Australia Residential Real Estate Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Australia Residential Real Estate Market Summary:

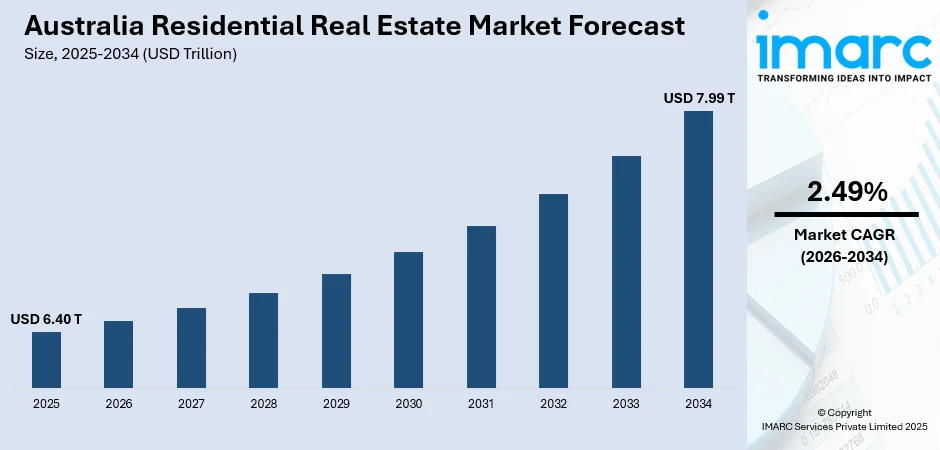

The Australia residential real estate market size was valued at USD 6.40 Trillion in 2025 and is projected to reach USD 7.99 Trillion by 2034, growing at a compound annual growth rate of 2.49% from 2026-2034.

The Australian residential real estate market is experiencing sustained growth driven by robust population expansion through international migration, favorable lending conditions, and comprehensive government initiatives aimed at increasing housing supply. Accelerating urbanization in major metropolitan centers, combined with rising demand for sustainable and energy-efficient housing solutions, continues to fuel market expansion. The integration of smart home technologies and the emergence of build-to-rent housing models are reshaping the residential landscape, while infrastructure developments in suburban and regional areas are creating new investment opportunities across the Australia residential real estate market share.

Key Takeaways and Insights:

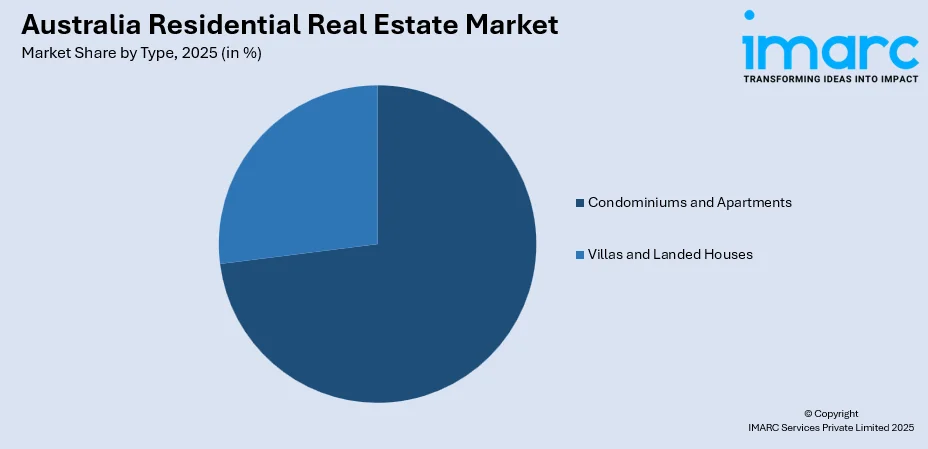

- By Type: Condominiums and apartments dominated the market with 73.01% revenue share in 2025, driven by escalating urbanization, affordability constraints for detached housing in major cities, and growing preference among young professionals and downsizers for convenient, low-maintenance living options near employment hubs and amenities.

- By Region: Australia Capital Territory & New South Wales leads the market with a share of 34% in 2025, supported by Sydney’s position as the nation’s largest economic hub, strong population growth exceeding 107,500 residents annually, and concentrated demand for residential properties near established infrastructure and employment centers.

- Key Players: The Australian residential real estate market exhibits a moderately fragmented competitive structure, with established developers competing alongside regional builders across diverse price segments. Major participants leverage strategic land banking, vertical integration of construction operations, and innovative housing designs to capture market share in both metropolitan and regional growth corridors.

To get more information on this market Request Sample

The Australian residential real estate landscape is undergoing a significant transformation, shaped by demographic shifts, evolving buyer preferences, and comprehensive policy interventions. Strong overseas migration has contributed a net gain of approximately 446,000 people to Australia’s population in the year ending June 2024, intensifying demand particularly in metropolitan areas of Sydney, Melbourne, and Brisbane. The National Housing Accord reflects a coordinated effort between federal, state, and local governments to address housing supply challenges through large-scale residential development. Homebuyers are increasingly favoring properties with eco-friendly designs, solar energy systems, and energy-efficient appliances, with sustainable-certified developments commanding higher market value. At the same time, the rise of build-to-rent housing models is attracting institutional investment, offering stable, long-term rental income. These trends are supporting the diversification of housing options and promoting sustainable, professionally managed residential developments across the country.

Australia Residential Real Estate Market Trends:

Rise of Sustainable and Energy-Efficient Homes

Growing environmental awareness and regulatory standards are fueling strong demand for sustainable residential properties across Australia. For instance, in October 2025, the Green Building Council of Australia (GBCA) partnered with Measurabl to integrate Green Star certification data into its real estate sustainability platform. This collaboration brings Australia’s Green Star standards, comparable to US LEED certification, into Measurabl’s global database, improving access to sustainable building performance information worldwide. Buyers increasingly prioritize homes featuring eco-friendly designs, renewable energy systems, energy-efficient appliances, and sustainable construction materials. Government policies and building codes promote energy-efficient practices in residential development, encouraging developers to integrate green certifications and environmentally responsible features. Industry initiatives support the creation of sustainable communities and aim to advance net-zero emission buildings, reflecting a broader shift toward environmentally conscious housing and long-term sustainability in the Australian property market.

Integration of Smart Home Technologies

Smart home technologies are becoming increasingly integral to Australia’s residential real estate market, as purchasers seek greater convenience, security, and energy efficiency. New residential developments increasingly feature smart lighting, automated climate control, home security systems, and voice-activated assistants as standard amenities. The integration of these technologies enables homeowners to remotely control various aspects of their homes, optimizing energy consumption while enhancing comfort and security. This trend is particularly pronounced in premium residences, where smart home amenities are viewed as essential components of modern living and key differentiators in competitive market segments. For instance, in October 2025, EcoFlow, a global leader in portable power and a top European provider of home energy storage systems, officially entered the Australian market. Revealed at All Energy 2025, the country’s premier solar and renewable energy expo, this launch represents a significant step in EcoFlow’s international expansion and introduces a new phase of smart, sustainable home energy solutions for Australian households.

Expansion of Build-to-Rent Housing Models

Australia is witnessing notable expansion in build-to-rent housing developments, driven by changing demographics, affordability challenges, and evolving tenant preferences. These professionally managed rental communities offer flexible, hotel-style living options in well-located urban areas, catering to a growing renter population seeking convenience and community amenities. Approximately 4,660 BTR homes were delivered nationwide in 2024, with an additional 6,000 expected in 2025. The Marrickville Timber Yard project in Sydney, slated for completion by 2028, will transform a former wood mill into a 1,188-unit rental community representing the largest BTR development in Sydney.

Market Outlook 2026-2034:

The Australian residential real estate market is set for steady growth, supported by favorable demographic trends, potential easing of monetary policy, and ongoing infrastructure development across urban and regional areas. Rising population levels, driven in part by migration, along with improving buyer sentiment, are expected to maintain consistent demand across various housing segments. Combined with continued investment in transportation, utilities, and community facilities, these factors are likely to underpin long-term market stability and create opportunities for residential development throughout the country. The market generated a revenue of USD 6.40 Trillion in 2025 and is projected to reach a revenue of USD 7.99 Trillion by 2034, growing at a compound annual growth rate of 2.49% from 2026-2034.

Australia Residential Real Estate Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Condominiums and Apartments |

73.01% |

|

Region |

Australia Capital Territory & New South Wales |

34% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Condominiums and Apartments

- Villas and Landed Houses

Condominiums and apartments lead the market with a share of 73.01% of the total Australia residential real estate market in 2025.

The condominiums and apartments segment dominates Australia’s residential real estate landscape, reflecting accelerating urbanization and shifting buyer preferences toward high-density living arrangements. Urban land scarcity in major metropolitan centers, combined with escalating house prices that have pushed median values beyond affordability thresholds for many buyers, continues to channel demand toward apartment living. These properties offer accessible entry points into property markets of Sydney, Melbourne, and Brisbane, attracting first-time buyers, young professionals, and downsizers seeking convenient locations near employment centers, public transport, and lifestyle amenities.

Property developers are adapting to changing buyer preferences by offering larger apartments with three to four bedrooms and incorporating high-end amenities such as rooftop terraces, fitness centers, and concierge services. Luxury high-rise developments are setting new standards for upscale apartment living, reflecting the increasing sophistication and expectations of the market. Streamlined planning approvals and supportive policy measures are encouraging greater development activity, enabling the construction of modern, amenity-rich residential projects that meet the evolving lifestyle demands of urban homebuyers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory & New South Wales region dominates the market with a 34% share of the total Australia residential real estate market in 2025.

New South Wales, anchored by Sydney’s position as Australia’s largest economic and population center, commands the predominant share of residential real estate activity. Sydney’s population has reached 5.56 million residents as of June 2024, with projections indicating an additional 650,000 residents by 2034. This demographic expansion, combined with strong overseas migration and limited housing supply, sustains robust demand across metropolitan and regional markets. The NSW Government’s First Home Buyers Assistance Scheme provides a full transfer duty exemption for homes valued up to 800,000 dollars, while the Housing Delivery Authority established in early 2025 is streamlining approvals for major residential developments exceeding 60 million dollars in Greater Sydney.

The residential market in this region is supported by strong infrastructure, well-established employment hubs, and high-quality educational and healthcare facilities, attracting both local and international buyers. Demand for premium housing remains robust despite affordability challenges, with developers focusing on upscale projects that feature high-end materials and finishes. Luxury residential developments are transforming the urban landscape, combining modern design with sophisticated amenities, and reflecting the growing preference for quality, well-located homes in highly connected metropolitan areas.

Market Dynamics:

Growth Drivers:

Why is the Australia Residential Real Estate Market Growing?

Population Growth and International Migration

Australia’s residential real estate market is facing strong demand due to ongoing population growth, driven largely by international migration. Influxes of skilled migrants, students, and long-term residents are concentrating in major cities, placing pressure on the limited housing supply. This is fueling development across high-density urban apartments and suburban estates. New residents often seek well-connected neighborhoods, increasing competition for available properties and maintaining upward pressure on prices. Rising demand for both rental and owner-occupied housing, supported by family reunification and employment opportunities, underpins continued growth in the residential market.

Favorable Lending Environment and Monetary Policy Easing

Australia’s housing market continues to benefit from a supportive lending environment, with accessible credit options and expectations of monetary policy easing. Financial institutions are offering flexible mortgage solutions, including longer loan terms and competitive interest rates, improving affordability for prospective buyers. Government-backed schemes further assist first-time buyers by reducing deposit requirements and mitigating mortgage insurance costs, encouraging broader participation in the property market. These measures collectively stimulate housing demand, enhance buyer confidence, and support continued activity across both the rental and owner-occupied residential segments.

Government Initiatives and Housing Supply Programs

The residential real estate development in Australia is being fuelled by extensive government programs at the federal and state levels. Cooperative work is aimed at responding to the shortage of housing supply by using the simplified planning and zoning system, speeding up land release, and ensuring specific infrastructure support to conduct large-scale work. State-level reforms facilitate expedited approvals of developments of multiple stories and transit-oriented development, whereas programs in the federal system can be used to stimulate individuals in the private sector. Collectively, these projects are set to broaden housing accessibility, enhance the efficacy of project delivery, and contribute to the development of various and properly planned residential zones in the country.

Market Restraints:

What Challenges the Australia Residential Real Estate Market is Facing?

Persistent Housing Supply Constraints

Australia continues to face significant challenges in increasing housing supply to meet steadily growing demand. Housing construction activity remained subdued throughout 2024, with only 177,000 dwellings completed nationally, falling substantially short of the estimated 223,000 units required to satisfy underlying demand. The National Housing Supply and Affordability Council projects that gross new housing supply will remain constrained through early 2027, with total output over the Housing Accord period expected to reach 938,000 dwellings, falling short of the 1.2 million target by approximately 262,000 units.

Elevated Construction Costs and Material Expenses

The cost of construction in Australia is still very high in comparison with previous years and it is exerting pressure on project viability and restricting the creation of new housing. Although the cost growth rate is declining, high costs of labor, materials and funding remain a significant problem to the commercial viability of most projects. A lack of confidence within the wider economy and an increase in the cost of inputs are making developers take a more cautious stance, which is slowing the beginning of new construction and limiting the growth of the housing supply pipeline.

Skilled Labor Shortages in Construction Sector

The residential construction sector is facing significant labor shortages that are slowing the recovery of housing supply. Many positions across the industry remain unfilled, particularly in skilled trades such as bricklaying and carpentry. A decline in apprenticeship completions has further reduced the pool of qualified workers, limiting the capacity to undertake new residential projects. These workforce constraints are contributing to delays in construction activity and restricting the development of new housing, placing additional pressure on the sector’s ability to meet growing demand.

Competitive Landscape:

The Australian residential real estate market exhibits a moderately fragmented competitive structure, characterized by the presence of large national developers competing alongside regional builders and specialized apartment developers across diverse price segments and geographic markets. Major participants leverage integrated development capabilities, strategic land portfolios, and established brand recognition to secure market positioning in high-growth metropolitan and regional corridors. Competition intensifies around well-located urban sites and infrastructure-connected suburban growth areas, with developers increasingly differentiating through sustainable building practices, smart home technology integration, and premium amenity offerings. The emergence of build-to-rent as a distinct asset class has attracted institutional investors and international capital, introducing new competitive dynamics to the residential development landscape.

Recent Developments:

- March 2025: Green Street, a leading provider of commercial real estate intelligence and impartial market insights, has acquired the Australian Property Journal, a prominent publication covering commercial and residential real estate, including REITs, investment sales, and leasing activity. This acquisition expands Green Street News’ presence into Australia, strengthening its global platform and enabling the company to further support the commercial real estate community with reliable data, analysis, and market intelligence across both domestic and international property markets.

- May 2024: Sydney-based real estate investment manager Apt.Residential entered a long-term collaboration with PGGM Private Real Estate Fund, managed by the Dutch pension investor PGGM, to systematically expand Build-to-Rent developments across Australia.

Australia Residential Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Condominiums and Apartments, Villas and Landed Houses |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia residential real estate market size was valued at USD 6.40 Trillion in 2025.

The Australia residential real estate market is expected to grow at a compound annual growth rate of 2.49% from 2026-2034 to reach USD 7.99 Trillion by 2034.

Condominiums and apartments dominated the market with 73.01% revenue share in 2025, driven by accelerating urbanization, affordability constraints for detached housing in major metropolitan centers, and growing buyer preference for convenient, amenity-rich living options near employment hubs and transport infrastructure.

Key factors driving the Australia residential real estate market include robust population growth fueled by international migration, favorable lending conditions and anticipated interest rate reductions, comprehensive government initiatives through the National Housing Accord, rising demand for sustainable and energy-efficient homes, and the emergence of build-to-rent housing models attracting institutional investment.

Major challenges include persistent housing supply constraints with construction completions falling short of demand, elevated construction costs remaining approximately 45 percent above pre-pandemic levels, acute skilled labor shortages in the construction sector, complex planning approval processes, and affordability pressures limiting buyer access particularly in major metropolitan markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)