Australia RegTech Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033

Australia RegTech Market Overview:

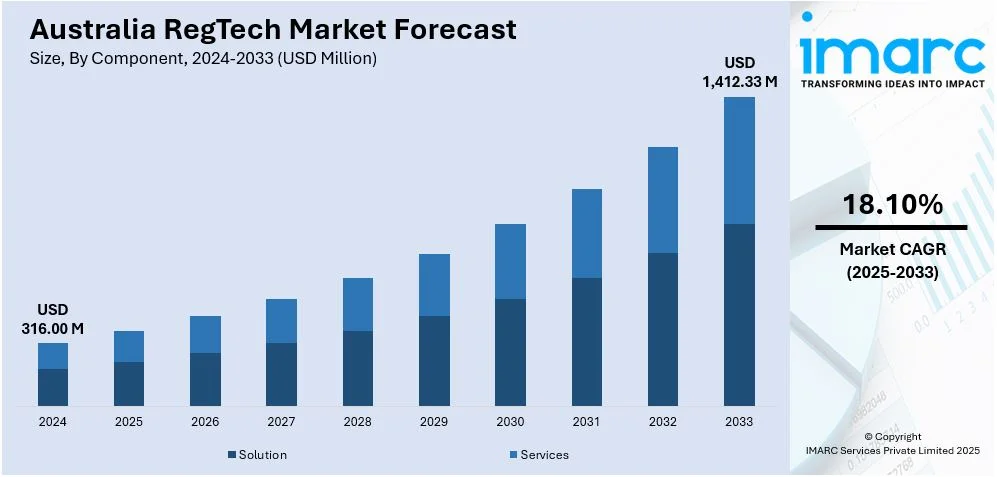

The Australia RegTech market size reached USD 316.00 Million in 2024. Looking forward, the market is expected to reach USD 1,412.33 Million by 2033, exhibiting a growth rate (CAGR) of 18.10% during 2025-2033. Tightening compliance mandates, rising audit and reporting obligations, and expansion of regulatory oversight into non-financial sectors, along with national data privacy laws, digital banking expansion, and secure data-sharing protocols, are some of the factors positively impacting the market. AI-driven compliance tools, real-time monitoring platforms, and CDR-aligned governance solutions are additional factors augmenting the Australia RegTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 316.00 Million |

| Market Forecast in 2033 | USD 1,412.33 Million |

| Market Growth Rate 2025-2033 | 18.10% |

Key Trends of Australia RegTech Market:

Strengthening Regulatory Mandates Across Financial and Non-Financial Sectors

Australia has implemented a robust regulatory framework driven by agencies such as the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA), placing increased emphasis on compliance, transparency, and risk oversight. Following high-profile inquiries and enforcement actions in recent years, regulatory scrutiny has intensified across banking, insurance, and superannuation sectors. Institutions are now required to adhere to detailed compliance obligations including real-time transaction reporting, breach notifications, and enhanced audit trails. Traditional manual compliance approaches are proving insufficient to manage the growing volume and complexity of these requirements. The expansion of mandates under legislation such as the Anti-Money Laundering and Counter-Terrorism Financing Act and the Consumer Data Right framework has necessitated the adoption of digital compliance systems capable of automating regulatory workflows and ensuring accuracy at scale. Additionally, non-financial sectors, such as legal, property, and gaming, are facing greater accountability under cross-industry compliance rules, further widening the addressable market for regulatory technology. As more organizations prioritize operational efficiency while mitigating enforcement risks, demand is shifting toward RegTech platforms with integrated monitoring, reporting, and governance capabilities. On April 6, 2025, Ozone API and ProductCloud formed a partnership to assist Australian companies in achieving open banking API compliance. This collaboration will help non-bank lenders comply with the Consumer Data Right (CDR) legislation, streamlining the integration of open APIs in line with Australian Consumer Data Standards. The partnership leverages both companies’ expertise in open banking to deliver a cost-effective, rapid compliance solution to the Australian financial sector. This evolution in compliance expectations and technological readiness has significantly contributed to Australia RegTech market growth across both traditional and emerging regulated industries.

To get more information of this market, Request Sample

Data Privacy Standards and Expansion of Digital Financial Services

According to the Australia RegTech market analysis, the growth of digital banking, payment systems, and fintech solutions in the region has heightened the importance of secure, compliant, and automated data governance frameworks. With the introduction of the Privacy Act reforms, the Notifiable Data Breaches scheme, and the operationalization of the Consumer Data Right (CDR), institutions must now provide customers with greater control over their data while ensuring strict adherence to privacy protections. This legal landscape has compelled firms to invest in technologies that automate consent management, customer identity verification, and secure data transmission. Simultaneously, the Australian financial ecosystem is experiencing increasing digital transactions through neobanks, open banking platforms, and API-based service models. These innovations require continuous oversight to meet both compliance and cybersecurity requirements without impeding agility. RegTech vendors are responding by offering AI-driven solutions for risk scoring, behavioural analysis, and audit readiness tailored to data-intensive, digital-first business models. On May 8, 2023, AssuranceLab, an Australian regtech startup based in Sydney, made significant strides in expanding its operations in the US. The company, known for its cloud-based audit platform, Pillar, has grown its client base to include over 200 high-growth software companies across 13 countries, with a notable 15% of its clients now based in the US. The startup's success in the US has been propelled by a strategic partnership with Drata, a leading compliance automation platform, and support from Austrade’s Landing Pads program, which facilitated key market connections and insights. Organizations are turning to these tools to ensure alignment with evolving regulations while maintaining customer trust and operational resilience.

Growth Drivers of Australia RegTech Market:

Strong Regulatory Framework and Compliance Requirements

One of the most important drivers of the RegTech market in Australia is the nation's increasingly strong regulatory framework, especially across financial services. Organizations like the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA) are putting more pressure on Australian institutions to adhere to a wide range of rules. Due to increased scrutiny brought about by incidents such as the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, banks, insurers, and superannuation funds are now subject to stricter compliance standards. The changes have triggered a robust need for technology-based compliance solutions with the capability to automate regulatory reporting, track transactions in real time, and provide transparency. RegTech platforms facilitate organisations to better control risks and lower the expenditures linked to compliance processes that are carried out manually. As regulations are changing at a fast pace and enforcement is turning more stringent, Australian businesses are adopting RegTech as a strategic investment to keep abreast of regulation and steer clear of high penalties.

Innovation-Friendly Ecosystem and Government Support

The innovation-friendly business ecosystem and government-supported programs are also driving the Australia RegTech market demand. The nation boasts a robust fintech and startup environment, with Sydney and Melbourne being hotspots for tech innovation and financial services. Sandboxes initiated by regulatory bodies and funding from government agencies like Austrade and the Australian Trade and Investment Commission facilitate testing and implementation of RegTech solutions in a safe environment. These efforts help startups collaborate with regulators and finance institutions closely, building confidence and driving uptake. Additionally, Australia's high priority on cybersecurity, data privacy, and digitalization offers favorable ground for RegTech solutions that can deliver secure and scalable services. Domestic demand is also supported by international interest, as Australian RegTech companies start venturing outwards, capitalizing on the nation's global standing for high regulatory standards. This support system allows for constant innovation, keeping RegTech providers ahead of local and international compliance issues.

More Emphasis on ESG Reporting and Corporate Responsibility

The escalating attention to Environmental, Social, and Governance (ESG) reporting and corporate responsibility within Australia is developing as one of the leading drivers of the RegTech market. Companies face growing pressure from investors, regulators, and society at large to make their ESG practices transparent and consistent. Regulators are setting new standards and guidelines for sustainability reporting, responsible business conduct, and climate change- and social issue-related risk management. This has put pressure on companies to have real-time automated systems that can monitor, manage, and report ESG-related information. RegTech solutions are adapting to meet this need through the provision of tools for ensuring conformity with ESG disclosure needs, incorporating sustainability metrics into corporate reporting and third-party auditing. In Australia, where regulatory directions become ever more aligned with international sustainability aspirations, business houses are using RegTech to remain compliant and competitive as well as increasing stakeholder confidence and brand reputation through improved governance practices.

Australia RegTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

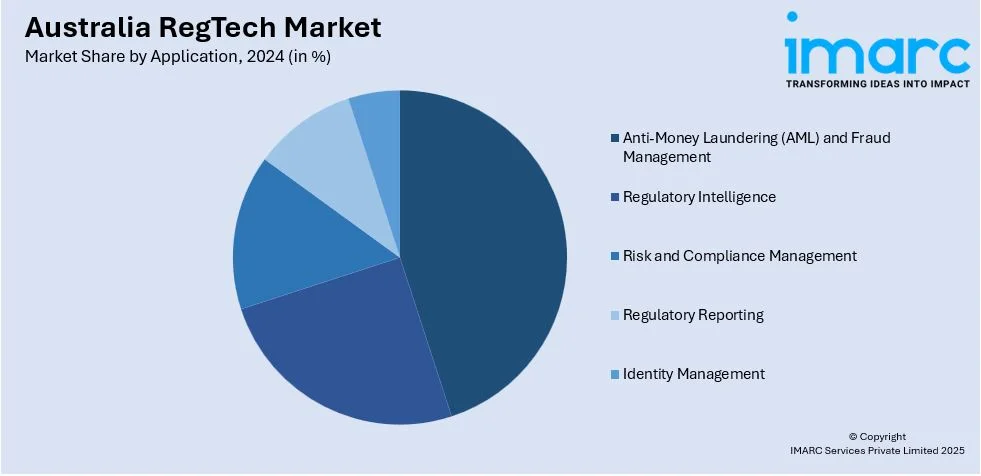

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

The report has provided a detailed breakup and analysis of the market based on the application. This includes anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, insurance companies, FinTech firms, IT and telecom, public sector, energy and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia RegTech Market News:

- On June 7, 2024, FrankieOne, an Australian RegTech leader, was awarded the prestigious title of FinTech Organisation of the Year 2024 by FinTech Australia. This marks the fourth consecutive year the company has received this honor, underscoring its innovation in providing global solutions for identity verification, KYC, and fraud prevention. Recently, FrankieOne also secured the RegTech of the Year APAC 2024 award, highlighting its rapid growth with a remarkable 4,743% revenue increase and its commitment to transforming the fintech sector.

Australia RegTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia RegTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia RegTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia RegTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia RegTech market was valued at USD 316.00 Million in 2024.

The Australia RegTech market is projected to exhibit a CAGR of 18.10% during 2025-2033.

The Australia RegTech market is expected to reach a value of USD 1,412.33 Million by 2033.

The Australia RegTech market trends include rising adoption of AI-driven compliance tools, real-time risk monitoring, and ESG-focused reporting solutions. Open banking and digital transformation are accelerating demand for automated regulatory technologies. Collaboration between startups, regulators, and financial institutions supports innovation, while global expansion of local RegTech firms further strengthens market influence.

The Australia RegTech market is driven by strict regulatory compliance demands, strong government support for innovation, and a growing focus on ESG reporting. A robust financial sector, increasing digitalization, and active regulatory bodies push organizations to adopt advanced technologies that streamline compliance, reduce risk, and enhance transparency across operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)