Australia Power Tools Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

Australia Power Tools Market Overview:

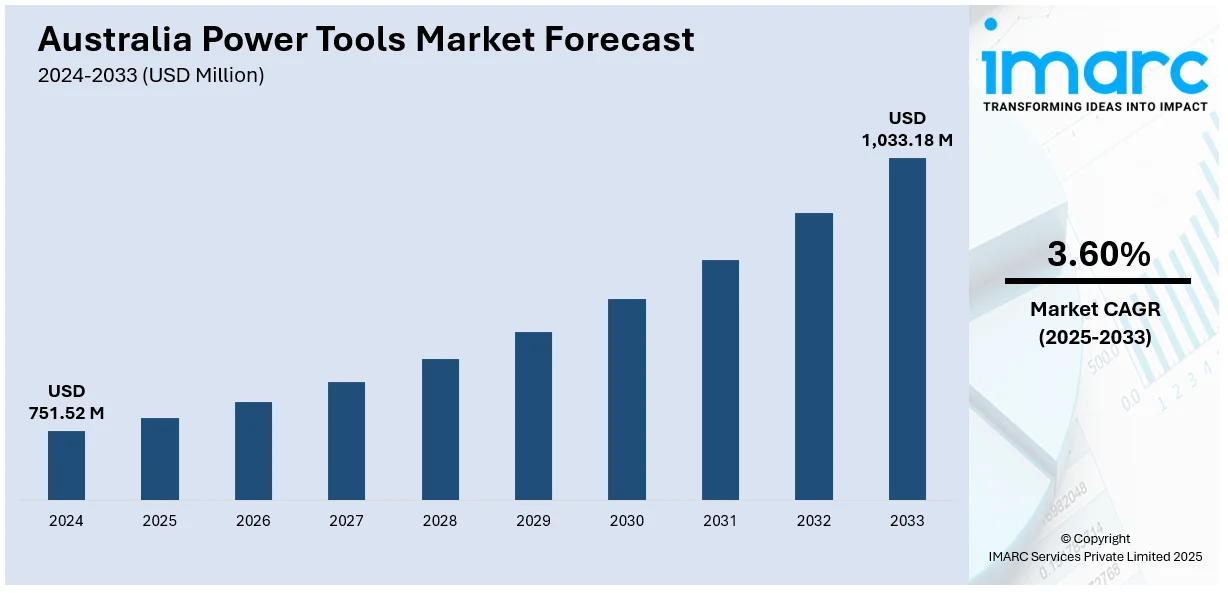

The Australia power tools market size reached USD 751.52 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,033.18 Million by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The growth of construction and infrastructure sectors is driving the demand for high-quality, efficient power tools, crucial for complex projects. Additionally, the growing number of e-commerce platforms is enhancing accessibility, enabling easier purchasing and wider reach, and contributing significantly to the Australia power tools market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 751.52 Million |

| Market Forecast in 2033 | USD 1,033.18 Million |

| Market Growth Rate 2025-2033 | 3.60% |

Australia Power Tools Market Trends:

Increase in Construction and Infrastructure Sectors

The construction and infrastructure industries in Australia are witnessing strong growth, leading to a rise in the demand for power tools. As major infrastructure initiatives, such as road building, housing projects, and commercial constructions accelerate, the demand for dependable, high-quality tools is becoming more essential. Sophisticated power tools are crucial in optimizing construction workflows, enhancing efficiency, and guaranteeing on-time project delivery. Notably, projects like the Melbourne North East Link (NEL) Road Project, estimated at around $8.5 billion, underscore the magnitude of investment in infrastructure, employing advanced technology like Tunnel Boring Machines (TBMs) for a 6.5km tunnel, expected to be finished by 2028. This substantial endeavor, together with an increasing number of residential and commercial initiatives, is driving the need for power tools that are resilient and able to meet the requirements of extensive construction projects. The continuous investments in infrastructure by the governing body further support this expansion, while a rising emphasis on sustainability and energy efficiency in construction encourages innovation within the power tools industry. This encompasses the emergence of environment-friendly designs and aspects like energy-efficient modes. As construction projects become more complex and sustainability becomes a priority, the demand for high-quality, versatile power tools is growing, ensuring the market remains strong and dynamic in the coming years.

To get more information on this market, Request Sample

Expansion of Online Sales Channels and E-Commerce Platforms

The rising number of e-commerce channels is bolstering the Australia power tools market growth, with more people choosing online platforms to buy tools. The ease of online shopping, along with the chance to compare prices, obtain thorough product details, and view user feedback, are simplifying the process for buyers to discover the appropriate tools for their needs. E-commerce platforms are expanding access to power tools, especially in remote regions, and offer convenient delivery options and promotions that attract both professional tradespeople and do-it-yourself (DIY) enthusiasts. The greater access to product descriptions, tutorial videos, and client reviews is also assisting buyers in making better decisions, improving the overall shopping experience. As more brands and retailers enhance their online presence, the availability and accessibility of power tools are improving, resulting in higher sales and broader market reach beyond traditional brick-and-mortar stores. The Australian e-commerce market, estimated at USD 536.0 billion in 2024, is expected to expand at a compound annual growth rate (CAGR) of 12.70%, aiming for USD 1,568.60 billion by 2033, as per the IMARC Group. This expansion of e-commerce is a key driver in the power tools sector, making tools more accessible and affordable while catalyzing the demand across various user segments, ranging from professionals to hobbyists.

Australia Power Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type.

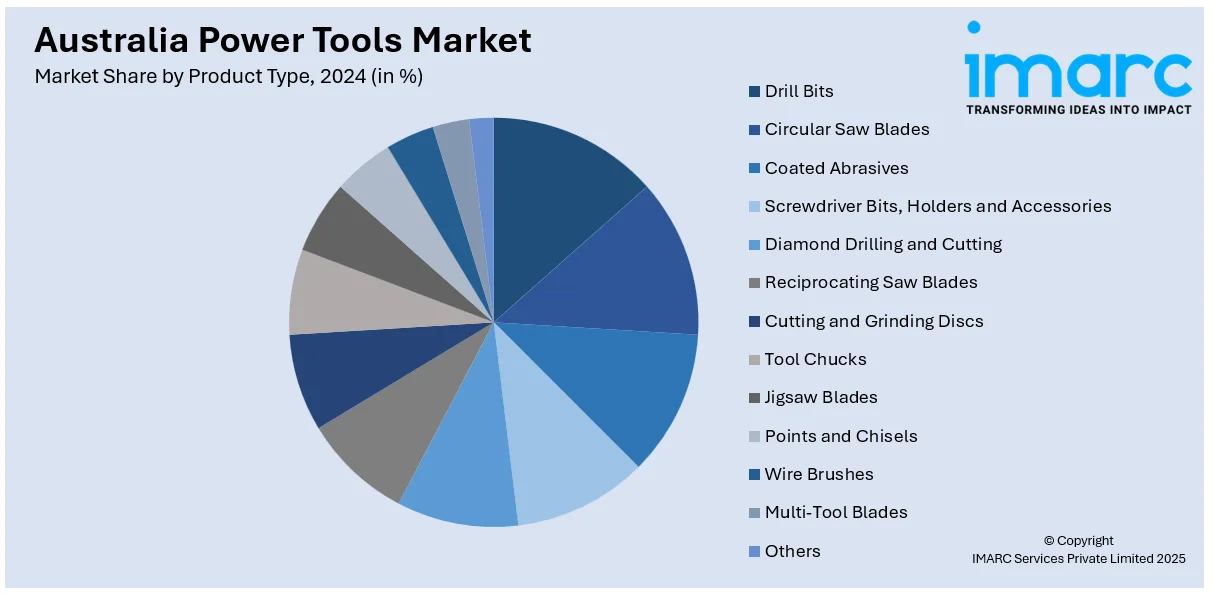

Product Type Insights:

- Drill Bits

- Circular Saw Blades

- Coated Abrasives

- Screwdriver Bits, Holders and Accessories

- Diamond Drilling and Cutting

- Reciprocating Saw Blades

- Cutting and Grinding Discs

- Tool Chucks

- Jigsaw Blades

- Points and Chisels

- Wire Brushes

- Multi-Tool Blades

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes drill bits, circular saw blades, coated abrasives, screwdriver bits, holders and accessories, diamond drilling and cutting, reciprocating saw blades, cutting and grinding discs, tool chucks, jigsaw blades; points and chisels, wire brushes, multi-tool blades, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Tools Market News:

- In February 2025, Stealth Group Holdings secured exclusive distribution rights in Australia and New Zealand for CAT® Power Tools, Wesco Power Tools, and Harden Hand Tools. These multi-year agreements support Stealth’s FY28 growth plan and aim to boost sales and profit margins. The partnerships enhance its competitive position in the power and hand tool market.

Australia Power Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Drill Bits, Circular Saw Blades, Coated Abrasives, Screwdriver Bits, Holders and Accessories, Diamond Drilling and Cutting, Reciprocating Saw Blades, Cutting and Grinding Discs, Tool Chucks, Jigsaw Blades, Points and Chisels, Wire Brushes, Multi-Tool Blades, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power tools market on the basis of product type?

- What is the breakup of the Australia power tools market on the basis of region?

- What are the various stages in the value chain of the Australia power tools market?

- What are the key driving factors and challenges in the Australia power tools market?

- What is the structure of the Australia power tools market and who are the key players?

- What is the degree of competition in the Australia power tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)