Australia Power Transmission Equipment Market Size, Share, Trends and Forecast by Equipment Type, Voltage Level, Application and Region, 2025-2033

Australia Power Transmission Equipment Market Size and Share:

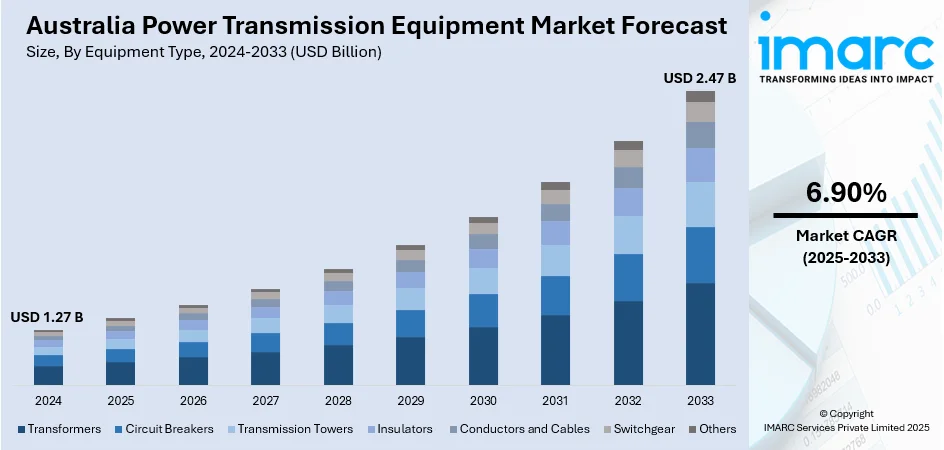

The Australia power transmission equipment market size reached USD 1.27 Billion in 2024. The market is projected to reach USD 2.47 Billion by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is t is expanding rapidly due to increasing renewable energy integration and government-backed infrastructure projects like EnergyConnect and HumeLink. Advances in smart grid technologies, including AI, IoT, and HVDC systems, are enhancing grid efficiency and reliability. Growing electricity demand and a strong focus on sustainable energy solutions further drive market growth. Investments from both public and private sectors continue to strengthen the network, boosting the overall Australia power transmission share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.27 Billion |

| Market Forecast in 2033 | USD 2.47 Billion |

| Market Growth Rate 2025-2033 | 6.90% |

Australia Power Transmission Equipment Market Trends:

Renewable Integration Driving Grid Upgrades

Australia is rapidly overhauling its electricity transmission network to support its shift to renewable energy. The Australian Energy Market Operator (AEMO) estimates that 10,000 km of new transmission lines are needed by 2050 to connect remote Renewable Energy Zones (REZs) to population centers, enabling a net-zero economy. In response, the government launched the AUD 20 billion “Rewiring the Nation” program to modernize infrastructure These developments aim to strengthen grid reliability, improve interconnectivity between states, and accommodate intermittent renewable sources such as wind and solar. Aging transmission assets are also being upgraded to support digitalization, real-time monitoring, and flexible load management. The growing use of technologies like dynamic line rating and smart substations reflects a shift toward a more adaptive grid. Private sector participation is increasing through co-investment and public-private partnerships. With renewable energy already accounting for over 35% of the energy mix in 2024, the modernization of Australia’s transmission network is essential to achieving net-zero targets and ensuring long-term energy security and sustainability.

To get more information on this market, Request Sample

Digital Monitoring and Automation

Australia's transmission grid is changing fast with the upgrade of its power grid using the latest digital monitoring and automation technologies, and it's a big step towards more intelligent, efficient grids. Dynamic line rating, remote diagnostics, and automated switching are some of the most important technologies being implemented in new as well as old infrastructure, drastically improving the reliability of the grid and allowing real-time fault detection. These technologies enable grid operators to better control power flows and react instantly to faults, reducing downtime and optimizing overall operational performance. By enabling more timely and accurate grid management, digital monitoring systems have a key role to play in enabling more renewable energy to be integrated into the grid, which is essential as Australia ramps up its shift toward a low-carbon energy future. This drive towards modernization not only enhances the resilience and responsiveness of the grid but also provides increasing support for the complexity growth of the Australia power transmission market growth over different levels of voltage as well as geography. Ultimately, the transformation to smart grids is pushing toward a more stable, flexible, and future-proofed electricity network that can cater to changing energy needs.

Demand for Interconnection and Resilience

Increasing interconnection capacity between various transmission grids is a growing priority in Australia to facilitate effective power sharing as well as improve energy security in the event of outages or peak demand periods. Attempts are being initiated to plan looped transmission systems, which provide multiple channels for electricity transmission, minimizing the likelihood of disruption. Redundancy planning is also given priority to guarantee that should a section of the grid shut down, alternative pathways can keep supply going without hindrance. Infrastructure resilience is also being enhanced to be able to withstand severe weather patterns, which are increasingly frequent and intense due to global warming. In June 2024, Transgrid announced plans to deploy up to 14 synchronous condensers and 4.8 GW of grid-forming batteries to stabilize the grid in New South Wales—replacing the system strength lost as coal plants retire and renewables surge. These assets bolster voltage control and provide alternative pathways, aligning with looped and redundant grid strategies. These coordinated strategies work towards ensuring stable electricity supply between regions so that the grid can absorb sudden stresses while facilitating continued investment in the industry. This holistic approach to transmission planning and grid design is redefining Australia's power network future. Possessing a strong presence in this space directly influences Australia power transmission market trends since grid resilience and local interconnectivity are now at the center of network value.

Australia Power Transmission Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, voltage level and application.

Equipment Type Insights:

- Transformers

- Circuit Breakers

- Transmission Towers

- Insulators

- Conductors and Cables

- Switchgear

- Others

The report has provided a detailed breakup and analysis of the market based on equipment type. This includes transformers, circuit breakers, transmission towers, insulators, conductors and cables, switch gear and others.

Voltage Level Insights:

- High Voltage (HV)

- Extra High Voltage (EHV)

- Ultra-High Voltage (UHV)

A detailed breakup and analysis of the market based on the voltage level have also been provided in the report. This includes high voltage (HV), extra high voltage (EHV) and ultra-high voltage (UHV).

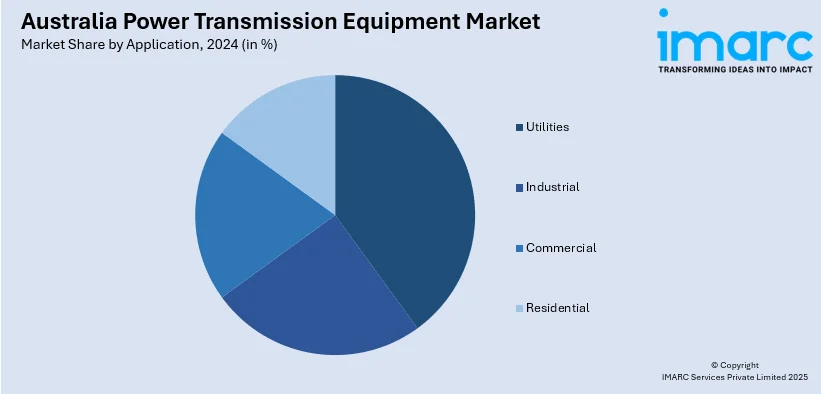

Application Insights:

- Utilities

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes utilities, industrial, commercial and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Power Transmission Equipment Market News:

- In December 2024: Transgrid revealed a $80–130 million program to modernize its control room systems. This includes implementation of AI/ML tools for predictive monitoring, advanced alarm analytics, and real-time visualization—enabling more dynamic and secure grid operation amid rising renewables.

- In May 2024 – Hitachi Energy was selected by Marinus Link Pty Ltd to supply HVDC technology for the Australia-first Marinus Link project. The 345-km undersea and underground cable will link Tasmania and Victoria, enabling two-way renewable energy flow, powering 1.5 million homes and supporting Australia’s Net Zero emissions goal by 2050.

Australia Power Transmission Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equiment Types Covered | Transformers, Circuit Breakers, Transmission Towers, Insulators, Conductors and Cables, Switchgear, Others |

| Voltages Covered |

High Voltage (HV), Extra High Voltage (EHV), Ultra-High Voltage (UHV) |

| Applications Covered | Utilities, Industrial, Commercial, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia power transmission market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia power transmission market on the basis of equipment type?

- What is the breakup of the Australia power transmission market on the basis of voltage level?

- What is the breakup of the Australia power transmission market on the basis of application?

- What is the breakup of the Australia power transmission market on the basis of region?

- What are the various stages in the value chain of the Australia power transmission market?

- What are the key driving factors and challenges in the Australia power transmission?

- What is the structure of the Australia power transmission market and who are the key players?

- What is the degree of competition in the Australia power transmission market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia power transmission market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia power transmission market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia power transmission industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)