Australia Powder Coating Equipment Market Size, Share, Trends and Forecast by Resin Type, Component, End-Use Industry, and Region, 2026-2034

Australia Powder Coating Equipment Market Summary:

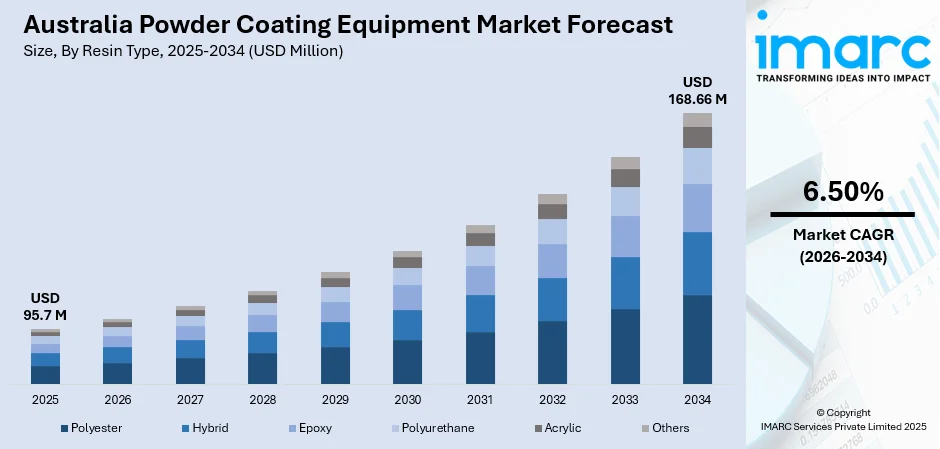

The Australia powder coating equipment market size was valued at USD 95.7 Million in 2025 and is projected to reach USD 168.66 Million by 2034, growing at a compound annual growth rate of 6.50% from 2026-2034.

The Australia powder coating equipment market is experiencing robust growth driven by the expanding construction and infrastructure sectors, increasing demand from the mining and resources industry, and a strong shift toward sustainable and environmentally friendly coating solutions. Powder coatings have emerged as a preferred alternative to traditional liquid coatings due to their near-zero volatile organic compound emissions and superior durability. The general industrial sector, encompassing machinery manufacturing, metal fabrication, and equipment production, continues to be the primary consumer of powder coating equipment. Rising urbanization, infrastructure development projects across major cities, and government investments in transportation and renewable energy projects are further propelling market expansion across the country.

Key Takeaways and Insights:

- By Resin Type: Polyester dominates the market with a share of 35% in 2025, owing to its excellent weather resistance, superior UV stability, and suitability for outdoor applications that are essential for Australia's harsh climate conditions requiring durable exterior finishes.

- By Component: Kneader leads the market with a share of 32% in 2025, driven by its critical role in the initial mixing and compounding stages of powder coating production, ensuring homogeneous distribution of resins, pigments, and additives for consistent product quality.

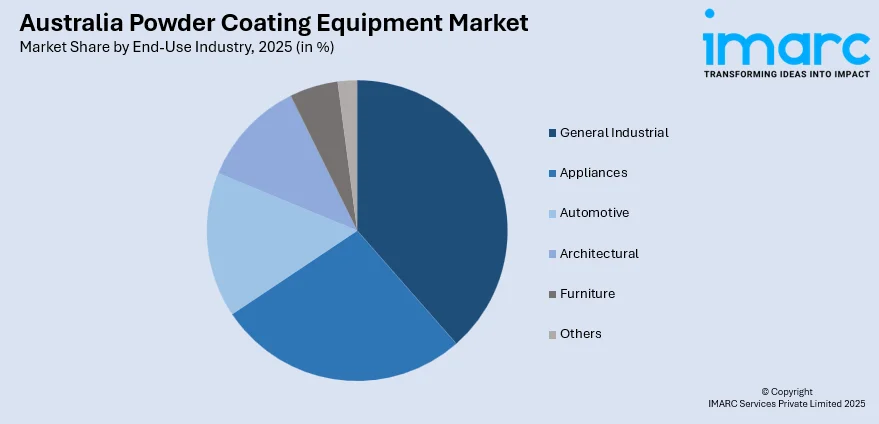

- By End-Use Industry: General Industrial represents the largest segment with a market share of 30% in 2025, supported by extensive applications across machinery manufacturing, metal fabrication, structural steel components, and industrial equipment requiring protective and aesthetic surface finishing solutions.

- Key Players: The Australia powder coating equipment market exhibits a moderately consolidated competitive structure, with established global manufacturers competing alongside regional equipment suppliers and specialized technology providers catering to diverse industrial coating requirements.

To get more information on this market, Request Sample

The Australian powder coating equipment market is characterized by continuous technological advancement and growing emphasis on operational efficiency. Equipment manufacturers are increasingly focusing on developing automated systems with advanced electrostatic application technology, improved powder recovery mechanisms, and energy-efficient curing systems. Recently, LINK Powder Coating announced that it has adopted Capral Aluminium’s LocAl® Green lower-carbon aluminium — signalling a shift toward more sustainable raw‑material sourcing in powder‑coating operations. This move highlights how environmental considerations are starting to shape not just coatings but also upstream material choices. The construction sector's sustained growth, particularly in residential and commercial developments across Sydney, Melbourne, and Brisbane, creates consistent demand for architectural coating applications. Additionally, the mining sector's requirements for heavy-duty protective coatings for equipment and infrastructure components contribute significantly to market expansion. Environmental regulations encouraging low-emission coating technologies and industry initiatives toward sustainable manufacturing practices are further accelerating the adoption of advanced powder coating equipment across diverse end-use sectors.

Australia Powder Coating Equipment Market Trends:

Growing Emphasis on Sustainable and Eco-Friendly Coating Solutions

The Australian market is witnessing a significant shift toward environmentally sustainable coating technologies as industries prioritize reducing their carbon footprint and complying with stringent environmental regulations. Powder coatings, with their near-zero volatile organic compound emissions and minimal waste generation, are increasingly preferred over traditional solvent-based alternatives. In September 2025, BASF, AkzoNobel and Arkema announced a value‑chain collaboration that lowered the carbon footprint of architectural powder coatings (Interpon D range) by up to 40% — leveraging bio‑attributed raw materials and supplier‑specific carbon data. Manufacturers are investing in advanced equipment capable of handling bio-based and recycled powder formulations, reflecting the broader industry commitment to circular economy principles and sustainable manufacturing practices.

Advancement in Automation and Smart Manufacturing Technologies

Integration of automation, robotics, and Industry 4.0 technologies is transforming powder coating operations across Australian manufacturing facilities. Advanced equipment featuring automated spray systems, real-time thickness monitoring, and predictive maintenance capabilities is gaining traction among high-volume producers seeking enhanced consistency and reduced operational costs. For example, Automated Solutions Australia (ASA) — a major supplier of robotic finishing lines in Australia — highlights how its integration of FANUC paint robots and automated spray systems is driving improved yield, process control and repeatable quality for coating applications. These technological advancements enable manufacturers to achieve superior coating quality while minimizing material wastage and improving overall production efficiency throughout the coating process.

Rising Demand for High-Performance and Specialty Powder Coatings

The market is experiencing growing demand for specialized powder coating equipment capable of processing advanced formulations, including heat-resistant, antimicrobial, and ultra-durable coatings. These high-performance products cater to demanding applications in mining equipment, transportation infrastructure, and outdoor architectural elements exposed to Australia's challenging climate conditions. According to sources, demand is rising especially for “super durable powders,” formulations engineered to resist UV degradation, weathering, and mechanical wear, making them ideal for heavy duty and outdoor applications. Equipment manufacturers are responding by developing versatile systems that accommodate diverse powder formulations while maintaining precise application parameters and consistent finish quality.

Market Outlook 2026-2034:

The Australia powder coating equipment market is positioned for sustained growth through the forecast period, supported by continued infrastructure investments, expanding manufacturing activities, and increasing adoption of sustainable coating technologies. Government commitments to major transportation projects, renewable energy infrastructure, and urban development initiatives will drive demand for industrial coating applications. The market generated a revenue of USD 95.7 Million in 2025 and is projected to reach a revenue of USD 168.66 Million by 2034, growing at a compound annual growth rate of 6.50% from 2026-2034.

Australia Powder Coating Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Resin Type | Polyester | 35% |

| Component | Kneader | 32% |

| End-Use Industry | General Industrial | 30% |

Resin Type Insights:

- Polyester

- Hybrid

- Epoxy

- Polyurethane

- Acrylic

- Others

The polyester dominates with a market share of 35% of the total Australia powder coating equipment market in 2025.

Polyester-based powder coatings represent the leading resin type in Australia due to their exceptional durability, outstanding weather resistance, and superior UV stability essential for the country's harsh outdoor conditions. The versatility of polyester formulations makes them suitable for diverse applications ranging from architectural aluminum facades and window frames to outdoor furniture and automotive components. In 2025, Dulux Powder Coatings announced that it has completed 33 Environmental Product Declarations (EPDs) across its powder coating product lines, including its polyester based ranges such as Duratec, covering products manufactured and sold in Australia. Equipment designed for polyester powder processing benefits from well-established application parameters and consistent curing characteristics.

The preference for polyester coatings is reinforced by their excellent color retention properties and resistance to chalking, critical attributes for maintaining aesthetic appearance in Australia's high UV exposure environment. Powder coating equipment manufacturers have optimized their systems for polyester formulations, offering enhanced recovery efficiency and precise film thickness control. Growing demand from the construction and architectural sectors continues to drive investments in polyester-compatible equipment across manufacturing facilities nationwide.

Component Insights:

- Kneader

- Extruder

- Cooling Equipment

- Grinder

- Others

The kneader leads with a share of 32% of the total Australia powder coating equipment market in 2025.

Kneaders serve as essential equipment in powder coating manufacturing, facilitating the initial mixing and compounding of raw materials including resins, hardeners, pigments, and additives. The component's critical role in achieving homogeneous distribution of ingredients directly impacts final product quality and consistency. BUSS, a leading supplier of compounding systems, highlights that its PCS Co Kneader series is used in powder coating production to handle formulations including polyester, epoxy, and hybrids, providing precise temperature control and consistent mixing for high quality output. Australian manufacturers increasingly invest in advanced kneading systems featuring precise temperature control and optimized screw configurations for enhanced material processing efficiency.

The kneader segment benefits from ongoing technological improvements aimed at reducing processing times and energy consumption while maintaining superior mixing performance. Modern systems incorporate advanced monitoring capabilities enabling real-time process optimization and quality assurance. Growing domestic powder coating production capacity and expanding specialty formulation requirements continue driving demand for high-performance kneading equipment across the Australian market.

End-Use Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Appliances

- Automotive

- General Industrial

- Architectural

- Furniture

- Others

The general industrial with a market share of 30% of the total Australia powder coating equipment market in 2025.

The general industrial segment encompasses a broad range of applications including machinery manufacturing, structural steel fabrication, industrial equipment production, and metal component finishing. This sector's sustained demand for powder coating equipment reflects the ongoing industrial expansion across Australian manufacturing facilities requiring durable and corrosion-resistant surface finishes. For example, in the steel fabrication industry, powder coating is widely used for structural steel components, industrial machinery, pipelines, conveyor systems, and metal enclosures — delivering strong corrosion and chemical resistance along with a uniform finish suitable for heavy‑duty industrial applications. Equipment investments in this segment emphasize versatility, high throughput capacity, and consistent coating quality across diverse substrate geometries.

Industrial manufacturers increasingly prioritize powder coating solutions offering superior protective properties against Australia's challenging environmental conditions, including coastal salt exposure, extreme temperatures, and high UV radiation. The segment benefits from growing requirements for equipment coatings in mining, agriculture, and transportation industries where durability and longevity are paramount considerations driving coating equipment specifications and selection.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

New South Wales represents the largest regional market for powder coating equipment, driven by Sydney's extensive construction activities, major infrastructure projects including Sydney Metro, and concentrated manufacturing base. The region hosts significant industrial coating operations serving architectural, automotive, and general industrial sectors. Government investments in transportation infrastructure and urban development continue generating sustained demand for coating equipment across metropolitan and regional areas.

Victoria maintains a strong position in the powder coating equipment market, supported by Melbourne's robust manufacturing sector and ongoing mega-infrastructure projects including the Melbourne Metro Tunnel. The region's diverse industrial base encompasses automotive components, architectural products, and consumer goods manufacturing. Tasmania contributes through specialized applications in marine equipment and agricultural machinery requiring durable protective coatings resistant to harsh coastal conditions.

Queensland's powder coating equipment market is propelled by the state's significant mining and resources sector, construction activities in Brisbane and the Gold Coast, and expanding manufacturing operations. The region's mining industry requires heavy-duty coating equipment capable of processing specialized formulations for equipment protection against extreme operating conditions. Growing renewable energy infrastructure projects create additional demand for industrial coating applications across the state.

The Northern Territory and South Australia collectively contribute to the market through mining operations, defense industry requirements, and regional infrastructure development. Adelaide's manufacturing sector serves diverse industrial coating applications while Darwin's strategic location supports coating operations for mining equipment and infrastructure. Both regions emphasize coatings capable of withstanding extreme temperatures and challenging environmental conditions prevalent across remote operational areas.

Western Australia represents a significant market driven primarily by the state's dominant mining and resources sector concentrated in the Pilbara region. The iron ore, gold, and lithium mining industries require substantial coating equipment investments for processing protective formulations for heavy machinery, transportation equipment, and infrastructure components. Perth's manufacturing sector and expanding construction activities provide additional demand for architectural and industrial coating applications across the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Powder Coating Equipment Market Growing?

Expansion of Industrial and Infrastructure Projects

The continuous growth of industrial construction, automotive manufacturing, and infrastructure development across Australia is significantly driving demand for powder coating equipment. Manufacturers and fabricators require durable, corrosion-resistant, and visually appealing finishes for metal surfaces used in large-scale projects. Investing in modern powder coating systems ensures high-quality, uniform coatings while supporting high-volume production. In 2025, the Future Made in Australia Innovation Fund committed A$750 million to boost the metals manufacturing sector, supporting modern equipment upgrades and adoption of advanced manufacturing processes, creating a favourable environment for increased deployment of powder coating and related finishing equipment. Advanced equipment allows companies to meet stringent project specifications efficiently, improving productivity and helping businesses stay competitive in a rapidly expanding industrial and construction landscape.

Rising Focus on Operational Efficiency and Cost Reduction

Australian manufacturers are increasingly prioritizing methods to optimize production efficiency while minimizing material and energy wastage in coating processes. Powder coating equipment that enables faster curing, accurate application, and reduced rework directly supports cost reduction and operational streamlining. In 2025, the Australian Government launched a $5 billion Net Zero Fund to help heavy industries invest in new, low‑emission and energy‑efficient equipment — a move that encourages adoption of modern coating systems for reduced energy consumption. Businesses are adopting modern systems that require less maintenance, consume less energy, and improve workflow efficiency. By integrating such equipment, companies can achieve consistent product quality, faster turnaround times, and a stronger competitive position in the manufacturing sector.

Demand for Versatile Coating Solutions Across Diverse Industries

A growing number of industries, including furniture, appliances, transportation, and metal fabrication, are seeking flexible coating solutions for varied product types and sizes. Powder coating equipment capable of handling different materials, complex geometries, and diverse finishes enables manufacturers to meet these evolving demands efficiently. The Australia powder coatings market size reached USD 436.80 Million in 2024, and it is expected to grow to USD 760.38 Million by 2033, reflecting rising adoption of powder coating technologies across multiple industrial sectors. Modern systems allow for rapid changeovers between product lines while maintaining consistent quality. This versatility not only reduces downtime but also supports innovation, helping companies address niche applications and deliver customized solutions to a broader range of customers.

Market Restraints:

What Challenges the Australia Powder Coating Equipment Market is Facing?

High Initial Equipment and Installation Costs

The substantial capital investment required for advanced powder coating equipment systems presents a significant barrier, particularly for small and medium-sized enterprises seeking to establish or upgrade coating capabilities. Complete production lines incorporating kneaders, extruders, cooling systems, and grinders require considerable initial outlay along with installation infrastructure and facility modifications to accommodate specialized equipment requirements.

Raw Material Price Volatility and Supply Chain Constraints

Fluctuations in raw material prices including resins, pigments, and curing agents impact equipment utilization rates and coating production economics. Supply chain disruptions affecting key input materials can result in production delays and increased operational costs. Australian manufacturers face additional challenges related to import dependencies for specialized equipment components and powder coating raw materials from international suppliers.

Technical Complexity and Workforce Skill Requirements

Advanced powder coating equipment requires skilled operators and maintenance personnel capable of managing sophisticated automated systems, quality control processes, and troubleshooting technical issues. The limited availability of specialized workforce talent and training programs creates operational challenges for manufacturers seeking to maximize equipment performance and maintain consistent production quality across coating operations.

Competitive Landscape:

The Australia powder coating equipment market exhibits a moderately consolidated competitive structure featuring established global manufacturers alongside regional equipment suppliers and specialized technology providers. International companies maintain significant market presence through direct sales operations, authorized distributors, and local service networks supporting equipment installation and maintenance. Domestic players compete through customized solutions, responsive customer service, and technical support capabilities addressing specific requirements of Australian manufacturing operations. Competition increasingly centers on technological advancement, energy efficiency, automation capabilities, and after-sales service quality. Strategic partnerships between equipment manufacturers and powder coating formulators enable integrated solutions addressing complete coating system requirements from raw material processing through final application stages.

Recent Developments:

- In October 2025, Australian Aluminium Finishing (AAF) announced a major upgrade to its aluminium‑finishing plants, installing the latest powder coating technology to deliver premium-quality finishes. Upgrades include high-density powder flow adapted to horizontal lines, ATE Pure Powder Flow spray‑booths with electrostatic guns, and Evergrain® woodgrain finishes in Melbourne and Sydney, enhancing both aesthetic appeal and industrial durability.

- In September 2025, Australia has revised its standard for architectural aluminium powder coatings, introducing AS 3715:2025 — Thermoset Powder Coatings for Architectural Aluminium, replacing the 2002 version. The update provides a performance‑based framework aligned with modern coating technologies and Australia’s diverse corrosivity zones, likely driving demand for durable, corrosion- and UV-resistant coatings and encouraging adoption of advanced powder‑coating systems.

Australia Powder Coating Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Hybrid, Epoxy, Polyurethane, Acrylic, Others |

| Components Covered | Kneader, Extruder, Cooling Equipment, Grinder, Others |

| End-Use Industries Covered | Appliances, Automotive, General Industrial, Architectural, Furniture, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia powder coating equipment market size was valued at USD 95.7 Million in 2025.

The Australia powder coating equipment market is expected to grow at a compound annual growth rate of 6.50% from 2026-2034 to reach USD 168.66 Million by 2034.

Polyester dominated the resin type segment with a 35% market share, driven by its excellent weather resistance, superior UV stability, and suitability for outdoor architectural applications throughout Australia.

Key factors driving the Australia powder coating equipment market include expanding construction and infrastructure development, growing mining sector requirements, increasing environmental regulations favoring sustainable coating technologies, and technological advancements in automated application systems.

Major challenges include high initial equipment and installation costs, raw material price volatility, supply chain constraints for specialized components, technical complexity requiring skilled workforce, and competitive pressure from established liquid coating alternatives in certain application segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)