Australia Ready Mix Concrete Market Size, Share, Trends and Forecast by Product, End Use Sector, and Region, 2025-2033

Australia Ready Mix Concrete Market Overview:

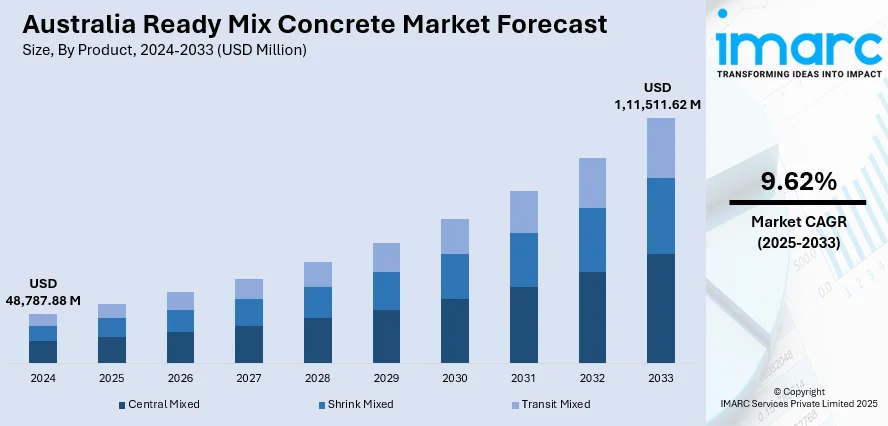

The Australia ready mix concrete market size reached USD 48,787.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,11,511.62 Million by 2033, exhibiting a growth rate (CAGR) of 9.62% during 2025-2033. Market growth is fueled by drivers like the rapid development of infrastructure projects, rising demand for residential and commercial buildings, and the emphasis on sustainable construction techniques. Urbanization and government investments in transport and energy projects also have a huge impact on the Australia ready mix concrete market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 48,787.88 Million |

| Market Forecast in 2033 | USD 1,11,511.62 Million |

| Market Growth Rate 2025-2033 | 9.62% |

Australia Ready Mix Concrete Market Trends:

Technological Advancements in Concrete Production

One of the dominant trends in Australia ready mix concrete market development is the integration of cutting-edge technology in producing concrete. Through innovation like computer-controlled batching plants, improved mix design, and utilizing recycled content, manufacturers can make production more efficient, save costs, and guarantee higher quality. These advancements also enable better customizability, which allows for ready mix concrete manufacturers to meet the individualized needs of megaproject infrastructure. Moreover, the use of predictive analytics and Internet of Things (IoT) devices in plant operations assists in enhancing the precision of production, tracking quality, and lowering operational expenses. This trend is likely to speed up the overall growth and sustainability of the market. For instance, in January 2025, ITOCHU Corporation entered into a collaboration agreement with Mitsubishi UBE Cement and MCi Carbon Pty Ltd to produce carbon-embodied products utilizing MCi's mineral carbonation technology. This innovative technology captures CO2 and repurposes waste materials, such as concrete and steel slag, as alternatives to traditional cement. A demonstration plant in Newcastle, Australia, is scheduled to commence operations in 2025.

To get more information on this market, Request Sample

Focus on Sustainability and Green Building Materials

Sustainability is increasingly becoming a significant trend in the Australia ready mix concrete market. With heightened environmental awareness, both private and public sectors are prioritizing the use of eco-friendly materials in construction. Ready mix concrete manufacturers are now incorporating waste materials such as fly ash, slag, and recycled aggregates to reduce the carbon footprint of concrete production. This transition to more sustainable practices aligns with the government’s focus on green building certifications and environmental standards. Moreover, the rise of "green concrete" solutions is driving demand, as it helps achieve energy efficiency and reduces the overall environmental impact of construction projects. This trend is expected to further contribute to the Australia ready mix concrete market growth in the coming years. For instance, in April 2025, Boral secured USD 15 Million from the Australian government for decarbonisation upgrades at its Berrima cement plant in New South Wales. The funding will support a kiln feed optimisation project aimed at increasing the use of alternative raw materials (ARM) from 9% to 23%, reducing energy intensity. Boral's recent decarbonisation efforts include a chlorine bypass unit and a carbon capture pilot project.

Australia Ready Mix Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product and end use sector.

Product Insights:

- Central Mixed

- Shrink Mixed

- Transit Mixed

The report has provided a detailed breakup and analysis of the market based on the product. This includes central mixed, shrink mixed, and transit mixed.

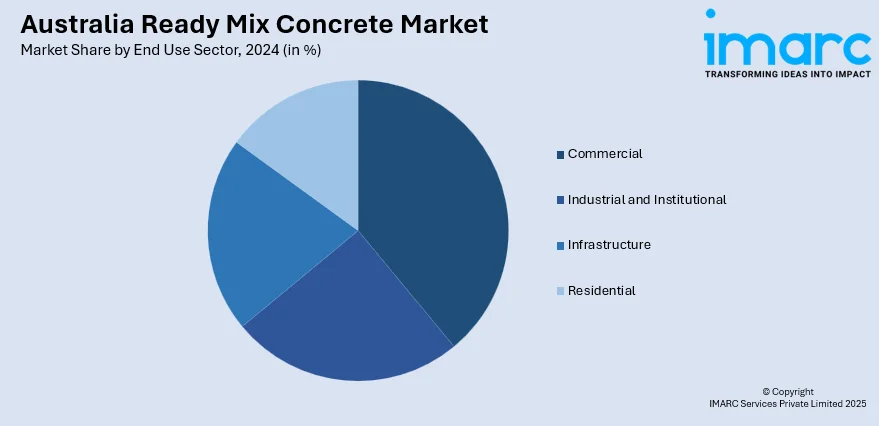

End Use Sector Insights:

- Commercial

- Industrial and Institutional

- Infrastructure

- Residential

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes commercial, industrial and institutional, infrastructure, and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ready Mix Concrete Market News:

- In April 2025, Heidelberg Materials acquired Midway Concrete, an Australian family-owned ready-mixed concrete business, enhancing its presence in the Melbourne and Geelong areas. The acquisition adds four concrete plants to its operations, reinforcing its market position and product portfolio, particularly with sustainable solutions.

- In April 2025, the HW Richardson Group Ltd (HWR), a Southland-based family-owned company, acquired Christchurch Ready-Mix Concrete Ltd (CRMC). HWR, which has a diverse portfolio including transport, energy, and quarrying in New Zealand and Australia, views the acquisition as an opportunity to strengthen its customer service and expand its presence in the concrete industry.

- In February 2025, Cement Australia, Holcim, and Heidelberg Materials (HMA) proposed plans to acquire BGC Cementitious, a division of BGC Group, which supplies cement, concrete, aggregates, and asphalt in Western Australia. The acquisition would involve Cement Australia taking BGC’s cement assets, while Holcim and HMA will jointly manage BGC’s quarry and asphalt assets. BGC’s ready-mix concrete sites in Perth will be divided between Holcim and HMA.

- In November 2024, Hanson Australia rebranded as Heidelberg Materials Australia, aligning with its parent company's global rebranding strategy. The transformation emphasizes sustainability, digital innovation, and a broadened range of low-carbon construction materials, including concrete, aggregates, and asphalt.

Australia Ready Mix Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Central Mixed, Shrink Mixed, Transit Mixed |

| End Use Sectors Covered | Commercial, Industrial and Institutional, Infrastructure, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia ready mix concrete market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia ready mix concrete market on the basis of product?

- What is the breakup of the Australia ready mix concrete market on the basis of end use sector?

- What is the breakup of the Australia ready mix concrete market on the basis of region?

- What are the various stages in the value chain of the Australia ready mix concrete market?

- What are the key driving factors and challenges in the Australia ready mix concrete market?

- What is the structure of the Australia ready mix concrete market and who are the key players?

- What is the degree of competition in the Australia ready mix concrete market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ready mix concrete market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ready mix concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ready mix concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)