Australia POS Device Market Size, Share, Trends and Forecast by Component, Terminal Type, Industry Vertical, and Region, 2025-2033

Australia POS Device Market Overview:

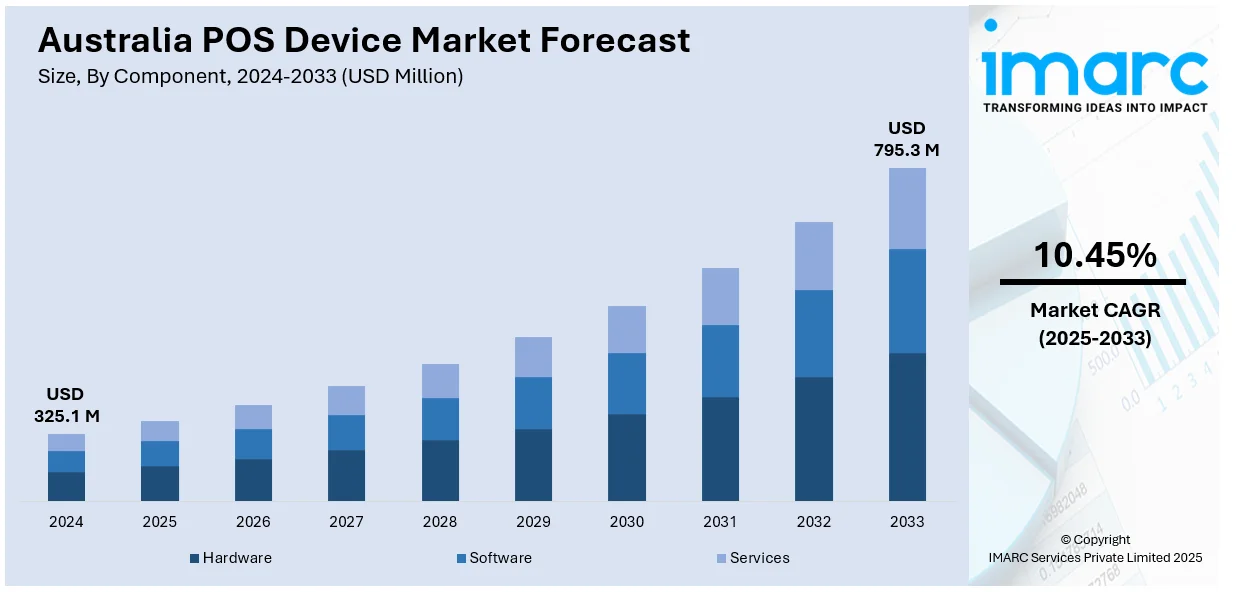

The Australia POS device market size reached USD 325.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 795.3 Million by 2033, exhibiting a growth rate (CAGR) of 10.45% during 2025-2033. The market is growing due to rising demand for integrated, space-saving solutions, contactless payment options, and hardware-independent systems. Businesses are adopting modern devices to improve efficiency, lower costs, and meet evolving customer expectations for faster, secure, and seamless transactions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 325.1 Million |

| Market Forecast in 2033 | USD 795.3 Million |

| Market Growth Rate 2025-2033 | 10.45% |

Australia POS Device Market Trends:

Push Toward Customized Integrated Solutions

The Australian POS device market is witnessing growing demand for integrated solutions that simplify daily business operations. Businesses are shifting away from fragmented systems and are seeking platforms that combine payments, sales tracking, and inventory tools within one device. This trend is largely driven by the need for space-saving hardware, user-friendly interfaces, and systems that require minimal setup. The preference for flexibility and customization has increased, especially among small and medium businesses that value operational control without depending on multiple service providers. In line with this shift, Zeller introduced Terminal 2 in August 2024, a locally designed POS device offering a built-in POS Lite app, digital receipts, and customizable hardware in three colors. The device allowed businesses to manage sales and inventory on a single terminal, eliminating the need for separate systems. Zeller Terminal 2 also integrated with over 600 third-party POS platforms, supporting seamless operations across retail and hospitality setups. The terminal supported modern payment methods and came with a large 6.5-inch screen for ease of use. This innovation boosted the local adoption of multi-function POS systems. As more businesses seek devices that align with both their brand identity and operational needs, the demand for sleek, modular POS systems in Australia is expected to maintain steady growth across sectors.

To get more information on this market, Request Sample

Movement Toward Hardware-Less Flexibility

The rising shift toward software-driven, device-agnostic solutions is driving the POS market in Australia. Businesses increasingly want flexibility to operate payment systems on their own smart devices, without investing in standalone hardware. The rising use of mobile payment platforms, contactless transactions, and NFC-supported devices reinforces this trend. Retailers and service providers are actively looking for solutions that lower hardware dependency while offering speed, security, and consistent performance. Reflecting this change, Tyro launched Australia’s first embedded payments solution in December 2024, allowing merchants to process tap-to-pay transactions directly on iOS or Android devices. The SDK-based solution eliminated the need for traditional EFTPOS terminals and enabled fast, secure transactions via existing smartphones or tablets. With no EFTPOS rental fees and a transaction-based model, it helped businesses lower their operating costs. Tyro’s embedded payments went live with partners like Liven and Metapos, bringing the solution directly to Australian merchants. This approach introduced more flexibility to Australia’s POS market, especially for businesses that operate on the go or at temporary locations. As embedded solutions gain popularity, they are helping shift the POS landscape from hardware-first to software-led systems, allowing merchants to run payments and operations with greater independence and efficiency.

Australia POS Device Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, terminal type, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Terminal Type Insights:

- Fixed POS Terminals

- Mobile POS Terminals

A detailed breakup and analysis of the market based on the terminal type have also been provided in the report. This includes fixed POS terminals and mobile POS terminals.

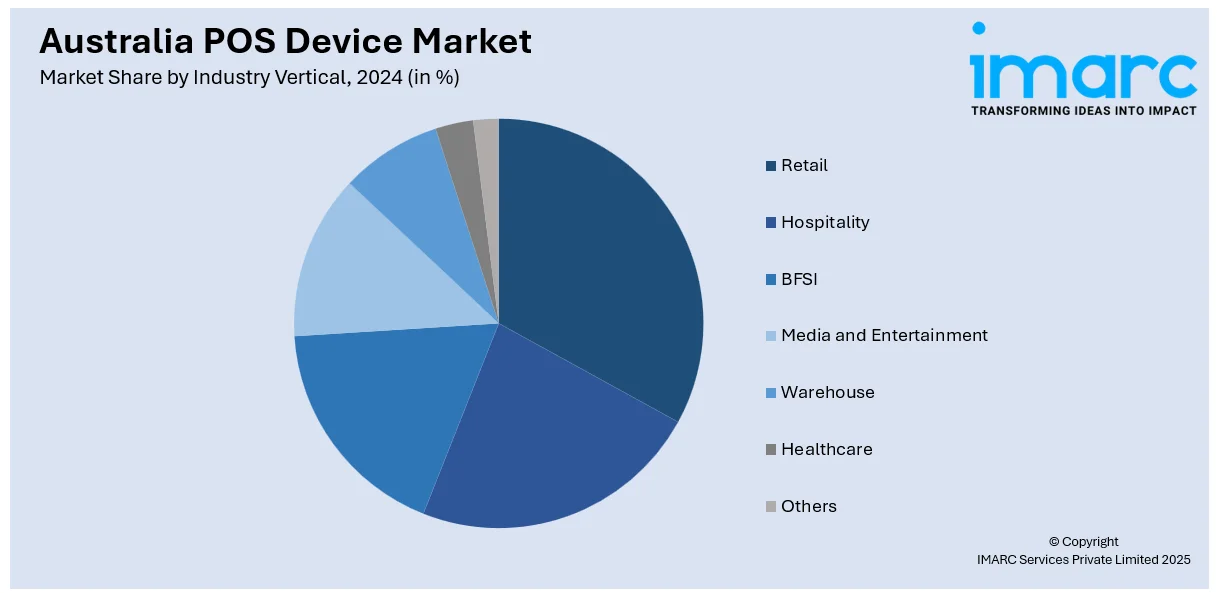

Industry Vertical Insights:

- Retail

- Hospitality

- BFSI

- Media and Entertainment

- Warehouse

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes retail, hospitality, BFSI, media and entertainment, warehouse, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia POS Device Market News:

- April 2025: Fiserv launched Clover POS in Australia, offering integrated hardware and software for retail, hospitality, and service sectors. The system simplified sales, inventory, and staff management. Its arrival strengthened the POS device market by supporting small businesses with scalable, efficient, and growth-oriented solutions.

- December 2024: Tyro introduced Australia’s first embedded payments solution, allowing tap-to-pay transactions via NFC-enabled iOS and Android devices without separate terminals. This launch advanced the POS device market by reducing hardware reliance, lowering costs, and enabling faster, integrated checkout experiences for Australian merchants.

Australia POS Device Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Terminal Types Covered | Fixed POS Terminals, Mobile POS Terminals |

| Industry Verticals Covered | Retail, Hospitality, BFSI, Media and Entertainment, Warehouse, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia POS device market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia POS device market on the basis of component?

- What is the breakup of the Australia POS device market on the basis of terminal type?

- What is the breakup of the Australia POS device market on the basis of industry vertical?

- What is the breakup of the Australia POS device market on the basis of region?

- What are the various stages in the value chain of the Australia POS device market?

- What are the key driving factors and challenges in the Australia POS device market?

- What is the structure of the Australia POS device market and who are the key players?

- What is the degree of competition in the Australia POS device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia POS device market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia POS device market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia POS device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)