Australia Powder Coatings Market Size, Share, Trends and Forecast by Resin Type, Coating Method, Application, and Region, 2026-2034

Australia Powder Coatings Market Summary:

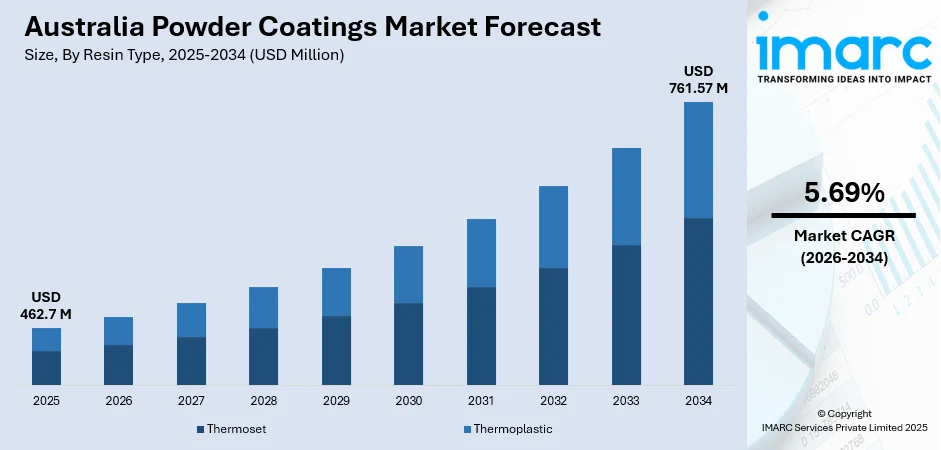

The Australia powder coatings market size was valued at USD 462.7 Million in 2025 and is projected to reach USD 761.57 Million by 2034, growing at a compound annual growth rate of 5.69% from 2026-2034.

The market is driven by the increasing demand for durable, eco-friendly finishes in industrial, automotive, and construction sectors. Powder coatings are valued for strong adhesion, chemical resistance, and appeal; thus, they provide quality, durable surface protection. Further, growing application in residential, commercial, and infrastructure projects is driving market growth, whereas innovations in application technologies and formulations improve efficiency, performance, and sustainability. The momentum of the market reflects the broader trends toward high-quality, eco-conscious coating solutions across diversified sectors.

Key Takeaways and Insights:

- By Resin Type: Thermoset dominates the market with a share of 65% in 2025, capturing the largest share. Their superior durability, excellent chemical resistance, and ability to deliver high-performance, long-lasting finishes make them ideal for diverse industrial, automotive, and construction applications.

- By Coating Method: Electrostatic spray leads the market with a share of 80% in 2025, offering uniform coverage, operational efficiency, and ease of application. Its effectiveness on complex surfaces and versatility across industrial, automotive, and construction projects reinforce its position as the preferred coating method in Australia.

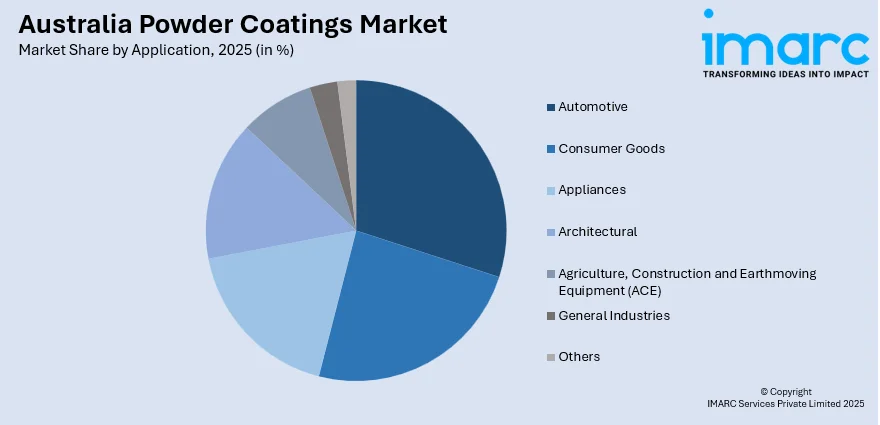

- By Application: Automotive commands the market with a share of 25% in 2025. Growing demand for corrosion-resistant, aesthetically appealing, and durable finishes, along with increasing vehicle production and emphasis on long-lasting protective coatings, positions automotive applications at the forefront of the market.

- Key Players: The competitive landscape is marked by major players focusing on technological innovation, sustainability, and strategic growth. Companies leverage advanced coating solutions, robust distribution networks, and tailored products to strengthen market presence, enhance competitiveness, and meet evolving industry requirements.

To get more information on this market, Request Sample

The market is expanding due to a growing emphasis on sustainable and eco-friendly finishing solutions. Increasing industrialization, urban infrastructure projects, and a rising automotive sector are driving demand for durable surface protection. Powder coatings offer advantages such as minimal environmental impact, superior adhesion, chemical resistance, and long-lasting finishes, making them preferred over traditional liquid coatings. Rising adoption in construction, household appliances, and industrial equipment is stimulating market growth. Additionally, innovations in coating technologies, including efficient application methods and advanced resin formulations, are further enhancing product performance and appeal. Consumer preference for premium and high-quality finishes also fuels market momentum across commercial and residential sectors.

Australia Powder Coatings Market Trends:

Sustainable Powder Coatings

Increasing environmental awareness is driving the adoption of sustainable powder coatings in Australia. These coatings offer low volatile organic compounds, reduced environmental impact, and high durability. In August 2025, Dulux Powder Coatings launched 33 Environmental Product Declarations (EPDs) across its Australian range, providing verified environmental performance data to support sustainable building projects and Green Star submissions. Moreover, industries and commercial projects are prioritizing eco-friendly solutions that combine performance with sustainability, aligning with regulations and green building initiatives. Manufacturers are developing green formulations to meet growing demand while ensuring energy-efficient production and minimized emissions. Sustainable powder coatings are gaining traction across automotive, construction, and industrial applications, reflecting a shift toward long-lasting, environmentally responsible surface protection solutions.

Advanced Application Technologies

Innovations in application methods, including automated electrostatic systems, robotic spraying, and precision coating equipment, are reshaping the Australia powder coatings market. In November 2025, Sparc Technologies partnered with Dulux Australia to trial ecosparc graphene-enhanced coatings on Cape Jaffa Lighthouse, protecting the historic cast iron structure from corrosion and harsh coastal conditions. Furthermore, these technologies improve coating uniformity, accuracy, and efficiency, reducing material waste and operational costs. Adoption in automotive, industrial, and construction sectors supports faster project completion while maintaining consistent high-quality finishes. Manufacturers and end-users benefit from improved productivity, reduced labor intensity, and enhanced repeatability. Continuous advancement in application technologies is driving market growth by delivering superior performance, efficiency, and sustainability in powder coating processes.

Color and Finish Customization

Rising demand for aesthetic appeal is encouraging diverse color palettes, textures, and specialty finishes in Australia’s powder coatings market. Manufacturers are offering customizable solutions to meet industrial and consumer preferences, architectural trends, and brand-specific requirements. In March 2024, Dulux Powder Coatings refreshed its CustomColour™ service in Australia, offering tailored, made-to-order powder coating colours for unique architectural and industrial projects. Additionally, enhanced flexibility allows coatings to deliver unique visual effects, metallic or textured surfaces, and tailored finishes across automotive, residential, and commercial projects. This focus on combining functionality with visual appeal is increasing adoption, enabling end-users to achieve durable, high-performance coatings while expressing design creativity, individuality, and sophistication in finished products.

Market Outlook 2026-2034:

The Australia powder coatings market is expected to witness consistent revenue growth through 2034. Increasing industrialization, infrastructure development, and automotive sector expansion will drive demand for durable and eco-friendly coatings. Powder coatings’ advantages, including chemical resistance, aesthetic versatility, and environmental sustainability, will further support market adoption. Innovations in coating technologies, efficient application methods, and enhanced resin formulations will enhance product performance, creating new opportunities. Industrial, commercial, and residential applications will continue to dominate, contributing to rising revenue streams. The market generated a revenue of USD 462.7 Million in 2025 and is projected to reach a revenue of USD 761.57 Million by 2034, growing at a compound annual growth rate of 5.69% from 2026-2034.

Australia Powder Coatings Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Resin Type | Thermoset | 65% |

| Coating Method | Electrostatic Spray | 80% |

| Application | Automotive | 25% |

Resin Type Insights:

- Thermoset

- Epoxy

- Polyester

- Epoxy Polyester Hybrid

- Acrylic

- Thermoplastic

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

The thermoset dominates with a market share of 65% of the total Australia powder coatings market in 2025.

Thermoset resins are the largest segment in Australia’s powder coatings market, widely appreciated for their superior durability, chemical resistance, and long-lasting performance. In support of sustainability, the federal government’s Recycling Modernisation Fund (RMF) has established over 50 upgraded recycling facilities nationwide, enhancing circular economy practices for industries including coatings. These resins provide exceptional adhesion and high-quality finishes, making them ideal for industrial, automotive, and construction applications where robust surface protection is required. Their ability to withstand harsh environmental conditions ensures consistent performance over time, which drives widespread adoption across various sectors.

These powder coatings also offer flexibility in application methods and a broad range of color and texture options, enhancing their appeal for both functional and decorative purposes. Manufacturers and end-users prefer thermoset resins for projects requiring minimal maintenance and superior aesthetic appeal. Their long-term reliability and high-performance characteristics make thermoset resins the dominant choice in Australia’s powder coatings market.

Coating Method Insights:

- Electrostatic Spray

- Fluidized Bed

The electrostatic spray leads with a share of 80% of the total Australia powder coatings market in 2025.

Electrostatic spray coating is the leading application method in Australia, recognized for its uniform coverage, precision, and efficiency. The technique uses electrostatic charges to attract powder particles to surfaces, ensuring consistent coating even on complex geometries. This method reduces material waste while improving finish quality, making it highly favored across industrial, automotive, and construction applications.

The popularity of electrostatic spray is also driven by its ease of integration into automated production lines and its compatibility with a wide range of powder formulations. Its ability to deliver smooth, high-quality finishes with minimal overspray enhances productivity and operational efficiency, securing its position as the dominant coating method in the Australian market.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Consumer Goods

- Appliances

- Automotive

- Architectural

- Agriculture, Construction and Earthmoving Equipment (ACE)

- General Industries

- Others

The automotive dominates with a market share of 25% of the total Australia powder coatings market in 2025.

Automotive coatings are the largest application segment, driven by the increasing demand for corrosion-resistant, durable, and aesthetically appealing vehicle finishes. In 2024, the Australia automotive paints and coatings market size reached USD 626.91 Million, highlighting the sector’s significant contribution to the overall coatings industry. Powder coatings protect automotive components from environmental exposure while enhancing color retention and surface smoothness, making them essential for both OEM and aftermarket applications.

The segment benefits from growing vehicle production, repair, and customization trends, as powder coatings provide long-lasting finishes with minimal maintenance. Their efficiency, durability, and range of finishes make automotive applications a major revenue contributor in Australia’s powder coatings market, reinforcing the segment’s leading position across end-use industries.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory and New South Wales region experiences strong demand for powder coatings due to rapid urbanization, infrastructure development, and a robust automotive sector. Industrial and residential construction projects drive the need for durable, high-quality finishes, while sustainability initiatives encourage adoption of eco-friendly and low-emission coating solutions. In August 2024, LINK Powder Coating adopted Capral’s LocAl® Green lower-carbon aluminium, reducing its environmental footprint and advancing sustainable practices in Australia’s powder coating industry.

Victoria and Tasmania exhibit growing interest in powder coatings, supported by increasing manufacturing activities and commercial construction projects. The region emphasizes aesthetic appeal alongside durability, prompting demand for advanced coating technologies. Local initiatives promoting environmentally responsible products further enhance adoption, as industries seek coatings that combine performance, sustainability, and cost efficiency.

Queensland’s powder coatings market is shaped by expanding industrial and automotive activities, along with infrastructure and residential development. The region favors coatings with high durability, chemical resistance, and low environmental impact. Government and industry efforts to implement sustainable practices further support the uptake of eco-friendly powder coating solutions across commercial, industrial, and automotive applications.

Northern Territory and South Australia demonstrate steady growth in powder coatings demand, driven by mining, industrial equipment manufacturing, and urban development projects. The region values high-performance coatings capable of withstanding harsh environmental conditions. Adoption is supported by increasing awareness of sustainable materials and regulations encouraging environmentally responsible finishing solutions.

Western Australia’s powder coatings market benefits from strong mining, construction, and automotive sectors. The region prioritizes coatings that offer durability, corrosion resistance, and minimal environmental impact. Rising industrial and residential activities, combined with sustainability initiatives, encourage manufacturers and contractors to adopt advanced powder coating technologies for long-lasting, high-quality finishes.

Market Dynamics:

Growth Drivers:

Why is the Australia Powder Coatings Market Growing?

Expanding Industrial and Infrastructure Development

The market is growing as industrialization and infrastructure projects increase demand for durable and high-quality surface finishes. Powder coatings are widely used in manufacturing, construction, and heavy machinery applications due to their chemical resistance, long-lasting performance, and aesthetic appeal. In August 2023, Capral Aluminium installed a new CUBE Plus vertical powder coating line at its Huntingwood, NSW facility, enhancing automation, efficiency, and sustainability, while acquiring Allyman Aluminium to expand its distribution network in Australia. Additionally, the growing focus on modern infrastructure, commercial buildings, and industrial facilities is driving adoption, as powder coatings enhance product longevity, minimize maintenance, and provide reliable protection in diverse environmental conditions. This sustained industrial expansion is a key factor boosting market growth across the country.

Rising Environmental Awareness and Sustainability Initiatives

Sustainability considerations are propelling the adoption of powder coatings in Australia. These coatings are eco-friendly alternatives to liquid paints, producing minimal waste and negligible volatile organic compounds. Industries are increasingly prioritizing green manufacturing practices, seeking coatings that align with environmental regulations while maintaining high performance. In May 2024, Axalta launched the Alesta® BioCore™ range, the industry’s first ISCC Plus-certified biobased powder coatings, providing sustainable, high-performance alternatives that reduce CO₂ emissions while maintaining durability and finish quality. Further, the shift toward environmentally responsible products encourages innovation in formulations, finishes, and application technologies, ensuring both durability and reduced ecological impact. Rising awareness of sustainable practices in industrial, automotive, and construction sectors continues to drive revenue growth for powder coatings in the region.

Technological Advancements and Product Innovation

Technological progress in powder coating resins, application methods, and finishing techniques is supporting market expansion. Innovations such as advanced electrostatic spraying, robotic coating systems, and specialty resins improve efficiency, coverage, and surface performance. Customizable color options, textures, and functional coatings enhance aesthetics while meeting diverse industrial requirements. Improved durability, corrosion resistance, and chemical stability increase product appeal for automotive, industrial, and architectural applications. Continuous research and development in coating technologies allows manufacturers to provide high-performance solutions, making powder coatings the preferred choice for a wide range of end-users in Australia.

Market Restraints:

What Challenges the Australia powder coatings Market is Facing?

High Initial Equipment Investment

Implementing advanced powder coating systems requires significant upfront capital for machinery, curing ovens, and application infrastructure. Small-scale manufacturers often find it difficult to bear these costs, which can limit their ability to adopt modern, efficient coating technologies. High investment requirements may slow the expansion of powder coating operations in certain industrial and commercial segments, restricting market penetration and adoption in emerging or cost-sensitive sectors.

Technical Expertise Requirement

Effective application of powder coatings demands skilled operators and technical knowledge to achieve uniform coverage, optimal curing, and minimal material wastage. Lack of trained personnel can result in inferior finishes, reduced efficiency, and increased operational costs. This expertise requirement creates a barrier for new entrants or smaller companies attempting to adopt advanced coating technologies, limiting the overall growth potential and expansion of powder coatings across diverse applications.

Limitations on Substrate Compatibility

Powder coatings are not universally suitable for all surface types. Certain heat-sensitive, flexible, or irregular substrates may experience poor adhesion or finish quality, reducing the range of applications. These limitations restrict adoption in specialized industrial sectors or products requiring delicate or complex surface treatments. Manufacturers may need alternative solutions for such materials, limiting market opportunities and influencing decision-making when selecting coating methods for diverse applications.

Competitive Landscape:

The Australia powder coatings market demonstrates a moderately competitive landscape, featuring established companies and regional manufacturers prioritizing innovation, quality, and sustainability. Firms are investing in research and development to deliver advanced resin formulations, specialty finishes, and efficient application technologies suited for industrial, automotive, and construction sectors. Strategic partnerships and collaborations help expand market reach, optimize production, and enhance technological capabilities. Emphasis on eco-friendly formulations, energy-efficient processes, and regulatory compliance aligns with sustainability trends. Product differentiation through durability, corrosion resistance, color diversity, and aesthetic appeal remains vital. Continuous innovation and performance-focused strategies drive growth and strengthen competitiveness across the market.

Recent Developments:

- In January 2025, AkzoNobel formally introduced the Interpon D Futura Collection to the Australian and New Zealand markets. Designed for architects and designers, the solvent-free, sustainable powder coatings feature three curated colour palettes—Merging Worlds, Healing Nature, and Soft Abstraction—offering durable performance with up to 25-year warranties and Environmental Product Declaration (EPD) certification.

- In May 2024, Dulux Powder Coatings partnered with South Australian recycler Transmutation to convert factory powder waste into PostPrime Plastic™ Bar Chairs. This GECA-certified solution supports a circular economy, reduces carbon emissions, and offers a sustainable, durable, and eco-friendly alternative for concrete reinforcement in Australian construction projects.

Australia Powder Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered |

|

| Coating Methods Covered | Electrostatic Spray, Fluidized Bed |

| Applications Covered | Consumer Goods, Appliances, Automotive, Architectural, Agriculture, Construction and Earthmoving Equipment (ACE), General Industries, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia powder coatings market size was valued at USD 462.7 Million in 2025.

The Australia powder coatings market is expected to grow at a compound annual growth rate of 5.69% from 2026-2034 to reach USD 761.57 Million by 2034.

Thermoset resins held the largest share in the Australia powder coatings market, valued for their exceptional durability, chemical resistance, and ability to deliver high-performance, long-lasting finishes across a wide range of industrial, automotive, and construction applications.

The market growth is fueled by industrial and automotive sector expansion, rising demand for eco-friendly finishes, and technological innovations that improve coating performance, application efficiency, and versatility, supporting adoption across diverse industrial, commercial, and construction applications.

Key challenges include high initial investment in equipment, the need for skilled technical expertise to ensure optimal coating performance, and limited compatibility with certain heat-sensitive or irregular surfaces, restricting adoption in specific applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)