Australia Recycled Plastics Market Size, Share, Trends and Forecast by Plastic Type, Raw Material, Application, and Region, 2025-2033

Australia Recycled Plastics Market Overview:

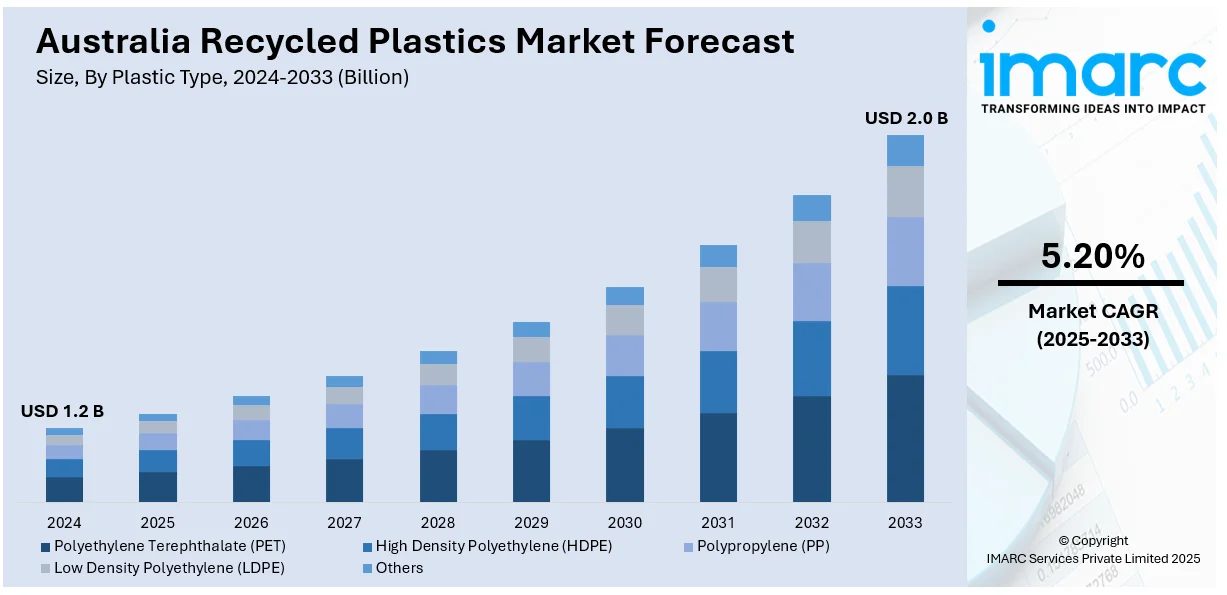

The Australia recycled plastics market size reached USD 1.2 Billion in 2024. Looking forward, the market is expected to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by the growing focus on measures like phasing out the problematic plastics, enhancing recycling infrastructure, and imposing mandatory packaging targets, rising environmental awareness and demand for sustainable products, and increasing use of sophisticated mechanical and chemical recycling technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Key Trends of Australia Recycled Plastics Market:

Government Regulations and Policy Support for Circular Economy

Australia's shift toward a circular economy is emerging as a major factor driving the demand for recycled plastics. Federal and state-level regulatory frameworks are encouraging industries to minimize plastic waste and enhance recycling rates. According to an article by the Australian Institute, by 2050 the quantity of plastic consumed by Australia will be more than double. The initiatives launched by the Australian Government, requires measures like phasing out the problematic plastics, enhancing recycling infrastructure, and imposing mandatory packaging targets. These goals mandate that 100% of packaging must be reusable, recyclable, or compostable. In turn, producers are incorporating recycled plastics into their supply chains to meet compliance levels and prevent penalties. In addition, investment programs are speeding up investment in next generation recycling plants, enhancing local processing capacity. This policy environment is creating a conducive ecosystem that promotes the use of recycled plastic by businesses and municipalities.

To get more information of this market, Request Sample

Rising Environmental Awareness and Demand for Sustainable Products

At present, environmental awareness is rising, which is driving the demand for products with recycled content. Concern about pollution of the ocean, landfills overflowing, and global warming is motivating companies to become more sustainable. Australians now prefer environment friendly products more, and companies that visibly incorporate recycled material earn brand reputation and loyalty, as various studies on consumers indicate. Retailers and fast-moving consumer goods (FMCG) companies are reacting by incorporating recycled plastics into packaging, which resonates with consumer values and boosts brand reputation. For instance, certain beverage and personal care brands are introducing packaging with high levels of recycled content. This trend is supported by labeling programs like the Australian Recycling Label (ARL), which enables consumers to make informed choices. The Government of Australia also initiated a consultation period on September 28, 2024, to reform packaging regulation to reduce waste, promote recycling levels, and support a circular economy for packaging, which further supports the Australia recycled plastics market growth and development as well.

Technological Advancements in Recycling Processes

Innovations in plastic recycling technological is greatly improving the quality, effectiveness, and profitability of recycled plastic in Australia. The use of sophisticated mechanical and chemical recycling technology is opening the types of plastics that can be recycled, such as earlier hard-to-process plastics like colored plastics and multi-layer packaging. These developments are important in that they enable the production of recycled plastic that has industry-grade specifications, making it a viable competitor to virgin plastic. Specifically, chemical recycling technologies like pyrolysis and depolymerization are on a rise, allowing for the disintegration of plastic waste into fuel or monomers, which can be reused to make high-quality plastic. These processes enable the production of food-grade recycled plastic, which is critical to use in food and beverage packaging. According to the IMARC Group, the Australia food and beverage (F&B) market size is expected to reach USD 189.56 Billion by 2033.

Growth Drivers of Australia Recycled Plastics Market:

Government Investment in Recycling Infrastructure

Substantial government investment through the Recycling Modernization Fund is accelerating Australia recycled plastics market demand by enhancing processing capabilities nationwide. The AUD 250 Million fund supports next-generation recycling facility construction, technology upgrades, and capacity expansion projects. Federal and state governments are co-investing in modern sorting facilities, advanced recycling plants, and collection infrastructure improvements. These investments address processing bottlenecks, improve recycling efficiency, and create economies of scale. The infrastructure development reduces transportation costs, improves material quality, and enables local processing of plastic waste, making recycled plastics more cost-competitive and readily available for manufacturers across Australia.

Corporate Sustainability Commitments and ESG Requirements

Increasing corporate sustainability commitments and Environmental, Social, and Governance (ESG) requirements are driving systematic adoption of recycled plastics across industries. Major Australian corporations are setting science-based targets for carbon reduction and circular economy implementation. Institutional investors are prioritizing ESG performance in investment decisions, pressuring companies to demonstrate environmental responsibility. Brand reputation risks associated with plastic pollution are motivating proactive sustainability strategies. Supply chain transparency requirements and sustainability reporting standards are mandating recycled content disclosure. These factors create consistent, long-term demand for recycled plastics as companies integrate circular economy principles into their core business strategies and operations.

Waste-to-Resource Value Creation Initiatives

The region’s transition from waste disposal to resource recovery is creating significant economic opportunities in the Australia recycled plastics market share. Advanced sorting technologies and quality control systems are improving recycled plastic specifications, enabling premium applications. Product stewardship schemes and container deposit systems are increasing collection rates and material quality. Innovation in recycling processes is creating new revenue streams from previously low-value plastic waste streams. Public-private partnerships are developing integrated waste management systems that optimize material recovery and processing. These initiatives transform plastic waste from a disposal cost into a valuable resource, supporting sustainable business models and driving market expansion.

Government Regulation for Australia Recycled Plastics Market:

National Plastics Plan Implementation

The National Plastics Plan of the Australian Government offers a thorough policy framework that encourages the growth of the recycled plastics market through financial incentives and regulatory actions. In order to achieve 100% recyclable or compostable packaging by 2025, the strategy calls for the phase-out of problematic single-use plastics, increased recycling objectives, and obligatory packaging regulations. Various plastic product categories are implementing product stewardship programs, which establish organized mechanisms for collection and recycling. By requiring businesses to pay for recycling, Extended Producer Responsibility laws provide long-term funding for infrastructure improvements. By coordinating the efforts of the federal, state, and local governments, the strategy provides long-term market stability and regulatory predictability for investments in and business development related to recovered plastics.

Recycling Modernization Fund Investment

According to the Australia recycled plastics market analysis, the Recycling Modernization Fund represents the largest government investment in the region’s recycling infrastructure, providing AUD 250 million in co-investment for modern recycling facilities and technology upgrades. The fund supports next generation sorting technology, advanced recycling plant construction, and capacity expansion projects specifically targeting plastic waste processing. Federal and state government co-investment reduces private sector risk and enables large-scale infrastructure development. Priority funding for innovative recycling technologies including chemical recycling processes accelerates industry transformation. The investment program creates jobs in regional areas while building domestic processing capacity, reducing reliance on overseas markets and ensuring supply chain resilience for recycled materials.

Regulatory Framework and Standards Development

Government organizations are creating thorough regulatory frameworks and industry standards to boost customer confidence and the growth of the recycled plastics business. In order to avoid anti-competitive behavior and maintain market openness, the Australian Competition and Consumer Commission regulates fair trade and market practices in recycling marketplaces. In order to enable uniform performance expectations across applications, Standards Australia is creating quality standards for items made from recycled plastic. In order to allow food-grade recycled plastics while upholding consumer protection standards, food safety rules are being revised. There is a steady demand for recycled materials as a result of environmental protection legislation that are tightening recycling regulations and waste reduction goals. Frequent consultation procedures with industry participants guarantee that laws continue to be useful and efficient in fostering market expansion.

Opportunities of Australia Recycled Plastics Market:

Food-Grade Recycled Plastics Development

The development of food-grade recycled plastics presents significant opportunities as food and beverage companies seek sustainable packaging solutions. Advanced chemical recycling technologies enable the production of recycled plastics meeting strict food safety standards and regulatory requirements. The Australian food and beverage market's projected growth to USD 189.56 billion by 2033 creates substantial demand for food-contact packaging materials. Investment in closed-loop recycling systems specifically for food packaging could capture this premium market segment. Partnerships between recycling companies and food manufacturers can develop specialized supply chains, ensuring quality consistency and regulatory compliance while meeting growing consumer demand for sustainable packaging solutions.

Construction Industry Integration

The construction sector offers substantial opportunities for recycled plastic applications including infrastructure, building materials, and innovative construction solutions. Recycled plastics can replace traditional materials in applications like road construction, drainage systems, and building components, offering durability and weather resistance. Government infrastructure spending and housing development projects create consistent demand for construction materials. Recycled plastic products often provide superior performance characteristics compared to traditional materials while contributing to green building certifications. Development of construction-grade recycled plastic standards and building code approvals could unlock this significant market opportunity, supporting both sustainability goals and industry growth.

Export Market Development

Australia's strategic position in the Asia-Pacific region creates opportunities for recycled plastic exports to countries with growing manufacturing sectors and sustainability commitments. Regional trade agreements and sustainability partnerships can facilitate market access for high-quality recycled materials. Developing countries in the region are implementing plastic waste reduction policies, creating demand for recycled inputs. Australia's advanced recycling technologies and quality standards provide competitive advantages in export markets. Investment in export-oriented recycling facilities and international certification could capture these opportunities. Strategic partnerships with Asian manufacturers and government-to-government sustainability agreements could facilitate market entry and long-term supply relationships.

Challenges of Australia Recycled Plastics Market:

Quality Consistency and Contamination Issues

Pricing and market acceptance of recycled plastic are still largely impacted by the problem of managing contamination while maintaining constant quality standards. The quality of finished products and processing efficiency are impacted by the non-recyclable contaminants that are frequently included in mixed plastic waste streams. Production costs are raised by the need for thorough sorting and cleaning procedures due to contamination from food remains, labels, and mixed polymer types. Market potentials are limited by the quality variations in recycled plastics, which limit their use in high-specification products. To increase the quality of the waste stream, money must be invested in cutting-edge sorting technologies and consumer education initiatives. It may be possible to resolve concerns about market confidence and facilitate wider industry adoption by creating standardized quality standards and certification procedures.

Economic Competitiveness Against Virgin Plastics

The cost of virgin plastic is directly impacted by changes in oil market prices, which makes it difficult for recycled alternatives to compete. The demand for recycled materials declines when the price of crude oil declines because virgin plastics become more affordable. Recycled plastic processing costs are frequently higher than those of virgin plastic manufacture, necessitating premium pricing or regulatory assistance for sustainability benefits. Economic feasibility and the use of recycling facilities are impacted by changes in market demand. Investment certainty requires stable pricing structures and long-term contracts. By internalizing the environmental costs of producing virgin plastic, carbon pricing policies and extended producer responsibility programs could aid in leveling the playing field.

Collection and Logistics Infrastructure Gaps

The quantity and quality of plastic waste feedstock for recycling operations are restricted by inadequate collecting methods and logistical difficulties. Inefficient collection networks are common in rural and remote locations, which lowers material recovery rates and raises transportation expenses. Waste generation patterns are impacted by seasonal fluctuations in visitor numbers, which results in irregular recycling facility supplies. Material deterioration and contamination result from collection locations' inadequate storage and sorting capacities. To maximize material flows, investments must be made in regional processing capacities, reverse logistics networks, and collection infrastructure. To create effective networks for collection and processing, coordination between recycling facilities, waste management firms, and municipal governments is crucial.

Australia Recycled Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on plastic type, raw material, and application.

Plastic Type Insights:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

The report has provided a detailed breakup and analysis of the market based on the plastic type. This includes polyethylene terephthalate (pet), high density polyethylene (HDPE), polypropylene (PP), low density polyethylene (LDPE), and others.

Raw Material Insights:

- Plastic Bottles

- Plastic Films

- Rigid Plastic and Foam

- Fibers

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plastic bottles, plastic films, rigid plastic and foam, fibers, and others.

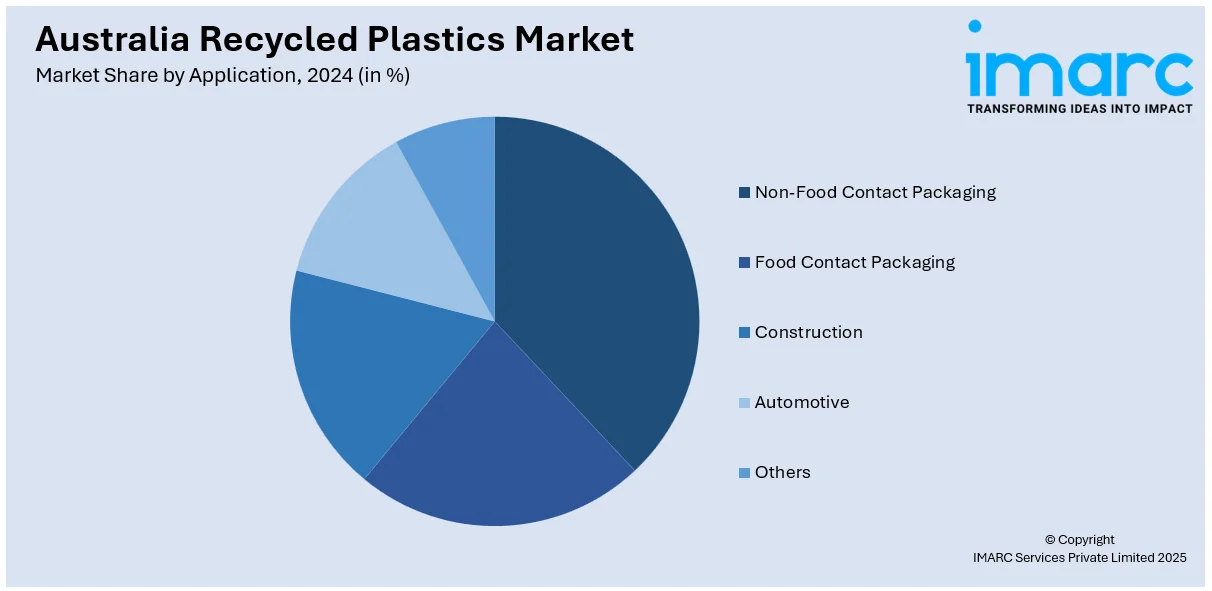

Application Insights:

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Automotive

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-food contact packaging, food contact packaging, construction, automotive, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Recycled Plastics Market News:

- February 2024: Australia initiated soft plastic recycling restoration through a limited trial in 12 supermarkets after the collapse of REDcycle in 2022. The Soft Plastics Taskforce launched this pilot program to test new collection and processing systems before nationwide expansion. This development addresses the recycling gap created when REDcycle failed, leaving consumers without convenient soft plastic recycling options.

- September 2024: The Australian Government commenced public consultation on packaging regulation reforms aimed at reducing waste and promoting circular economy principles. The consultation focused on two key legislative pieces: toxic chemical reduction in packaging and mandatory minimum recycled content requirements. These proposed regulations support long-term market development for recycled plastics through structured demand creation.

- December 2024: NSW EPA announced major investment in soft plastics recycling infrastructure, targeting diversion of over 12,000 tonnes annually from landfills. The investment supports development of local processing facilities capable of transforming soft and hard-to-recycle plastics into valuable manufacturing inputs. This infrastructure development strengthens regional recycling capacity and creates sustainable markets for previously non-recyclable materials.

- 2024: The launch of Soft Plastics Stewardship Australia marked a significant milestone in industry-led recycling initiatives. This stewardship scheme brings together major retailers, manufacturers, and recycling companies to create sustainable soft plastics collection and processing systems. The initiative represents collaborative industry response to recycling challenges and demonstrates commitment to circular economy principles.

Australia Recycled Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Plastic Types Covered | Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Polypropylene (PP), Low Density Polyethylene (LDPE), Others |

| Raw Materials Covered | Plastic Bottles, Plastic Films, Rigid Plastic and Foam, Fibers, Others |

| Applications Covered | Non-Food Contact Packaging, Food Contact Packaging, Construction, Automotive, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia recycled plastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia recycled plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia recycled plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia recycled plastics market was valued at USD 1.2 Billion in 2024.

The Australia recycled plastics market is projected to exhibit a CAGR of 5.20% during 2025-2033.

The Australia recycled plastics market is projected to reach a value of USD 2.0 Billion by 2033.

The market is experiencing significant transformation through trends like advanced chemical recycling technology adoption, comprehensive circular economy policy implementation, and rising consumer sustainability preferences. Chemical recycling processes also enable high-quality material recovery from complex waste streams, while government mandates for recyclable packaging create structured demand.

The Australia recycled plastics market is driven by substantial government infrastructure investment through the recycling modernization fund, increasing corporate sustainability commitments and ESG requirements, and waste-to-resource value creation initiatives. Advanced processing technologies, regulatory support, and institutional investor pressure for environmental responsibility are accelerating market growth nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)