Australia Property Management Market Report by Component (Solution, Services), Deployment (Cloud, On-Premises), Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), End User (Housing Associations, Real Estate Agents, Property Investors, and Others), Application (Residential, Commercial, Industrial, Recreational Facilities), and Region 2026-2034

Australia Property Management Market Overview:

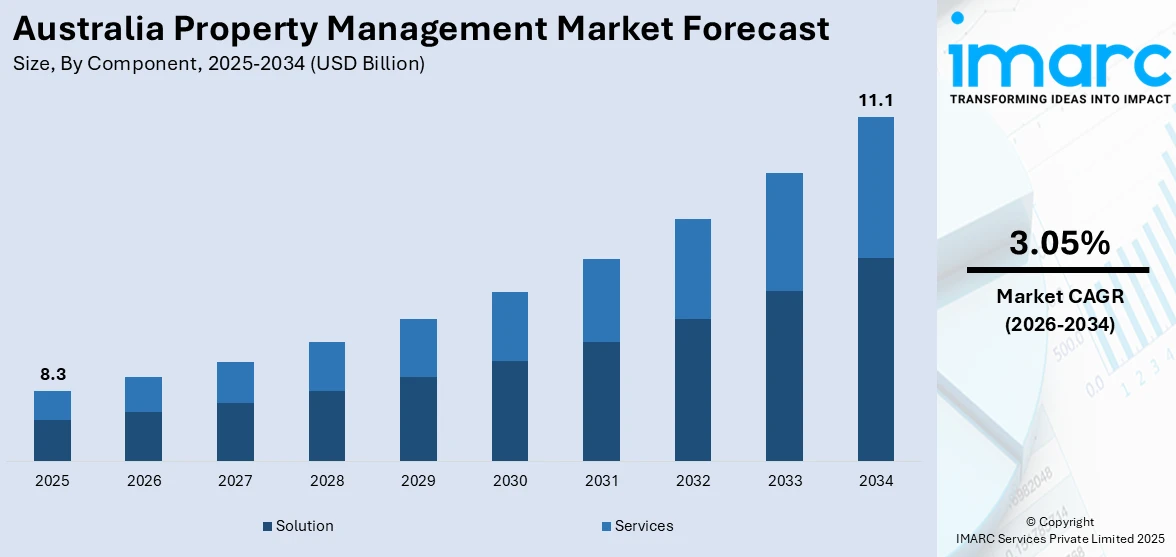

The Australia property management market size reached USD 8.3 Billion in 2025. Looking forward, the market is projected to reach USD 11.1 Billion by 2034, exhibiting a growth rate (CAGR) of 3.05% during 2026-2034. The market is growing steadily due to increasing demand for rental properties, rapid urbanization, rising real estate investments, regulatory compliance requirements, continual advancements in property management technology, increasing focus on sustainability and specialized housing for an aging population.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.3 Billion |

| Market Forecast in 2034 | USD 11.1 Billion |

| Market Growth Rate 2026-2034 | 3.05% |

Key Trends of Australia Property Management Market:

Growth of Real Estate Investment

Growing demand for the investment properties means that owners require services from professional property managers. Owners tend to let the professional property managers take charge of such routine operational tasks as tenant screening and selection, fee collection, and repairs and maintenance among others. International investors and business individuals are the most dominant in this trend since they want to invest in rental properties, but they prefer not to manage multiple properties themselves. With increasing investments in property, there is a similar increase in the demand to find the best solutions hitherto managing the properties. Additionally, with more investors entering the market, there is a growing need for efficient management solutions to handle property portfolios effectively.

To get more information on this market Request Sample

Stricter Regulatory Compliance Requirements

Australia’s property market is governed by a range of legal and regulatory requirements that property managers must adhere to. These include tenancy laws, health and safety standards, and property maintenance regulations. In recent years, there has been a tightening of these rules, particularly around areas such as tenant rights and property inspections. As a result, property owners are increasingly relying on professional property management services to navigate the complex legal landscape. Property managers ensure compliance and mitigate risks for landlords, thereby reducing the chances of disputes and legal issues. This drives demand for their expertise and knowledge in maintaining regulatory standards, which in turn is creating lucrative opportunities in the market.

Technological Advancements in Property Management

Technological innovations are significantly transforming the property management market in Australia. Digital platforms and property management software now allow landlords and managers to streamline processes such as tenant communication, rent payments, and property inspections. This tech-driven approach is making property management more efficient and transparent, attracting both landlords and tenants. Additionally, property management companies that adopt smart technologies, such as remote monitoring systems and AI-driven maintenance solutions, are gaining a competitive edge. These advancements are reducing the manual workload associated with property management, improving tenant satisfaction, and offering better reporting capabilities for landlords.

Increased Focus on Property Maintenance and Sustainability

Property maintenance and sustainability have become significant concerns for both tenants and landlords in Australia. With rising awareness regarding environmental issues and the push for energy-efficient buildings, property managers are increasingly being asked to implement green solutions. This includes overseeing energy-efficient renovations, sustainable waste management, and environmentally friendly building materials. Property management firms prioritizing sustainability and effective maintenance practices are witnessing increased demand, as landlords aim to align their properties with current standards and regulatory requirements. This trend reflects a shift toward more responsible property management, where adherence to environmental considerations and regulatory compliance plays a crucial role in property upkeep. As modern regulations improve, landlords seek professional services that can ensure both sustainability and efficiency in managing their assets, further driving the need for expert property management solutions.

Growth Drivers of Australia Property Management Market:

Growing Rental Market

The rising rental market in Australia significantly drives the demand for property management services. The increasing need for rental properties, driven by urban migration, evolving lifestyles, and investment patterns, prompts property owners to seek professional management solutions. Investors are diversifying their rental portfolios, necessitating expertise in tenant acquisition, lease management, maintenance, and regulatory compliance. Effective property management leads to optimal occupancy rates, timely rent collection, and a lighter administrative load for landlords. Moreover, the heightened interest in short-term and serviced rentals adds complexity, further increasing the demand for professional services. As more investors enter the residential and commercial rental sectors, the dependence on expert property management is becoming more pronounced. This trend directly impacts the Australia property management market share, underscoring the sector’s growing significance.

Urbanization and Population Growth

Accelerating urban development and population increase in Australia are crucial elements driving the property management industry. The growth of urban centers leads to greater demand for residential, commercial, and mixed-use developments, while the influx of people stimulates rental activity and property investments. As new residential projects and commercial buildings are constructed, property owners encounter challenges in efficiently managing multiple units, from tenant onboarding to maintenance organization. Professional property management services offer structured solutions that ensure operational efficiency, adherence to regulations, and effective resource use. The rise in multi-family housing and high-density developments further heightens the need for centralized management systems. As a result, the ongoing trend of urbanization, alongside demographic growth, profoundly influences the real estate landscape, directly affecting the Australia property management market demand and long-term market expansion.

Focus on Tenant Experience

Improving tenant experience has become a vital growth factor within the Australian property management sector. Tenants are increasingly seeking timely maintenance, responsive communication, and personalized services when choosing rental properties. Professional property management firms meet these expectations by employing technology-driven platforms, providing round-the-clock support, and ensuring quick resolution of maintenance and service requests. Positive tenant experiences contribute to enhanced retention rates, shorter vacancy periods, and improved landlord-tenant relationships. Furthermore, property owners recognize the importance of prioritizing tenant satisfaction to optimize returns and preserve property value. By focusing on service quality, maintenance effectiveness, and proactive engagement, the market is shifting beyond traditional administrative roles. This emphasis plays a vital role in the Australia property management market growth driving the adoption of professional management services across both residential and commercial sectors.

Opportunities of Australia Property Management Market:

Growth in Short-Term Rentals

The increase in short-term rental options, such as vacation homes, serviced apartments, and properties listed on platforms like Airbnb, offers a significant opportunity for property management in Australia. Property owners are progressively looking for professional services to efficiently handle bookings, guest interactions, cleaning, and maintenance. Specialized management ensures compliance with local laws, optimizes occupancy rates, and enriches guest experiences. With travelers valuing flexibility and convenience, the demand for well-managed short-term rental accommodations continues to rise. This trend prompts property managers to provide customized solutions, including dynamic pricing, property marketing, and 24/7 guest support. By tackling the unique challenges associated with short-term rentals, property management companies can enhance their service offerings and seize opportunities in the thriving domestic and international tourism markets in Australia.

Corporate Leasing and Commercial Portfolio Management

The growing commercial real estate sector in Australia presents significant opportunities in corporate leasing and multi-tenant portfolio management. Businesses are increasingly leasing office spaces, retail units, and industrial properties, necessitating professional management to oversee lease agreements, tenant relationships, and facility upkeep. Property managers play a key role in ensuring operational efficiency, adherence to contracts, and timely revenue collection. According to Australia property management market analysis, the rise of mixed-use commercial developments and coworking environments further boosts the need for specialized services. Moreover, companies desire streamlined reporting, risk management, and strategic planning to enhance asset performance. By addressing the needs of corporate clients, property management firms can secure long-term contracts, expand their portfolios, and strengthen their position in the commercial real estate sector.

Data Analytics and Predictive Maintenance

Integrating data analytics and predictive maintenance solutions is unlocking new growth potential in Australia's property management market. By employing advanced analytics, property managers can foresee maintenance needs, minimize downtime, and prolong the life of building systems. Insights derived from data also aid in optimizing rental pricing, monitoring tenant behavior, and improving overall service effectiveness. Predictive maintenance lowers operational costs and curtails emergency repairs, enhancing tenant satisfaction and retention. Additionally, the embrace of technology enables property managers to offer personalized services, track energy consumption, and monitor compliance metrics. The rising dependence on digital tools and analytics empowers firms to make informed decisions, optimize resources, and foster strong client relationships. These innovations position data analytics as a crucial factor for future growth in the market.

Challenges of Australia Property Management Market:

Regulatory Compliance Complexity

Navigating Australia’s intricate regulatory landscape presents a major challenge for property management companies. Each state and territory enforces its own property laws, tenancy regulations, and local council mandates, making compliance a demanding and resource-heavy endeavor. Managers are required to remain informed about updates to leasing rules, safety protocols, building codes, and dispute resolution methods to avoid potential legal issues and financial repercussions. Noncompliance can result in fines, damage to reputation, and tenant dissatisfaction. Moreover, the increasing focus on sustainability, energy efficiency, and accessibility regulations adds further operational intricacies. Ensuring compliance across a range of property types, from residential dwellings to commercial properties, necessitates specialized legal knowledge and staff training. This regulatory challenge consistently impacts efficiency and heightens operational risks in Australia's property management sector.

High Competition Among Service Providers

Intense competition is a significant challenge for property management firms in Australia. The market features many local and national players, all providing similar services like tenant sourcing, maintenance management, and lease administration. Distinguishing services and building brand identity is becoming increasingly challenging, especially for small and mid-sized companies. Price competition threatens profit margins, compelling businesses to find a balance between affordability and service quality. Furthermore, digital platforms and technology-driven startups are redefining traditional models with automated solutions and online property management services. To stay competitive, firms must constantly innovate, enhance service efficiency, and ensure high levels of customer satisfaction. The saturated market complicates client retention and business growth, necessitating strategic positioning, effective marketing, and added value offerings to thrive in the Australian property management landscape.

Rising Operational Costs

Escalating operational costs are a considerable challenge for property management firms in Australia. Labor costs, including those for skilled property managers, maintenance teams, and administrative staff, continue to climb. Maintenance and repair expenses, driven by aging properties and elevated service expectations, further strain profitability. Additionally, implementing and integrating advanced property management software, digital platforms, and IoT technologies require significant financial investment. Utility costs, insurance, and compliance-related expenses contribute to the overall financial pressure, especially for companies managing extensive or diverse portfolios. Balancing these costs while delivering high-quality services and staying competitively priced is an ongoing challenge. Rising operational expenditures can squeeze profit margins and limit reinvestment into growth strategies, making cost efficiency a key priority for firms in the Australian property management market.

Australia Property Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on component, deployment, organization size, end user, and application.

Component Insights:

- Solution

- Facility Management

- Lease Accounting and Real Estate Management

- Asset Maintenance Management

- Workspace and Relocation Management

- Reservation Management

- Project Management

- Security and Surveillance Management

- CRM Software

- Others

- Facility Management

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution [facility management (lease accounting and real estate management, asset maintenance management, workspace and relocation management, reservation management), project management, security and surveillance management, CRM software, others)] and services [professional services, managed services].

Deployment Insights:

- Cloud

- On-Premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud, and on-premises.

Organization Size Insights:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises (SMEs), and large enterprises.

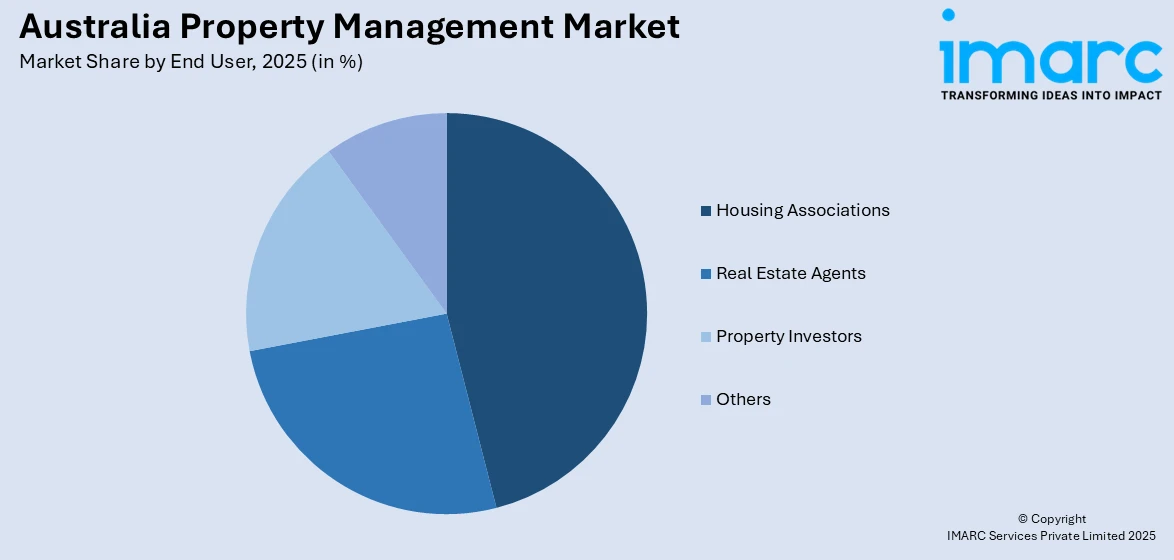

End User Insights:

Access the comprehensive market breakdown Request Sample

- Housing Associations

- Real Estate Agents

- Property Investors

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes housing associations, real estate agents, property investors, and others.

Application Insights:

- Residential

- Commercial

- Industrial

- Recreational Facilities

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and recreational facilities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Property Management Market News:

- On 4th April 2024, Thailand's leading luxury property developer Raimon Land (RML) announced plans to expand its brand into the Australian real estate market next year. This will enable buyers or developers to own property linked to exclusive hotels globally, creating a private home that blends hotel-level services with the convenience and security of a luxurious lifestyle.

Australia Property Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Cloud, On-premises |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| End Users Covered | Housing Associations, Real Estate Agents, Property Investors, Others |

| Applications Covered | Residential, Commercial, Industrial, Recreational Facilities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia property management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia property management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia property management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The property management market in Australia was valued at USD 8.3 Billion in 2025.

The Australia property management market is projected to exhibit a compound annual growth rate (CAGR) of 3.05% during 2026-2034.

The Australia property management market is expected to reach a value of USD 11.1 Billion by 2034.

The market is witnessing increased adoption of digital property management platforms, smart building technologies, and automated tenant communication systems. Additionally, emphasis on sustainability, energy-efficient properties, and data-driven decision-making is shaping service offerings, while short-term rental management and integrated facility services gain traction.

Rising real estate development, growing rental demand, and urbanization are driving market growth. Increasing focus on tenant experience, outsourcing of property operations, and technological advancements in management software, along with regulatory compliance needs, further strengthen the adoption of professional property management services across residential and commercial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)