Australia Prebiotic and Probiotic Foods Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, End User, and Region, 2025-2033

Australia Prebiotic and Probiotic Foods Market Size and Share:

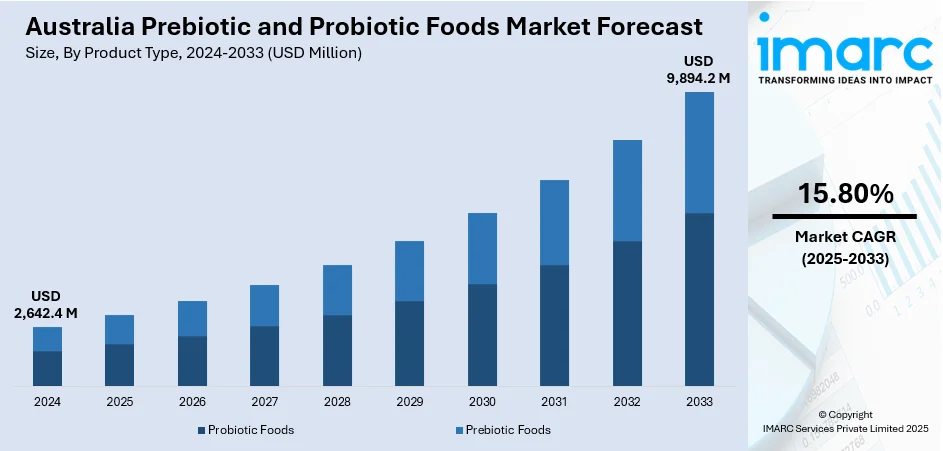

The Australia prebiotic and probiotic foods market size reached USD 2,642.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,894.2 Million by 2033, exhibiting a growth rate (CAGR) of 15.80% during 2025-2033. Government initiatives and health campaigns promoting gut health are driving the prebiotic and probiotic food market in Australia by increasing awareness and supporting functional food consumption. Additionally, the rise of retail and online distribution channels, such as e-commerce platforms and health stores, is making these foods more accessible, driving increased consumption and contributing to the expansion of the Australia prebiotic and probiotic foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,642.4 Million |

|

Market Forecast in 2033

|

USD 9,894.2 Million |

| Market Growth Rate 2025-2033 | 15.80% |

Australia Prebiotic and Probiotic Foods Market Trends:

Government Initiatives and Public Health Campaigns

Government programs and health campaigns focusing on gut health and overall wellness are significantly contributing to the growth of the prebiotic and probiotic food market in Australia. These initiatives, aimed at enhancing overall well-being and mitigating the effects of lifestyle-related diseases, often promote the consumption of functional foods that support digestive and immune health. In 2024, the Gut Foundation initiated its 'Gutcheck' campaign in partnership with The Brand Agency to promote awareness about digestive health throughout Australia. Through the use of humor and striking digital billboards, the campaign successfully reduced the stigma associated with gut health, prompting a greater number of individuals to candidly discuss digestive concerns and consider incorporating gut-enhancing foods into their meals. These efforts not only inform consumers about the benefits of prebiotics and probiotics but also help create a more favorable regulatory environment. Health agencies actively endorse products with validated health assertions, and regulatory bodies guarantee truthful labeling on food containers. This degree of openness fosters consumer trust and assurance in these products, enabling individuals to select functional foods that promote their health. As a result, public health initiatives are increasing the demand for prebiotic and probiotic foods as more people become aware about the importance of a healthy gut for overall well-being.

To get more information on this market, Request Sample

Expansion of Retail and Online Distribution Channels

The growth of retail and online distribution channels is notably increasing the availability of prebiotic and probiotic foods in Australia. Shopping online is becoming more convenient for buyers, allowing them to easily obtain a variety of functional foods from the comfort of their home. Numerous brands are currently providing specialized prebiotic and probiotic products via e-commerce platforms, reaching a broader audience nationwide. As a result, shoppers are more frequently opting to buy these functional foods online because of easy access and the opportunity to compare different products. Alongside e-commerce, supermarkets, health food shops, and pharmacies are increasing their variety of prebiotic and probiotic foods, enhancing accessibility for the everyday consumer. This wider accessibility via various channels is contributing to a rise in consumption while also assisting in informing individuals about the health advantages of these functional foods. The influence of online retail is clear in the Australian e-commerce sector, assessed at USD 536.0 billion in 2024, projected to rise to USD 1,568.60 billion by 2033, indicating a CAGR of 12.70% from 2025-2033, as reported by the IMARC Group. With the ongoing expansion of the e-commerce sector, the availability of these foods via online channels is boosting awareness and demand, greatly influencing the Australia prebiotic and probiotic foods market growth.

Australia Prebiotic and Probiotic Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, form, distribution channel, and end user.

Product Type Insights:

- Probiotic Foods

- Dairy Products

- Non-Dairy Products

- Beverages

- Supplements

- Prebiotic Foods

- Whole Grains

- Vegetables

- Fruits

- Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes probiotic foods (dairy products, non-dairy products, beverages, and supplements) and prebiotic foods (whole grains, vegetables, fruits, and supplements).

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

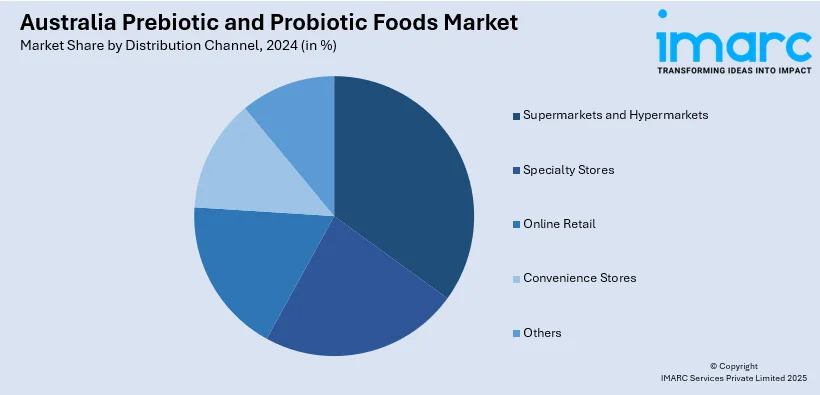

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online retail, convenience stores, and others.

End User Insights:

- Adults

- Children

- Geriatric Population

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes adults, children, and geriatric population.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Prebiotic and Probiotic Foods Market News:

- In June 2024, Australian probiotic brand Life-Space launched its new ‘Full of Life’ campaign in partnership with Dig Agency. The visually striking campaign uses projection mapping on the human body to highlight the gut microbiome's role in health and vitality. It aims to emotionally connect with audiences by showing how Life-Space probiotics support wellbeing at every life stage.

- In June 2024, wellness brand Akesi, founded by Victoria McKellar and Dr. Elizabeth Biggs, announced their entry into the Australian market at the Naturally Good event in Sydney. Known for their all-natural Bio-Fermented Tonics and Probiotic+ range, Akesi products support gut health using prebiotics, probiotics, postbiotics, and polyphenols. Their formulations are plant-based, potent, and free from dairy, sugar, and tea.

Australia Prebiotic and Probiotic Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Forms Covered | Liquid, Solid |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, Others |

| End Users Covered | Adults, Children, Geriatric Population |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia prebiotic and probiotic foods market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia prebiotic and probiotic foods market on the basis of product type?

- What is the breakup of the Australia prebiotic and probiotic foods market on the basis of form?

- What is the breakup of the Australia prebiotic and probiotic foods market on the basis of distribution channel?

- What is the breakup of the Australia prebiotic and probiotic foods market on the basis of end user?

- What is the breakup of the Australia prebiotic and probiotic foods market on the basis of region?

- What are the various stages in the value chain of the Australia prebiotic and probiotic foods market?

- What are the key driving factors and challenges in the Australia prebiotic and probiotic foods market?

- What is the structure of the Australia prebiotic and probiotic foods market and who are the key players?

- What is the degree of competition in the Australia prebiotic and probiotic foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia prebiotic and probiotic foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia prebiotic and probiotic foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia prebiotic and probiotic foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)