Australia Residential Battery Storage Market Size, Share, Trends and Forecast by Battery Type, Capacity, Ownership Model, Sales Channel, Application, and Region, 2025-2033

Australia Residential Battery Storage Market Size and Trends:

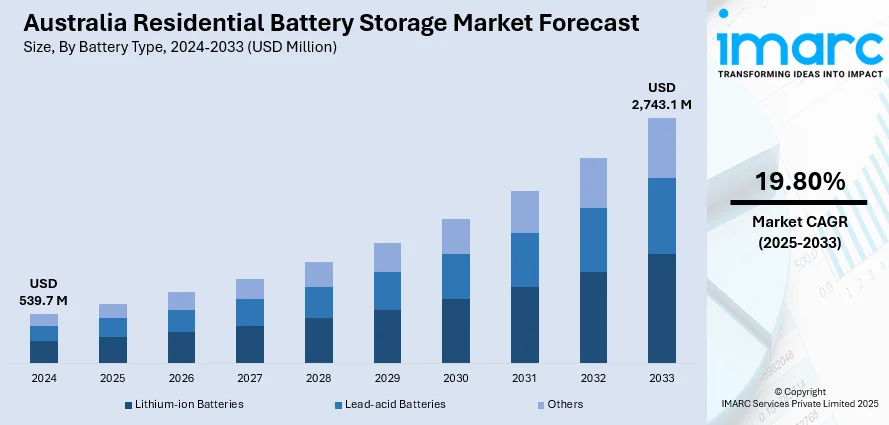

The Australia residential battery storage market size reached USD 539.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,743.1 Million by 2033, exhibiting a growth rate (CAGR) of 19.80% during 2025-2033. The market is primarily driven by high rooftop solar adoption and supportive state-level incentive schemes. Also, feed-in tariff adjustments and cost-reduction trends are fueling the product adoption. Additionally, increasing grid reliability concerns are elevating the overall system demand. Energy price volatility, policy incentives, and growing consumer interest in energy independence are some of the other factors positively impacting the Australia residential battery storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 539.7 Million |

|

Market Forecast in 2033

|

USD 2,743.1 Million |

| Market Growth Rate 2025-2033 | 19.80% |

Key Trends of Australia Residential Battery Storage Market:

Growth in Rooftop Solar Installations

The increasing penetration of rooftop solar systems across Australian households is one of the most significant contributors to the development of residential battery storage. With the country experiencing high solar irradiance levels and generous feed-in tariff structures gradually being phased out, homeowners are turning toward energy self-consumption models. This shift has accelerated interest in storing excess solar energy for use during evening hours, thereby enhancing energy independence. In urban and suburban regions, particularly in New South Wales, Queensland, and South Australia, residential solar adoption has created a conducive environment for integrated storage solutions. The growing mismatch between solar generation and peak household demand further intensifies the need for on-site energy retention. On April 7, 2025, the Australian Labor Party pledged to introduce a AUD 2.3 billion (USD 1.41 billion) national home battery subsidy program if re-elected, aiming to cut upfront battery costs by 30% and support the installation of one million units by 2030. The proposed “Cheaper Home Batteries Program” would offer rebates of up to AUD 4,000 (USD 2,440) per system and be available from July 1, 2025, with eligibility extended retroactively to installations from April 6. This marks a significant development for Australia's residential battery storage market, which currently sees battery adoption in only 2.5% of solar-equipped homes, and is expected to boost uptake by easing the cost barrier. In response, consumers are increasingly evaluating residential battery solutions not merely as backup systems, but as long-term investments in energy cost management. Electricity price volatility, combined with policy uncertainty around grid incentives, is making storage technology a more attractive proposition. Battery manufacturers and energy service companies are capitalizing on this demand shift by tailoring product offerings with smart features and modular capacities. The underlying infrastructure upgrades and incentive programs at state levels are facilitating installation and financing. These factors are directly contributing to Australia residential battery storage market growth as demand aligns with broader shifts in consumer energy behavior.

To get more information of this market, Request Sample

Government Incentives and Regulatory Support

A multi-tiered structure of incentives, rebates, and policy mechanisms implemented across federal and state levels continues to significantly shape the energy storage landscape. Targeted programs such as the South Australia Home Battery Scheme, Victoria’s Solar Homes Program, and various interest-free loan options are directly aimed at making home energy storage systems more accessible to a wider consumer base. These initiatives often bundle battery solutions with solar PV, enhancing their overall cost-benefit appeal. Regulatory adjustments such as feed-in tariff reductions and dynamic export control measures have also shifted consumer preferences toward maximizing self-use of solar energy through storage. On February 13, 2025, the Clean Energy Council reported that Australia installed over 28,000 residential battery systems in 2024, marking a 30% increase compared to the previous year. The total number of household battery installations across the country reached 121,551, driven in part by government incentives such as zero-interest loans in the Australian Capital Territory. The surge in installations aligns with broader energy trends, including a 50% rise in grid-scale battery capacity and record-high renewable electricity generation on the national grid, underscoring the growing relevance of residential storage in Australia's clean energy shift. In effect, these changes are encouraging households to invest in residential batteries to retain greater control over their electricity consumption and reduce reliance on the grid. The prospect of participating in Virtual Power Plant (VPP) schemes further enhances the financial viability of such investments by allowing users to generate additional revenue streams from their stored energy. In parallel, grid operators and energy retailers are beginning to incorporate distributed storage into broader network management strategies. This regulatory encouragement for behind-the-meter solutions is fostering innovation in both product offerings and business models. This environment, shaped by policy, pricing, and performance mechanisms, continues to influence adoption trajectories across the country.

Integration of Battery Storage with Smart Home Energy Management Systems

A major trend escalating the Australia residential battery storage market demand is the integration of battery systems with advanced smart home energy management technologies. With increased awareness of energy among consumers, the market is demanding optimized electricity utilization and storage of excess solar energy, and real-time control of household appliances. These combined systems employ artificial intelligence and machine learning to forecast consumption, automate energy usage, and increase battery efficiency. The emergence of smart meters and the Internet of Things is rapidly increasing this trend, and it provides homeowners with better visibility and control over their energy footprint. This convergence of battery storage and smart technology not only boosts cost savings and energy independence but also aligns with Australia’s broader push toward a decentralized, intelligent energy grid.

Growth Factors of Australia Residential Battery Storage Market

Surging Electricity Prices and Energy Independence Demand

One of the primary drivers of growth in Australia’s residential battery storage market is the consistent rise in electricity prices. Homeowners are encouraged to move beyond grid dependence and insulate themselves against energy price fluctuations. Battery storage systems enable consumers to store surplus solar electricity and consume it at peak rate hours to increase savings and self-sufficiency. This is particularly compelling in areas where there is a history of outages or grid reliability is limited. Combined with an increased understanding of the long-term cost savings, lots of homeowners currently consider battery systems as a calculated move towards energy independence and resilience. This transition is causing a surge in installations, even in those that already have rooftop solar, to optimize self-consumption and cost optimization.

Technological Advancements and Cost Reductions

Rapid technological innovation in battery chemistry, design, and performance has significantly enhanced the appeal of residential energy storage. Lithium-ion batteries have seen steady improvements in efficiency, energy density, and lifespan. At the same time, manufacturing scale and global supply chain maturity have driven down costs, making batteries more affordable for average homeowners. Innovations like modular battery systems, mobile app integration, and AI-driven optimization are also simplifying usage and boosting consumer confidence. As battery systems become smarter and more efficient, their return on investment improves, encouraging broader adoption. According to the Australia residential battery storage market analysis, these advancements ensure that battery storage is not just a backup solution but a central component of modern energy systems in Australian households.

Emergence of Aggregation Models and VPP Participation

The growing participation in Virtual Power Plants (VPPs) and energy aggregation platforms is reshaping how residential batteries are perceived and used. Through these models, individual households can connect their batteries to a larger energy network, contributing stored energy back to the grid during peak demand and earning financial returns. This collective approach transforms passive energy consumers into active market participants, incentivizing battery adoption. Programs offered by utilities and tech providers, often in partnership with government-backed incentives, make joining VPPs increasingly accessible. These platforms also enhance grid stability and support renewable energy integration, aligning individual homeowner benefits with national energy goals. As more households see economic value in aggregation, the market is expected to grow rapidly in the near future.

Australia Residential Battery Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on battery type, capacity, ownership model, sales channel, and application.

Battery Type Insights:

- Lithium-ion Batteries

- Lead-acid Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead-acid batteries, and others.

Capacity Insights:

- Below 5 kWh

- 5–10 kWh

- 10–20 kWh

- Above 20 kWh

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes below 5 kWh, 5–10 kWh, 10–20 kWh, and above 20 kWh.

Ownership Model Insights:

- Customer-owned Systems

- Third-party Owned/Leasing Models

The report has provided a detailed breakup and analysis of the market based on the ownership model. This includes customer-owned systems and third-party owned/leasing models.

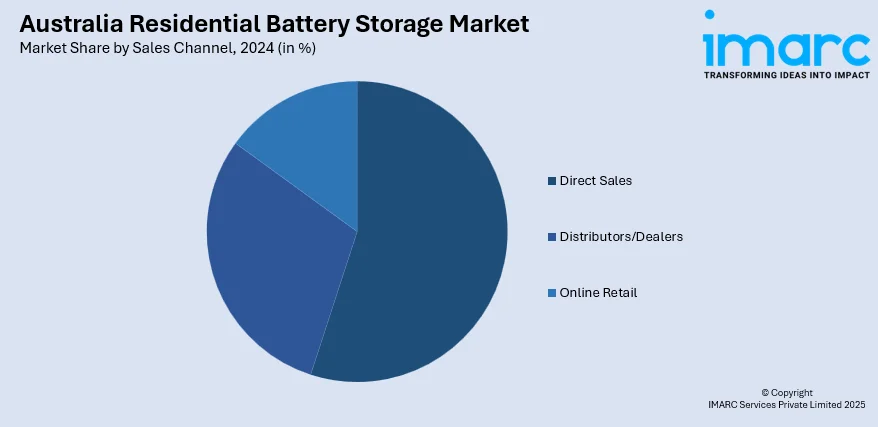

Sales Channel Insights:

- Direct Sales

- Distributors/Dealers

- Online Retail

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes direct sales, distributors/dealers, and online retail.

Application Insights:

- Backup Power Supply

- Solar Energy Storage

- Off-grid Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes backup power supply, solar energy storage, off-grid systems, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Residential Battery Storage Market News:

- On April 10, 2025, NHOA Energy and Elecnor commissioned the 238.5 MW / 477 MWh Blyth Battery for Neoen in South Australia, marking one of the largest operational battery storage assets in the country. The facility will supply 70 MW of renewable baseload power to BHP and support the national electricity market, underpinned by project financing from international lenders. The successful delivery reinforces South Australia's lead in grid-scale battery deployment and highlights accelerating momentum in Australia's residential and utility-scale battery storage markets.

- On March 31, 2025, Anker SOLIX launched its full-range home energy storage systems in Australia, partnering with Blue Sun Group to promote smarter and more accessible solar-plus-storage solutions. The SOLIX X1 system features modular capacity from 5 kWh to 180 kWh, supports AC coupling for easier retrofits, and claims to generate up to 2,000 kWh more than conventional systems over a decade. With Australian households facing average annual electricity bills of AUD 2,500 (USD 1,630), this product targets a market where only 10% of homes currently adopt energy storage due to high upfront costs and limited system flexibility.

Australia Residential Battery Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Batteries, Lead-acid Batteries, Others |

| Capacities Covered | Below 5 kWh, 5–10 kWh, 10–20 kWh, Above 20 kWh |

| Ownership Models Covered | Customer-owned Systems, Third-party Owned/Leasing Models |

| Sales Channels Covered | Direct Sales, Distributors/Dealers, Online Retail |

| Applications Covered | Backup Power Supply, Solar Energy Storage, Off-grid Systems, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia residential battery storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia residential battery storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia residential battery storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia residential battery storage market is projected to exhibit a CAGR of 19.80% during 2025-2033.

Australia's residential battery storage market is being driven by government subsidies, falling battery costs, rising solar-PV adoption, and longer-duration systems. Virtual Power Plants, V2G integration, and shifting revenue models from frequency control to energy trading are transforming household energy strategies.

Key growth drivers for Australia’s residential battery storage market include federal and state subsidies slashing upfront costs, skyrocketing rooftop solar adoption, spiking electricity prices, desire for energy resilience during outages, and emerging V2G and virtual power plant income streams.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)