Australia Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2026-2034

Australia Pro AV Market Overview:

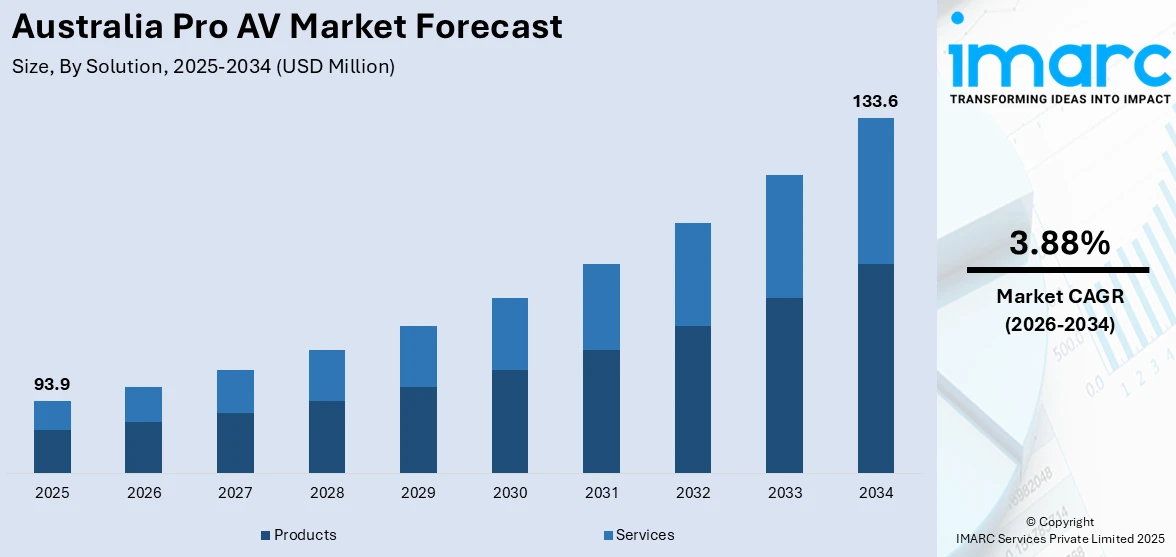

The Australia pro AV market size reached USD 93.9 Million in 2025. Looking forward, the market is expected to reach USD 133.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.88% during 2026-2034. The market share is expanding, driven by the rising investments in advanced solutions that ensure smooth communication across remote and in-office teams, along with the increasing tourism activities, which is creating the need for digital signage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 93.9 Million |

| Market Forecast in 2034 | USD 133.6 Million |

| Market Growth Rate 2026-2034 | 3.88% |

Key Trends of Australia Pro AV Market:

Growing adoption of hybrid and remote work arrangements

The rising usage of hybrid and remote work models is impelling the Australia pro AV market growth. As per industry reports, in 2024, 53% of workers in Australia engaged in remote work part-time, while 14% were fully remote. Businesses are investing in advanced audiovisual systems to improve communication, collaboration, and productivity, as employees are working from different locations. Companies are modernizing meeting rooms with high-quality video conferencing systems, interactive screens, and smart audio solutions to enable smooth virtual meetings. Professional-grade microphones, cameras, and cloud-based tools are becoming increasingly popular, as firms strive to create efficient hybrid work environments. Co-working spaces, corporate offices, and educational institutions are using large-format monitors, wireless presentation systems, and touchless AV technology to promote remote communication. The shift towards digital workflows is also promoting the utilization of reliable professional audiovisual solutions in home offices, with businesses looking for noise-cancelling headphones, external displays, and ergonomic arrangements to improve work efficiency. Additionally, businesses are using digital signage and virtual town halls to keep employees engaged, informed, and connected regardless of location. Training programs and virtual events are becoming more interactive with AV tools, allowing companies to deliver immersive learning experiences. As flexible work arrangements have become a long-term trend, the requirement for reliable pro AV technology is rising.

To get more information on this market Request Sample

Rising tourism activities

The increasing tourism activities are offering a favorable Australia pro AV market outlook. Hotels, resorts, theme parks, and entertainment venues are investing in high-quality audiovisual solutions to enhance visitor experiences. Tourists expect modern digital displays, immersive sound systems, and interactive kiosks in hotels, museums, and attractions, encouraging businesses to upgrade their pro AV infrastructure. The demand for large-scale light emitting diode (LED) screens, projection mapping, and automated lighting in events, concerts, and exhibitions is also increasing, as Australia continues to attract international visitors. Restaurants, bars, and shopping malls are using digital signage and background music systems to create engaging environments that appeal to tourists. Airports and transport hubs are adopting advanced AV technologies for better communication, real-time information updates, and passenger entertainment. Additionally, tour operators and travel agencies are integrating virtual reality (VR)-based presentations to offer a more interactive and informative experience to travelers. As tourism brings more foot traffic to different sectors, the requirement for high-quality pro AV installations grows, leading to continuous spending on innovative solutions that provide customer satisfaction and refine business efficiency. According to the IMARC Group, the Australia tourism market is set to attain USD 21.23 Billion by 2032, showing a growth rate (CAGR) of 4.30% during 2024-2032.

Growth Drivers of Australia Pro AV Market:

Expanding Corporate Digitalization

Australian enterprises are rapidly embracing advanced professional audiovisual technologies to transform communication, collaboration, and client engagement. Businesses across sectors, ranging from finance and healthcare to retail and technology, are integrating cutting-edge conferencing systems, large-format displays, and interactive presentation tools into daily operations. This shift enhances workplace productivity by enabling seamless virtual meetings and high-impact presentations, supporting both in-office and flexible work models. Dynamic digital signage and immersive AV installations are used in customer-facing spaces like retail shops and hospitality spaces to create better brand experiences and appeal to new customers. The increased focus on the use of data as the basis of decision-making and the need to ensure real-time communication only serve to increase the importance of high-quality, scalable professional AV solutions. Since organizations are increasingly investing in professional audiovisual infrastructure as a way of competing, the market is experiencing massive growth.

Booming Entertainment and Live Events Sector

Australia’s flourishing entertainment and live events industry is a major catalyst for Australia pro AV market demand. Concerts, music festivals, sports tournaments, exhibitions, and cultural performances are increasingly demanding sophisticated sound systems, large-scale LED displays, high-definition video walls, and advanced lighting solutions to create engaging, memorable experiences for audiences. Event organizers and production companies rely on professional AV providers to deliver seamless audio and visual quality that meets the expectations of tech-savvy attendees. Additionally, the expansion of convention centers, arenas, and outdoor venues across the country further drives demand for state-of-the-art AV infrastructure. As consumers seek more immersive and interactive entertainment, the requirement for high-performance, integrated AV setups intensifies, providing strong opportunities for manufacturers, rental companies, and service providers within the professional AV sector.

Strong Education and Government Adoption

Educational institutions and government agencies in Australia are increasingly incorporating professional audiovisual systems to support modern learning environments and efficient public communication. According to the Australia pro AV market analysis, schools, universities, and training centers utilize interactive whiteboards, lecture capture systems, and high-quality audio setups to enable hybrid learning, distance education, and engaging classroom experiences. Government departments and municipal offices are implementing digital signage, conference room solutions, and public address systems to improve internal collaboration and community outreach. These deployments enhance information sharing, decision-making efficiency, and accessibility for diverse audiences. Continued focus on digital inclusion, improved public services, and technology-driven learning ensures steady demand for professional AV solutions across both sectors. This widespread adoption fosters long-term market growth, creating sustained opportunities for equipment suppliers, systems integrators, and technology service providers nationwide.

Australia Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes Products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Distributors

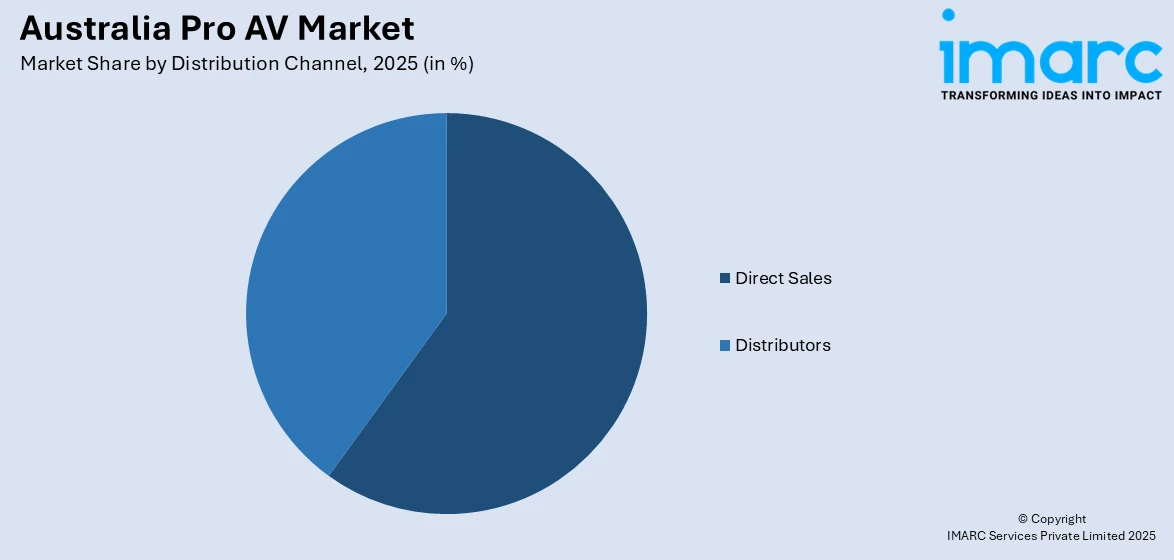

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pro AV Market News:

- In February 2025, NETGEAR revealed the introduction of total NETGEAR solutions (TNS) in Australia, signifying a notable growth in its market footprint. The launch aimed to improve the firm's current pro AV items by delivering scalable solutions customized for Australia's unique requirements.

- In October 2024, PlexusAV, the professional AV branch of Sencore, declared that they entered into a distribution agreement with Merik Distribution for both Australia and New Zealand. Merik aimed to deliver advanced Pro-AV solutions to its clients, aligning seamlessly with PlexusAV’s strategy and philosophy.

Australia Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pro AV market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pro AV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia pro AV market was valued at USD 93.9 Million in 2025.

The Australia pro AV market is projected to exhibit a CAGR of 3.88% during 2026-2034.

The Australia pro AV market is projected to reach a value of USD 133.6 Million by 2034.

Key trends in Australia’s pro AV market include rising integration of AI and IoT technologies, increased demand for immersive experiences such as 4K/8K displays, growth in AV-as-a-Service models, and expanding applications across education, corporate, entertainment, and government sectors for seamless digital communication and engagement.

Growth of Australia’s pro AV market is fueled by expanding smart city projects, increasing investments in advanced broadcast and streaming infrastructure, strong adoption of interactive retail displays, heightened focus on sustainable energy-efficient AV solutions, and continuous upgrades of transportation hubs with cutting-edge audio-visual systems to enhance traveler experience and operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)