Australia Pneumatic Cylinders Market Size, Share, Trends and Forecast by Product Type, Motion, End-Use Industry, and Region, 2025-2033

Australia Pneumatic Cylinders Market Size and Share:

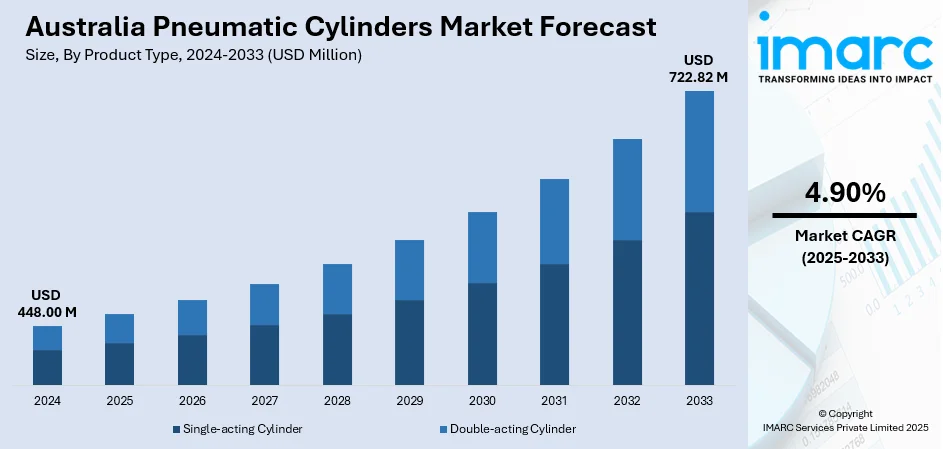

The Australia pneumatic cylinders market size reached USD 448.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 722.82 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. Growing demand from mining, construction, and manufacturing sectors is one of the factors contributing to Australia pneumatic cylinders market share. Focus on automation, energy efficiency, and replacing older hydraulic systems also supports adoption. Ongoing infrastructure projects and preference for low-maintenance solutions further contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 448.00 Million |

| Market Forecast in 2033 | USD 722.82 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Australia Pneumatic Cylinders Market Trends:

Growth in Industrial Automation Components

Australia is seeing rising demand for reliable and efficient motion control solutions in manufacturing and process automation. Pneumatic cylinders have become a mainstay due to their simplicity, durability, and ability to perform across a wide range of applications, from lifting and shifting heavy loads to automating complex industrial tasks. With clean operation and minimal maintenance needs, these components are increasingly favored in environments that prioritize safety and cost-efficiency. The availability of high-quality products from established international brands further supports adoption across various sectors. As industries continue to modernize, the need for adaptable and high-performing automation components remains strong. Local suppliers with broad product offerings and technical expertise are helping businesses select the right solutions based on performance requirements, environmental conditions, and budget. These factors are intensifying the Australia pneumatic cylinders market growth. For example, based on industry reports published in June 2024, the market in Australia is growing steadily, with MasterMac2000 playing a key role as a trusted supplier. Offering products from leading brands like Univer, Mack, Tolomatic, and Piab, the company supports diverse automation needs. Pneumatic cylinders are widely used for tasks such as moving heavy loads and streamlining industrial processes. Their clean operation, reliability, and versatility continue to make them a preferred solution across Australia’s manufacturing and process automation sectors.

To get more information on this market, Request Sample

Shift toward Customization and Application-Specific Solutions

Australia’s pneumatic cylinders market is evolving with growing emphasis on tailored solutions designed to meet specific industrial needs. Rather than relying solely on standard, off-the-shelf models, many businesses are now seeking cylinders that match precise application parameters, such as stroke length, mounting configurations, speed, and environmental resistance. This shift is driven by increasingly specialized processes in sectors like food processing, mining, packaging, and advanced manufacturing, where unique operating conditions demand precision and flexibility. Manufacturers and suppliers are responding with a broader portfolio of modular components, offering options in materials, sealing systems, and cushioning techniques. Demand for compact cylinders and corrosion-resistant models has also risen, especially in industries with space constraints or exposure to moisture and chemicals. The availability of these options is improving with better access to engineering support, digital configuration tools, and local assembly services. As a result, Australian businesses are able to reduce downtime, improve efficiency, and extend equipment life. This move toward customization reflects a maturing market where performance and long-term value increasingly outweigh short-term cost considerations in equipment selection and procurement decisions.

Australia Pneumatic Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market baesd on product type, Motion, and end-use industry.

Product Type Insights:

- Single-acting Cylinder

- Double-acting Cylinder

The report has provided a detailed breakup and analysis of the market based on the product type. This includes single-acting cylinder and double-acting cylinder.

Motion Insights:

- Linear

- Rotary

A detailed breakup and analysis of the market based on the motion have also been provided in the report. This includes linear and rotary.

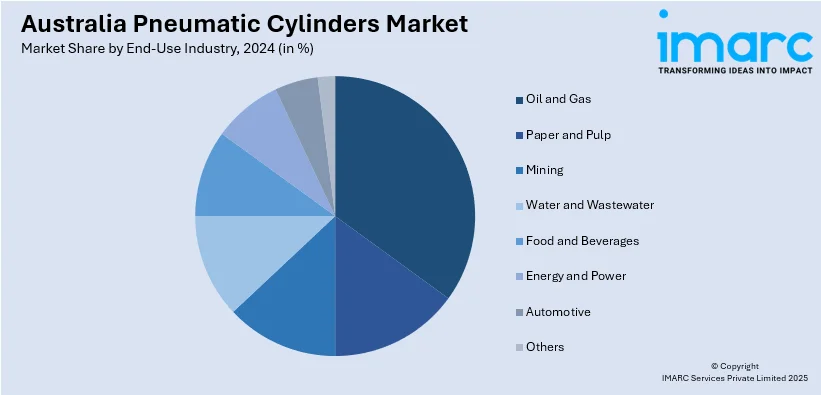

End-Use Industry Insights:

- Oil and Gas

- Paper and Pulp

- Mining

- Water and Wastewater

- Food and Beverages

- Energy and Power

- Automotive

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas, paper and pulp, mining, water and wastewater, food and beverages, energy and power, automotive, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pneumatic Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Single-acting Cylinder, Double-acting Cylinder |

| Motions Covered | Linear, Rotary |

| End-Uses Industries Covered | Oil and Gas, Paper and Pulp, Mining, Water and Wastewater, Food and Beverages, Energy and Power, Automotive, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pneumatic cylinders market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pneumatic cylinders market on the basis of product type?

- What is the breakup of the Australia pneumatic cylinders market on the basis of motion?

- What is the breakup of the Australia pneumatic cylinders market on the basis of end use industry?

- What is the breakup of the Australia pneumatic cylinders market on the basis of region?

- What are the various stages in the value chain of the Australia pneumatic cylinders market?

- What are the key driving factors and challenges in the Australia pneumatic cylinders market?

- What is the structure of the Australia pneumatic cylinders market and who are the key players?

- What is the degree of competition in the Australia pneumatic cylinders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pneumatic cylinders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pneumatic cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pneumatic cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)