Australia Positive Displacement Pumps Market Size, Share, Trends and Forecast by Product Type, Capacity, Pump Characteristic, Raw Material, End Use Industry, and Region, 2025-2033

Australia Positive Displacement Pumps Market Overview:

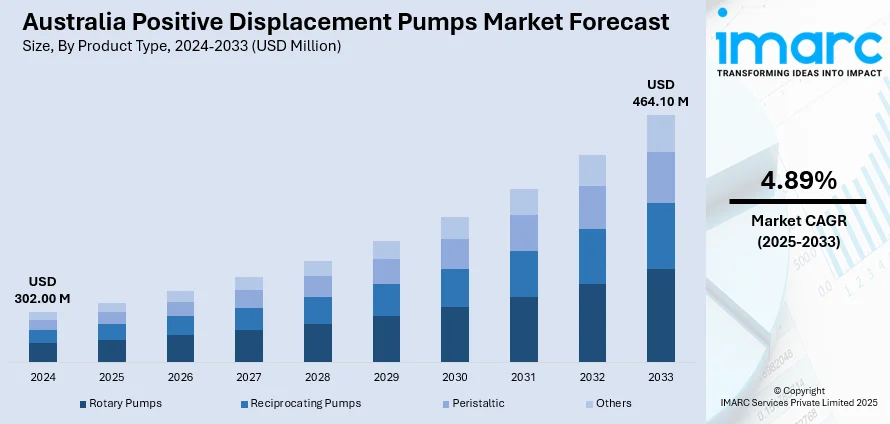

The Australia positive displacement pumps market size reached USD 302.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 464.10 Million by 2033, exhibiting a growth rate (CAGR) of 4.89% during 2025-2033. The market is driven by growing investments in water infrastructure and renewable energy projects, alongside increased demand for precise fluid handling in industries such as mining, agriculture, and wastewater treatment, where the pumps’ ability to manage viscous, abrasive, or shear-sensitive fluids ensures operational efficiency and environmental compliance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 302.00 Million |

| Market Forecast in 2033 | USD 464.10 Million |

| Market Growth Rate 2025-2033 | 4.89% |

Australia Positive Displacement Pumps Market Trends:

Growth of Australia’s Mining and Resources Sector

The robust growth of Australia’s mining and natural resource extraction industry is a principal driver of the positive displacement (PD) pumps market. The unique and often extreme operational conditions inherent to mining environments necessitate the use of fluid handling technologies that can withstand highly viscous, abrasive, and corrosive materials. PD pumps are particularly well-suited to such demanding applications, including slurry transfer, mine dewatering, and chemical dosing, due to their superior ability to maintain consistent flow and pressure irrespective of fluid characteristics. Australia ranks among the world’s leading producers of essential minerals, including iron ore, gold, lithium, and bauxite. The extraction and processing of these resources demand specialized pumping solutions that are not only durable and efficient but also reliable under remote and challenging conditions. In operations where precision and consistency are paramount (particularly in low-flow, high-pressure environments), PD pumps significantly outperform centrifugal alternatives. Moreover, Australia's strategic focus on expanding its critical minerals sector, particularly in lithium and rare earth elements, in response to the global energy transition, is expected to increase demand for advanced, heavy-duty pumping systems substantially.

To get more information on this market, Request Sample

Rising Demand in the Food & Beverage Processing Industry

The rising product demand from Australia’s food and beverage (F&B) processing industry represents another significant growth avenue for the PD pump market. This sector necessitates hygienic, precise, and low shear pumping solutions, as many food products require careful handling to preserve their integrity, texture, and quality. PD pumps are ideally suited to meet these requirements, particularly for handling viscous and sensitive substances such as syrups, fruit concentrates, sauces, yogurt, and thick dairy products. Australia's food and beverage (F&B) industry, a multi-billion-dollar contributor to both domestic economic output and international trade, is rapidly advancing towards increased automation and stringent hygiene standards. In alignment with global and domestic food safety regulations, such as Hazard Analysis and Critical Control Points (HACCP), manufacturers are prioritizing equipment that integrates advanced sanitation capabilities. PD pumps, particularly those of the rotary lobe and diaphragm variety, are equipped with features such as clean-in-place (CIP) and sterilize-in-place (SIP) systems, which facilitate compliance by reducing operational downtime and contamination risk.

Australia Positive Displacement Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, capacity, pump characteristic, raw material, and end use industry .

Product Type Insights:

- Rotary Pumps

- Vane

- Screw

- Lobe

- Gear

- Progressing Cavity (PC)

- Others

- Reciprocating Pumps

- Piston

- Diaphragm

- Plunger

- Others

- Peristaltic

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes rotary pumps (vane, screw, lobe, gear, progressing cavity (PC), and others), reciprocating pumps (piston, diaphragm, plunger, and others), peristaltic, and others.

Capacity Insights:

- Low Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes low capacity pumps, medium capacity pumps, and high capacity pumps.

Pump Characteristic Insights:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

The report has provided a detailed breakup and analysis of the market based on the pump characteristic. This includes standard pumps, engineered pumps, and special purpose pumps.

Raw Material Insights:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes bronze, cast iron, polycarbonate, stainless steel, and others.

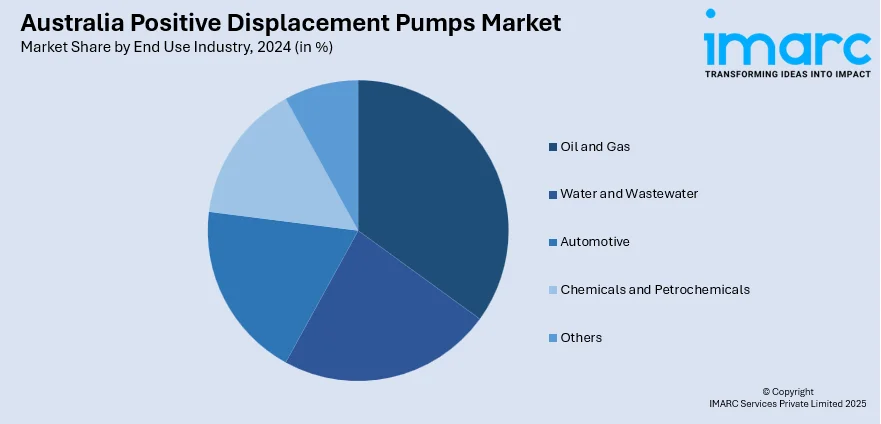

End Use Industry Insights:

- Oil and Gas

- Water and Wastewater

- Automotive

- Chemicals and Petrochemicals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, water and wastewater, automotive, chemicals and petrochemicals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Positive Displacement Pumps Market News:

- December 2024: Roto Energy Systems Ltd., a subsidiary of Roto Pumps Ltd., secured 100 orders in Australia for its Roto Rudra solar submersible pumping systems. These positive displacement pumps, specifically the RSSH 1.2-C and RSSH 1.4-D models, are designed for agricultural applications such as irrigation, livestock watering, and gardening.

Australia Positive Displacement Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Capacities Covered | Low Capacity Pumps, Medium Capacity Pumps, High Capacity Pumps |

| Pump Characteristics Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End Use Industries Covered | Oil and Gas, Water and Wastewater, Automotive, Chemicals and Petrochemicals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia positive displacement pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia positive displacement pumps market on the basis of product type?

- What is the breakup of the Australia positive displacement pumps market on the basis of capacity?

- What is the breakup of the Australia positive displacement pumps market on the basis of pump characteristic?

- What is the breakup of the Australia positive displacement pumps market on the basis of raw material?

- What is the breakup of the Australia positive displacement pumps market on the basis of end use industry?

- What is the breakup of the Australia positive displacement pumps market on the basis of region?

- What are the various stages in the value chain of the Australia positive displacement pumps market?

- What are the key driving factors and challenges in the Australia positive displacement pumps market?

- What is the structure of the Australia positive displacement pumps market and who are the key players?

- What is the degree of competition in the Australia positive displacement pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia positive displacement pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia positive displacement pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia positive displacement pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)