Australia Quinoa Market Size, Share, Trends and Forecast by Source, Product Type, Application, Distribution Channel, End Use, and Region, 2025-2033

Australia Quinoa Market Overview:

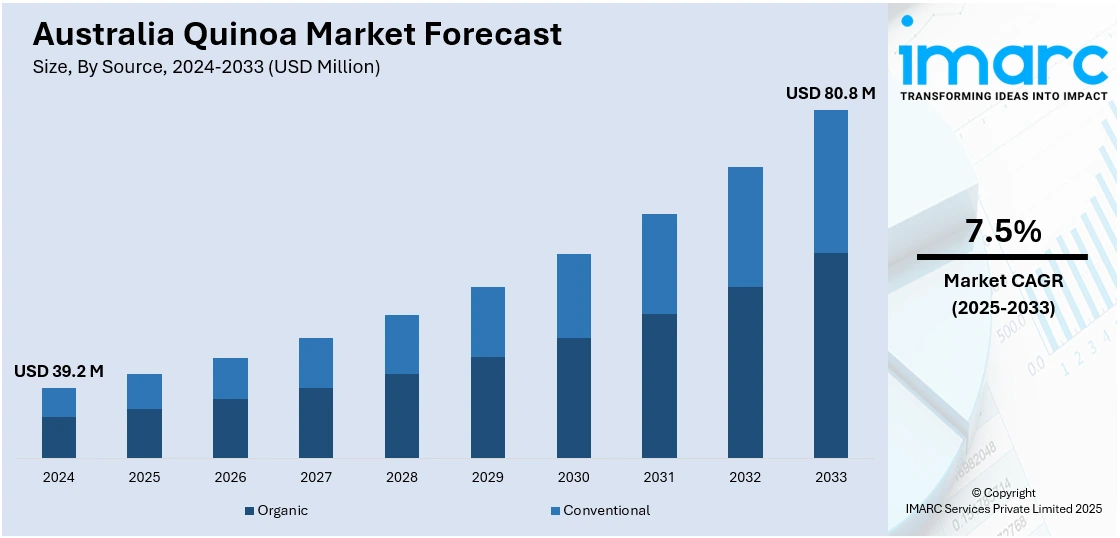

The Australia quinoa market size reached USD 39.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 80.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.5% during 2025-2033. The market is witnessing steady growth, driven by rising health awareness, increased local cultivation, and plant-based dietary trends. Furthermore, expanding product innovation, organic demand, and regional production support are further boosting its presence in retail, foodservice, and export channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 39.2 Million |

| Market Forecast in 2033 | USD 80.8 Million |

| Market Growth Rate 2025-2033 | 7.5% |

Australia Quinoa Market Trends:

Rising Health Consciousness Driving Quinoa Demand in Australia

Health and wellness trends are playing a major role in reshaping food preferences across Australia, and quinoa has emerged as a key beneficiary. Consumers are increasingly seeking high-protein, gluten-free, and nutrient-rich alternatives to traditional grains. Quinoa, known for its complete amino acid profile, low glycemic index, and rich fiber content, is gaining popularity among fitness-conscious individuals, people with dietary restrictions, and those following plant-based diets. Its reputation as a superfood has led to its inclusion in a variety of meals from breakfast bowls and salads to wraps and smoothies. The shift away from processed carbs toward clean-label and whole foods is also contributing to quinoa’s appeal. As Australian consumers become more informed about nutrition and long-term health, demand for functional foods like quinoa continues to rise, supporting sustained Australia quinoa market growth.

To get more information on this market, Request Sample

Growth in Domestic Cultivation

Australian farmers are increasingly turning to quinoa as a viable crop, with cultivation expanding significantly in regions such as Western Australia. Favorable climatic conditions, especially in the Ord River Irrigation Area and other parts of the west coast, are enabling consistent yields of high-quality quinoa suited for local and export markets. This domestic expansion is helping reduce reliance on imported quinoa, which traditionally came from South American countries like Peru and Bolivia. Local cultivation allows better control over supply chains, freshness, and pricing, while also enabling producers to meet growing consumer demand with traceable, home-grown options. Government support for crop diversification and sustainable farming practices is further encouraging quinoa production. As availability and awareness increase, locally grown quinoa is becoming more visible in supermarkets and foodservice, contributing to a rising Australia quinoa market share.

Rising Demand from Plant-Based Consumers

The rising popularity of vegan and vegetarian lifestyles across Australia is significantly contributing to quinoa’s market traction. As more consumers shift away from animal-based products, there's a growing demand for nutrient-dense plant proteins that offer versatility and balance. Quinoa, being a complete protein with all nine essential amino acids, fits perfectly into meat-free diets. Its adaptability across meals from breakfast porridges and salads to stir-fries and baked goods makes it a staple in plant-based cooking. Restaurants, cafes, and meal delivery services are increasingly featuring quinoa in their vegan-friendly offerings, while retail brands are launching quinoa-based products like patties, snacks, and bowls. The strong alignment with health, sustainability, and dietary variety is reinforcing quinoa’s role in daily consumption. With plant-based trends showing no signs of slowing, this segment will remain central to the Australia quinoa market outlook.

Australia Quinoa Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product type, application, distribution channel, and end use.

Source Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the source. This includes organic and conventional.

Product Type Insights:

- Red Quinoa

- Black Quinoa

- White Quinoa

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes red quinoa, black quinoa, white quinoa, and others.

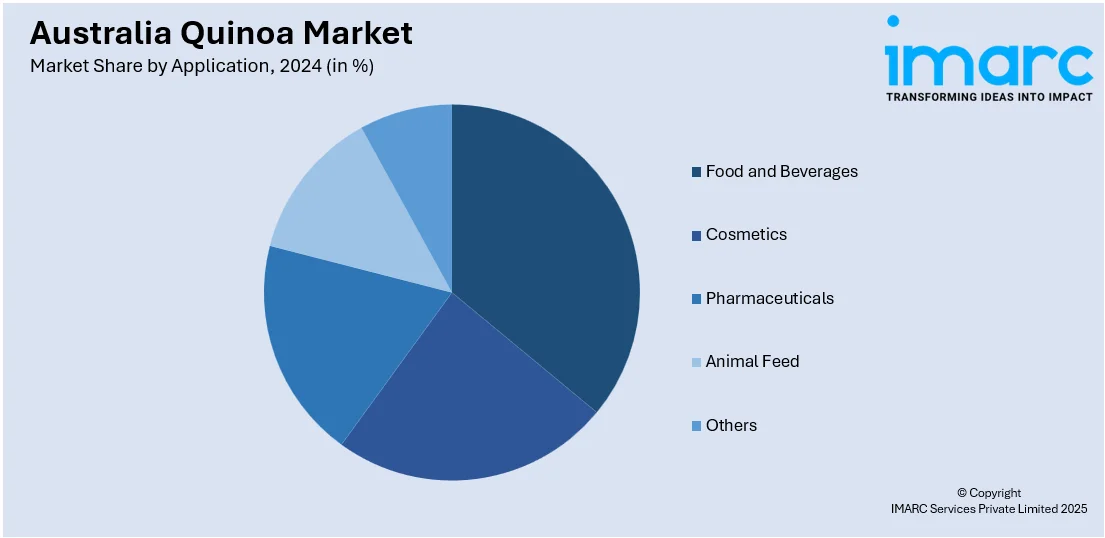

Application Insights:

- Food and Beverages

- Cosmetics

- Pharmaceuticals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, cosmetics, pharmaceuticals, animal feed, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Retail Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional retail stores, convenience stores, online, and others.

End Use Insights:

- Ingredient

- Packaged Food

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes ingredient and packaged food.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Quinoa Market News:

- In June 2023, Shandi Global launched its high-protein vegan shawarma, branded as FOREVER, in Singapore and Australia. The innovative plant-based product debuted at Byblos Grill and the University of Melbourne. Made with non-GMO ingredients like quinoa and pea protein, it aims to offer a delicious and sustainable meat alternative.

Australia Quinoa Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Organic, Conventional |

| Product Types Covered | Red Quinoa, Black Quinoa, White Quinoa, Others |

| Applications Covered | Food and Beverages, Cosmetics, Pharmaceuticals, Animal Feed, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Retail Stores, Convenience Stores, Online, Others |

| End Uses Covered | Ingredient, Packaged Food |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia quinoa market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia quinoa market on the basis of source?

- What is the breakup of the Australia quinoa market on the basis of product type?

- What is the breakup of the Australia quinoa market on the basis of application?

- What is the breakup of the Australia quinoa market on the basis of distribution channel?

- What is the breakup of the Australia quinoa market on the basis of end use?

- What is the breakup of the Australia quinoa market on the basis of region?

- What are the various stages in the value chain of the Australia quinoa market?

- What are the key driving factors and challenges in the Australia quinoa market?

- What is the structure of the Australia quinoa market and who are the key players?

- What is the degree of competition in the Australia quinoa market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia quinoa market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia quinoa market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia quinoa industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)