Australia Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Region 2026-2034

Australia Plywood Market Size and Share:

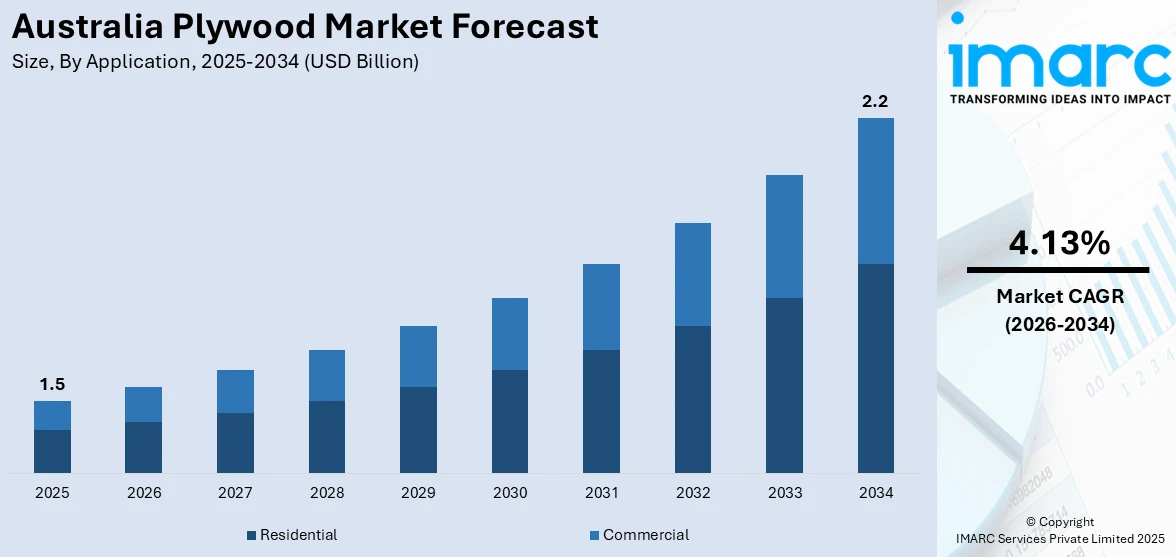

The Australia plywood market size reached USD 1.5 Billion in 2025. Looking forward, the market is projected to reach USD 2.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.13% during 2026-2034. The market share is driven by the growing construction and infrastructure projects, rising demand for sustainable materials, and the growing traction of plywood in furniture and interior design.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.2 Billion |

| Market Growth Rate 2026-2034 | 4.13% |

Key Trends of Australia Plywood Market:

Construction and Infrastructure Growth

Development of construction and infrastructure is among the key drivers of the Australia plywood market. With Australia continuing to experience population growth and urbanization, demand for residential, commercial, and industrial infrastructure is increasing at a very rapid rate. Large-scale projects like commercial complexes, residential buildings, and public infrastructure like roads and bridges require cost-effective, durable, and versatile materials, and plywood just makes the cut. The ratio of strength to weight of plywood renders it a viable material for structural applications, flooring, roofing, and wall systems in building construction. Plywood is particularly valued for its ability to provide durability with design flexibility, rendering it a popular choice in numerous applications in building construction. Growing construction activity, both public and private investment, drives the consistent demand for plywood. In fact, the worth of construction activity performed in Australia increased by 0.5%, to $73,936.9 million, as the industry continued to expand. Furthermore, the Australian government's focus on increasing housing supply, expanding transport networks, and enhancing public infrastructure is also increasing demand for building materials like plywood. The demand to meet these infrastructure requirements effectively and responsibly goes hand in hand with the increased application of plywood, which is seen as a green alternative compared to other traditional building materials. This increased building activity will be expected to lead the Australia plywood market growth.

To get more information on this market Request Sample

Rise in Furniture and Interior Design

The expansion in furniture and interior designing businesses is positively influencing the Australia plywood market outlook. As people's tastes and preferences change, there is increasing demand for eco-friendly, pleasing, and durable products to be used in furniture and interior designing. As it is moldable into diverse shapes and finishing styles, the plywood is picking up popularity across various sectors. It has a perfect blend of strength and lightness, so it is a favorite material used in furniture making, from shelves and cabinets to tables and chairs. Plywood is also gaining popularity in interior design due to its natural charm and adaptability in conforming to modern and minimalist trends. Its smooth finish and customizability are also a top choice for creating one-of-a-kind, trendy interiors. The move towards green alternatives is also propelling demand for plywood, as it is viewed as a renewable material compared to something like MDF or particle board. In addition, higher-than-average home improvement and remodeling activity within Australia is also driving plywood market growth. Homeowners and interior designers alike are increasingly looking to plywood due to its affordability and green credentials, as well as its ability to produce a high-end finish at a price that is difficult to match. Based on information provided by the IMARC Group, the Australian furniture market is predicted to grow at a CAGR of 5.8% during 2025-2033, again reflecting the greater utilization of plywood in the market.

Preference for Sustainable and Certified Wood

Sustainability is becoming an increasingly important factor influencing the Australia plywood market demand. Consumers, builders, and manufacturers are more focused on eco-friendly sourcing than ever before. The use of certified plywood such as that from FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) is growing ensuring that timber originates from responsibly managed forests. This trend is fueled by rising environmental consciousness, tougher building regulations, and the increasing desire for green construction materials. Certified plywood aligns with ethical and environmental standards and attracts buyers looking for durability and quality assurance. As sustainable construction becomes more prevalent in Australia certified plywood emerges as the preferred choice, enhancing brand reputation and meeting eco-conscious building criteria.

Growth Factors of Australia Plywood Market:

Shift Toward Lightweight yet Durable Materials

The demand for construction materials that provide a blend of strength and ease of handling is driving the inclination toward plywood in Australia. In comparison to solid wood, plywood boasts a superior strength-to-weight ratio, making it ideal for both structural and decorative uses. Its layered construction offers durability, resistance to warping, and versatility for various applications, including flooring and wall panels. This efficiency in transportation, installation, and handling on-site leads to reduced labor and overall project costs. As builders, furniture makers, and designers seek materials that combine performance with economic viability, plywood stands out as a practical solution. The interplay of lightness and durability is becoming a crucial factor in its growing acceptance across a wide range of industries.

Rising Popularity of Modular and Prefabricated Buildings

According to Australia plywood market analysis, the increasing trend of modular and prefabricated construction is generating significant demand for versatile materials like plywood. Prefabrication necessitates materials that are light, transport-friendly, and easy to assemble in a short time with no compromises on structural integrity. Plywood serves these needs by providing uniform quality, dimensional flexibility, and availability to cut precisely to size for any module. Its use in walls, floors, roofs, and furniture makes it an ideal material for rapid construction jobs, such as residential houses, commercial buildings, and temporary facilities. With the Australian construction sector more and more relying on prefabricated options to mitigate labor shortages and reduce construction time, the use of plywood is poised to expand significantly.

Technological Advancements in Plywood Manufacturing

Technological advancements in plywood production are also serving to greatly improve product performance and extend its use in the Australian market. New bonding technologies have enhanced adhesive performance, resulting in increased durability and resistance to delamination. More effective surface finishes and treatments now offer improved resistance to moisture, making plywood compatible with humid and exterior environments. Besides, precision cutting and lamination processes guarantee even thickness and exceptional aesthetics to satisfy high-end furniture and interior designing requirements. Such developments enhance the functional characteristics of plywood and allow the manufacturer to provide specialty types like fire-retardant, marine-grade, and decorative plywood. Such ongoing development in manufacturing is making plywood a premium and dynamic option in the construction and designing industries.

Opportunities of Australia Plywood Market:

Expansion in Renovation and Remodeling

The increasing trend of home renovation and remodeling in Australia is significantly boosting plywood consumption. As more homeowners invest in upgrading kitchens, bathrooms, flooring, and storage solutions, the demand for plywood rises due to its durability, ease of installation, and aesthetic qualities. It is commonly utilized for cabinetry, wall panels, and decorative finishes because of its design versatility. The growing popularity of DIY projects and custom interiors further enhances the use of plywood. Renovation activities are also fueled by government incentives and rising property values, prompting homeowners to modernize their spaces. This steady demand from the renovation sector guarantees consistent growth for plywood manufacturers and suppliers across Australia’s residential and commercial markets.

Product Innovation

The Australia plywood market is seeing strong potential through product innovation. Manufacturers are increasingly focused on creating specialty plywood types, including fire-resistant, marine-grade, and decorative panels to meet specific industry needs. Fire-resistant plywood is gaining traction in public infrastructure and commercial projects, while marine-grade options are crucial for coastal and humid areas. Decorative plywood featuring unique finishes and textures appeals to the furniture and interior design sectors, combining aesthetics with functionality. These innovations broaden application possibilities and assist manufacturers in standing out from standard plywood offerings. As consumer expectations change, ongoing research and development in quality, performance, and design are becoming vital for market competitiveness and growth opportunities.

Integration with Advanced Manufacturing

The implementation of cutting-edge manufacturing technologies, including CNC (Computer Numerical Control) machining and precision cutting, is reshaping the plywood sector in Australia. These advancements enable manufacturers to craft highly customized designs with remarkable precision, addressing the increasing demand from architects, interior designers, and furniture makers for tailor-made solutions. CNC technology facilitates the creation of intricate shapes, detailed patterns, and uniform quality, making plywood ideal for premium applications in both residential and commercial settings. Additionally, precision cutting minimizes material waste, enhancing cost-effectiveness and sustainability. By incorporating these state-of-the-art processes, plywood manufacturers can provide value-added products that differentiate themselves in a competitive landscape, appealing to clients who seek unique, durable, and visually striking wood-based solutions.

Challenges of Australia Plywood Market:

Price Volatility of Raw Timber Impacting Profitability

Fluctuations in raw timber prices pose a considerable challenge for the Australia plywood market. Timber prices are affected by factors such as global supply-demand imbalances, logging restrictions, environmental policies, and transportation costs. These price changes directly influence production expenses for plywood manufacturers, often leading to diminished profit margins. In some instances, increased raw material costs are passed on to consumers, which could affect sales volumes. Furthermore, reliance on specific timber species for premium-grade plywood makes the market susceptible to supply disruptions. To address this issue, manufacturers may need to explore alternative timber sources, enhance resource efficiency, or adopt long-term procurement strategies to stabilize costs and maintain competitiveness in an increasingly price-sensitive market.

Import Competition Pressuring Local Manufacturers

Affordable plywood imports, especially from countries with large-scale production capabilities, are intensifying competition for Australian manufacturers. Imported plywood often benefits from lower production and labor costs, enabling it to be priced competitively in the domestic market. This situation pressures local producers to cut costs while ensuring quality standards are upheld. Additionally, in some cases, imported products present appealing finishes and designs, further challenging domestic sales. The surge of cheaper imports can restrict market share growth for Australian plywood manufacturers, compelling them to focus on differentiation through certified sustainability, custom products, and quicker delivery times. Strategic positioning is crucial to compete against these overseas suppliers.

Environmental Regulations Increasing Compliance Costs

Stricter forestry and environmental regulations in Australia are elevating operational and compliance costs for plywood manufacturers. Laws governing sustainable logging, emissions control, and waste management necessitate investment in eco-friendly production methods and certified raw material sourcing. While these regulations encourage environmental responsibility, they also increase production costs and can delay manufacturing timelines. Non-compliance risks include penalties, reputational damage, and restricted market access.Additionally, demand for FSC or PEFC-certified plywood means companies must maintain rigorous tracking and verification systems. Although environmentally conscious practices can enhance brand value, balancing compliance with cost efficiency remains a challenge for many manufacturers in a competitive and price-sensitive market.

Australia Plywood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on application and sector.

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

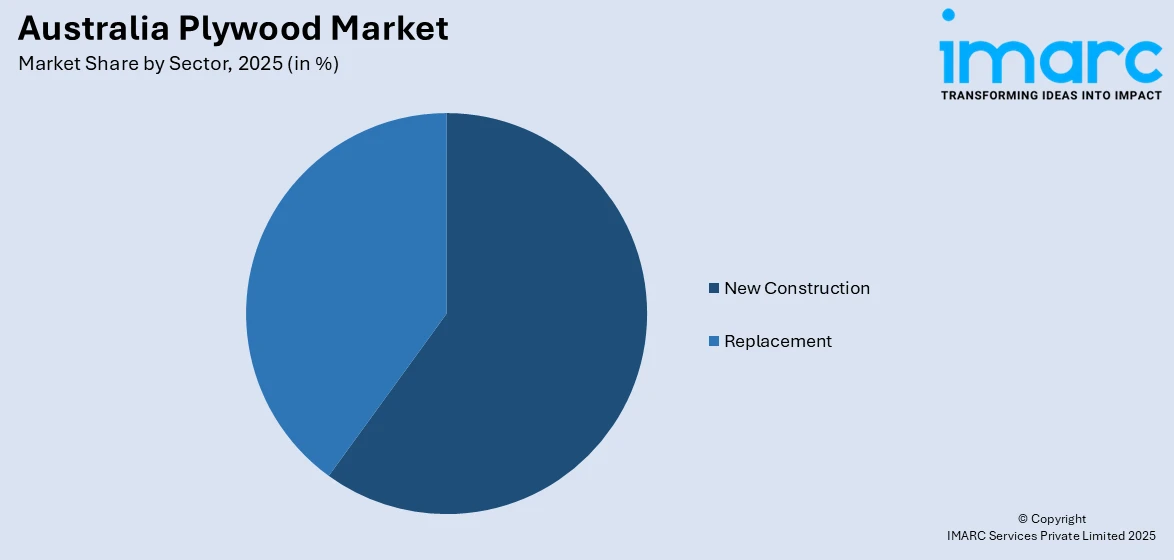

Sector Insights:

Access the comprehensive market breakdown Request Sample

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Plywood Market News:

- In February 2025, Millari Group Australia acquired Juken New Zealand's Gisborne facilities, which include LVL and plywood manufacturing lines and a sawmill, to strengthen Australia's timber supply. The facility, now rebranded as Millari NZ, will reopen, creating 100 jobs and supporting the local timber industry with domestically sourced products.

Australia Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia plywood market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia plywood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia plywood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plywood market in Australia was valued at USD 1.5 Billion in 2025.

The Australia plywood market is projected to exhibit a compound annual growth rate (CAGR) of 4.13 % during 2026-2034.

The Australia plywood market is expected to reach a value of USD 2.2 Billion by 2034.

The Australia plywood market is experiencing trends such as a shift toward sustainable and certified wood products, rising demand from modular and prefabricated construction, increased adoption in home renovation projects, and the use of advanced manufacturing techniques for customised, high-quality plywood designs.

Market growth is driven by plywood’s strength-to-weight advantage, its versatility across construction and furniture applications, technological advancements in moisture resistance and finishes, and rising demand from modular housing. Expanding renovation activities and increasing preference for eco-friendly materials further support strong demand across residential, commercial, and industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)