of relying on overseas raw material sources, such as virgin plastics. These outside forces are encouraging industries to move toward closed-loop systems based on locally recycled plastics, ultimately enhancing the domestic market for recycling and aiding long-term sustainability initiatives throughout the supply chain system of Australia.

Industry-Led Innovation and Retail Commitments

Yet another key driver for the growth according to the Australia plastic recycling market analysis is the self-initiating role of industry players, particularly in the packaging, manufacturing, and retail segments. Key Australian supermarket brands, consumer goods businesses, and packaging companies have pledged strongly in public to cut plastic waste and use more recycled content in their products. These are not just token commitments; they are supported by R&D spend, partnerships with recycling technology suppliers, and implementation of eco-design principles in packaging. In addition, several corporations are setting their own sustainability objectives in line with those of the Australian Packaging Covenant Organization, which requires that all packaging either be recyclable, compostable, or reusable. This private sector drive is creating increasing demand for high-quality recycled plastic, which encourages upgrading of sortation and processing technology. The combination of environmental sustainability and brand image is therefore proving to be an efficacious growth driver for the plastic recycling sector in Australia.

Consumer Awareness and Local Community Involvement

Increasing consumer consciousness and high community participation have turned out to be key drivers of the plastic recycling sector in Australia. Plastic pollution, especially its effects on marine life and biodiversity, has raised public alarm in Australia, leading to broad-based behavioral change throughout the nation. Australians are becoming more involved in recycling programs, separating rubbish more conscientiously, and patronizing companies which favor recycled content. Grass-roots movements, school projects, and local council programs have further reinforced recycling culture at the local community level. Notably, Aboriginal communities and country councils have also joined in localized recycling programs, encouraging the use of traditional ecological knowledge and circular material use. These grassroots movements, supported by effective national activism and publicity, are instilling an environmental ethos that is developing a reliable stream of recyclable feedstock. Such local involvement in turn underpins a secure feedstock for the recycling process, reinforcing its economic resilience and future growth prospects.

Opportunities of Australia Plastic Recycling Market:

Domestic Recycling Infrastructure Expansion

Expansion and upgrading domestic recycling infrastructure is perhaps the most promising opportunity in the Australian plastic recycling industry. With the banning of unprocessed plastic waste exports in the country, there is a huge need to process and deal with plastic domestically. This change is paving the way for investment in sophisticated facilities to deal with a wider variety of plastics, including contaminated and multi-layered plastics. There is specific potential within regional and remote locations where there is limited recycling infrastructure but where there are huge amounts of plastic waste produced, particularly from the mining and agricultural sectors. Constructing regional material recovery facilities (MRFs) decentralizes the process and optimizes transport costs and emissions. Furthermore, infrastructure development makes it possible for Australia to harmonize its national goals with those of a circular economy, which means that the recycled plastic can be reused in high-value applications like food-grade packaging, construction products, and automotive parts. This infrastructure drive has long-term commercial sustainability and environmental advantages.

Innovation in Advanced Recycling Technologies

Australia's increasing emphasis on innovation and research provides a further significant opportunity in the plastic recycling industry, particularly in the take-up of new recycling technologies. There are limitations on mechanical recycling, especially in the treatment of low-quality or degraded plastics, but chemical recycling, pyrolysis, and enzymatic disassembly can have a significant impact on rising recovery rates. Australia's universities and private R&D centers are working on a scalable application of these technologies, creating a rich prospect for pilot projects and technology partnerships. Additionally, the distinctive Australian plastic waste mix—high use of ag-plastic and low-density rural waste streams—calls for tailored technological solutions, posing a niche challenge for startups and entrepreneurs. Through investment in these technologies, Australia can minimize landfill waste and create better-quality recycled products ready for export or local reuse. The nation's robust regulatory system and grants supporting innovation further add to the viability of commercializing next-generation recycling technology in a profitable and sustainable way.

Market Demand for Recycled Content Products

A new opportunity within the Australia plastic recycling market is the increase in demand by companies and consumers for products with a recycled plastic content. As environmental awareness grows across industries, companies are being pressured to minimize their carbon and plastic footprint. Several Australian manufacturers and retailers are publicly committing to include recycled content into their packaging and products, providing a strong downstream market for recyclers. This is most apparent in the food and beverage sector, where companies are seeking sustainable packaging solutions to satisfy consumers' needs and corporate ESG objectives. Interest is also growing in recycled plastic for applications in building materials, textiles, and durable consumer products. Australia's focus on traceability and product stewardship schemes guarantees that recycled material meets high standards of quality and safety, making it more attractive to mass buyers. This growing demand presents a lucrative opportunity for recycling companies to scale operations and create specialized, value-added plastic materials tailored for specific industries.

Government Regulation of Australia Plastic Recycling Market:

National Waste Policy and Legislative Frameworks

Government regulation plays a central role in shaping the future of the Australia plastic recycling market. The National Waste Policy provides a cohesive framework that guides Australia’s long-term waste management strategy, with a strong emphasis on resource recovery and recycling. This policy is pursued through action plans and targets formulated in partnership with state and territory governments, producing a coordinated yet regionally responsive strategy. Reducing plastic waste going to landfills by promoting reuse, recycling, and reusing plastic items is one of the major goals. The policy framework has spawned legislation like single-use plastics bans and product packaging minimum recycled content requirements. These rules require recycling practices to be implemented, while they also encourage industries to invest in and develop sustainable processing and packaging technologies. This dynamic regulatory environment offers strong guidance to producers and waste processors, motivating compliance while providing business development opportunities through environmental responsibility.

Export Bans and Circular Economy Incentives

A turning point in the plastic recycling regulation in Australia was the implementation of export bans on non-processed plastic waste. These restrictions were implemented in order to lower environmental damage and encourage home-based recycling solutions. Consequently, companies must now invest in local facilities and processing strength to deal with plastic waste within Australia's confines. In further support of this policy shift, the government has implemented numerous funding schemes and incentives to construct a circular economy. These efforts target increasing local recycling capacity, promoting product stewardship schemes, and promoting innovation in sorting and reprocessing technology. Policy realignment from waste export to establishing an autonomous system has opened new regulatory needs but also business opportunities in huge scale. Those businesses that evolve rapidly and align with circular economy objectives are likely to gain from government incentives and long-term agreements. This regulatory drive serves to defend the environment while encouraging employment creation and innovation in the recycling industry.

State-Level Initiatives and Compliance Mechanisms

Complementing national policies, Australia's state and territory governments actively respond to regulating plastic recycling through localized initiatives and compliance enforcement. Each state has its own strategies best suited to address local waste challenges and opportunities. For instance, some states have enforced stringent landfill charges to deter plastic dumping, and others have prescribed certain recovery rates for municipalities and enterprise. State-mandated Extended Producer Responsibility (EPR) schemes are also being enforced more and more, obliging producers and importers to be responsible for the end-of-life effect of their plastics. These are backed by compliance monitoring systems tracking the operation of recycling programs and imposing penalties for non-adherence. Moreover, partnerships between local councils and states are giving way to investments in community education programs, collection initiatives, and small-scale recycling facilities. By integrating regulatory compliance with financial and education incentives, state-level government is strongly complementing the country's momentum toward a cleaner and more efficient plastic recycling network.

Challenges of Australia Plastic Recycling Market:

Limited Recycling Infrastructure and Processing Capacity

One of the primary issues in the Australia plastic recycling industry is the limited processing capacity and uneven distribution of recycling infrastructure in the country. While larger cities such as Sydney, Melbourne, and Brisbane have comparatively well-established recycling systems, rural and distant locations frequently are not provided with proper sorting and processing facilities. The wide geography of Australia introduces logistical complexity, and the transportation of recyclable materials is expensive and inefficient, particularly from remote communities. Furthermore, not all plastic can be processed using current mechanical recycling technology, so much of the recyclable plastic goes to landfill. Investment in innovative recycling technologies like chemical recycling is still at an early stage and not yet commercially developed widely. Consequently, Australia still has a gap between the amount of plastic waste produced and the ability to recycle it sufficiently. Closing this gap will involve investment along with careful coordination among federal, state, and local players.

Low Market Demand for Recycled Plastics

One consistent hindrance to taking the next step in Australia's plastic recycling initiative is the relatively low and uneven demand for products made from recycled plastic. Most producers remain inclined to use virgin plastics because of cost savings, uniform quality, and supply predictability. Even with increased public and government acceptance of sustainable inputs, companies are generally not eager to relinquish traditional inputs in the absence of certain economic benefits or government-mandated recycled content requirements. Additionally, recycled plastic that is made domestically must compete with cheaper, possibly higher purity imported recycled material. Strict food-grade application standards for product quality and safety in Australia restrict the kinds of recycled plastics that can be used commercially. This issue is exacerbated by limited large-scale buyers for products that include recycled content at scale. Without enhanced regulatory enforcement or market transformation, recyclers face difficulties in securing reliable demand, which subsequently impacts investment in recycling infrastructure and innovation.

Contamination and Public Participation Problems

A second key problem in the Australian plastic recycling industry arises through contamination of the waste stream and variable public participation. Through continuing education campaigns and council recycling schemes, much of the household plastic waste is incorrectly sorted or includes non-recyclable items. This contamination lowers the quality of recyclable feedstock and raises recycling plant processing cost. Differing recycling regulations among local councils also make the public confused, with differences in acceptable materials and bin systems in different areas. Therefore, many citizens are uncertain about how to dispose of waste, leading to decreased recovery rates. Retail and hospitality sectors are also adding to plastic pollution due to the practice of mixed collection and minimal segregation at the source. Solving this issue requires a national standardization of recycling practices, better public education, and investment in automated sorting technologies to manage contamination more effectively. Until these systemic issues are addressed, contamination will continue to hinder the efficiency and profitability of Australia’s plastic recycling sector.

Australia Plastic Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, source, and end user.

Type Insights:

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), Polyvinyl chloride (PVC), polystyrene (PS), and others.

Source Insights:

- Bottles

- Films

- Fibers

- Foams

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes bottles, films, fibers, foams, and others.

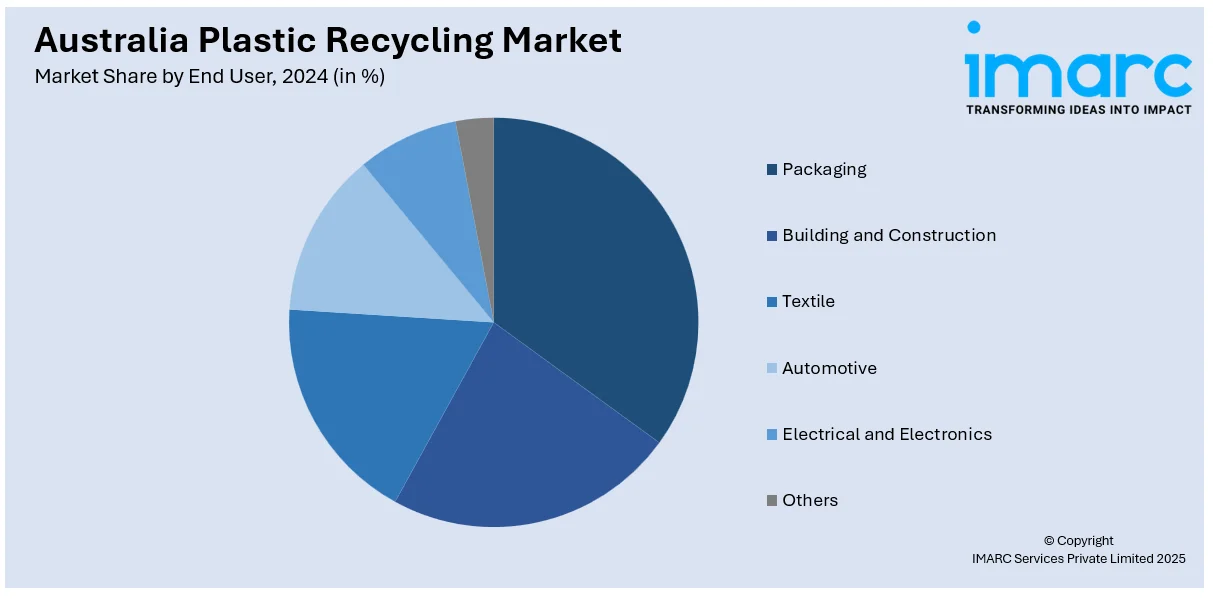

End User Insights:

- Packaging

- Building and Construction

- Textile

- Automotive

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes packaging, building and construction, textile, automotive, electrical and electronics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plastic Recycling Market News:

- In August 2025, Australia’s competition watchdog, the Australian Competition and Consumer Commission (ACCC), revealed intentions to endorse a groundbreaking plastic packaging recycling initiative that includes competing supermarkets and leading food producers. The ACCC determined that the public environmental advantages — such as decreased landfill waste and diminished plastic pollution — outweighed any possible anticompetitive issues. The initiative united rival industry participants in a synchronized approach to gather, process, and recycle plastic packaging extensively, representing an important advancement toward realizing Australia’s circular economy objectives. By combining resources, knowledge, and infrastructure, participants sought to speed up recycling innovation and guarantee more uniform collection systems across the country.

- In July 2024, a report indicated that a USD 40 Million investment in advanced mechanical recycling for soft plastics will lead to the establishment of a new processing facility in South Australia at Recycling Plastics Australia's Kilburn site, utilizing proprietary technology provided by PreOne. The Australian Government has allocated $20 Million for the initiative, allowing approximately 14,000 tons of soft plastics to be redirected from landfills in South Australia annually. The initiative, involving the building of a facility designed to process food-grade recycled materials, will create 45 job opportunities.

Australia Plastic Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene Terephthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Others |

| Sources Covered | Bottles, Films, Fibers, Foams, Others |

| End Users Covered | Packaging, Building and Construction, Textile, Automotive, Electrical and Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plastic recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plastic recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plastic recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia plastic recycling market was valued at USD 1,212.12 Million in 2024.

The Australia plastic recycling market is projected to exhibit a CAGR of 4.45% during 2025-2033.

The Australia plastic recycling market is expected to reach a value of USD 1,793.59 Million by 2033.

The Australia plastic recycling market is witnessing trends such as the rise of advanced recycling technologies, increased adoption of circular economy practices, and growing corporate demand for sustainable packaging. State-level bans on single-use plastics and national targets are also accelerating innovation and investment in closed-loop recycling and waste management systems.

Government regulations, rising environmental awareness, and corporate sustainability commitments are key drivers of the Australia plastic recycling market. Investments in local recycling infrastructure and advanced technologies, coupled with growing demand for recycled content products, are further supporting market expansion and reducing reliance on virgin plastics across industries and supply chains.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)