Australia Protein Bar Market Size, Share, Trends and Forecast by Source, Type, Distribution Channel, and Region, 2026-2034

Australia Protein Bar Market Summary:

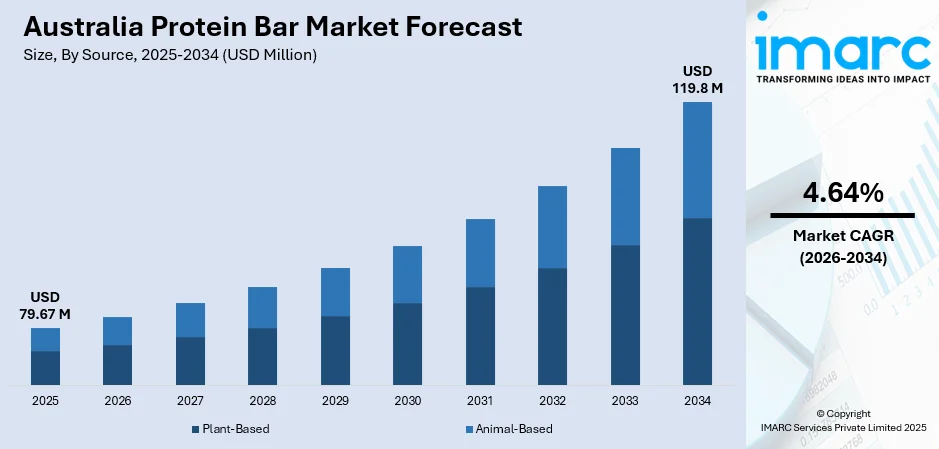

The Australia protein bar market size was valued at USD 79.67 Million in 2025 and is projected to reach USD 119.8 Million by 2034, growing at a compound annual growth rate of 4.64% from 2026-2034.

The Australia protein bar market is seeing strong growth, driven by increased health awareness among consumers, higher involvement in fitness activities, and the need for quick, convenient nutrition. With the growing culture in the gym and fast-paced lifestyles in metropolitan areas, protein bars have become one of the major dietary options for athletes, fitness enthusiasts, and professionals who want to eat well quickly and effectively without compromising their wellness goals, which enhances the share of the market in Australia.

Key Takeaways and Insights:

- By Source: Plant-Based dominates the market with a share of 65% in 2025, driven by the growing trend towards veganism, sustainability concerns, and increasing consumer preference for clean-label products derived from pea, rice, hemp, or soy proteins.

- By Type: Sports Nutrition Bar leads the market with a share of 55% in 2025, attributed to the rising fitness culture, increasing gym memberships, and growing awareness about the importance of protein intake for muscle recovery and athletic performance.

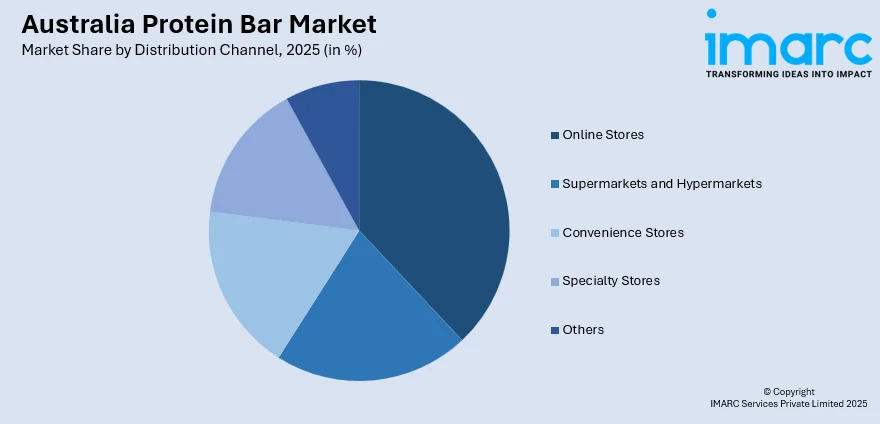

- By Distribution Channel: Online Stores represents the largest segment with a market share of 38% in 2025, owing to the convenience of digital shopping, diverse product availability, subscription-based delivery models, and enhanced consumer accessibility through e-commerce platforms.

- Key Players: The Australia protein bar market exhibits a competitive landscape with multinational corporations and regional manufacturers competing across various product segments, focusing on innovation in flavors, textures, and functional ingredients to capture consumer interest.

To get more information on this market, Request Sample

The Australian protein bar market is characterized by increasing consumer demand for functional nutrition products that align with modern wellness goals. Rising health awareness, particularly among young professionals and fitness enthusiasts, has accelerated the adoption of protein-enriched snacks as meal replacements and post-workout recovery options. In October 2024, Ferndale Foods Australia launched a new protein-bar range called “Team Nutrition,” rolling it out across national retail chains — a reflection of growing demand for convenient, protein-rich snacks. The market benefits from robust retail infrastructure, expanding e-commerce channels, and strong digital marketing strategies employed by brands. Additionally, the growing preference for plant-based alternatives and clean-label products with minimal artificial additives is reshaping product development priorities, encouraging manufacturers to innovate with sustainable ingredients and allergen-free formulations.

Australia Protein Bar Market Trends:

Growing preference for plant-based formulations

Australian consumers are increasingly gravitating toward plant-based protein bars, with environmental consciousness and dietary preferences in a state of constant evolution. The shift reflects increased awareness regarding sustainability, animal welfare concerns, and health benefits associated with plant-derived proteins. In March 2025, Sydney-based nutrition brand Vybey expanded beyond beverages to launch a new “Complete Nutrition” range of plant-based snack bars — each bar delivering ~20 g of plant protein derived from ingredients such as pea protein, oats, almonds, and dates. In response, manufacturers are developing innovative formulations based on pea, hemp, rice, and soy proteins that provide similar nutritional profiles to their traditional whey-based counterparts while meeting the demands of both vegan and flexitarian demographics.

Increasing Demand for Clean-Label Products

The clean-label movement has a significant degree of influence on product development in the Australian protein bar market. Consumers increasingly want to see transparency in the source of ingredients and prefer products without artificial additives, preservatives, and too much sugar. In July 2025, Nuzest launched its new range of "Clean Lean Protein Bars" in Australia, positioning them as 100% plant-based and using only simple whole-food ingredients without unnecessary additions or artificial sweeteners. As a result, the demand to remove unwanted ingredients from products and to introduce new offerings focused on whole foods, natural sweeteners, and recognizable nutritional components is evident in today's health-conscious purchasing decisions.

Integration of Functional Ingredients

The push for more than just basic protein in protein bars has driven Australian consumers to look toward the incorporation of functional ingredients, including probiotics, adaptogens, collagen, and nootropics. Such multi-benefit formulations address increasing demand for products positioned to aid digestive health, immune function, and cognitive performance, alongside traditional fitness nutrition. Brands that incorporate these ingredients strengthen product differentiation and appeal through their ability to offer health-conscious consumers convenient, science-backed solutions. This trend underlines a movement toward functional value-added protein bars, positioned to deliver holistic benefits in everyday diets.

Market Outlook 2026-2034:

The Australia protein bar market is set for steady growth over the forecast period, fueled by shifting consumer preferences and the expansion of distribution channels. Rising health awareness, fast-paced lifestyles, and a growing fitness culture are creating strong opportunities across all demographic segments. Continued innovation in product formulations—such as plant-based options, low-sugar variants, and functional enhancements—will further boost consumer appeal and drive deeper market penetration. The market generated a revenue of USD 79.67 Million in 2025 and is projected to reach a revenue of USD 119.8 Million by 2034, growing at a compound annual growth rate of 4.64% from 2026-2034.

Australia Protein Bar Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

Plant-Based |

65% |

|

Type |

Sports Nutrition Bar |

55% |

|

Distribution Channel |

Online Stores |

38% |

Source Insights:

- Plant-Based

- Animal-Based

The plant-based dominates with a market share of 65% of the total Australia protein bar market in 2025.

The plant-based protein bar segment is experiencing significant momentum as Australians increasingly adopt vegan, vegetarian, and flexitarian dietary patterns. The Australia plant-based protein market size reached USD 338.0 Million in 2024 and is projected to reach USD 599.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.58% during 2025–2033. Consumer preferences are shifting towards sustainable and ethically sourced ingredients, driving manufacturers to develop innovative formulations using pea, hemp, rice, and soy proteins. The segment benefits from growing environmental consciousness, health-focused purchasing decisions, and broader availability of plant-based alternatives across retail channels. Clean-label positioning and allergen-free formulations further strengthen the appeal of plant-derived protein bars among health-conscious consumers seeking natural nutrition solutions.

The animal-based segment continues to maintain relevance among consumers who prioritize traditional protein sources like whey and casein for their complete amino acid profiles and established efficacy in muscle building and recovery. Athletes and fitness enthusiasts seeking maximum protein bioavailability often prefer animal-derived formulations. However, sustainability concerns and dietary restrictions are gradually influencing consumer preferences towards plant alternatives.

Type Insights:

- Sports Nutrition Bar

- Meal Replacement Bar

- Others

The sports nutrition bar leads with a share of 55% of the total Australia protein bar market in 2025.

The sports nutrition bar segment dominates the Australian market, reflecting the nation's strong fitness culture and growing gym participation rates. In 2023, protein/energy bars in Australia grew by 9.4%, with the segment accounting for a substantial portion of sports nutrition sales. These bars are specifically formulated to support athletic performance, muscle recovery, and energy maintenance during physical activities. The increasing number of Australians engaging in regular exercise, combined with heightened awareness about the role of protein in fitness outcomes, drives demand for performance-oriented nutrition products. Sports nutrition bars cater to diverse consumer needs from pre-workout energy to post-exercise recovery.

The meal replacement bar segment is gaining traction among busy professionals and health-conscious consumers seeking convenient alternatives to traditional meals. These bars provide balanced nutrition with controlled calorie content, appealing to individuals managing weight or maintaining dietary discipline amid hectic schedules.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The online stores dominates with a market share of 38% of the total Australia protein bar market in 2025.

The online retail channel has become the dominant distribution platform for protein bars in Australia, driven by the convenience of digital shopping and the rapid growth of e-commerce. Consumers increasingly favor online purchases for the wide product variety, competitive pricing, subscription-based delivery options, and home convenience. Enhanced brand visibility through digital marketing, influencer collaborations, and social media engagement has further strengthened online accessibility, particularly among younger, digitally savvy shoppers. Domestic manufacturers are also expanding their presence; for instance, Ferndale Foods Australia, a family-owned producer, launched its Team Nutrition sports and diet bar range in late 2024 after investing a $23 million in its Ballarat production facility.

Meanwhile, supermarkets and hypermarkets continue to play a key role, providing physical access to a wide range of protein bar brands and facilitating impulse purchases. Convenience stores serve on-the-go consumers seeking quick nutrition, while specialty stores offer curated selections for fitness enthusiasts and health-conscious shoppers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In ACT and NSW, protein bars are gaining traction among urban professionals and fitness enthusiasts. Demand is driven by convenience, active lifestyles, and growing health awareness. Retailers and gyms increasingly stock premium, functional, and plant-based options, while e-commerce platforms expand reach through subscription models and personalized nutrition solutions.

Victoria and Tasmania are witnessing a rise in protein bar consumption due to growing fitness culture and wellness trends. Consumers are seeking clean-label, organic, and allergen-free bars. Boutique health stores and supermarkets cater to these preferences, while online channels enable delivery of customized protein blends supporting energy, muscle recovery, and holistic wellbeing.

Queensland’s protein bar market is expanding, fueled by active outdoor lifestyles and sports participation. Consumers favor nutrient-dense, on-the-go snacks that support fitness, weight management, and immunity. Retailers offer a mix of plant-based, high-protein, and functional bars, with digital commerce and subscription services increasingly enhancing accessibility and repeat purchase patterns.

In NT and SA, protein bars are emerging as convenient health snacks for fitness enthusiasts and busy consumers. Growth is supported by rising awareness of functional ingredients like collagen and probiotics. Regional retail chains and e-commerce platforms are expanding distribution, offering plant-based and high-protein options tailored to diverse dietary needs and preferences.

Western Australia’s protein bar market is driven by health-conscious consumers seeking convenient, nutrient-rich snacks. Sports, outdoor activities, and gym culture boost demand for protein-rich and functional bars. Supermarkets, health stores, and online retailers are increasing product variety, emphasizing clean-label, allergen-free, and plant-based formulations to meet evolving consumer expectations.

Market Dynamics:

Growth Drivers:

Why is the Australia Protein Bar Market Growing?

Rising Health and Fitness Consciousness Among Australian Consumers

The increasing health and fitness consciousness among Australians represents a primary driver of the protein bar market. Consumers have become significantly more proactive in embracing healthier lifestyles, with heightened focus on physical fitness, mental well-being, and dietary balance. This cultural transformation is driven by growing awareness of chronic lifestyle diseases including obesity, type-2 diabetes, and cardiovascular conditions. For instance, according to a 2024 health‑survey report, around two‑thirds of Australian adults are living with overweight or obesity — a long‑term trend that fuels demand for nutritious, protein‑rich foods. Australians increasingly demand foods with high nutritional content, particularly products that are protein-rich, low in sugar, and free from artificial additives. Protein bars are now viewed as convenient solutions to supplement daily protein requirements without requiring meal preparation time. The integration of protein bars into fitness regimens as pre-workout or post-workout snacks has become commonplace among gym enthusiasts, athletes, and recreational exercisers.

Demand for Convenient On-the-Go Nutrition in Urban Lifestyles

The growing demand for easy, portable nutrition resulting from hectic urban lifestyles serves as another significant market driver. Australia's working population, particularly in major cities like Sydney, Melbourne, and Brisbane, experiences long work hours, extensive commuting times, and demanding daily routines. This has resulted in fundamental changes in eating patterns, with traditional meal structures giving way to fast, grab-and-go foods consumed on the move, between meetings, or during brief breaks. In late 2024, domestic food manufacturer Ferndale Foods Australia introduced a new protein bar line called Team Nutrition, launched through major supermarkets, directly targeting busy consumers seeking convenient, nutrient dense snacks suited for urban lifestyles. Protein bars perfectly address this evolving consumption pattern through their compact size, extended shelf-life, and nutrient-dense composition. The demand extends beyond fitness-conscious consumers to include office workers, busy parents, students, and travelers seeking convenient nourishment solutions that support their active lifestyles.

Expansion of E-commerce and Digital Retail Channels

The rise of digital commerce is significantly fueling growth in Australia’s protein bar market. Direct-to-consumer models, subscription services, and tailored nutrition plans enable brands to reach wider audiences while promoting regular consumption and repeat purchases. Convenience factors such as online shopping, competitive pricing, and home delivery have accelerated adoption of digital channels. Social media marketing, influencer partnerships, and targeted digital advertising further boost brand visibility, particularly among younger, tech-savvy consumers. Government initiatives like the Healthy Food Partnership encourage reduced sugar, sodium, and saturated fat, motivating producers to develop cleaner, nutrition-focused bars. These trends collectively enhance accessibility, engagement, and appeal for health-conscious Australians.

Market Restraints:

What Challenges the Australia Protein Bar Market is Facing?

High Price Sensitivity

Protein bars, particularly premium and functional variants, are often priced higher than conventional snacks. This price differential limits adoption among cost-conscious consumers, particularly students and lower-income groups, creating a barrier for widespread market penetration despite growing health awareness.

Taste and Flavor Limitations

While protein bars focus on nutrition, some formulations compromise on taste and texture. Consumers seeking enjoyable snacking experiences may reject bars perceived as chalky, overly sweet, or artificial, hindering repeat purchases and slowing market growth.

Regulatory and Labeling Challenges

Strict Australian regulations on nutritional claims, health benefits, and ingredient labeling pose challenges for manufacturers. Compliance costs and potential penalties for inaccurate claims can restrict innovation, delay product launches, and limit marketing flexibility, impacting overall market expansion.

Competitive Landscape:

The Australia protein bar market is moderately competitive, with multinational companies competing with regional manufacturers in different product categories and price points. The market participants have been emphasizing product innovation, flavor profile expansion, and the addition of value-added functional ingredients as important differentiators to gain consumer attention. Key strategies adopted include product launches, brand collaborations, retail channel expansion, and digital marketing investments. Clean-label positioning, sustainable sourcing, and allergen-free formulation remain key areas of corporate messaging. The competitive scenario is also marked by continued consolidation efforts and the entry of new players desiring to capitalize on attractive growth prospects.

Recent Developments:

- In November 2024, FULFIL Vitamin & Protein Bars expanded into the Australian market through a new retail partnership with Woolworths. The launch introduces indulgent, low-sugar, high-protein bars fortified with essential vitamins, targeting rising demand for convenient, health-focused nutrition products nationwide. The range includes flavors such as Chocolate Peanut Butter and Salted Caramel.

- In July 2025, SnackHQ launched three new snack bars under its ReFil brand in Australia — aimed at older children. Each bar packs nine grams of prebiotic fiber, six grams of protein, and under one teaspoon of sugar, combining nutrition and taste to meet demand for healthier kids' snacks.

Australia Protein Bar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Plant-Based, Animal-Based |

| Types Covered | Sports Nutrition Bar, Meal Replacement Bar, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia protein bar market size was valued at USD 79.67 Million in 2025.

The Australia protein bar market is expected to grow at a compound annual growth rate of 4.64% from 2026-2034 to reach USD 119.8 Million by 2034.

Plant-Based held the largest market share of 65% in 2024, driven by growing consumer preference for sustainable, vegan-friendly protein alternatives derived from pea, hemp, rice, and soy sources.

Key factors driving the Australia protein bar market include rising health consciousness among consumers, increasing fitness participation, growing demand for convenient on-the-go nutrition, expansion of e-commerce channels, and innovation in plant-based formulations.

Major challenges include premium pricing concerns limiting accessibility for budget-conscious consumers, intense competition from alternative healthy snack categories, regulatory compliance requirements, and the need for continuous product innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)