Australia Portable Power Tools Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Portable Power Tools Market Size and Share:

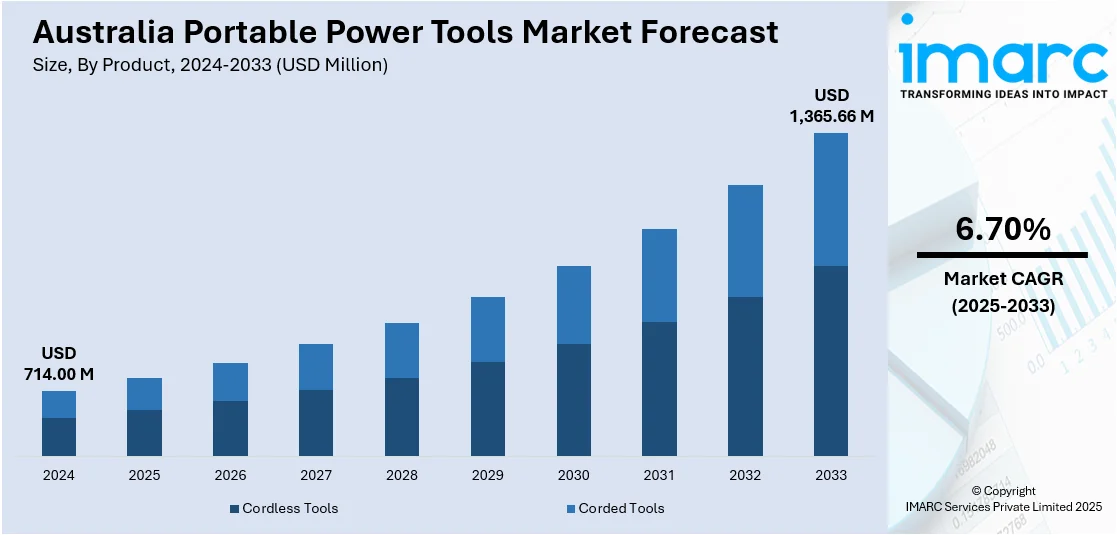

The Australia portable power tools market size reached USD 714.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,365.66 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is driven by increasing demand for cordless and battery-powered tools across residential, commercial, and industrial segments. Along with this, the growth in home renovations and DIY activities, along with heightened construction activity and infrastructure investments in the country, continues to support tool adoption. Moreover, technological advancements improving power efficiency, portability, and user safety are encouraging consumer and professional uptake, further expanding the Australia portable power tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 714.00 Million |

| Market Forecast in 2033 | USD 1,365.66 Million |

| Market Growth Rate 2025-2033 | 6.70% |

Australia Portable Power Tools Market Trends:

Rising Demand for Cordless Tools Across User Segments

Cordless portable power tools are increasingly preferred across residential, commercial, and industrial users in Australia. Besides this, improvements in lithium-ion battery technology have led to longer runtimes, faster charging, and lighter tool weight, which enhances overall productivity. Professional tradespeople and contractors value the mobility and ease of use cordless tools provide, particularly on job sites where access to power outlets is limited or non-existent. Within the DIY consumer base, cordless products also offer convenience and simplicity, requiring less setup and enabling safer operation in domestic settings. Moreover, the adoption of battery platform systems, where a single battery can power multiple tools, is gaining traction and improving brand loyalty. Along with this, environmental concerns are pushing users to reduce generator use and promote battery-powered alternatives, which is supporting the Australia portable power tools market growth. As a result, cordless solutions are transitioning from niche to standard preference across Australian user groups.

To get more information on this market, Request Sample

Increased Adoption Driven by Infrastructure and Housing Investment

The significant investment in infrastructure development and residential construction is a major contributor to the demand for portable power tools. For instance, the Australian Government’s 2024–25 Budget allocated USD 78 Million to land transport projects in the ACT, including over USD 50 Million for road and light rail planning and USD 27.1 Million to complete the William Hovell Drive Duplication. This supports the broader USD 120 Billion, 10-year national infrastructure pipeline focused on safety and efficiency. These government-backed projects in transportation, energy, and civil engineering sectors require reliable tools for a wide range of applications, from drilling and fastening to cutting and grinding. Portable power tools are critical for tasks where access to fixed machinery is impractical or unsafe, particularly on expansive or multi-phase construction sites. In addition to this, the rise in homebuilding and renovation activity, especially in suburban and regional areas, has accelerated the demand from homebuilders, electricians, plumbers, and other trades. Furthermore, urban development trends and the increasing shift toward modular and prefabricated construction also rely on efficient and transportable tools. This construction-driven demand influences not only volume sales but also the design requirements for durability, compactness, and compliance with local safety standards.

Shift Toward Smart and Connected Tool Systems

Smart portable power tools integrated with sensors, digital controls, and connectivity features are beginning to influence procurement decisions among professionals in Australia. These tools enable features like usage tracking, maintenance alerts, load monitoring, and integration with job-site management software. Apart from this, companies are incorporating these capabilities to enhance tool lifecycle management, ensure compliance with safety standards, and minimize operational downtime. Also, Bluetooth and Wi-Fi-enabled tools allow real-time communication with mobile apps, where users can customize performance settings, lock or disable stolen equipment, and analyze productivity data. This is particularly valuable in commercial construction and mining sectors, where tool misuse or malfunction can result in significant cost overruns. While adoption is still in the early stages in the Australian market, demand is expected to grow as businesses prioritize efficiency, data-driven maintenance, and job-site automation.

Australia Portable Power Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Cordless Tools

- Corded Tools

The report has provided a detailed breakup and analysis of the market based on the product. This includes cordless tools and corded tools.

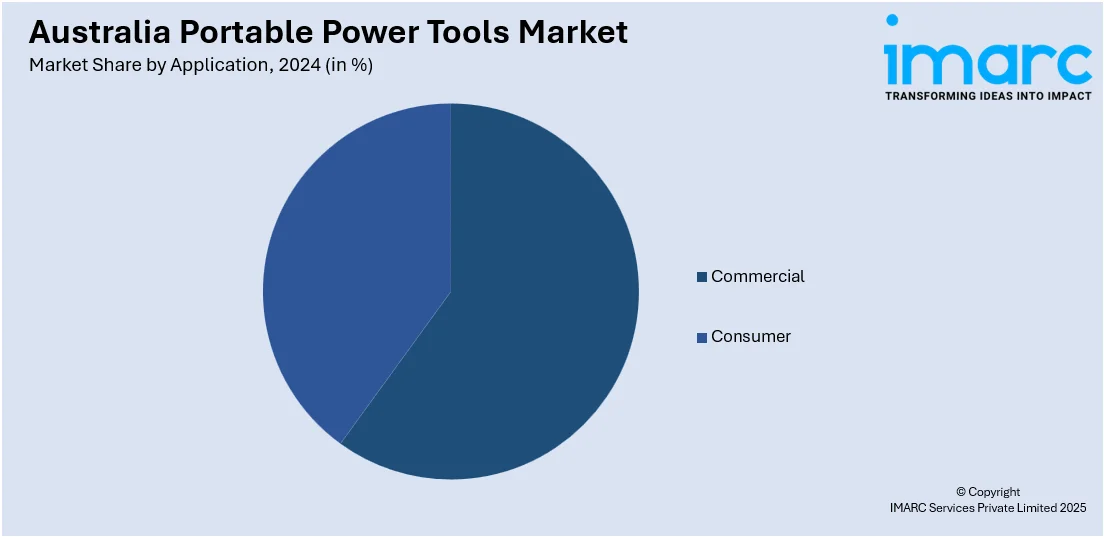

Application Insights:

- Commercial

- Consumer

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial and consumer.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Portable Power Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cordless Tools, Corded Tools |

| Applications Covered | Commercial, Consumer |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia portable power tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia portable power tools market on the basis of product?

- What is the breakup of the Australia portable power tools market on the basis of application?

- What is the breakup of the Australia portable power tools market on the basis of region?

- What are the various stages in the value chain of the Australia portable power tools market?

- What are the key driving factors and challenges in the Australia portable power tools market?

- What is the structure of the Australia portable power tools market and who are the key players?

- What is the degree of competition in the Australia portable power tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia portable power tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia portable power tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia portable power tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)