Australia Rainwater Harvesting Market Size, Share, Trends and Forecast by Harvesting Method, End User, and Region, 2025-2033

Australia Rainwater Harvesting Market Overview:

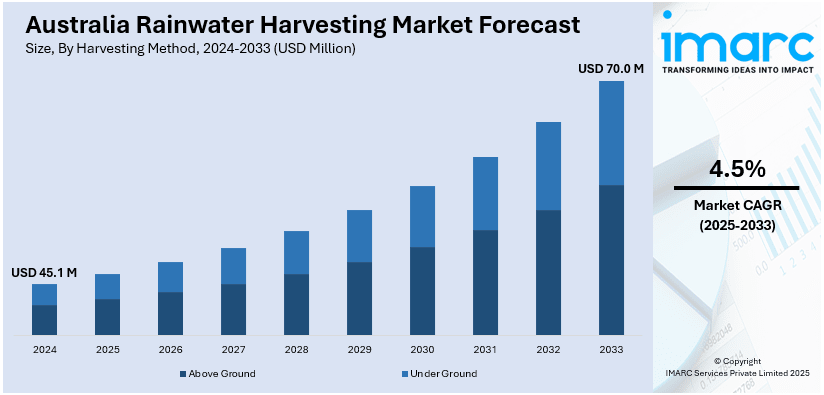

The Australia rainwater harvesting market size reached USD 45.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 70.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The market is driven by increasing water scarcity, stringent government incentives, expanding sustainable construction trends, rising environmental awareness, surging demand for self-sufficiency, climate change impacts, and growing adoption in residential, commercial, and agricultural sectors for water conservation and cost savings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 45.1 Million |

| Market Forecast in 2033 | USD 70.0 Million |

| Market Growth Rate 2025-2033 | 4.5% |

Australia Rainwater Harvesting Market Trends:

Integration of Rainwater Harvesting Systems in Green Building Initiatives

The integration of rainwater harvesting systems is boosting the Australia rainwater harvesting market share, as it has become more relevant within Australian building projects that adhere to green building standards. In addition to this, the modern building industry implements these systems for new developments because they promote efficient water use and sustainable practices. This trend aligns with the present focus on environmentally responsible practices as well as the requirement for sustainability certification compliance. Moreover, rainwater used for irrigation, toilet flushing, and cooling system applications enables buildings to lower their dependence on municipal water supply, resulting in savings and protection of important water resources. For example, in June 2024, Western Australia's Department of Energy, Mines, Industry Regulation and Safety announced new licensing requirements for rainwater system installers, effective February 10, 2025, ensuring proper installation and encouraging adoption in building projects. Furthermore, rainwater harvesting has become a standard practice in sustainable building projects due to the active promotion of its adoption across building projects by the government incentives and regulations, which is driving the Australia rainwater harvesting market growth.

To get more information on this market, Request Sample

Adoption of Advanced Technologies in Rainwater Harvesting Systems

The adoption of advanced technologies in rainwater harvesting systems to enhance water system performance and simplify user operation is significantly enhancing the Australia rainwater harvesting market outlook. In line with this, the integration of automated controls, along with smart sensors and enhanced filtration systems, now enhances rainwater harvesting systems. Moreover, continuous technological advancements enable real-time system monitoring and water quality assessment, empowering users with efficient tools for optimizing water usage and ensuring sustainable rainwater harvesting performance. For instance, in April 2024, CSIRO launched AquaWatch Australia to develop a national system for monitoring water quality, integrating data from water-based sensors and satellites to provide real-time updates and forecasts. Additionally, the incorporation of smart home technologies facilitates seamless integration with existing building management systems. Apart from this, the rising dependence on intelligent water management systems demonstrates a national effort to merge sustainability with operational efficiency and practical system maintenance, thereby propelling the market forward.

Australia Rainwater Harvesting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on harvesting method and end user.

Harvesting Method Insights:

- Above Ground

- Under Ground

The report has provided a detailed breakup and analysis of the market based on the harvesting method. This includes above ground and under ground.

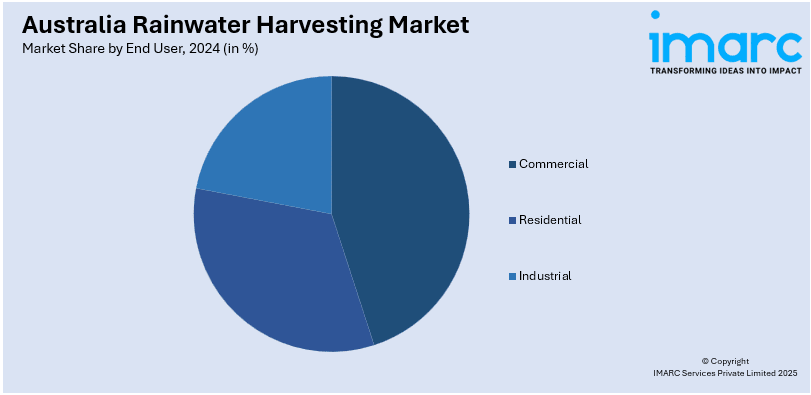

End User Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Rainwater Harvesting Market News:

- In September 2024, the Irrigation Australia Conference hosted a workshop titled "Water Utility Irrigation Industry Partnerships," focusing on enhancing collaborations between water utilities and the irrigation sector to promote sustainable water management practices, including rainwater harvesting, across Australia.

- In April 2024, Rotoplas acquired a 51% stake in IrriVan to enhance its agricultural water management capabilities. This move is expected to introduce advanced irrigation technologies into Australia, driving innovation and efficiency in the country's rainwater harvesting market.

Australia Rainwater Harvesting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Harvesting Methods Covered | Above Ground, Under Ground |

| End Users Covered | Commercial, Residential, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia rainwater harvesting market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia rainwater harvesting market on the basis of harvesting method?

- What is the breakup of the Australia rainwater harvesting market on the basis of end user?

- What is the breakup of the Australia rainwater harvesting market on the basis of region?

- What are the various stages in the value chain of the Australia rainwater harvesting market?

- What are the key driving factors and challenges in the Australia rainwater harvesting?

- What is the structure of the Australia rainwater harvesting market and who are the key players?

- What is the degree of competition in the Australia rainwater harvesting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia rainwater harvesting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia rainwater harvesting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia rainwater harvesting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)