Australia Power Plant Equipment Market Size, Share, Trends and Forecast by Technology, Power Plant Type, and Region, 2025-2033

Australia Power Plant Equipment Market Overview:

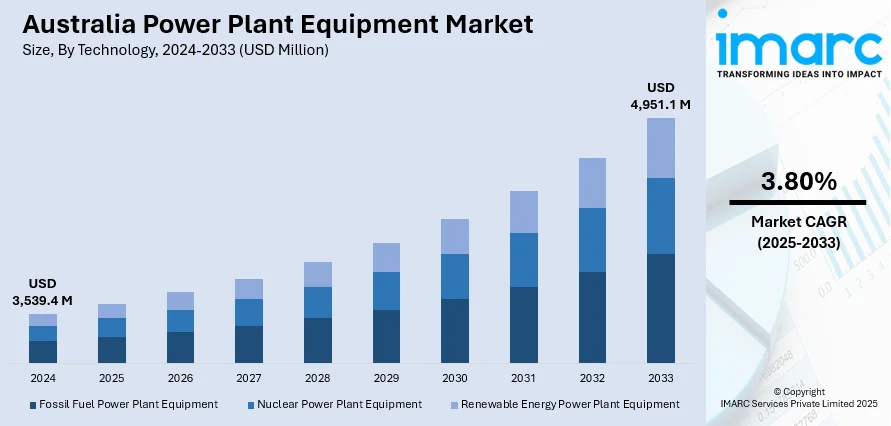

The Australia power plant equipment market size reached USD 3,539.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,951.1 Million by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is buoyed by the upgradation of old infrastructure, heightened use of renewable sources of energy, and extensive digital automation technology implementation. Rising investment in grid reliability and emission-friendly equipment is adding efficiency to operations at both fossil and non-fossil power plants. Technology enhancements, especially in turbines, generators, and control systems, are driving long-term energy transformation objectives. These trends are all working together to impact the growth of the Australia power plant equipment market share over the last few years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,539.4 Million |

|

Market Forecast in 2033

|

USD 4,951.1 Million |

| Market Growth Rate 2025-2033 | 3.80% |

Australia Power Plant Equipment Market Trends:

Growth of Renewable-Compatible Power Equipment

Australia's expanding renewable energy environment is having a strong impact on the design and deployment of power plant equipment. The ever-growing incorporation of wind, solar, and hydro power into the country's national energy mix has fueled demand for variable generation input-compatible equipment. This encompasses smart grid interfaces, hybrid-capable turbines, energy storage devices, and flexible inverters. Dispatchable generation technologies are being implemented to stabilize the grid, and substations and transformers are being modernized to support two-way flow of electricity. Thermal power plants are implementing co-firing mechanisms and emission-reduction modules to conform to low-carbon initiatives. Modular and mobile generation units have increased in demand, particularly for remote and off-grid locations. Such changes mirror growth in both equipment performance and infrastructure durability. This transformation driven by renewables is contributing directly to the Australia power plant equipment market growth, guaranteeing long-term compatibility with a greener and diversified power system among states and territories. According to the sources, in September 2024, Fortescue began constructing a $225 million, 50 MW green hydrogen facility close to Gladstone, Queensland, with a goal of 8,000 tonnes annual output and first-stage operation in 2025.

To get more information on this market, Request Sample

Speeding Up Digital Automation and Predictive Maintenance

The digital changeover in Australia's power generation industry is bringing fundamental changes to the way power plant equipment is run and serviced. Smart sensors, online data capture systems, and AI-driven analytics are being more and more integrated into turbines, boilers, and switchgear to allow for ongoing performance monitoring and fault detection. Cloud-based control platforms and digital twin technologies are making it possible to centrally monitor several assets and schedule predictive maintenance, cutting unplanned outages dramatically. Automation has also enhanced the fuel management, temperature control, and emissions management efficiencies. With cybersecurity frameworks evolving in parallel, remote asset management is increasingly confided in. As matured infrastructure is upgraded with smart systems, plants are gaining amplified efficiency and reduced operation costs. Digitalization is also critical in meeting government regulations around safety and sustainability. These technology-led developments are influencing Australia power plant equipment market trends, demonstrating a move towards a smarter, more responsive, and data-focused way of managing power infrastructure. As per the reports, in August 2023, Queensland's Stanwell Power Station began installing Australia's biggest 1 MW/10 MWh iron flow battery as part of a AUD 100 million clean energy hub to become operational in September 2024.

Modernization and Retrofitting of Aging Power Plants

Australia's aging power infrastructure is being comprehensively modernized to prolong the life of current generation facilities and enhance their operating performance. Power plants constructed many decades ago are undergoing retrofitting with the latest turbines, efficiency boilers, high-capacity generator sets, and emissions-reducing modules to comply with present environmental and regulatory requirements. The incorporation of modular retrofit packages and condition-based monitoring equipment has made cost-effective upgrades possible with very minimal disruption to operations. Plant operators are additionally spending in digital control systems and auxiliary services to ensure stable power under new load scenarios. These retrofits contribute to grid reliability, particularly at peak times, and are regarded as a viable option to outright decommissioning. The focus on lifecycle extension enhances economic efficiency, in addition to national energy security. As upgrades to these infrastructures proceed, they are becoming a core driver for Australia power plant equipment market growth, providing continuous capacity while positioning the industry for upcoming energy changes.

Australia Power Plant Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and power plant type.

Technology Insights:

- Fossil Fuel Power Plant Equipment

- Nuclear Power Plant Equipment

- Renewable Energy Power Plant Equipment

The report has provided a detailed breakup and analysis of the market based on the technology. This includes fossil fuel power plant equipment, nuclear power plant equipment, and renewable energy power plant equipment.

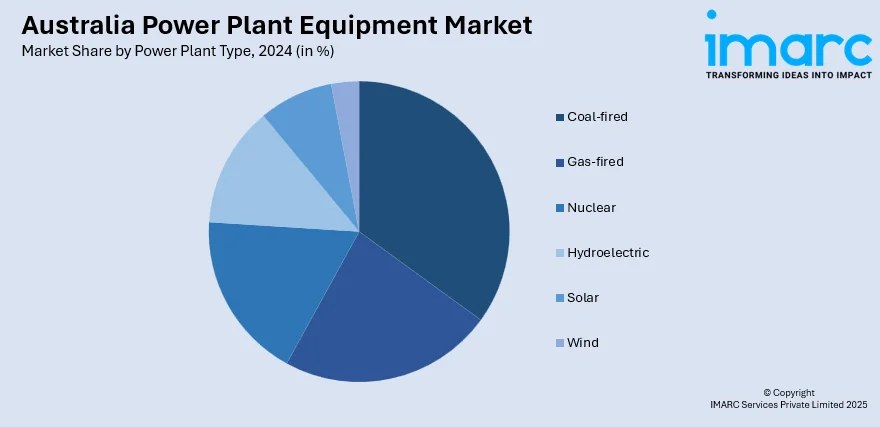

Power Plant Type Insights:

- Coal-fired

- Gas-fired

- Nuclear

- Hydroelectric

- Solar

- Wind

A detailed breakup and analysis of the market based on the power plant type have also been provided in the report. This includes coal-fired, gas-fired, nuclear, hydroelectric, solar, and wind.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Plant Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Fossil Fuel Power Plant Equipment, Nuclear Power Plant Equipment, Renewable Energy Power Plant Equipment |

| Power Plant Types Covered | Coal-fired, Gas-fired, Nuclear, Hydroelectric, Solar, Wind |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power plant equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power plant equipment market on the basis of technology?

- What is the breakup of the Australia power plant equipment market on the basis of power plant type?

- What is the breakup of the Australia power plant equipment market on the basis of region?

- What are the various stages in the value chain of the Australia power plant equipment market?

- What are the key driving factors and challenges in the Australia power plant equipment?

- What is the structure of the Australia power plant equipment market and who are the key players?

- What is the degree of competition in the Australia power plant equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power plant equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power plant equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power plant equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)