Australia Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Potato Chips Market Overview:

The Australia potato chips market size reached USD 704.0 Million in 2024. Looking forward, the market is projected to reach USD 902.6 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The market is witnessing steady growth due to increasing consumer demand and changing tastes. The steady growth indicates its robust presence in the nation's packaged food market, driven by greater availability and a surging preference for convenient snack foods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 704.0 Million |

| Market Forecast in 2033 | USD 902.6 Million |

| Market Growth Rate 2025-2033 | 2.80% |

Key Trends of Australia Potato Chips Market:

Rising Demand for Health-Oriented Snack Options

Health consciousness has become a key factor influencing snack choices across Australia, as consumers increasingly prioritize foods that align with balanced diets and active lifestyles. As a result, the potato chip sector is witnessing a significant move towards healthier versions. Reduced sodium, no preservative, and less saturated fat products are being sought after. In addition, baked, air-popped, and kettle-cooked styles produced using wholesome oils like olive or sunflower are popular. For example, in September 2024, Aldi Blackstone Deli Style Truffle & Olive Oil Potato Chips received the Best Newcomer choice from Australian consumers in the People's Picks, indicating growing popularity for premium-style potato chips. Furthermore, there is also growing appeal in organic, non-GMO, and allergen-free versions. These trends indicate a more general consumer shift toward clean-label eating. With manufacturers responding to changing needs, the industry should see increased value from sustained consumer demand for wellness-oriented snacking. Australia potato chip market outlook will continue to be positive as product innovation remains on track with priorities for public health and the increased popularity of improved-for-you snacking options.

To get more information on this market, Request Sample

Flavour Innovation and Cultural Fusion Drive Engagement

Taste in Australia is becoming increasingly diversified as shoppers proactively search for new and culturally derived snacking experiences. In the potato chip segment, the trend can be seen through increased access to global and local Australian cuisine-driven flavors. For instance, in August 2023, Pringles introduced two hot potato chip flavors—Sizzlin' Chipotle Sour Cream and Smokin' Cajun Spice—throughout Australia and New Zealand, developed in collaboration with Michelin-starred Chef Haikal Johari to meet local spice tastes. Moreover, options, such as Thai chili, butter chicken, truffle, and seaweed appeal to shoppers seeking newness and discovery. At the same time, locally inspired fusions, such as indigenous herbs and spices, provide national identity and gastronomic interest to consumers. These innovations create appeal for the product and build close consumer-brand bonds through limited edition and seasonal releases. Ongoing new flavour launches also promote repeat purchasing, driving product rotation on store shelves and fueling market competition. This experiential snacking revolution has expanded consumer interaction and raised the perceived value of the category. Consequently, Australia potato chips market share in the snack food market is witnessing a quantifiable growth fueled by enduring demand for innovative flavour profiles.

Expansion of Online Retail and Direct-to-Consumer Access

E-commerce is transforming consumer engagement with Australian food products, especially within the snack category. Internet retailing, enabled by sophisticated logistics and user-friendly websites, has become a convenient and effective means of buying potato chips. Consumers are increasingly drawn to the convenience of being able to scan wider ranges, enjoy exclusive online products that are not available offline, and have products delivered to the home. Subscription services and snack box curation present increased personalization, which is attractive to contemporary consumers who appreciate variety and convenience. This trend is particularly evident among younger, city-dwelling populations who have grown up with mobile-first consumer experiences. Retailers are also using data analytics to refine offerings and individualize marketing efforts. The digital convenience of ordering pairs well with purchases made in-store, together making products more accessible. This diversification of distribution channels guarantees more regular purchases and broader brand visibility. As a result, Australia potato chips market growth is being fueled by the convergence of digital commerce, which broadens market reach and deepens consumer interaction across demographics.

Growth Drivers of Australia Potato Chips Market:

Youth and Urban Demand

The increasing impact of younger populations and rapid urban lifestyles significantly drives potato chip consumption in Australia. Younger consumers tend to favor convenient and flavorful snacking options making potato chips a preferred choice for quick meals, social events, and informal dining. The attraction of trendy flavors, limited-time offerings, and innovative packaging strongly appeals to this demographic further enhancing sales. Urban consumers managing work, studies, and social activities find chips to be an affordable and easily accessible snack available at various retail outlets, vending machines, and online platforms. This vibrant consumer group continues to support the growth of Australia potato chips market demand ensuring that this segment remains a critical part of the overall snacking industry.

Marketing and Branding Strategies

Prominent marketing and branding strategies are essential in driving consumer interaction in the Australia potato chips industry. Companies are implementing energetic promotional campaigns, celebrity endorsements, and social media marketing to appeal to wider consumers. Innovative packaging and transparent product labeling are increasing shelf presence and provoking impulsive buying. Most brands are developing strong loyalty programs and launching seasonal or limited-time flavors to sustain consumer excitement. Partnerships with foodservice companies and restaurants are expanding brand visibility and diversifying distribution. Such initiatives drive brand familiarity and foster consumer confidence and loyalty, so marketing innovation is critical to long-term growth in the potato chips segment.

Premiumization Trend

The shift toward premium snacking is transforming consumer preferences in the Australia potato chips market. The growing desire for artisanal, organic, and small-batch chips is appealing to health-conscious and quality-focused buyers who seek more authentic flavors and healthier ingredients. Products crafted from locally sourced potatoes, cooked in healthier oils, and offered in unique textures are becoming increasingly popular. Consumers are willing to invest more in chips that promise exceptional taste, minimal additives, and sustainable production methods. This premium segment attracts urban professionals and niche snack lovers who value quality over cost. According to Australia potato chips market analysis, the premiumization trend is opening new avenues for manufacturers, positioning chips as gourmet lifestyle products instead of mere casual snacks.

Australia Potato Chips Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plain

- Flavoured

The report has provided a detailed breakup and analysis of the market based on the product type. this includes plain and flavoured.

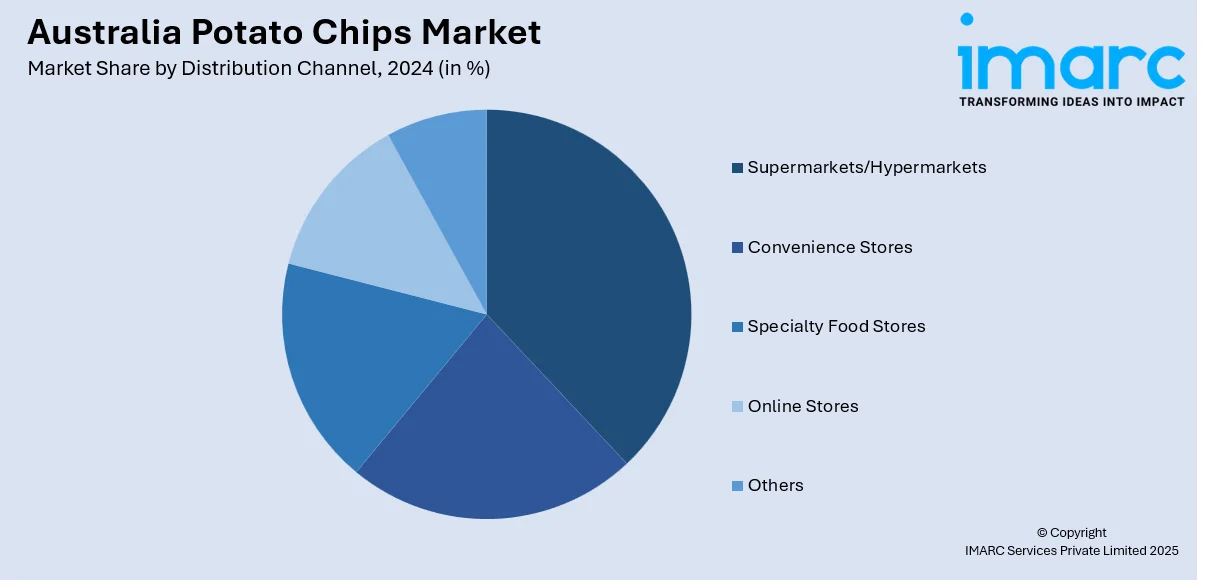

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Chappy's

- Pringles

- Snackbrands Australia

- The Smith’s Snackfood Company Pty Ltd (PepsiCo Inc.)

- Tixana Pty Limited

Australia Potato Chips Market News:

- In October 2024, Lay's released its Kettle Cooked Cajun Spice Potato Chips in Australia this October. Filled with red and black pepper, paprika, and buttermilk, the spicy-sweet combination reinvents Southern flavors in crunchy potato shape.

- In April 2024, Choice magazine's consumer group ranked Birds Eye's Golden Crunch Thin and Crispy Chips as the top supermarket frozen potato chips, with a score of 88%. The brand's Microwave Shoestring Chips ranked lowest at 37%, which indicates significant quality difference in Australia's expanding frozen potato chips market.

Australia Potato Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plain, Flavoured |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Chappy's, Pringles, Snackbrands Australia, The Smith’s Snackfood Company Pty Ltd (PepsiCo Inc.), Tixana Pty Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia potato chips market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia potato chips market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potato chips market in Australia was valued at USD 704.0 Million in 2024.

The Australia potato chips market is projected to exhibit a compound annual growth rate (CAGR) of 2.80% during 2025-2033.

The Australia potato chips market is expected to reach a value of USD 902.6 Million by 2033.

The potato chips market in Australia is experiencing several trends, including a heightened demand for healthier choices, such as air-fried and low-sodium options. Additionally, there is a growing interest in bold and exotic flavors, along with a rising consumer preference for sustainable packaging. Furthermore, online shopping and snack subscription services are becoming increasingly popular among contemporary consumers.

Market growth is driven by rising snacking occasions across households, strong penetration in entertainment and social gatherings, and greater availability of chips in multipack and value formats. Expanding distribution through convenience stores, supermarkets, and online platforms, along with strong brand competition, further continues to fuel steady expansion of the Australia potato chips market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)