Australia Public Cloud Market Size, Share, Trends and Forecast by Service, Enterprise Size, End Use, and Region, 2025-2033

Australia Public Cloud Market Size and Share:

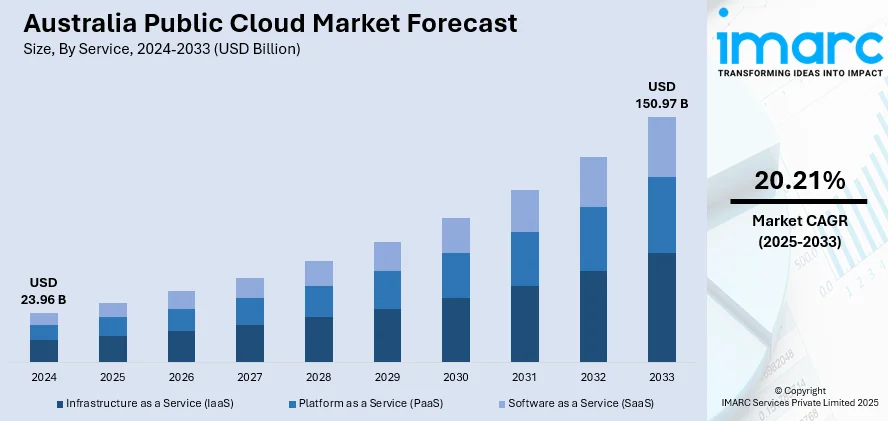

The Australia public cloud market size reached USD 23.96 Billion in 2024. Looking forward, the market is expected to reach USD 150.97 Billion by 2033, exhibiting a growth rate (CAGR) of 20.21% during 2025-2033. The market is growing steadily, fueled by digital transformation, remote work adoption, and demand for agile infrastructure. Key industries like finance, healthcare, and government are embracing cloud solutions. Global providers are deepening local engagement with investments and compliance initiatives. These trends are shaping the competitive landscape and influencing the evolving Australia public cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.96 Billion |

| Market Forecast in 2033 | USD 150.97 Billion |

| Market Growth Rate 2025-2033 | 20.21% |

Key Trends of Australia Public Cloud Market:

Digital Transformation Across Industries

Australia’s public cloud market is significantly driven by widespread digital transformation across various sectors. Enterprises are adopting cloud technologies to modernize legacy systems, streamline operations, and enhance customer engagement. In sectors like banking, healthcare, and retail, digital-first strategies are becoming a priority to remain competitive and resilient. Cloud platforms enable faster innovation cycles, real-time analytics, and the deployment of scalable applications. This shift is especially prominent in customer service, digital payments, and supply chain management. The Australian government’s push for digital service delivery further fuels cloud uptake in public sector projects. These efforts collectively position cloud as the backbone of Australia’s evolving digital economy, contributing strongly to its public cloud market momentum. For instance, in August 2023, Oracle opened a new cloud region for the Government of Australia. The new Oracle Cloud for Australian Government and Defense in Canberra was unveiled by the business this week. The new area, which offers over 100 services, is geographically separated from Oracle's other public and government cloud regions, including the company's current public regions in Sydney and Melbourne, and does not share any backbone connections with them.

To get more information on this market, Request Sample

Investment by Global and Local Cloud Providers

Major global cloud providers, such as AWS, Microsoft Azure, and Google Cloud, are significantly investing in Australia to expand infrastructure, improve service latency, and meet local compliance. These investments include new availability zones, dedicated support teams, and partnerships with Australian companies. Additionally, local providers are innovating with niche offerings tailored to regional business needs. This competitive landscape fosters better pricing, feature-rich services, and increased customer choice. The presence of skilled cloud professionals and a growing partner ecosystem further supports deployment and integration. Educational initiatives and training programs by these providers are also enhancing cloud literacy. Such robust investment and ecosystem development are crucial forces accelerating the growth and maturity of the Australia public cloud market. For instance, in February 2023, in Australia, Tech Data, a TD SYNNEX company, announced the regional launch of their enlarged cloud services portfolio. With over 100 service types in professional and support services, Tech Data's extended cloud services offering is intended to help the channel partner community better grasp and capitalize on opportunities related to their cloud organization.

Growth Drivers of Australia Public Cloud Market:

Government-Driven Digital Transformation and Data Sovereignty

Australia's public cloud growth is largely driven by federal mandates and data sovereignty concerns. The government's "cloud-first" policy based on platforms such as cloud.gov.au and led by the Digital Transformation Agency—has driven public sector cloud adoption. These programs incentivize agencies to consolidate citizen services onto scalable infrastructure, enhancing confidence in cloud reliability. Accompanied by regulatory systems like the Privacy Act, the Notifiable Data Breaches scheme, and Consumer Data Right, public institutions increasingly expect cloud solutions for storing data locally. This regulatory landscape has prompted cloud providers to establish secure, accredited areas, particularly in Canberra and Sydney, to meet strict national standards. These initiatives cater to national security issues and public confidence, keeping sensitive government workloads within Australian borders and run under certified environments.

Enterprise Digitalization, Hybrid Strategies, and Multi-cloud Adoption

Australian businesses across industries—finance, healthcare, retail, media, and mining—are quickly embracing cloud-led digital transformation. Industries adopt multi-cloud and hybrid setups to meet agility with risk mitigation, vendor independence, and data ownership. In financials, banks such as ANZ Bank migrate peripheral infrastructure to public cloud API environments for analytics and operational effectiveness, and in media, scalable infrastructure supports real-time streaming and interactive customer experiences. Data center networks and digital education initiatives in Victoria and New South Wales anchor technology hubs that cultivate cloud-knowledgeable workers, allowing organizations to implement sophisticated third-party integrations. The outcome is a multi-tiered cloud environment marrying localized on-premises infrastructure with accommodating, worldwide cloud services—a tendency underpinning strategic investment and sustainable capacity.

AI, Edge Innovation and Renewable-Driven Infrastructure Investment

The explosion in AI and IoT deployments has driven demand for cloud and edge computing at high performance very quickly in Australia. Large hyperscalers, particularly AWS, are investing tens of billions of dollars to establish local data center regions, AI infrastructure, and renewable energy assets, such as solar farms in Victoria and Queensland. These investments—AWS's multi-billion-dollar growth through 2029—offer local compute power critical to low-latency AI use cases, from business analysis to supercomputing workloads. Edge computing, a response to the country's geographic spread, fueled by growing 5G coverage, enables remote healthcare, mining telemetry, and agriculture monitoring. As businesses seek real-time insights at the edge and compliance-friendly, environmentally friendly solutions, public cloud platforms become critical infrastructure. This mature ecosystem combines performance with responsibility—providing domestic capacity for next‑gen uses, while strengthening Australia's commitment to secure, sovereign, and green digital growth.

Opportunities of Australia Public Cloud Market:

Creating a Sovereign and Secure AI Infrastructure

Australia finds itself in a distinctive position where sovereign cloud development intersects with AI preparedness. The country's dedication to a safe, locally hosted cloud infrastructure is highlighted by top hyperscalers—led by AWS—announcing multi‑billion-dollar investments to enhance AI computing power through data centers in Sydney and Melbourne, driven by Victoria and Queensland renewable energy schemes. This creates rich soil for cloud suppliers able to provide sovereign-level compliance, next-generation AI compute stacks, and connectivity to national cybersecurity architectures like ASD collaboration. In addition, the forthcoming government-supported "top-secret" government cloud establishes a clear precedent: suppliers that provide certified, high-assurance systems will see demand increasing across defense, intelligence, and sensitive sectors. Eventually, Australia's twin focus on AI stewardship and data sovereignty sets the stage for specialized cloud solutions, compliant infrastructure as a service, and analytics platforms optimized for safe, regulated workloads.

Regional Edge Integration and Industry-Specific Platforms

Australia's varied geography—between urban east-coast cities and remote resource-combined areas—creates a demand for public cloud services delivered in a distributed manner, hitched to edge infrastructure. Sectors including mining, agriculture, healthcare, and industrial IoT are already using models of edge-augmented clouds to empower real-time analytics, automation, and remote telemetry. Projects such as the Queensland "Connected Farms" pilot and Western Australia's green hyperscale WAi1 data center point to an increased desire for locally mass-deployed, low-latency compute backed by renewable infrastructure. These local edge-to-cloud systems present the possibility for cloud providers to provide managed services, data pipelines, and analytics solutions on behalf of mining companies, agritech ventures, and remote health services. Engineering cloud architectures that incorporate edge devices, meet the regulations of the local environment, and minimize bandwidth constraints can make cloud vendors key players in Australia's industry change.

Facilitating the Startup Ecosystem and Skills-Led Innovation

Australia's dynamic startup scene—specifically fintech, mining-tech, agritech, and deep-tech—depends largely on public cloud to grow worldwide without sinking a lot of capital in the process. Sydney, now classified among the world's leading startup cities, is supported by scalable experimentation, quick product deployment, and AI innovation made possible by public cloud tools. Public cloud services can capitalize on this by providing customized offerings like startup credits, domain-specific AI tools, compliance-enhanced environments for regulated industries, and personalized training paths. AWS's upskilling initiatives and collaborations with institutions like AIML in Adelaide fit into Australia's national agenda of filling technical skills gaps. Through developer enablement, compliance automation, and vertical-specialized accelerators, cloud vendors can become the go-to partners to Australia's next-generation unicorns.

Challenges of Australia Public Cloud Market:

Data Sovereignty and Regulatory Complexity

The most urgent issue confronting the Australian public cloud market is data sovereignty and regulatory complexity. According to Australia's legislation, certain sensitive data, such as government, defense, and health-related information, must be processed and stored within national borders. This has resulted in the slow take-up of cloud services across highly regulated sectors, in which cloud vendors need to guarantee that their infrastructure supports Australian legislation. Cloud providers must adhere to stringent guidelines set forth by the Australian Cyber Security Centre (ACSC) and the Information Security Registered Assessors Program (IRAP), which usually require local data centers, government collaborations, and end-to-end certifications. This can be a serious obstacle for smaller or foreign providers who might not have localized infrastructure or compliance yet. Additionally, the quick evolution in data protection regulation, coupled with growing fears of global surveillance threats, translates into cloud operators needing to continually evolve to be trusted and compliant in the Australian market.

Talent Shortage and Talent Retention Challenges

Despite the growing demand for cloud services in Australia, the country faces an ongoing shortage of skilled IT professionals capable of designing, deploying, and maintaining complex cloud environments. Cloud architects, security engineers, and DevOps specialists are in high demand as companies embrace hybrid and multi-cloud strategies. However, Australia's relatively small population and its reliance on overseas talent make it challenging to fill these roles at scale. Although government and industry efforts—i.e., vocational cloud training programs and collaborations with universities—are attempting to bridge this gap, the rate of technological change too often outpaces the pipeline of training. This shortage results in higher cloud service costs, delayed project rollouts, and intense competition for top-flight talent. Furthermore, regional regions are hit even harder by this shortage of cloud-talented staff, further exacerbating the digital gap between city centers and rural Australia.

Infrastructure Constraints and Geographic Disparities

Australia's huge geography comes with some distinct infrastructure-related challenges that affect public cloud adoption, especially beyond major urban centers. While urban centers such as Sydney, Melbourne, and Brisbane enjoy robust digital infrastructure, much of regional Australia still suffers from poor connectivity and latency problems. This restricts the functionality of cloud-reliant services like real-time analytics, IoT, and edge computing in sectors like agriculture and mining, which tend to be located in less urban areas. While national projects like the NBN (National Broadband Network) have enhanced overall connectivity, variation in speed, reliability, and availability are still ongoing issues. These disparities will discourage companies operating in distant regions from embracing cloud solutions or compel them to depend on hybrid strategies that diminish the advantages of a purely cloud-native environment. As cloud providers extend local data center regions and consider edge computing deployments, bridging these regional gaps will be imperative to securing inclusive and expansive cloud adoption nationwide.

Australia Public Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, enterprise size, and end use.

Service Insights:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

Enterprise Size Insights:

- Large Enterprise

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprise and small and medium-sized enterprises.

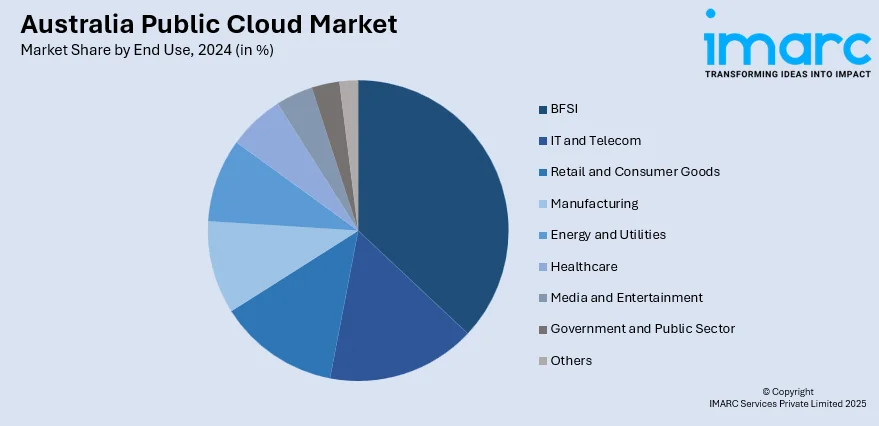

End Use Insights:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes BFSI, IT and telecom, retail and consumer goods, manufacturing, energy and utilities, healthcare, media and entertainment, government and public sector, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Public Cloud Market News:

- In June 2024, Macquarie Cloud Services, a division of Macquarie Technology Group, launched Macquarie Flex, an Australian first, by utilizing strategic partnerships with Dell Technologies and Microsoft.

- In July 2024, the Australian government announced a strategic partnership worth at least $2 billion over the next ten years between the Australian Signals Directorate (ASD) and Amazon Web Services (AWS). This partnership will change how the National Intelligence Community (NIC) and Defence collaborate to safeguard Australia and keep ahead of our enemies.

Australia Public Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium-sized Enterprises |

| End Uses Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia public cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia public cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia public cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia public cloud market was valued at USD 23.96 Billion in 2024.

The Australia public cloud market is projected to exhibit a CAGR of 20.21% during 2025-2033.

The Australia public cloud market is expected to reach a value of USD 150.97 Billion by 2033.

Australia's public cloud industry is fueled by government digitalization plans, high demand for secure and sovereign data solutions, and accelerating enterprise use of AI and analytics. Growth is further boosted by the proliferation of remote work, vertical industry digitalization, and increasing regional data center expansions, particularly in finance, healthcare, and education sectors.

Australia's public cloud market is shifting toward sovereign cloud growth, with multinational operators launching local regions to satisfy rigorous data residency needs. Companies are adopting hybrid and multi-cloud approaches, combining local data centers with global public clouds. AI and edge computing are increasing in popularity, especially among remote industries such as mining, agriculture, and healthcare.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)