Australia Poultry Market Size, Share, Trends and Forecast by Product Type, Nature, Distribution Channel, and Region, 2025-2033

Australia Poultry Market Size and Share:

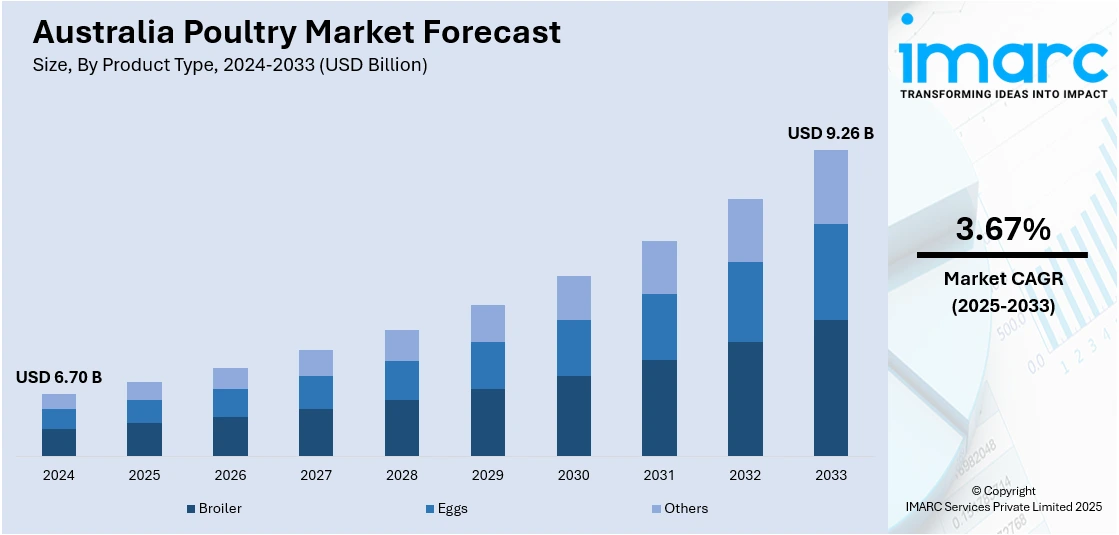

The Australia poultry market size reached USD 6.70 Billion in 2024. Looking forward, the market is expected to reach USD 9.26 Billion by 2033, exhibiting a growth rate (CAGR) of 3.67% during 2025-2033. The rising consumer preference for lean proteins, increasing demand for affordable and convenient meat options, advancements in poultry farming technology, expanding quick-service restaurant (QSR) chains, and heightened focus on animal welfare and antibiotic-free production practices are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.70 Billion |

| Market Forecast in 2033 | USD 9.26 Billion |

| Market Growth Rate 2025-2033 | 3.67% |

Key Trends of Australia Poultry Market:

Surge in Demand for Antibiotic-Free and Free-Range Poultry Products

A major trend shaping the Australian poultry market is the growing consumer demand for antibiotic-free and free-range poultry, driven by increased health consciousness, ethical considerations, and concerns over antimicrobial resistance. In response, major retailers like Coles and Woolworths have expanded their offerings of free-range, organic, and ethically raised poultry. Producers are investing in biosecurity, vaccination programs, and alternative farming methods to reduce antibiotic use. This shift is also influencing regulatory bodies to assess stricter transparency and labeling standards. Aligned with Australia’s National Antimicrobial Resistance Strategy, this movement supports reducing antibiotic use in livestock and promoting sustainable agriculture, positioning antibiotic-free and free-range poultry for continued growth through 2025 and beyond.

To get more information on this market, Request Sample

Growth of Value-Added and Ready-to-Eat Poultry Products

The rising preference for value-added and ready-to-eat (RTE) poultry products is playing a key role in transforming the Australian poultry market. This trend is driven by busy lifestyles, urbanization, and a shift toward convenient yet nutritious food options. Products like marinated cuts, pre-cooked chicken, poultry meal kits, and seasoned fillets are popular among time-conscious consumers seeking quick meal solutions. Major companies like Ingham's and Baiada are responding by launching innovative lines targeting health-conscious and convenience-driven consumers, including low-sodium, keto-friendly, and high-protein options. This shift reflects broader changes in Australian dietary preferences, with value-added poultry set to continue driving market growth.

Growth Drivers of Australia Poultry Market:

Rising Health Awareness and Lean Protein Preference

Dietary trends are changing as people in Australia are increasingly becoming health conscious, and the evidence is in the shift to food choices that favor active and balanced lifestyles. Red meat is slowly being replaced with poultry, particularly chicken, since it has less saturated fat, contains high-quality protein, among other reasons. Consumers regard clean eating and consider chicken as the right choice to lose weight, for fitness diets, and well-being. This is also manifested in its versatility that can be used in different cuisines and preparing styles, grilled, roasted, stir-fried, or steamed. Conversing with a time of growing appreciation of functional and nutritionally dense foods, chicken is a good product to sync with the shifting tastes of consumers. This strong nutritional profile and alignment with wellness trends make poultry a central component in the Australian diet, fueling consistent Australia poultry market growth.

Expanding Quick-Service and Foodservice Sectors

Australia's fast-paced urban lifestyle and rising demand for convenient dining options have fueled the expansion of the quick-service restaurant (QSR) and broader foodservice sectors. Global and local chains and independent stores also tend to introduce chicken into the menu as it is cheap, easy to prepare, and most people accept it. Chicken wraps, fried chicken, chicken burgers, and grilled chicken dishes have been added to menus to ensure that users have a variety and that they can get what they are looking for before the weather changes. The increasing demand for online food-delivery systems is also a factor that has aided an increase in the supply of poultry in various locations. Additionally, the increasing number of multicultural food outlets enhances the presence of chicken across cuisines. This growing foodservice demand strengthens poultry's role as a preferred protein, driving sustained Australia poultry market share.

Technological Advancements in Production Efficiency

Innovation across Australia’s poultry farming sector is transforming operations and improving productivity. Modern poultry farms are adopting automated feeding systems, climate-controlled housing, and advanced monitoring technologies to optimize bird health and welfare. Precision farming techniques allow for better control over feed ratios, resulting in improved growth rates and reduced waste. Enhanced biosecurity protocols and disease detection systems are minimizing risks of outbreaks, reducing mortality, and maintaining consistent output. These advancements also support sustainability goals by improving resource efficiency and minimizing environmental impact. Furthermore, real-time data analytics and AI-driven insights are streamlining farm management and decision-making. Collectively, these technologies lower operational costs, boost yields, and enhance quality, making poultry farming more resilient and competitive in an increasingly demanding and regulated market.

Opportunities of the Australia Poultry Market:

Expansion into Export Markets

Australia’s poultry industry is well-positioned to expand its presence in international markets, particularly across Asia and the Middle East, where demand for high-quality, safe, and ethically produced poultry is on the rise. The country’s reputation for clean, disease-free production practices, supported by stringent food safety regulations, adds to its global competitiveness. As middle-class populations grow and dietary preferences shift in importing countries, the demand for Australian poultry is expected to increase. Moreover, free trade agreements and streamlined export protocols are making it easier for producers to access these high-growth regions. By focusing on halal certification, frozen and processed offerings, and meeting diverse consumer preferences, Australian poultry exporters can tap into lucrative global opportunities and diversify beyond the domestic market.

Development of Plant-Poultry Hybrid Products

The growing popularity of flexitarian diets is opening a new category in the protein market, plant-poultry hybrids. These innovative products combine lean chicken with plant-based ingredients such as legumes, grains, and vegetables to deliver healthier, lower-fat options that appeal to health-conscious consumers, driving the Australia poultry market demand. They cater to those seeking to reduce meat intake without fully switching to vegetarian alternatives. The combination of animal and plant proteins allows producers to diversify offerings, reduce production costs, and appeal to sustainability-focused buyers. Hybrid products also provide a cleaner label and nutritional advantages by increasing fiber and reducing saturated fats. As consumer interest in alternative protein formats rises, developing these cross-category products offers Australian poultry companies a competitive edge and growth potential in both domestic and export markets.

Integration of Smart Farming and Traceability Systems

The adoption of advanced digital technologies is transforming Australia’s poultry sector into a more transparent, efficient, and responsive industry. Tools like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) enable real-time monitoring of bird health, feed consumption, environmental conditions, and production metrics. Blockchain enhances traceability from farm to fork, assuring consumers of food safety, origin, and ethical production practices. These systems are increasingly important as buyers demand higher animal welfare standards and supply chain transparency. Smart farming also supports early detection of disease and efficient resource use, improving sustainability and operational efficiency. By integrating these technologies, poultry producers can meet regulatory expectations, boost consumer trust, and remain competitive in a digitally evolving global food economy.

Challenges of Australia Poultry Market:

Rising Input and Feed Costs

One of the major challenges facing Australia’s poultry industry is the sharp increase in feed and input costs, driven by global grain market volatility, transportation disruptions, and inflationary pressures. Feed typically accounts for the largest share of production expenses, and unpredictable pricing of key ingredients like corn and soybean meal directly affects operational profitability. Additionally, climate change and extreme weather events, such as droughts and floods, disrupt crop yields, further tightening feed supply and escalating prices. These conditions force producers to either absorb higher costs or pass them on to consumers, which can impact competitiveness. Smaller farms are particularly vulnerable, often lacking the scale or financial flexibility to manage such fluctuations. Without long-term feed security strategies, cost volatility may continue to challenge growth and investment in the sector.

Environmental and Sustainability Pressures

Australia’s poultry industry is under increasing pressure to reduce its environmental footprint in response to heightened regulatory scrutiny and growing consumer awareness. According to the Australia poultry market analysis, key concerns include water consumption, greenhouse gas emissions, energy usage, and effective waste management. The need to adopt eco-friendly practices, such as renewable energy integration, manure recycling, and water-saving technologies, can lead to significant capital investment. Meeting corporate sustainability targets or certification standards often involves overhauling facilities and supply chains, which is particularly demanding for small and mid-sized producers. Additionally, balancing environmental goals with economic viability remains a complex task. As retailers and foodservice companies demand greater transparency and accountability in sourcing, producers must align operations with sustainability expectations to remain competitive while also navigating compliance with evolving environmental regulations.

Biosecurity and Disease Management Risks

Biosecurity remains a critical concern for Australia’s poultry sector, as disease outbreaks like avian influenza can severely disrupt operations and trade. Maintaining high standards of biosecurity requires consistent investment in surveillance, staff training, farm hygiene protocols, and facility design. The close confinement of birds in intensive systems increases the risk of rapid disease transmission, making early detection and response systems essential. Additionally, strict national and international biosecurity regulations necessitate regular audits and reporting, adding administrative burdens. Disease outbreaks not only result in economic losses due to bird culling and production halts but also damage industry reputation and export potential. With rising global movement of goods and climate-related changes affecting pathogen patterns, ensuring robust disease management is a complex yet unavoidable responsibility for all poultry stakeholders.

Australia Poultry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, nature, and distribution channel.

Product Type Insights:

- Broiler

- Eggs

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes broiler, eggs, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

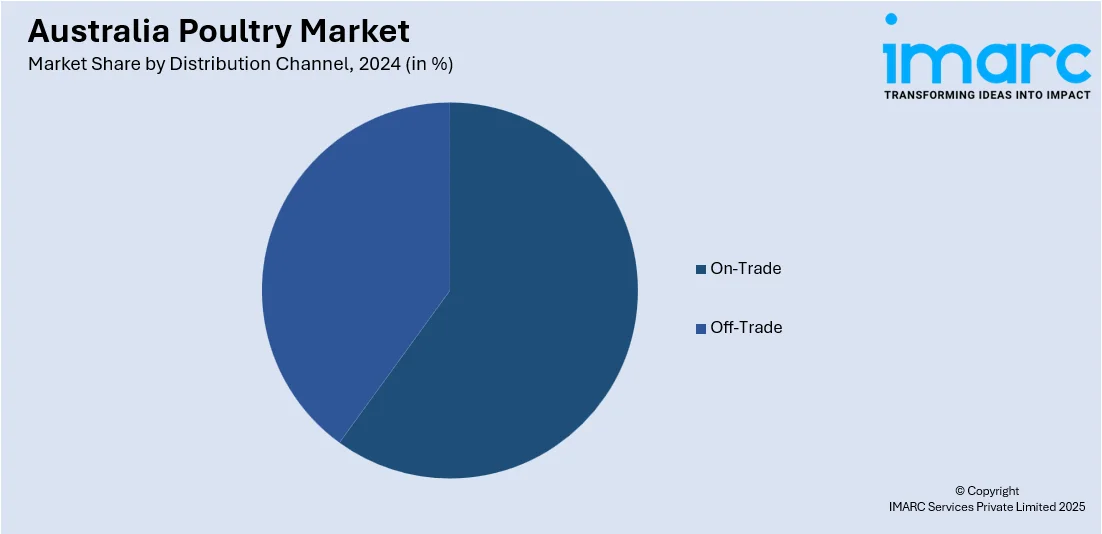

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Poultry Market News:

- November 2024: The Western Australian government granted Mt Barker Chicken, a meat processor, AUD 1 million to expand its operations and seize new market prospects. This grant will reportedly enable Mt Barker Chicken to acquire processing equipment, increase capacity by 30%, and enhance water, energy, and emissions efficiency.

- July 2024: Smart Commercial Solar established Australia's largest off-grid chicken farm, Agright, in Griffith, New South Wales. The project is reportedly Australia's largest off-grid poultry operation, powered by a 3.98 MW solar array and a 4.4 MWh battery system. This innovative setup supplies energy to 40 broiler chicken barns and six staff residences and exemplifies sustainable poultry farming through renewable energy integration.

Australia Poultry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Broiler, Eggs, Others |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia poultry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia poultry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia poultry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The poultry market in Australia was valued at USD 6.70 Billion in 2024.

The Australia poultry market is projected to exhibit a CAGR of 3.67% during 2025-2033.

The Australia poultry market is projected to reach a value of USD 9.26 Billion by 2033.

The Australia poultry market's key trends include rising demand for ethical, free-range, and ready-to-eat products, driven by health consciousness and convenience. Technological advancements like automation and renewable energy are boosting efficiency. Growth drivers are increasing consumer demand for affordable, lean protein, Quick-Service Restaurant expansion, and export opportunities, alongside a strong focus on animal welfare and biosecurity.

The growth drivers for the Australia poultry market include increasing consumer demand for lean, affordable, and convenient protein, especially ready-to-eat products. Further growth is fueled by innovation in farming technology, expanding Quick-Service Restaurant (QSR) chains, a strong focus on animal welfare, strategic investments, and growing export opportunities in markets like Papua New Guinea and Vietnam.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)