Australia Plumbing Fixtures Market Size, Share, Trends and Forecast by Product, Location, Application, Distribution Channel, End User, and Region, 2025-2033

Australia Plumbing Fixtures Market Size and Share:

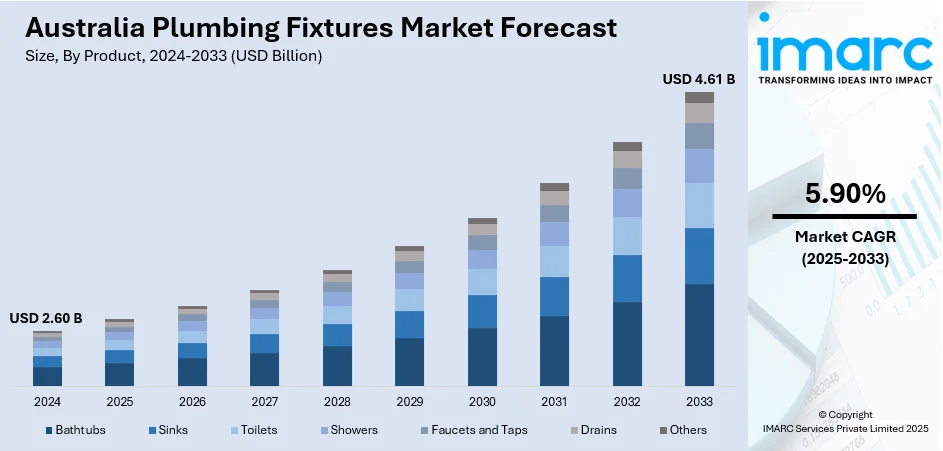

The Australia plumbing fixtures market size reached USD 2.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.61 Billion by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. Urban housing growth, bathroom renovations, demand for water-efficient solutions, compliance with green building codes, and rising consumer interest in smart home plumbing are some of the factors contributing to Australia plumbing fixtures market share. Commercial construction and infrastructure upgrades also contribute to sustained market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.60 Billion |

| Market Forecast in 2033 | USD 4.61 Billion |

| Market Growth Rate 2025-2033 | 5.90% |

Australia Plumbing Fixtures Market Trends:

Push toward Lead-Free Compliance

Australia’s plumbing fixtures sector is experiencing a shift toward safer, lead-free products as new regulations tighten limits on materials used in systems that carry drinking water. This regulatory move is prompting manufacturers to reformulate components and invest in updated production techniques. Installers and contractors are adjusting through focused training and increased awareness of compliance standards. The focus on public health is driving faster adoption of certified, lead-free alternatives, with early movers setting the pace for industry-wide changes. Beyond safety, the shift is encouraging material innovation, improved product design, and renewed competition based on quality and certification. This movement reflects growing expectations from both regulators and consumers for plumbing systems that prioritize safety, performance, and long-term environmental responsibility. These factors are intensifying the Australia plumbing fixtures market growth. For example, Australia is enforcing new regulations to reduce lead in plumbing products, with full compliance required by May 1, 2026. The rules mandate a maximum 0.25% lead content in fixtures contacting drinking water. The shift impacts manufacturers and plumbers, prompting reformulation and retraining. Brands like Oliveri are leading early compliance efforts. The move enhances public health, safety, and opens doors for innovation in Australia’s plumbing fixtures market.

To get more information on this market, Request Sample

Focus on Community-Driven Plumbing Solutions

Community-focused initiatives are shaping the direction of plumbing fixtures used in care facilities and public infrastructure across Australia. Projects supporting disability services are highlighting the growing need for durable, high-quality, and accessible hand-washing and sanitation systems. These efforts are bringing together industry professionals, apprentices, and social organizations to deliver practical solutions that improve everyday living. The emphasis is not only on installation but also on developing a skilled workforce equipped to handle evolving standards in plumbing systems. This collaborative approach is strengthening ties between training, innovation, and real-world application. As demand rises for tailored, reliable fixtures in health and support settings, suppliers and contractors are responding with improved designs that prioritize safety, accessibility, and long-term functionality. For instance, new hand-washing stations were installed at Yooralla’s Mooroopna site as part of the Plumbing Champions project during WorldSkills Australia, held August 17-19, 2023, in Melbourne. Led by IWSH and supported by PICAC apprentices and the Reece Foundation, the initiative showcased skilled plumbing work and highlighted rising demand for quality plumbing fixtures in community infrastructure and disability support services across Victoria.

Australia Plumbing Fixtures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, location, application, distribution, and end-user.

Product Insights:

- Bathtubs

- Sinks

- Toilets

- Showers

- Faucets and Taps

- Drains

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bathtubs, sinks, toilets, showers, faucets and taps, drains, and others.

Location Insights:

- Bathroom

- Kitchen

- Others

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes bathroom, kitchen, and others.

Application Insights:

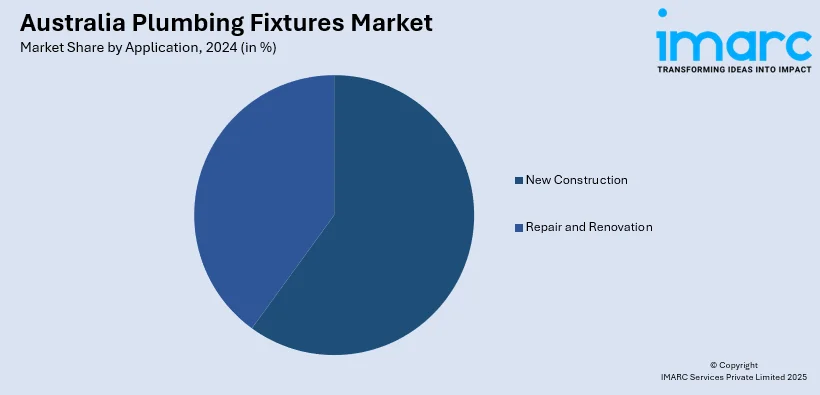

- New Construction

- Repair and Renovation

The report has provided a detailed breakup and analysis of the market based on the application. This includes new construction and repair and renovation.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plumbing Fixtures Market News:

- In February 2025, Temple & Webster reported a 25% sales surge in the last six months, fueled by strong demand for bathroom products. The retailer’s revenue hit USD 313.7 Million, exceeding expectations. This rebound signals rising consumer investment in home upgrades, particularly in bathrooms, and highlights the growing importance of online platforms in plumbing fixture distribution.

Australia Plumbing Fixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bathtubs, Sinks, Toilets, Showers, Faucets and Taps, Drains, Others |

| Locations Covered | Bathroom, Kitchen, Others |

| Applications Covered | New Construction, Repair and Renovation |

| Distribution Channels Covered | Online, Offline |

| End-Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia plumbing fixtures market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia plumbing fixtures market on the basis of product?

- What is the breakup of the Australia plumbing fixtures market on the basis of location?

- What is the breakup of the Australia plumbing fixtures market on the basis of application?

- What is the breakup of the Australia plumbing fixtures market on the basis of distribution channel?

- What is the breakup of the Australia plumbing fixtures market on the basis of end user?

- What is the breakup of the Australia plumbing fixtures market on the basis of region?

- What are the various stages in the value chain of the Australia plumbing fixtures market?

- What are the key driving factors and challenges in the Australia plumbing fixtures market?

- What is the structure of the Australia plumbing fixtures market and who are the key players?

- What is the degree of competition in the Australia plumbing fixtures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plumbing fixtures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plumbing fixtures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plumbing fixtures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)