Australia Rare Earth Elements Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Australia Rare Earth Elements Market Size and Share:

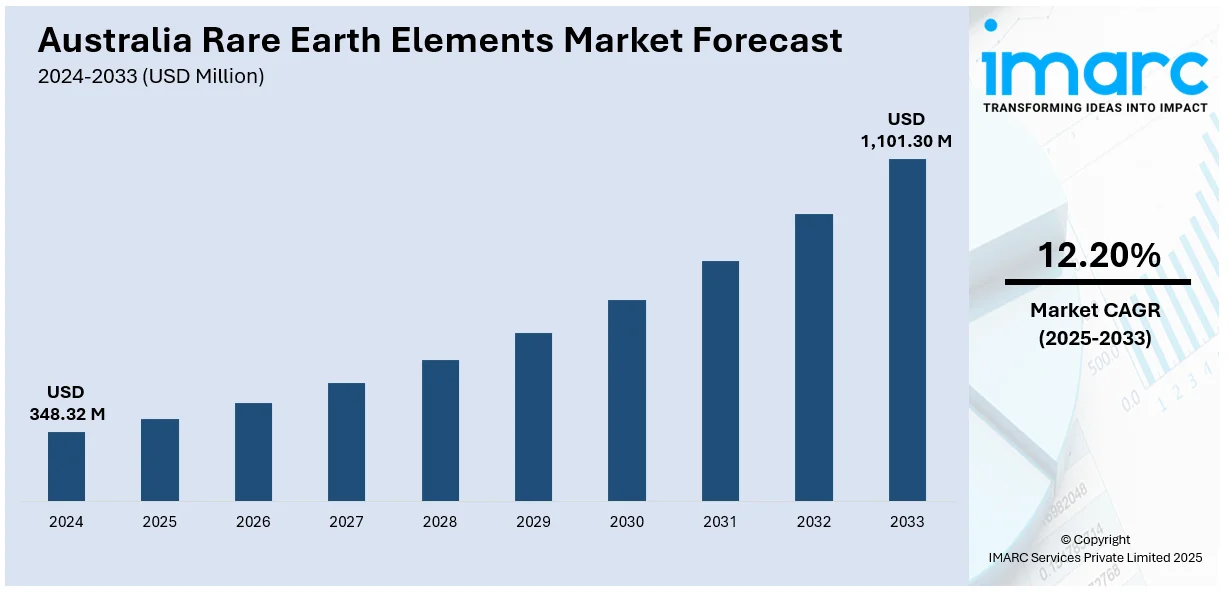

The Australia rare earth elements market size reached USD 348.32 Million in 2024. Looking forward, the market is projected to reach USD 1,101.30 Million by 2033, exhibiting a growth rate (CAGR) of 12.20% during 2025-2033. The market is being driven by the existence of abundant mineral reserves across the country, robust mining infrastructure, escalating global demand for clean energy technologies, geopolitical efforts to diversify supply chains away from China, and strong government support through strategic partnerships, export incentives, and investment in critical mineral projects to enhance national and international supply security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 348.32 Million |

| Market Forecast in 2033 | USD 1,101.30 Million |

| Market Growth Rate 2025-2033 | 12.20% |

Key Trends of Australia Rare Earth Elements Market:

Geological Abundance and Mining Infrastructure

Australia's rare earth elements industry is strongly driven by its geological resources and established mining infrastructure. Australia possesses some of the largest known rare earth mineral reserves outside China, especially in Western Australia, the Northern Territory, and Queensland. For example, Lynas Rare Earths' Mount Weld is richest known deposit in the world, emphasizing the country's natural advantage. Moreover, what distinguishes Australia is not only the richness of these minerals but also the politically stable environment and high environmental standards, which bring predictability and transparency to investors. The long history of mining in the country—covering commodities like gold, iron ore, and coal—has led to world-class infrastructure, such as rail connections, port access, and skilled workers. Furthermore, Australia is also supported by favorable government policies to promote critical mineral development. Initiatives such as the Critical Minerals Facilitation Office and financial assistance through Export Finance Australia further boost the industry. This provides a solid base for both local companies and foreign investors to expand operations with relative ease over less developed areas. With elevating demand, this strong base ensures that Australia can respond quickly and competitively.

To get more information on this market, Request Sample

Supply Chain Diversification and Geopolitical Shifts

Another key factor driving Australia's rare earth elements industry is the international trend towards supply chain diversification in the face of increasing geopolitical tensions, especially regarding China's monopoly in the REE industry. China has dominated the supply of more than 80% of the world's rare earths for decades, establishing a de facto monopoly that has raised global concerns over strategic reliance on one country. As a reaction, many countries—particularly the United States, Japan, and members of the European Union—are looking to create alternative, dependable supply chains. Australia, with its effective environmental regulation and established reserves, has become an attractive partner for nations seeking to acquire non-Chinese sources of rare earth elements. This is particularly important in strategic industries such as defense, renewable energy, and high-end electronics, where rare earths such as neodymium and dysprosium are used to produce permanent magnets, EV motors, and wind turbines. In addition to this, geopolitical developments such as US-China trade tensions and disruptions caused by the pandemic have further accentuated the dangers of dependence on a single-source supply paradigm.

Investment in Processing Infrastructure

Australia is significantly enhancing its capability to process rare earth elements (REE) domestically as part of a larger strategy aimed at reducing its reliance on international markets, particularly China, which has long been a leader in REE processing. Historically, Australia has been a major source of raw rare earths but has depended on foreign facilities for refining these materials. As global demand increases and the need for supply chain diversification becomes more pressing, Australia is focusing on developing its own refining infrastructure. This transition will lessen dependence on China and add value to Australia's raw materials, promoting economic growth and attracting investment. By bolstering its local processing facilities, Australia is working towards becoming a more independent and competitive participant in the global REE market. According to the Australia rare earth elements market analysis, this investment is anticipated to enhance the local economy, minimize supply chain vulnerabilities, and offer Australia increased control over the rare earths sector.

Growth Drivers of Australia Rare Earth Elements Market:

Increasing Global Demand

The increasing global need for rare earth elements (REEs) is accelerating, largely due to their vital function in electric vehicles (EVs), renewable energy solutions, and advanced electronic devices. As society pivots toward more sustainable energy and eco-friendly technologies, the demand for REEs like neodymium, praseodymium, and dysprosium essential for magnets in EVs and wind turbines has skyrocketed. With Australia holding extensive reserves of these critical materials, the country is well-positioned to fulfill this rising demand. The growing application of REEs in consumer gadgets, including smartphones, computers, and sophisticated medical equipment, further contributes to the market's expansion. Consequently, Australia rare earth elements market demand is anticipated to grow significantly as these industries evolve, reinforcing Australia’s significance in the global supply chain for REEs.

Government Support

The Australian government is playing a crucial role in advancing the rare earth elements (REE) market by making significant investments in infrastructure, exploration, and processing capabilities. By recognizing the strategic importance of REEs in emerging technologies and global supply chains, the government is providing funding to support exploration initiatives and enhance domestic production. Furthermore, efforts to establish processing facilities within Australia aim to decrease dependence on foreign refining, especially from China. This support strengthens the country’s REE supply chain and also generates employment, encourages technological advancements, and boosts Australia’s competitiveness in the international market. With ongoing policy support, the government is positioning the Australian REE sector as a vital contributor to meeting the increasing global demand for these materials.

Technological Advancements

Innovations in the extraction and processing of rare earth elements (REEs) are significantly elevating Australia’s status in the global market. New mining technologies that enable more efficient extraction of REEs from lower-grade ores are lowering operational expenses and making once-unprofitable resources viable. Advances in refining techniques, such as hydrometallurgy, are also enhancing the purity of the final product and increasing production efficiency. These developments boost supply and improve the competitiveness of Australia’s REE industry on a global scale. With ongoing advancements in technology, Australia is well-prepared to satisfy the growing demand for REEs across high-tech and sustainable industries, securing long-term growth in the market.

Opportunities of Australia Rare Earth Elements Market:

Sustainable Mining Practices

As the global need for environmentally friendly solutions increases, Australia is positioned to take a leading role in sustainable practices for rare earth mining. By implementing environmentally responsible methods such as decreasing water and energy consumption, minimizing land disruption, and establishing effective waste management systems the nation can improve its ecological footprint. Additionally, a commitment to sustainability may attract investments from international companies and governments focused on green technologies. By establishing itself as a responsible supplier of rare earth elements (REEs), Australia can meet stricter environmental standards and cater to industries that prioritize ethically sourced materials. This emphasis on sustainable practices is likely to enhance Australia rare earth elements market share, increasing the country's competitiveness in the global market.

Investment in Exploration

Australia boasts significant untapped reserves of rare earth elements (REEs), and ongoing investments in exploration provide a substantial opportunity to bolster its role as a major global supplier. By supporting advanced exploration technologies, Australia can identify new deposits in regions that have not been thoroughly explored. This initiative will broaden the country's rare earth resources and enhance its ability to satisfy the rising demand for REEs in high-tech and green sectors. Consequently, Australia can fortify its competitive position in the international market, secure long-term supply agreements, and play a critical role in diversifying the global REE supply chain.

Research and Innovation

Investing in research and innovation is vital for enhancing the efficiency and cost-effectiveness of extraction and refining methods in Australia's rare earth sector. Cutting-edge technologies, such as bioleaching and solvent extraction, can decrease production expenses and lessen environmental impacts. Moreover, refining methods that enhance the purity of rare earth elements will render Australian REEs more appealing to global industries. By prioritizing these innovations, Australia can boost productivity, diminish dependence on conventional practices, and establish itself as a frontrunner in the REE market. This technological advantage will help ensure Australia’s enduring position as a dependable supplier in the global arena.

Challenges of Australia Rare Earth Elements Market:

Processing and Refining Limitations

Australia possesses significant reserves of rare earth elements (REEs); however, its capabilities for processing and refining these materials are still quite limited. Although the nation is a top producer of raw REEs, the majority of value-added refining takes place abroad, mostly in China. This dependence on overseas processing facilities hinders Australia’s ability to fully capitalize on its rare earth resources economically. Moreover, the absence of local refining infrastructure leads to logistical difficulties and increased transportation costs, further constraining the profitability of Australia's rare earth industry. To address this issue, Australia needs to invest in domestic processing facilities to lessen its reliance on foreign markets and strengthen its position within the global rare earth supply chain.

High Production Costs

The processes involved in extracting and refining rare earth elements are intricate and costly, particularly for lower-grade deposits. Although Australia is rich in REE resources, many extraction techniques require sophisticated and expensive methods that can elevate production costs. This includes specialized equipment, chemicals, and techniques necessary for processing rare earths, along with environmental management expenses intended to minimize the ecological effects of mining. Consequently, the production costs in Australia are generally higher than in countries with more efficient processing systems or more easily accessible deposits. This high cost of production presents a challenge for Australian producers, who must strive to find a balance between competitive pricing, sustainability, and profitability amidst a fluctuating global market.

Market Volatility

The global market for rare earth elements experiences considerable volatility, influenced by various factors, including technological changes, geopolitical tensions, and shifts in manufacturing practices. The demand for REEs often varies based on the needs of technologies such as electric vehicles, renewable energy systems, and consumer electronics, which can be unpredictable due to rapid advancements and changing consumer trends. Geopolitical uncertainties, such as trade disputes and policy shifts, can also impact supply and pricing for rare earths. This market instability poses challenges for Australian producers, who find it difficult to plan for long-term investments and maintain steady returns in an environment characterized by fluctuating demand and pricing. It also complicates the establishment of stable contracts and securing consistent revenue streams.

Australia Rare Earth Elements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application.

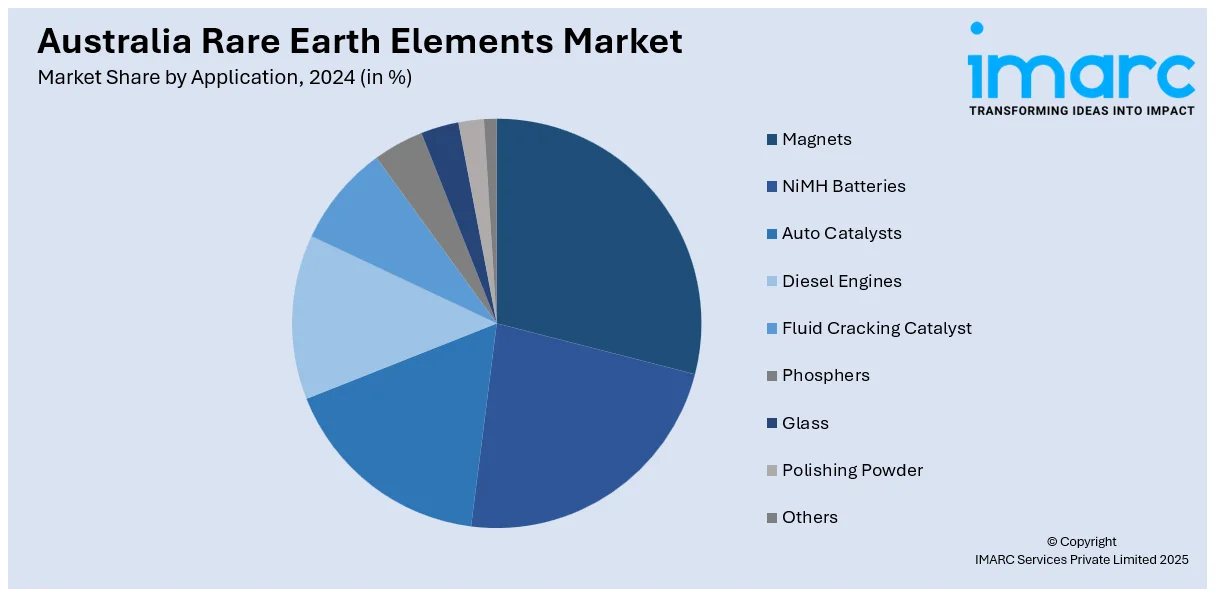

Application Insights:

- Magnets

- NiMH Batteries

- Auto Catalysts

- Diesel Engines

- Fluid Cracking Catalyst

- Phosphers

- Glass

- Polishing Powders

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes magnets, NiMH batteries, auto catalysts, diesel engines, fluid cracking catalyst, phosphers, glass, polishing powders, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Arafura Rare Earths

- Australian Rare Earths Limited

- Australian Strategic Materials Ltd

- Hastings Technology Metals Limited

- Iluka Resources Limited

- Lynas Rare Earths Ltd

- Northern Minerals Limited

Australia Rare Earth Elements Market News:

- December 2024: Australia approved an additional AUD 400 million (USD 257 million) loan to Iluka Resources for its Eneabba rare earths refinery in Western Australia, increasing total government support to AUD 1.65 billion. Eneabba aims to be Australia's first fully integrated rare earths refinery, crucial for diversifying global supply chains away from China.

- September 2024: ABx Group and Ucore Rare Metals signed a Memorandum of Understanding to establish a supply chain for mixed rare earth carbonates from Tasmania to the United States. The agreement grants Ucore the first right of refusal for 50% of ABx's annual output over five years and includes potential investment by Ucore into ABx's Tasmanian project. This collaboration aims to strengthen the Australia-USA rare earths supply chain, enhancing market confidence and potentially influencing rare earth prices.

Australia Rare Earth Elements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Magnets, NiMH Batteries, Auto Catalysts, Diesel Engines, Fluid Cracking Catalyst, Phosphers, Glass, Polishing Powders, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Arafura Rare Earths, Australian Rare Earths Limited, Australian Strategic Materials Ltd, Hastings Technology Metals Limited, Iluka Resources Limited, Lynas Rare Earths Ltd, Northern Minerals Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia rare earth elements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia rare earth elements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia rare earth elements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rare earth elements market in the Australia was valued at USD 348.32 Million in 2024.

The Australia rare earth elements market is projected to exhibit a compound annual growth rate (CAGR) of 12.20% during 2025-2033.

The Australia rare earth elements market is expected to reach a value of USD 1,101.30 Million by 2033.

The growing global demand for green technologies, such as electric vehicles and renewable energy, is a major driver. Additionally, strategic investments in exploration, processing infrastructure, and technological innovation, coupled with geopolitical shifts and government support, are fueling the growth of Australia’s rare earth market.

Australia is witnessing a shift towards developing local processing capabilities, reducing reliance on international facilities. Increased government investment, rising global demand for REEs in clean energy and technology sectors, and advancements in sustainable mining practices are further shaping the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)