Australia Power Cables Market Size, Share, Trends and Forecast by Installation, Voltage, Material, End-Use Sector, and Region, 2025-2033

Australia Power Cables Market Overview:

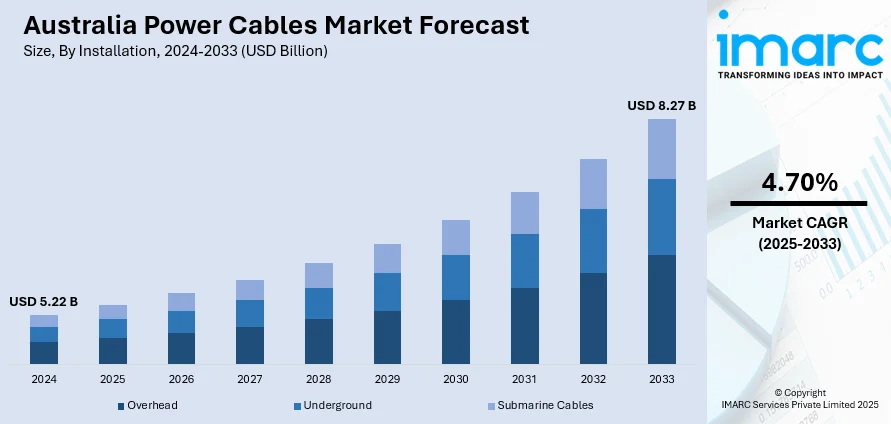

The Australia power cables market size reached USD 5.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.27 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market is being driven by increasing investments in renewable energy projects, rise in grid modernization initiatives, expanding infrastructure development, rising electricity demand, government support for sustainable power, and the transition to smart grids.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.22 Billion |

| Market Forecast in 2033 | USD 8.27 Billion |

| Market Growth Rate 2025-2033 | 4.70% |

Australia Power Cables Market Trends:

Rapid Renewable Energy Integration Necessitating Advanced Transmission Infrastructure

Australia's push toward renewable energy is transforming its power infrastructure. By 2023, renewables accounted for 35% of the country's electricity generation, with solar contributing 16%, wind 12%, and hydro 6%. The Clean Energy Council reported that 5.9 GW of renewable capacity was added in 2023, up from 5 GW in 2022. This growth highlights the need for resilient transmission systems to connect remote renewable energy sites to urban centers. The Australian Energy Market Operator (AEMO) noted that delays in projects like the 900 km EnergyConnect transmission line could hinder Australia’s goal of reaching 82% renewable energy by 2030. Achieving this target will require approximately 10,000 km of new and upgraded transmission lines. As a result, the demand for high-capacity power cables, including high-voltage and submarine varieties, is increasing. These upgrades, essential for integrating renewable sources into the grid and ensuring stable, reliable power distribution across the country, are boosting the demand for power cables.

To get more information on this market, Request Sample

Grid Modernization and Smart Grid Initiatives Enhancing Power Cable Demand

Australia's grid modernization efforts are central to reshaping its energy landscape. With a significant AUD 20 billion investment allocated through the Rewiring the Nation Fund, the country is focused on upgrading and expanding its grid to achieve 82% renewable electricity generation by 2030. The smart grid market is growing rapidly, driven by factors such as rising electricity costs, aging infrastructure, and the increasing demand for efficient energy management. The rollout of smart meters is also accelerating, aiming for 100% penetration by 2030, with current adoption rates varying from 39% to 99% across states. These advancements necessitate the deployment of advanced power cables capable of supporting two-way energy flows, real-time data transmission, and integration with distributed energy resources. Modern cables with enhanced insulation and monitoring capabilities are essential for the efficient operation of smart grids. Additionally, the transition to smart grids tackles the challenges of aging infrastructure and improves energy efficiency. Investments in advanced power cables are crucial to building a resilient and responsive energy network that meets the demands of the future.

Australia Power Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on installation, voltage, material, and end-use sector.

Installation Insights:

- Overhead

- Underground

- Submarine Cables

The report has provided a detailed breakup and analysis of the market based on the installation. This includes overhead, underground, and submarine cables.

Voltage Insights:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes high, medium, and low.

Material Insights:

- Copper

- Aluminum

The report has provided a detailed breakup and analysis of the market based on the material. This includes copper and aluminum.

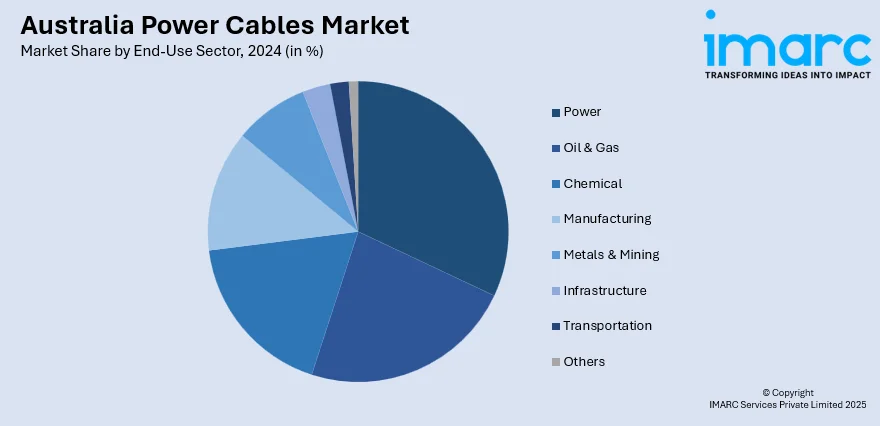

End-Use Sector Insights:

- Power

- Oil & Gas

- Chemical

- Manufacturing

- Metals & Mining

- Infrastructure

- Transportation

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes power, oil & gas, chemical, manufacturing, metals & mining, infrastructure, transportation, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Cables Market News:

- October 2024: SunCable received conditional approval from Singapore's Energy Market Authority to proceed with the Australia-Asia PowerLink (AAPowerLink) project. The initiative involves constructing a 12,400-hectare solar farm in the Northern Territory, an 800 km overhead transmission line to Darwin, and a 4,300 km high-voltage direct current (HVDC) undersea cable to Singapore. This subsea cable, expected to be the world’s longest, will deliver 2 GW of electricity.

- September 2024: Power Flex Cables partnered with Top Cable to distribute its advanced power cables in Australia. This collaboration brings high-quality European-manufactured cables to industries such as oil and gas, marine, and infrastructure. Notably, the cables are designed to perform in harsh environments, offering durability and reliability for critical projects.

Australia Power Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine Cables |

| Voltages Covered | High, Medium, Low |

| Materials Covered | Copper, Aluminum |

| End-Use Sectors Covered | Power, Oil & Gas, Chemical, Manufacturing, Metals & Mining, Infrastructure, Transportation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power cables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power cables market on the basis of installation?

- What is the breakup of the Australia power cables market on the basis of voltage?

- What is the breakup of the Australia power cables market on the basis of material?

- What is the breakup of the Australia power cables market on the basis of end-use sector?

- What are the various stages in the value chain of the Australia power cables market?

- What are the key driving factors and challenges in the Australia power cables?

- What is the structure of the Australia power cables market and who are the key players?

- What is the degree of competition in the Australia power cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power cables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)